BTC

Bitcoin rally hopes diminish as pro traders flip bearish, retail interest at 12-month lows

Bitcoin (BTC) has been trapped in a symmetrical triangle for 56 days and the trend change could last until early May, according to price technicals. Currently, the support level stands at $38,000, while the triangle resistance for daily close stands at $43,600. Bitcoin mining up, retail interest down Bitcoin/USD price at FTX. Source: TradingView The week started with a positive achievement for the Bitcoin network as the Lightning Network capacity reached a record-high 3,500 BTC. This solution allows extremely cheap and instant transactions on a secondary layer, known as off-chain processing. After cryptocurrency mining activities were banned in China in 2021, publicly-listed companies in the United States and Canada attracted most of this processing power. As a result, Bitcoin’s hash...

What happens to your Bitcoin when you die? A new service saves it for family and friends

When Bitcoin (BTC) traders pass away, their BTC may forever be lost within the blockchain if they haven’t given anyone else access to their wallets. However, an exchange project wants to give crypto traders another option. Back in 2020, a study showed that many crypto investors worry about what happens to their digital assets when they pass away. 89% of respondents expressed concerns on whether their assets would be given to family or friends after their demise. In an interview with Cointelegraph, Jeetu Kataria, the CEO of Digital Financial Exchange (DIFX), highlighted the importance of a way to pass crypto to loved ones in case of death. According to Kataria, their project created a blockchain-based nomination program that allows users to choose “trusted individuals, fam...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

Bitcoin rebounds over $41K after painting a ‘bullish hammer’ — Can BTC hit $64K next?

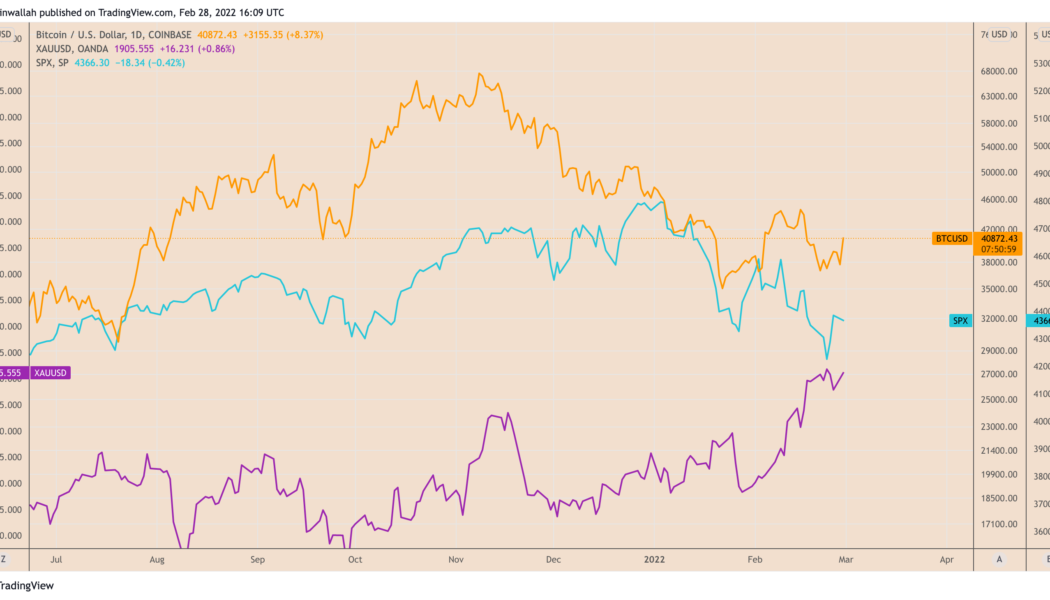

Bitcoin (BTC) rallied above $41,000 on Feb. 28 in a new sign of buying sentiment returning after last week’s brutal selloff across the risk-on markets, including the S&P 500. BTC’s price jumped by over 9% to reach $41,300, in part, as traders reacted to the ongoing development in the Russia-Ukraine crisis. In doing so, the cryptocurrency briefly broke its correlation with the U.S. stock market indexes to perform more like safe-haven gold, whose price also went higher in early trading on Feb. 28. BTC/USD versus XAUUSD and S&P 500 daily price chart. Source: TradingView Bitcoin downtrend exhausting — analyst Johal Miles, an independent market analyst, spotted “significant buying pressure” in the market, adding that its downtrend might be heading towards exhaust...

Terra’s Mirror Protocol MIR rebounds 40% two days after crashing to record low

Mirror Protocol, a decentralized finance (DeFi) protocol built on the Terra blockchain, was hit by one of the biggest collapses in financial history this week after Vladimir Putin ordered military strikes against Ukraine. Terra tokens rally Mirror Protocol’s native token, MIR, dropped to $0.993 on Feb. 24, its worst level to date amid a selloff across the broader crypto market. But a sharp rebound ensued, taking the price to as high as $1.41 two days later, up more than 40% when measured from MIR’s record low. MIR/USD four-hour price chart. Source: TradingView Just like the drop, MIR’s upside retracement came in the wake of similar recoveries elsewhere in the crypto market. But interestingly, MIR/USD returns appeared larger than some of the highly valued digital assets, i...

Ukraine Bitcoin exchange volume spikes 200% as Russia war sparks currency concerns

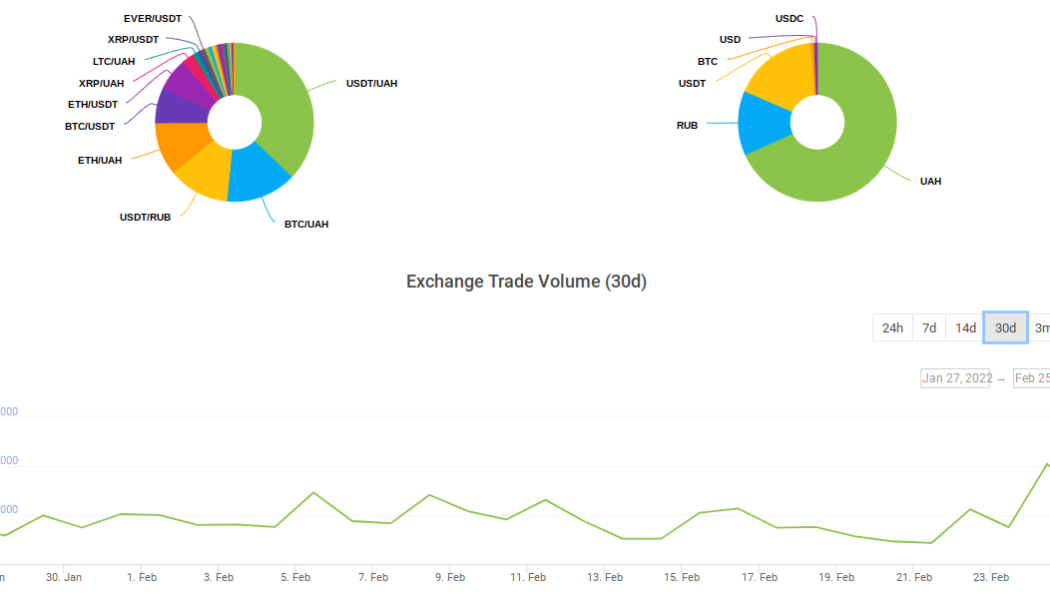

Bitcoin (BTC) and altcoin trading volumes have surged at a major Ukraine cryptocurrency exchange in the aftermath of Russia’s invasion, data shows. According to monitoring resource CoinGecko, on Feb. 24, volume at Kuna almost trippled to over $4 million. Crypto on the radar of Ukrainians As the armed conflict with Russia began, the impact on the fiat currencies of both countries was immediately apparent. While the Russian ruble suffered noticeably more, the Ukrainian hryvnia also fell, targeting 30 per dollar in what would be a new all-time low. Ukraine, which just this month finally ratified a law legalizing cryptocurrency after much to-and-fro between lawmakers, unsurprisingly saw interest in alternatives snap higher. The effect was obvious at seven-year-old Kuna, volumes at which ...

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

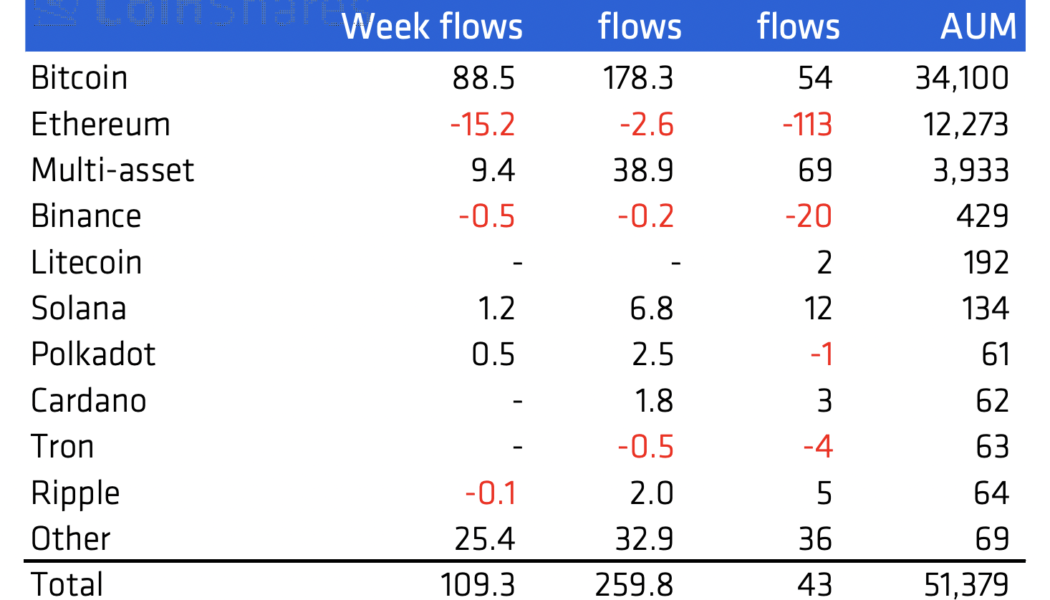

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

On-chain metrics hint at a bearish outlook for Bitcoin

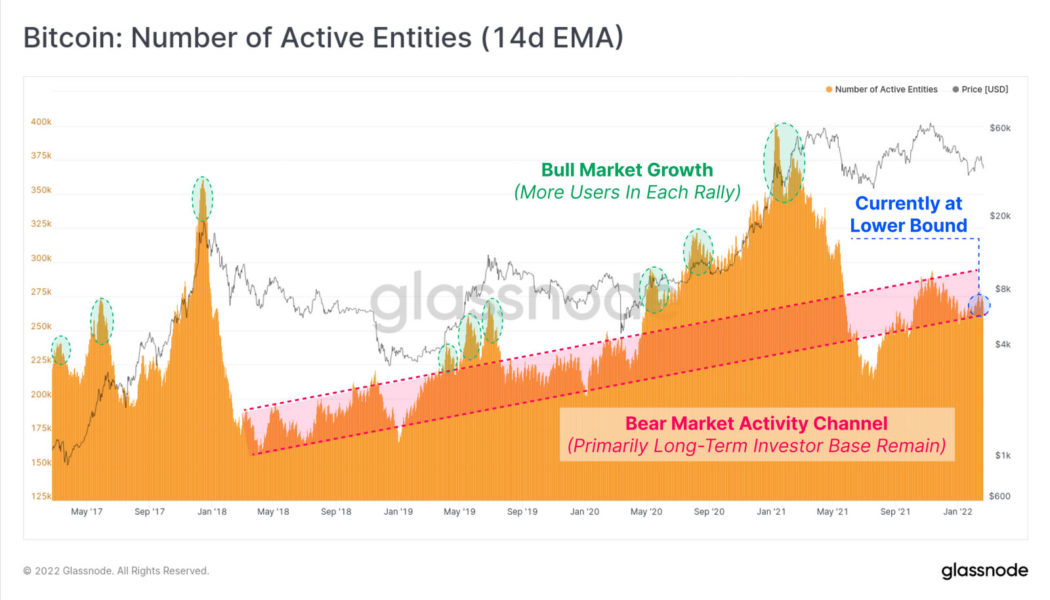

Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent. In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data. The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the reason for the current risk-off sentiment for crypto assets. “Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.” It added that as the downtrend deepens, “the probability of a ...

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

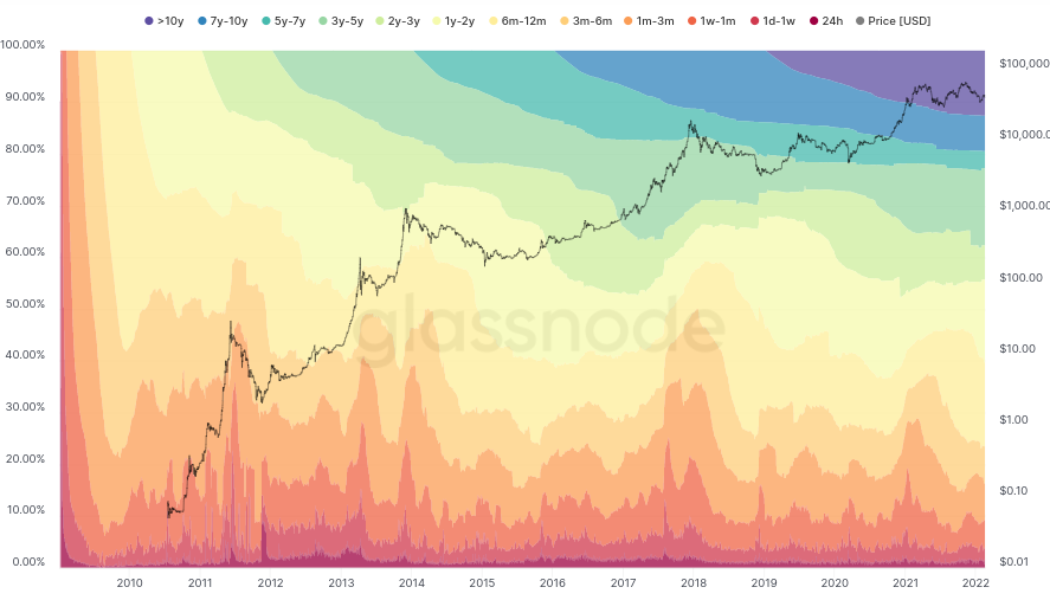

Bitcoin inactive supply nears record as over 60% of BTC stays unspent for at least 1 year

Bitcoin (BTC) may be struggling at $40,000 but fresh data is reinforcing the fact that hardly anyone is interested in selling. Data from on-chain analytics firm Glassnode shows that despite price volatility, over 60% of the BTC supply has not left its wallet in a year or more. Strong hands have rarely been stronger Stubborn hodling by long-term investors is a characteristic that differentiates the current Bitcoin market climate from most other downtrends. With spot price action passing 50% losses versus November’s all-time highs last month, expectations were for cold feet to kick in — but among seasoned hodlers, the sell-off never came. In fact, the opposite has been true for an extended period — long-term investors are adding to their positions or staying put on their BTC exposure. ...

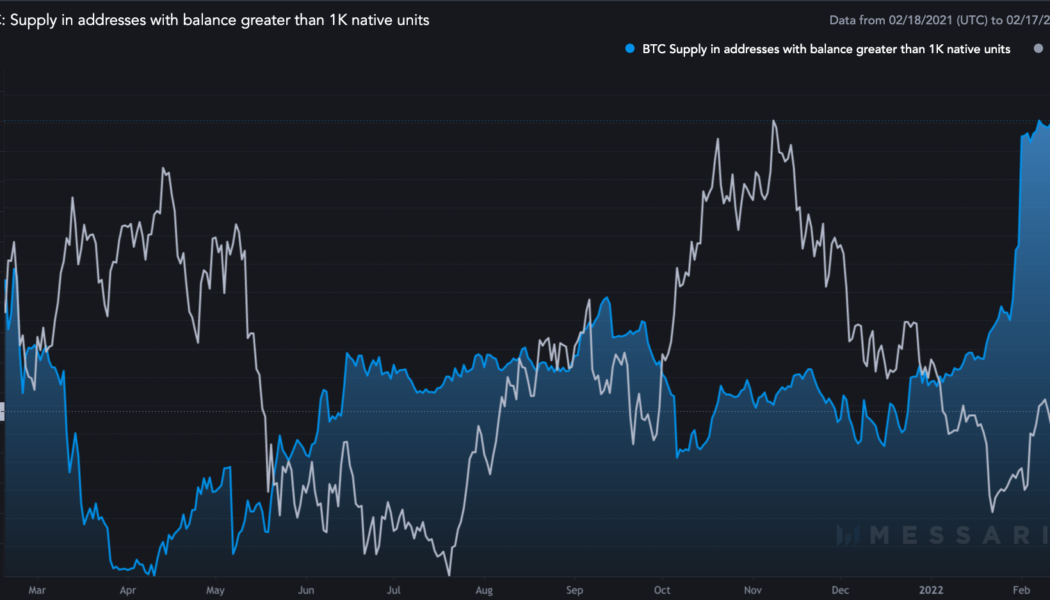

Bitcoin ‘whales’ and ‘fishes’ pause accumulation as markets weigh March 50bps hike odds

An uptick in Bitcoin (BTC) supply to whales’ addresses witnessed across January appears to be stalling midway as the price continues its intraday correction toward $42,000, the latest data from CoinMetrics shows. Whales, fishes take a break from Bitcoin The sum of Bitcoin being held in addresses whose balance was at least 1,000 BTC came to be 8.10 million BTC as of Feb. 16, almost 0.12% higher month-to-date. In comparison, the balance was 7.91 million BTC at the beginning of this year, up 2.4% year-to-date. Bitcoin supply in addresses with balance greater than 1,000 BTC. Source: CoinMetrics, Messari Notably, the accumulation behavior among Bitcoin’s richest wallets started slowing down after BTC closed above $40,000 in early February. Their supply fluctuated with...

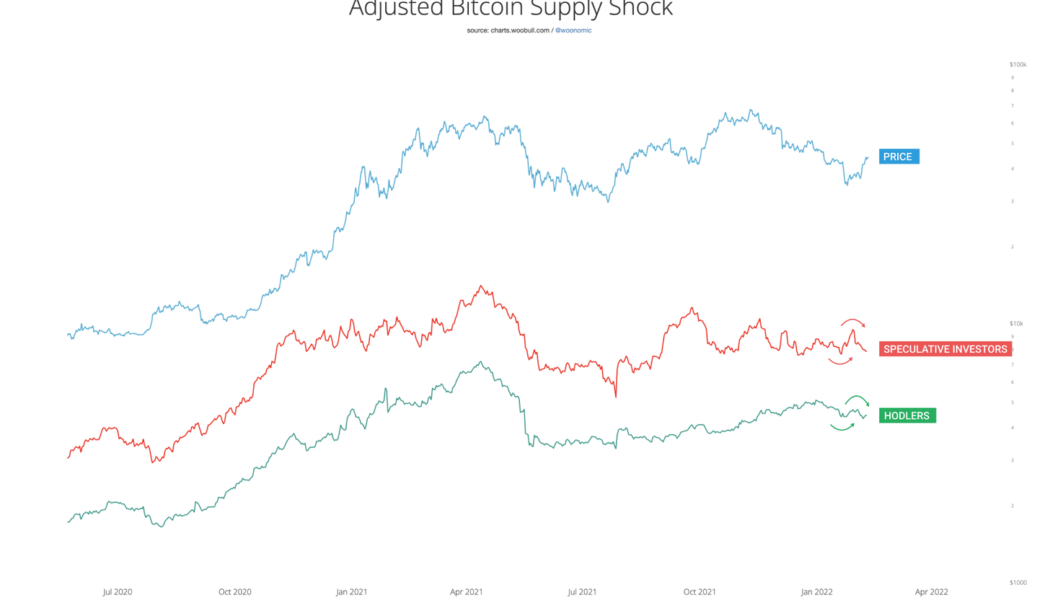

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...