BTC

Ethereum sets record ETH short liquidations, wiping out $500 billion in 2 days

Ether (ETH) is setting liquidation records this week as a comparatively modest price uptick reveals how bearish the market has become. Data from on-chain analytics platform CryptoQuant confirmed that United States dollar-denominated short liquidations hit a new all-time high on Oct. 25. Two days, half a billion dollars of ETH shorts It is not just Bitcoin (BTC) causing the bears severe pain this week — data from exchanges also shows that Ethereum shorters have suffered heavy losses. ETH/USD delivered fairly impressive gains on Oct. 25-26, rising from lows of $1,337 to highs of $1,593 on Bitstamp before retracing, according to data from Cointelegraph Markets Pro and TradingView. ETH/USD 1-day candle chart (Bitstamp). Source: TradingView While nothing unusual for crypto and for altcoins, in ...

Bitcoin will surge in 2023 — but be careful what you wish for

The Bitcoin (BTC) community is divided about whether the token’s price is going to surge or crash in the year ahead. A majority of analysts and technical indicators suggest it could bottom between $12,000 and $16,000 in the months to come. This correlates with a volatile macroeconomic environment, stock prices, inflation, Federal Reserve data and (at least according to Elon Musk) a possible recession that could last until 2024. On the other side, influencers, BTC maximalists and a range of other fanatical “shills” maintain its price could skyrocket to $80,000 and beyond. There is evidence to support both sides. One issue is that they may be looking at different time horizons. There’s a strong case to be made that BTC is likely to drop sharply in the months ahead but potentially rise ...

Global recession may last until near 2024 Bitcoin halving — Elon Musk

Bitcoin (BTC) may spend the time until its next block subsidy halving battling recession, Elon Musk suggested. In a tweet on Oct. 21, the Tesla CEO revealed his belief that the world would only exit recession in Spring 2024. Musk: Recession will “probably” stay until Q2, 2024 After the United States entered a technical recession with its Q3 GDP data, debate continues over how much worse the scenario could get. For Musk, while long predicting the United States economy would enter a recession, the likelihood of a global downturn lingering is now real. Asked on Twitter how long he considered a recession to last, the world’s richest man was noncommittal, but erred on the side of years rather than months. “Just guessing, but probably until spring of ‘24,” he wrote, having also said that “it sur...

HODL! Tesla hangs onto all its remaining $218M in Bitcoin in Q3

Electric vehicle manufacturer Tesla has made no further changes to its remaining stash of Bitcoin (BTC) in the third quarter of 2022, despite nearly a $1 billion sell-off in the previous quarter. The company’s Q3 report released Oct. 19 shows $218 million worth of “digital assets” remains on its balance sheet, with no reported losses in the value of its holdings. Based on current prices, it’s estimated that Tesla still holds around 9,720 BTC. In Q2 earnings report, Tesla said it sold 75% of its Bitcoin during the quarter, adding $936 million in cash to its books and recording a $64 million profit from the sale. Tesla CEO Elon Musk explained at the time that the sell-off was due to liquidity concerns from the COVID-19 lockdowns in China. The sell-off during the quarter took a large chunk of...

BTC to outperform ‘most major assets’ in H2 2022 — Bloomberg analyst

Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, stated October has historically been the best month for Bitcoin (BTC) since 2014, averaging gains of about 20% for the month, and that commodities appearing to peak could imply that Bitcoin has reached its bottom. In an Oct. 5 Bloomberg Crypto Outlook report, McGlone says while the rise of interest rates globally is putting downwards pressure on most assets, Bitcoin is gaining the upper hand when compared with commodities and tech stocks like Tesla, with the report noting: “When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum, and the Bloomberg Galaxy Crypto Index to outperform most major assets.” McGlone notes that Bitcoin has its lowest ever volatility against the Bloomberg Comm...

Bitcoin 2021 bull market buyers ‘capitulate’ as data shows 50% losses

Bitcoin’s (BTC) spot trading below $20,000 is seeing a new “capitulation” event encompassing an entire year’s worth of buyers, research reveals. In one of its Quicktake market updates on Sept. 29, on-chain analytics platform CryptoQuant flagged intense selling by a large number of recent hodlers. 2021 bull market coins “have been sold aggressively” As BTC/USD lingers near levels barely seen since 2020, it is not just miners feeling the pinch. Analyzing Bitcoin’s Exchange Inflow Spent Output Ages Bands (SOAB), CryptoQuant contributor Edris showed that those who bought between April 2021 and April 2022 have been selling coins en masse — for less than they bought them. “Looking at the chart, it is evident that coins aged between 6–18 months ago have been sold aggressively re...

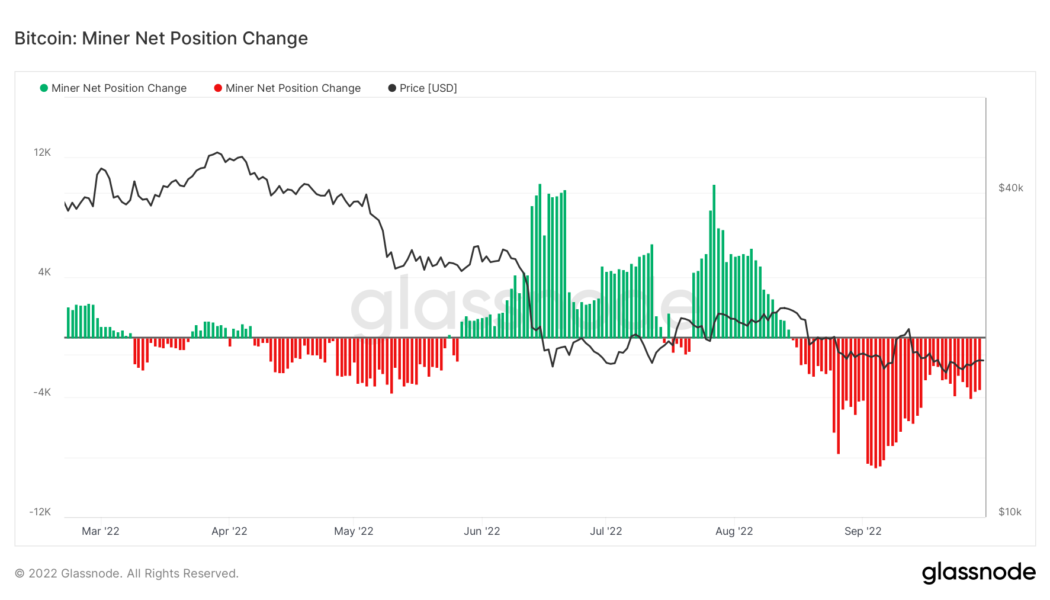

Bitcoin sees first difficulty drop in 2 months as miners sell 8K BTC

Bitcoin (BTC) miners remain under stress at current price levels as data shows large outflows from miner wallets returning. According to on-chain analytics firm Glassnode, monthly miner sales totaled up to around 8,000 BTC in September. Bitcoin miners see heavy sales In contrast to the June lows, when BTC/USD hit its current multi-year floor of $17,600, miners are currently selling considerable amounts of BTC. According to Glassnode, which tracks the 30-day change in miner balances, at the start of the month, miners were down a maximum 8,650 BTC over the month prior. Bitcoin miner net position change chart. Source: Glassnode While this subsequently reduced, taking into account changes in the BTC price, miners are still selling more than they earn on a rolling monthly basis. As of Sept. 29,...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

Bitcoin price dives pre-FOMC amid warning $17.6K low was not the bottom

Bitcoin (BTC) dropped to weekly lows at the Aug. 17 Wall Street open as upcoming Federal Reserve comments unsettled risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar climbs as Fed minutes due Data from Cointelegraph Markets Pro and TradingView tracked a more than 2% daily decline in BTC/USD, which hit $23,325 on Bitstamp. Already showing signs of weakness, the pair slid further as United States equities began trading, hours before the Federal Open Markets Committee (FOMC) was due to release minutes from its latest meeting. While not involving a decision on interest rates, the meeting was cued to give an insight into the Fed’s thinking in terms of the next rate tweak due in September. “The important event tonight with the FOMC minutes, through which information...

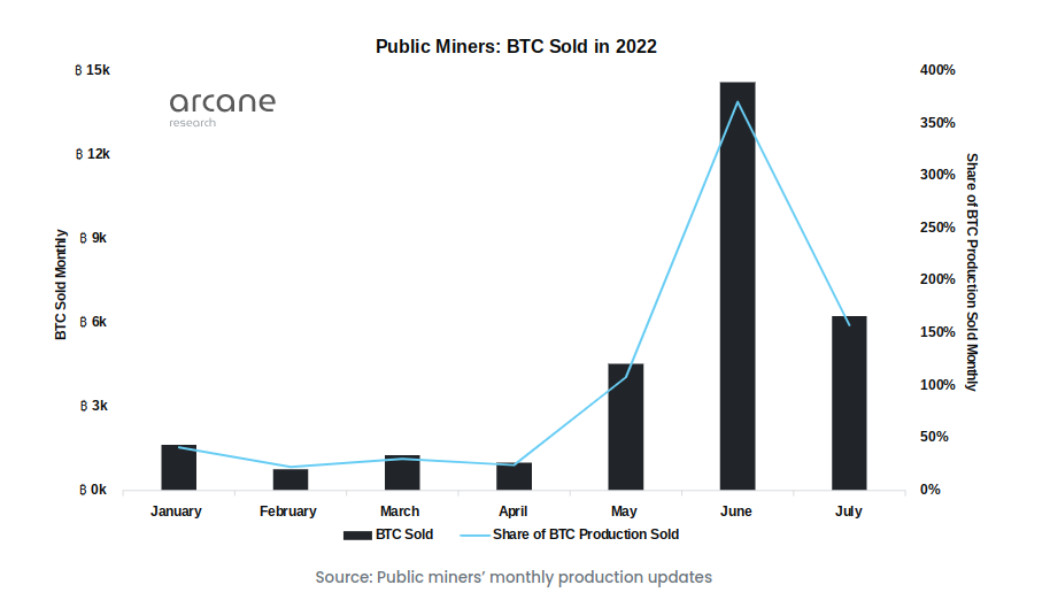

Bitcoin miners hodl 27% less BTC after 3 months of major selling

According to a fresh prediction from crypto analysis firm Arcane Research, miners will continue to sell more BTC than they earn. Miners sold nearly 30% of record BTC stash since May The trip to $25,000 this month decreased pressure on a Bitcoin mining sector which has struggled throughout 2022. At one point, fears abounded that miners’ production cost was far higher than the Bitcoin spot price, and that heavy sales would result in order for miners to stay in business. Worse still, many may have to retire altogether due to their activities no longer being financially viable. Data from the period since May appeared to confirm that major upheaval was taking place. As Arcane notes, one public miner alone — Core Scientific — sold around 12,000 BTC in the period from May to July. While the trend...

Ethereum hits 8-month highs in BTC as money heads for ‘riskier’ altcoins

Ether (ETH) is worth more in Bitcoin (BTC) than at any time since the start of the year amid renewed appetite for altcoins. ETH/BTC 1-day candle chart (Binance). Source: TradingView Altcoin market cap returns to $700 billio Data from Cointelegraph Markets Pro and TradingView confirms that ETH/BTC has cleared key resistance to pass 0.08 BTC on Aug. 13. The move is impressive for largest altcoin Ethereum, as the area around 0.075 represented a troublesome sell zone which had previously kept bulls in check for since January. At the time of writing, ETH/BTC is working to retain the newly-won level, as traders query how long its strength might last. As Cointelegraph reported earlier, ETH/USD passed $2,000 overnight, a significant psychological boundary in itself unseen since May. Not for l...

Elon Musk: US ‘past peak inflation’ after Tesla sells 90% of Bitcoin

Bitcoin (BTC) is in short supply at Tesla, even as its CEO predicts that United States inflation has already peaked. Speaking at Tesla’s 2022 Annual Meeting of Stockholders on Aug. 5, Elon Musk predicted that an upcoming United States recession would only be “mild to moderate.” Musk on costs: “The trend is down” After recently selling almost all of its $1.5 billion BTC holdings, Tesla is seeing the emergence of exactly the kind of economic landscape in which risk assets thrive. During a Q&A session at the Annual Meeting, Musk revealed that six-month commodities pricing for Tesla parts is already getting cheaper, not more expensive. Commodities, he said, are trending down, providing a hint that inflation has already hit its highest levels. “We sort of have some insight ...