BTC USD

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

3 reasons Ethereum price risks 25% downside in June

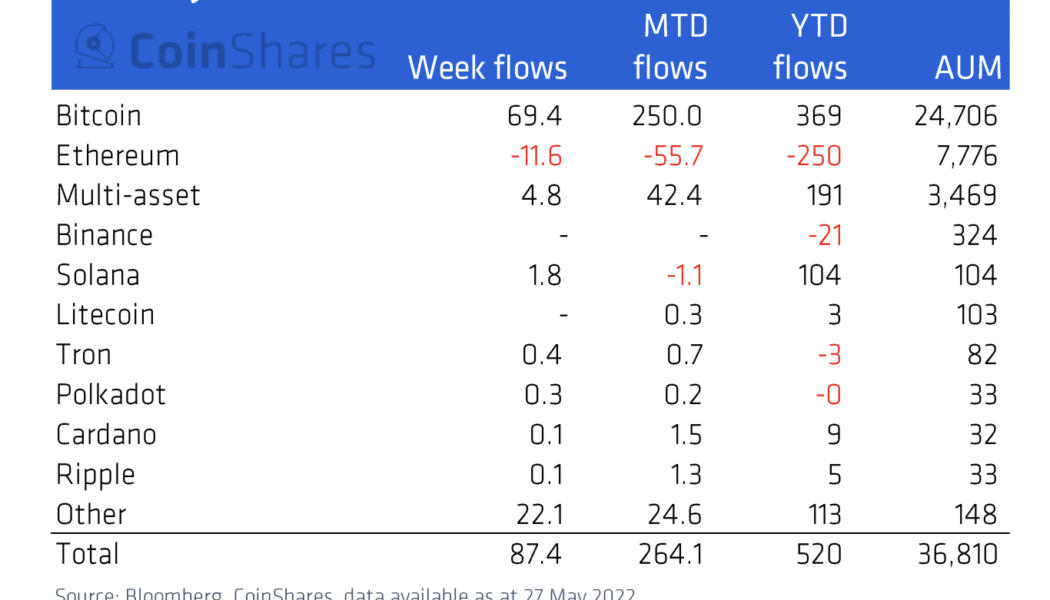

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

- 1

- 2