BTC price

Bitcoin price returns to $16K amid warning over BTC whale selling

Bitcoin (BTC) headed higher into the Nov. 22 Wall Street open after setting another two-year low. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Thanksgiving buywall appears at $12,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it recrossed the $16,000 mark, having set lows of $15,480 on Bitstamp. Momentum took the pair to $16,189 before consolidating, marking gains of 3.7% versus the day’s lows. Talk among analysts remained tied to the Digital Currency Group family, including Grayscale, currently at the center of rumors over the fallout from the defunct exchange FTX. For monitoring resource Material Indicators, a “guard rail” bid at $12,000 could ultimately be what protected the market should a major capitulation occur over the Thanksgiving holida...

Bitcoin price levels to watch as traders bet on sub-$14K BTC

Bitcoin (BTC) held steady at the Nov. 21 Wall Street open following a weekly close at levels not seen since late 2020. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering above $16,000 after dipping below the level overnight. Sentiment remained on a knife edge as rumors over crypto business conglomerate, Digital Currency Group (DCG) continued to swirl. Concerns focused on the $10.5 billion investment vehicle, the Grayscale Bitcoin Trust (GBTC), with unsubstantiated talk of possible liquidity problems surfacing across social media. Coinbase, the GBTC custodian, reportedly confirmed its Bitcoin holdings — over 635,000 BTC — were safe and present on the day. GBTC was just one of multiple potential victims...

GBTC next BTC price black swan? — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week still replaying November 2020 after its lowest weekly close in two years. The largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the world on everyone’s lips as November grinds on — just like the Terra LUNA collapse earlier this year, fears are that new victims of FTX’s giant liquidity vortex will continue to surface. The stakes are decidedly high — the initial shock may be over, but the consequences are only just beginning to surface. These include issues beyond just financial losses, as lawmakers attempt to grapple with FTX and place renewed emphasis on urgent Bitcoin and crypto regulation. With that, it is n...

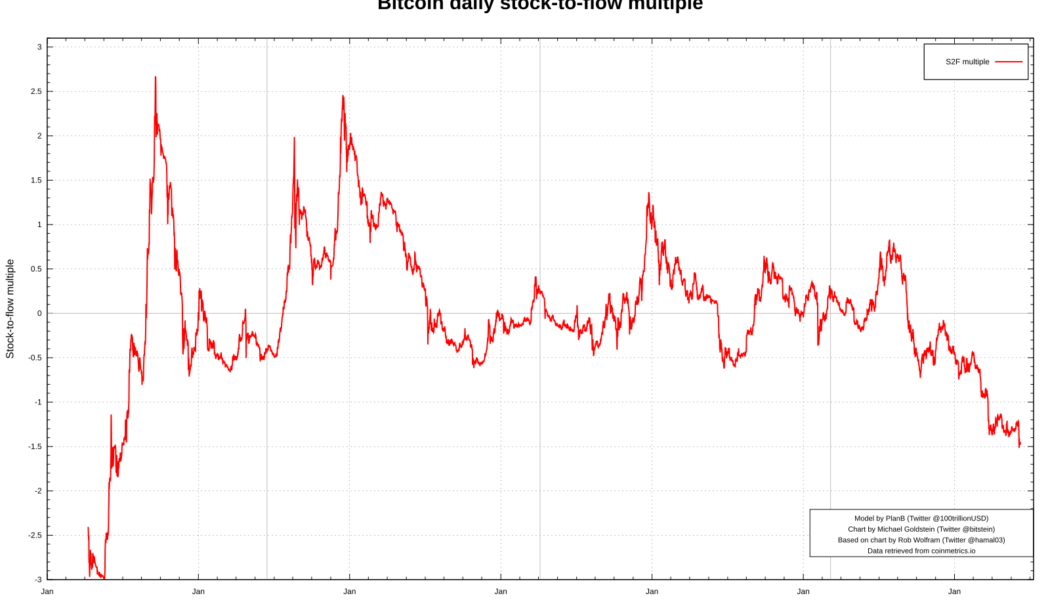

Bitcoin sees record Stock-to-Flow miss — BTC price model creator brushes off FTX ‘blip’

Bitcoin (BTC) is now further than ever from its target price according to the Stock-to-Flow (S2F) model. The latest data shows that BTC/USD has deviated from planned price growth to an extent never seen before. Stock-to-Flow sets grim new record With BTC price suppression ongoing in light of the FTX scandal, an already bearish trend has only strengthened. This has implications for many core aspects of the Bitcoin network, notably miners, but some of its best-known metrics are also feeling the heat. Among them is S2F, which is seeing its price forecasts come under increasing strain — and criticism. Enjoying great popularity until Bitcoin’s last all-time high in November 2021, the model uses block subsidy halving events as the central element in plotting exponential price growth through the ...

Bitcoin price may still drop 40% after FTX ‘Lehman moment’ — Analysis

Bitcoin (BTC) saw a fresh rejection at $17,000 on Nov. 18 as nervous markets weathered more FTX fallout. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC gets a $12,000 price target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to flip $17,000 to support — a trend in place for almost a week. The pair, like major altcoins, remained firmly tied down by cold feet over the FTX debacle and its knock-on effects for various crypto businesses. For analysts, the outlook remained just as grim, with already dismal forecasts worsening in light of recent events. “This underperformance of all crypto assets is here to stay until the bulk of uncertainly has cleared up — likely only near the turn of the new year,” trading firm QCP Capital wrote in its latest circ...

3 reasons why the FTX fiasco is bullish for Bitcoin

The “Bitcoin-is-dead” gang is back and at it again. The fall of the FTX cryptocurrency exchange has resurrected these infamous critics that are once again blaming a robbery on the money that was stolen, and not the robber. “We need regulation! Why did the government allow this to happen?” they scream. For instance, Chetan Bhagat, a renowned author from India, wrote a detailed “crypto” obituary, comparing the cryptocurrency sector to communism that promised decentralization but ended up with authoritarianism. Perhaps unsurprisingly, his column conveniently used a melting Bitcoin (BTC) logo as its featured image. Hi all,“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,” my colum...

Bitcoin price target now $13.5K as BTC trader says ‘exit all the markets’

Bitcoin (BTC) ranged around $16,500 on Nov. 17 as markets digested the latest events surrounding exchange FTX. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView FTX CEO tells of “complete failure of corporate controls” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD seeing only mild volatility at the Wall Street open. The pair showed acclimatization to events around the FTX insolvency, the latest including revelations that Alameda Research had been immune from liquidation while trading on the platform. After the departure of Sam Bankman-Fried, new CEO John Ray III wasted no time in acknowledging the extent of the problems left in his wake. In a filing with the U.S. Bankruptcy Court for the District of Delaware, Ray describes the corporate control of FTX as a “c...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

Bitcoin sets new 7-week high as BTC price jumps past $21K on US jobs

Bitcoin (BTC) passed $21,000 at the Nov. 4 Wall Street open as bulls tackled a formidable sell wall. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Sellers move aside for new multi-week highs Data from Cointelegraph Markets Pro and TradingView shows BTC/USD breaking through resistance to hit local highs of $21,262 on Bitstamp. The pair had struggled to return to higher levels during the week, but the latest order book data from Binance showed asks now shifting up to north of $21,500. BTC/USD order book data (Binance). Source: Material Indicators/Twitter The day’s high marked Bitcoin’s best performance since Sept. 13, beating previous local peaks. Material Indicators, which provided the order book charts, noted that above-expected United States unemployment figures may be a...

Bitcoin holds $20K post-Fed as rising dollar sparks BTC price warning

Bitcoin (BTC) lingered lower on Nov. 3 as the aftermath of the Federal Reserve interest rate hike subsided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trading range forms with $20,000 at center Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $20,000 on the day. The pair had seen flash volatility as the Fed hiked 0.75%, fakeout moves up and down triggering liquidations both long and short. Cross-crypto liquidations for the 24 hours to the time of writing totaled $165 million, data from Coinglass confirmed. Bitcoin ultimately finished slightly lower than its pre-Fed level, an area which continued to hold on the day as analysts awaited fresh cues. For popular Twitter trader Crypto Tony, there was little need to adjust an existing forecas...

Bitcoin price hits $20.8K as volatility ensues over Fed 75-point rate hike

Bitcoin (BTC) saw instant volatility on Nov. 2 as the United States Federal Reserve enacted a fourth consecutive 0.75% interest rate hike. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed hints more hikes to com Data from Cointelegraph Markets Pro and TradingView showed BTC/USD initially dropping to $20,200 before momentarily rebounding to $20,800. The Fed confirmed the 0.75% hike, which marks its most intensive hiking schedule in forty years, in a statement. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent,” it stated. “The Committee anticipates that ongoing increases in the target range wil...

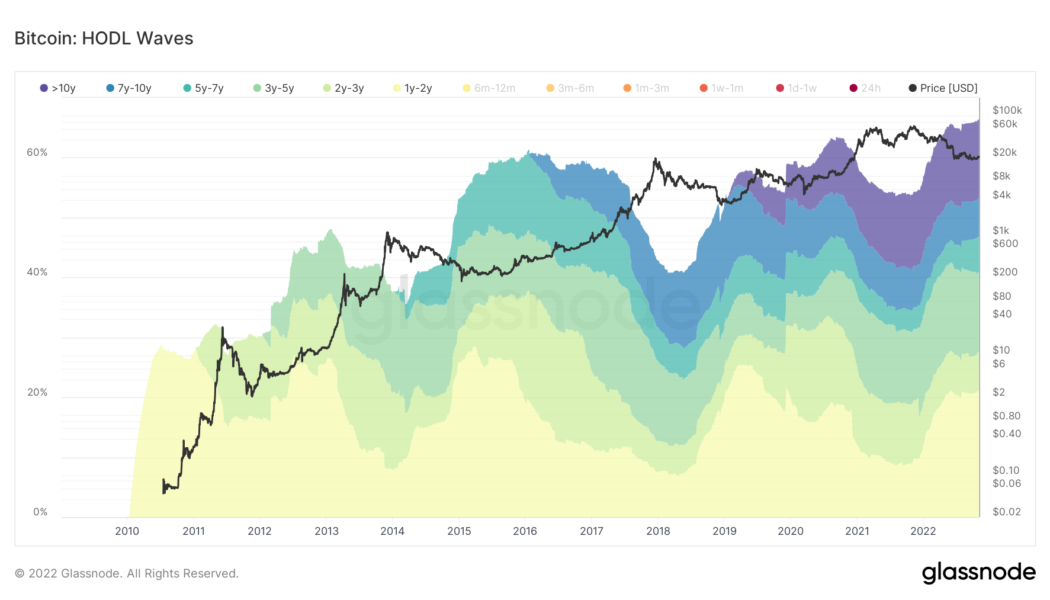

Bitcoin price bottom takes shape as ‘old coins’ hit a record 78% of supply

Bitcoin (BTC) and the rest of the crypto market have been in a bear market for almost a year. The top cryptocurrency has seen its market valuation plummet by more than $900 billion in the said period, with macro fundamentals suggesting more pain ahead. Another bear cycle produces more BTC hodlers But the duration of Bitcoin’s bear market has coincided with a substantial rise in the percentage of BTC’s total supply held by investors for at least six months to one year. Notably, the percentage of coins held for at least a year has risen from nearly 54% on Oct. 28, 2021, to a record high of 66% on Oct. 28, 2022, data shows. Bitcoin hodl waves. Source: Glassnode This evidence suggests that long-term investors are increasingly looking at Bitcoin as a store of value, asserts Charles Edward...