BTC

What happens when 21 million Bitcoin are fully mined? Expert answers

When the last Bitcoin (BTC) is finally mined, the livelihood of miners who rely on block rewards as a source of income will be affected. Despite this, the future of mining stays promising, according to an expert in space. In a Cointelegraph interview, Mohamed El Masri, the founder of mining solutions provider PermianChain, talked about new players jumping into mining, the future of mining and what happens to mine profitability after the 21 millionth BTC is minted. El Masri highlighted that efficiency is a very important focus that new players in the space must take into consideration. Because mining profit depends on how efficient a mining operation is, the executive noted that efficiency brings down the cost of energy to a minimum. [embedded content] When asked about the future of t...

Bitcoin wobbles on Wall Street open as Ethereum hits $1.6K in 6-week high

Bitcoin (BTC) took a step back as Wall Street trading began on July 22 after recovering most of its previous losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls fail to sustain assault on multi-week high Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD encountering fresh resistance near $24,000. The pair had spent the past 24 hours slowly clawing back lost ground after news that Tesla had sold most of its BTC holdings. With the pre-announcement high of $24,280 still in force, bulls saw something of a setback as Wall Street opened on the day, with BTC/USD losing around $400. Analyzing the current order book structure on major exchange Binance, on-chain monitoring resource Material Indicators warned that the overall bear market structure re...

Bitcoin hodling activity resembles previous market bottoms: Glassnode

The majority of Bitcoin has been “hodled” for at least three months in behavior bearing a striking resemblance to previous Bitcoin market bottoms, says blockchain analytics firm Glassnode. In a July 16 tweet, Glassnode noted that more than 80% of the total U.S. dollar (USD)-denominated wealth invested in Bitcoin has not been touched for at least three months. This signifies that the “majority of BTC coin supply is dormant” and that hodlers are “increasingly unwilling to spend at lower prices,” said the firm. Over 80% of the total USD denominated wealth invested in #Bitcoin has been HODLed for at least 3-months. This signifies that the majority of the $BTC coin supply is dormant, and HODLers are increasingly unwilling to spend at lower prices. Live Chart: https://t.co/lRtBe69Phz pic.twitter...

Worst quarter in 11 years as Bitcoin price and activity plunges

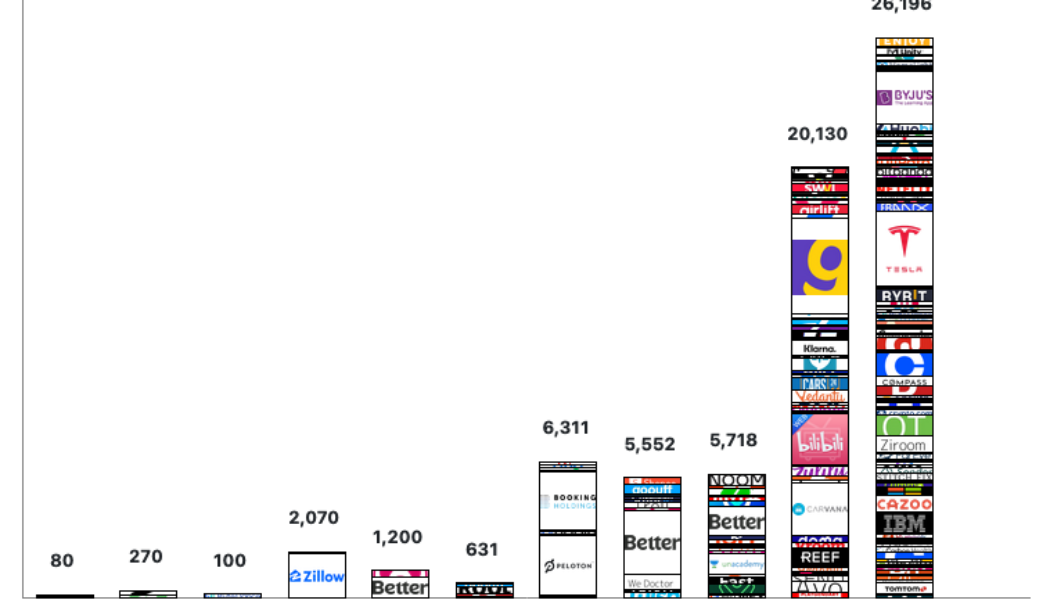

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months. The second quarter ending June 30 saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight ET on June 30 according to CoinGecko, representing a 56.2% loss according to crypto analytics platform Coinglass. It’s the steepest price fall since the third quarter of 2011, when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018, when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively. The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a draw down of over 37%, the heaviest monthly losses sin...

Bitcoin miner ‘capitulation event’ may have already happened — Research

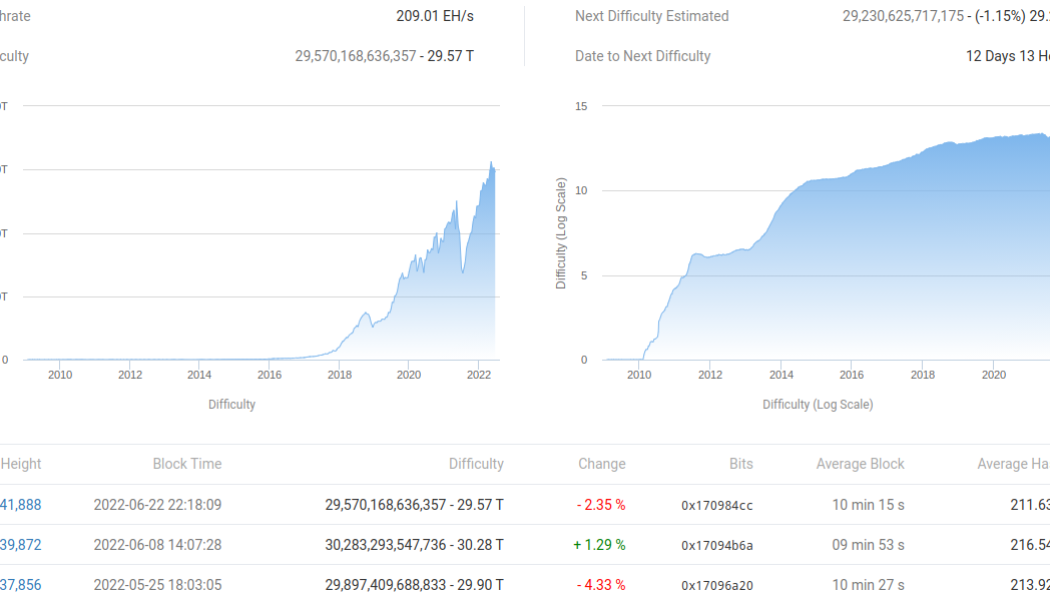

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded. In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due. BTC price bottom “typically” follows miner capitulation Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed. The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges. This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent. “Our data demonstrate a miner capitulation event that has...

Is It Profitable to Swap ETH to XNO?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

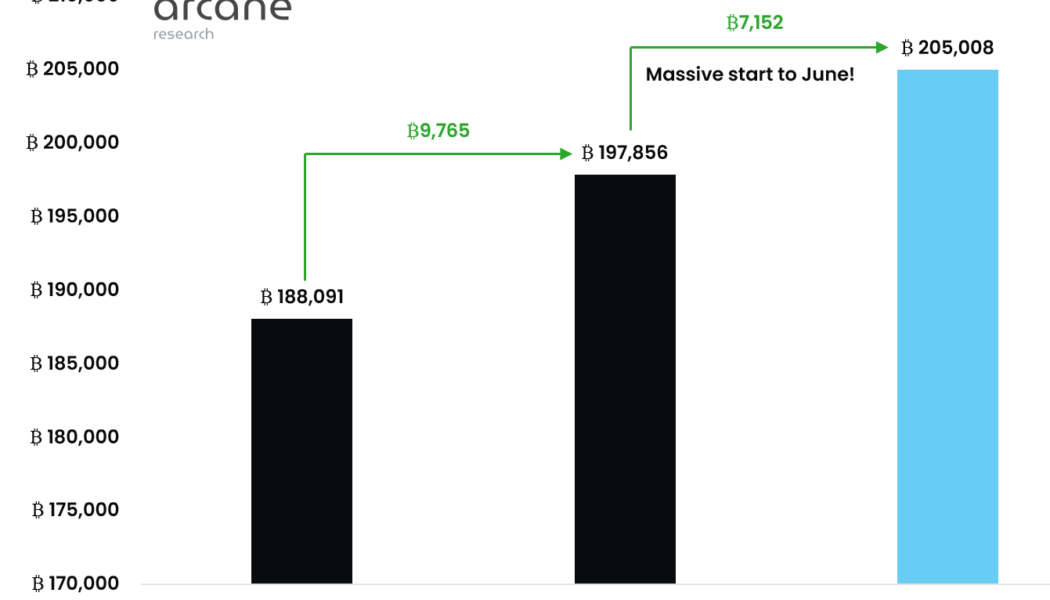

Over 200K BTC now stored in Bitcoin ETFs and other institutional products

Bitcoin (BTC) investment vehicles are seeing “gargantuan” inflows this month, which is a fresh sign that traders’ appetite for BTC exposure is mounting. Data from monitoring firm Arcane Research published this week shows that Bitcoin exchange-traded products (ETPs) now have record high BTC under management. “Happier days” for Bitcoin ETPs as buyers pile in Despite BTC price action failing to draw in buyers at over 50% below all-time highs, not everyone is feeling risk-off. According to Arcane’s data, Bitcoin ETPs have seen a flurry of interest from institutional investors both this month and last. In total, Bitcoin ETPs, which include products such as the ProShares Bitcoin Strategy exchange-traded fund (ETF), now have 205,000 BTC under their control — a new record. “While the M...

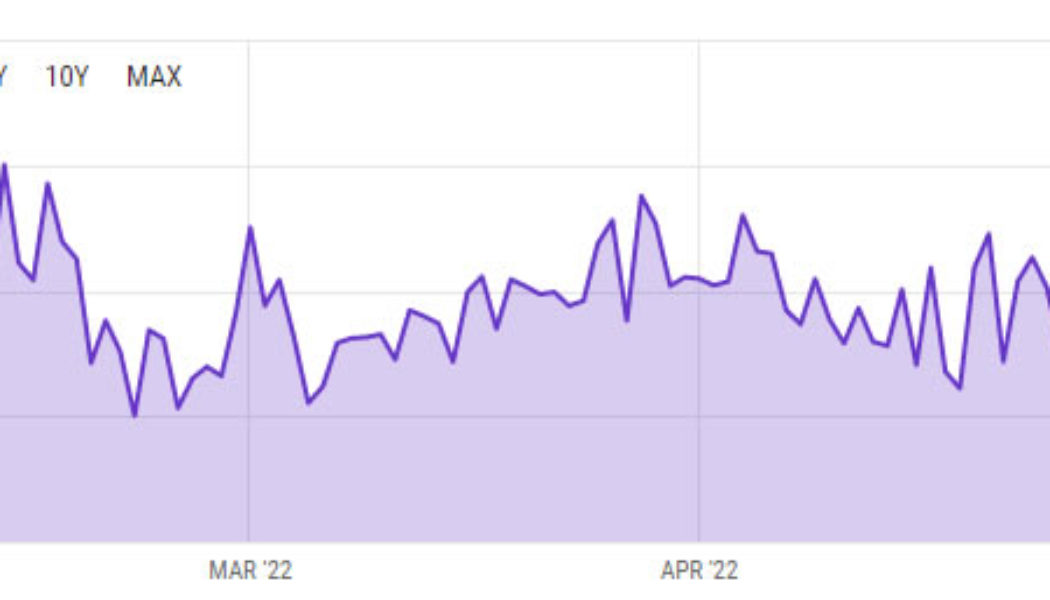

Bitcoin daily mining revenue slumped in May to eleven-month low

Bitcoin (BTC) mining revenue and profitability have continued to slide along with the asset’s price this year as the crypto winter deepens. May has been one of the worst months for Bitcoin miners in the past year as revenue and profitability continue to tank. Bitcoin daily mining revenue tanked as much as 27% in May, according to data from Ycharts sourcing data from Blockchain.com. On May 1, the analytics provider reported daily revenue of $40.57 million for BTC miners, but by the end of the month, it had fallen to $29.37 million. Daily mining revenue hit an eleven-month low of $22.43 million on May 24. BTC daily mining revenue YTD – ycharts.com Daily mining revenue spiked to a peak of around $80 million in April 2021 but has since fallen 62% to current levels. May ended the...

STEPN rebounds sharply after falling 80% in a month — is GMT price bottoming out?

A massive downtrend in the STEPN (GMT) prices witnessed in the last 30 days appears to be nearing exhaustion. GMT’s price has rebounded by nearly 35%—from $0.80 on May 27 to $0.99 on May 28. Interestingly, the upside retracement started after the price fell in the same range, which had acted as support before GMT’s 500% and 120% price rallies in March and early May, respectively. GMT/USD daily price chart. Source: TradingView Additionally, the rebound further preceded an 80% drop from its record high of $4.50, established on April 27, which left GMT oversold, per its daily relative strength index reading that slipped below the oversold threshold of 30 on May 26. The technical support, in addition to oversold RSI, suggests GMT is in the process of bottoming out. GMT price levels...

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and Chief Investment Officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24 Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the US withdrawal in August 2021 as an example. “When the US pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anybody in the world if you have a phone.” Miller said examples of how the crypto can function as ins...

World Bank won’t support Central African Republic’s Sango crypto hub

The World Bank has signalled its concerns over the Central African Republic (CAR) adopting Bitcoin (BTC) as a legal currency and says it won’t support the newly announced “Sango” crypto hub. At the end of April CAR president Faustin-Archange Touadéra established a regulatory framework for cryptocurrency in the country and adopted Bitcoin as a legal tender. On May 24 he announced a plan to launch the country’s first crypto hub called “Sango”. Sango is described as the country’s first “Crypto Initiative” — a legal hub for crypto related businesses encompassing economic policies including no corporate or income tax and thecreation of a virtual and physical “Crypto Island.” An official document outlining the Sango project states that the country “received approval for a $35 million development...

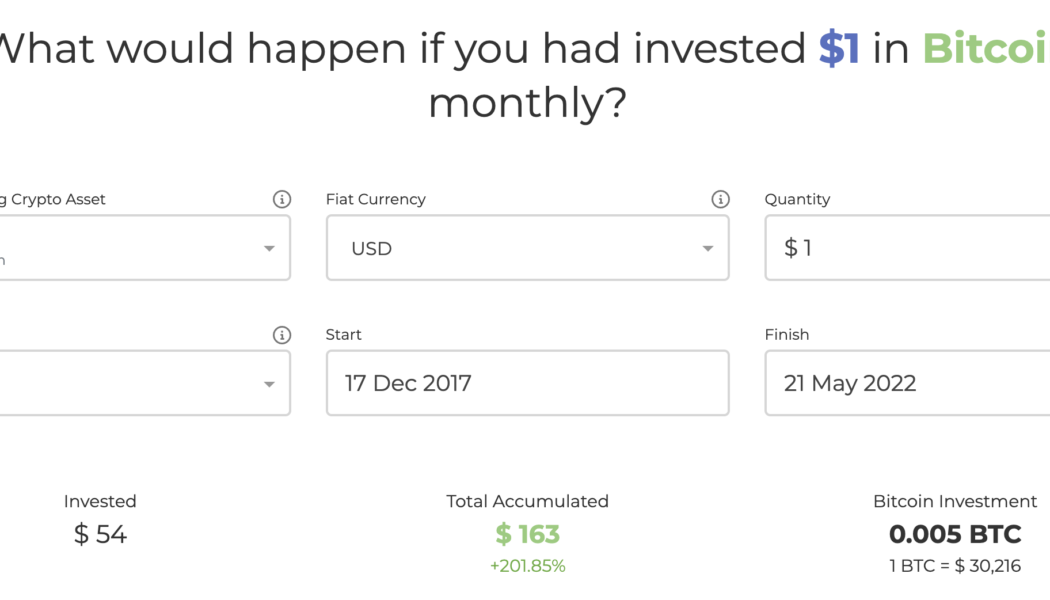

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...