BTC price

Bitcoin price starts ‘Uptober’ down 0.7% amid hope for final $20K push

Bitcoin (BTC) failed to hold $20,000 into the September monthly close as one trader eyed a final comeback before fresh downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader’s $20,500 upside target remains Data from Cointelegraph Markets Pro and TradingView showed BTC/USD staying lower after finishing the month at around $19,400. Capping 3% losses, the monthly chart failed to rally on Oct. 1, with BTC/USD down another 0.7% in “Uptober” so far, according to data from on-chain data resource Coinglass. BTC/USD monthly returns chart (screenshot). Source: Coinglass Dismal financial data from macro markets contributed to the lack of appetite for risk assets, and among crypto traders, the outlook remained gloomy. For popular Twitter account Il Capo of Crypto, a return ...

Bitcoin ‘great detox’ could trigger a BTC price drop to $12K — Research

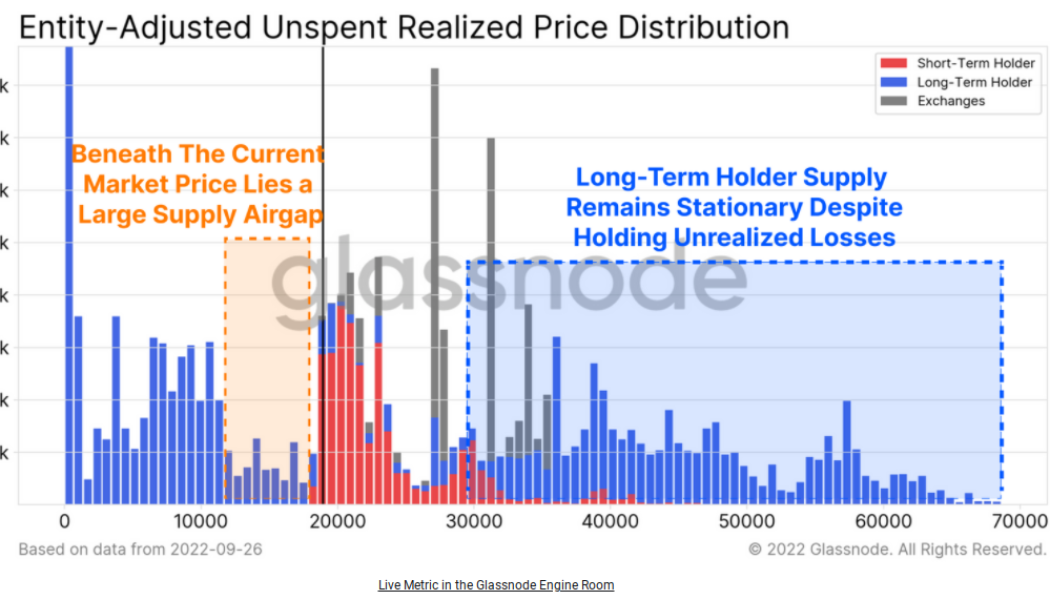

Bitcoin (BTC) is in a “dire condition” when it comes to adoption — but a silver lining is already visible, new research says. In the latest edition of its weekly newsletter, the Week On-Chain, crypto analytics firm Glassnode said that Bitcoin was going through a “great detox.” Bitcoin adoption returns to March 2020 Current BTC price action is pressuring everyone from long-term holders (LTHs) to miners, and relief is hard to come by. Macro turmoil and resistance at $20,000 is keeping BTC/USD at levels visited only once since 2020. With this week’s push above $20,000 accompanied by major profit-taking, warnings remain that more pain is due for the market first before a recovery takes place. For Glassnode, sustained lower levels are causing a seismic shift in the Bitcoin investor profile, wit...

BTC price stays under $19K amid hopes Q4 will end Bitcoin bear market

Bitcoin (BTC) hit new weekly lows into Sept. 28 as risk asset drawdown continued overnight. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: “First new lows” before Q4 recovery Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling to $18,461 on Bitstamp, down almost $2,000 versus the previous day’s high. The change of direction came in lockstep with stocks, which turned red after initially heading marginally higher at the Wall Street open. The S&P 500 and Nasdaq Composite Index ultimately finished the day down 0.25% and up 0.25%, respectively. Crypto, however, failed to recoup its losses, and while hopes were for Q4 to bring about a more solid recovery, traders were betting on the pain continuing first. Popular Twitter account Il Capo of Crypto a...

Bitcoin price loses $20K as trader warns US dollar ‘not quite topped out’

Bitcoin (BTC) crossed under $20,000 after the Sept. 27 Wall Street open as United States equities inched higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. dollar has room to run — trader Data from Cointelegraph Markets Pro and TradingView confirmed the $20,000 mark barely remaining as tentative support on the day. BTC/USD had managed local highs of $20,344 on Bitstamp overnight, while retracing U.S. dollar strength gave modest relief to risk assets across the board. The S&P 500 and Nasdaq Composite Index had been up 0.4% and 0.65%, respectively, after two hours’ trading, but subsequently reversed. At the same time, the U.S. dollar index (DXY) was down 0.15% on the day, back below the 114 mark but still near its highest since mid-2002. “U.S. open coming up. Green ...

Bitcoin gains 5% to reclaim $20K, eyes first ‘green’ September since 2016

Bitcoin (BTC) delivered long-anticipated volatility on Sep. 27 as a squeeze higher resulted in a push beyond $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price 9-day highs greet traders Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it added over 7% after the Sep. 26 close. Local highs of $20,344 appeared on Bitstamp before the pair began consolidating at around $20,200. The move naturally did not go unnoticed by in trading circles, but opinions differed over the outcome, amid warnings that the whole episode may end up trapping overoptimistic traders taking late long positions. “No [rejection] yet, but soon. Expecting higher for now,” popular Twitter account Il Capo of Crypto summarized, sticking by a theory which demanded new lower lows...

Bitcoin risks worst weekly close since 2020 as BTC price dices with $19K

Bitcoin (BTC) headed for its lowest weekly close since 2020 on Sep. 25 as a week of macro turmoil took its toll. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader prepares for “important week” for BTC Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading near $19,000 with hours left to run on the weekly candle. While only down $400 since the week began, the pair offered traders little optimism amid fears that the coming days would continue the bleedout across risk assets. “The whole week traded within the monday range. Weekly close gonna be bearish, looking like a pin bar,” popular trading account Crypto Yoddha told Twitter followers in a summary post. “Also consolidating at the range low. So need a bounce first before taking a position. Ne...

Goldman Sachs’ bearish macro outlook puts Bitcoin at risk of crashing to $12K

A sequence of macro warnings coming out of the Goldman Sachs camp puts Bitcoin (BTC) at a risk of crashing to $12,000. Bitcoin in “bottom phase?” A team of Goldman Sachs economists led by Jan Hatzius raised their prediction for the speed of Federal Reserve benchmark rate hikes. They noted that the U.S. central bank would increase rates by 0.75% in September and 0.5% in November, up from their previous forecast of 0.5% and 0.25%, respectively. Fed’s rate-hike path has played a key role in determining Bitcoin’s price trends in 2022. The period of higher lending rates — from near zero to the 2.25-2.5% range now — has prompted investors to rotate out of riskier assets and seek shelter in safer alternatives like cash. Bitcoin has dropped by almost 60% year-to-date and is...

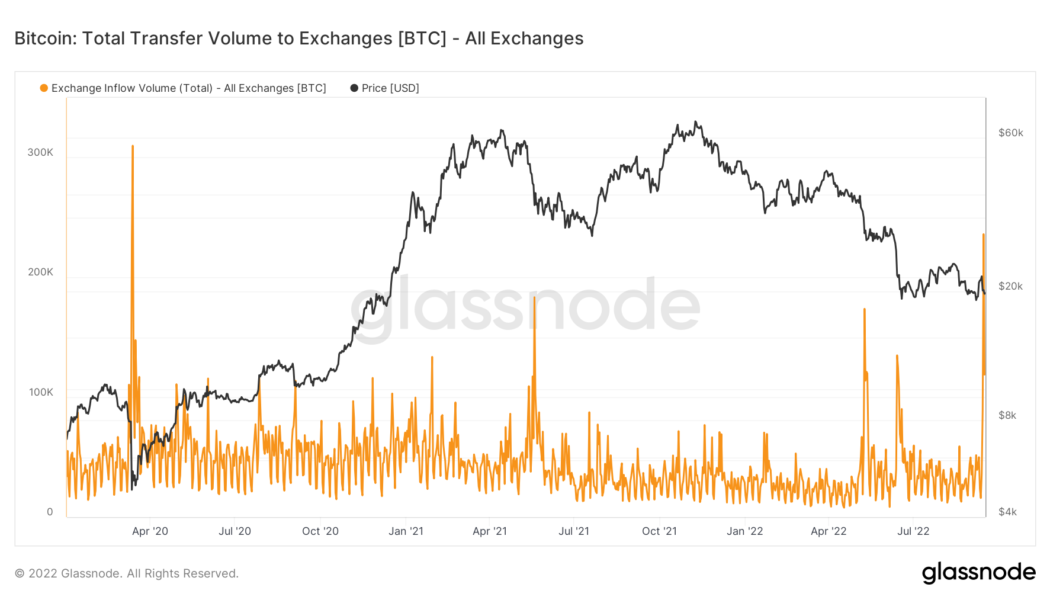

Bitcoin exchange inflows see biggest one-day spike since March 2020

Bitcoin (BTC) exchanges have seen huge volumes this month as price declines lead to renewed interest in trading. Data from sources including on-chain analytics firm Glassnode shows exchange inflows hitting their highest since March 2020. “The scent of volatility is in the air” On Sept. 14, over 236,000 BTC made its way to the 1 major exchanges tracked by Glassnode. This was the largest single-day spike since the chaos that surrounded Bitcoin’s dip to just $3,600 in March 2020. Bitcoin total transfer volume to exchanges chart. Source: Glassnode The sell-offs in May 2021 and May and June this year failed to match the tally, suggesting that more of the Bitcoin investor base is currently aiming to reduce exposure. Separate data from analytics firm Santiment covering both centralize...

Bitcoin price loses $20K, ETH price drops 8% after ‘monumental’ Ethereum Merge

Bitcoin (BTC) spent a second day threatening $20,000 support on Sept. 15 as markets processed the Ethereum (ET Merge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC stuck between price magnets’ Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking below $20,000 again overnight to recover marginally above the boundary for a brief period. The largest cryptocurrency broadly failed to regain lost ground after surprise United States inflation data on Sep. 13 sent risk assets into a tailspin. Down 13.5% versus the week’s top at the time of writing, Bitcoin offered little inspiration to traders who were still eyeing further losses. Yes, we could pump from here. No, the bottom is not in. pic.twitter.com/dXYKngcQtR — Material Indicators (@MI_Algos) S...

Bitcoin price sheds $1K in 3 minutes as US CPI inflation overshoots

Bitcoin (BTC) crashed below $22,000 instantly on Sep. 13 after United States inflation data failed to meet estimates. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print sparks major crypto rout Data from Cointelegraph Markets Pro and TradingView showed BTC/USD swiftly falling $1,000 after Consumer Price Index (CPI) inflation for August came in at 8.3% year-on-year. Consensus had agreed that 8.1% would be the latest figure, and the overshoot suggested that inflation was not slowing at the expected pace. US CPI for August YoY coming in above expectations at 8.3% (expected 8.1%) but lower than in July with 8.5%. MoM core CPI coming in hot at 0.6% twice as high as the expected 0.3%. Not what the Fed wants to see. So 75bps it is at the next meeting? — Jan Wüstenfel...

Elon Musk, Cathie Wood sound ‘deflation’ alarm — Is Bitcoin at risk of falling below $14K?

Bitcoin (BTC) has rebounded by 20% to almost $22,500 since Sept. 7. But bull trap risks abound in the long run as Elon Musk and Cathie Wood sound an alarm over a potential deflation crisis. Cathie Wood: “Deflation in the pipeline” The Tesla CEO tweeted over the weekend that a major Federal Reserve interest rate hike could increase the possibility of deflation. In other words, Musk suggests that the demand for goods and services will fall in the United States against rising unemployment. A major Fed rate hike risks deflation — Elon Musk (@elonmusk) September 9, 2022 Typically, rate hikes have been bad for Bitcoin this year. In context, the period of the Fed raising its benchmark rates from near zero in March 2022 to 2.25%–2.50% in August 2022 has coincided wi...

Bitcoin short squeeze ‘not over’ as BTC price eyes 17% weekly gains

Bitcoin (BTC) stayed higher into the Sep. 10 weekly close as optimistic forecasts favored $23,000 next. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $23,000 targets remain in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $21,730 on Bitstamp overnight — the most since Aug. 26. The pair managed to conserve its prior gains despite low-volume weekend trading conditions being apt to amplify any weakness. Among analysts, excitement was palpable going into the new week, one which should prove pivotal for short-term crypto price action. The Ethereum (ETH) Merge and fresh United States inflation data were the top catalysts expected to influence the market. “Expect volatility to pick up around next week’s economic data,” on-chain monitoring res...