BTC price

Bitcoin dips below $16.7K as US GDP meets fresh BTC price ‘death cross’

Bitcoin (BTC) fell at the Dec. 22 Wall Street open as United States equities reversed previous gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin risks new and unseen “death cross Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to intraday lows of $16,650 on Bitstamp. The pair remained a conspicuous stocks copycat as the S&P 500 opened down 1.6% and the Nasdaq Composite Index traded down 1.8% at the time of writing. The weakness appeared to be a reaction to stronger-than-expected U.S. gross domestic product (GDP) growth in Q3, data for which was released prior to the open. Despite notionally a sign of recovery, concerns focused on the Federal Reserve continuing its restrictive economic policy on the assumption that the economy wo...

BTC price faces 20% drop in weeks if Bitcoin avoids key level — Analyst

Bitcoin (BTC) stayed rigid below $17,000 at the Dec. 19 Wall Street open as skeptical traders feared more downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC traders call time on upside potential Data from Cointelegraph Markets Pro and TradingView showed BTC/USD lingering around the $16,700 mark, practically unmoved over the weekend. The pair saw only fractional volatility at the open, as United States equities fell slightly. At the time of writing, the S&P 500 and Nasdaq Composite Index were down 0.5% and 1%, respectively. For Bitcoin traders, there was little to celebrate, with consensus forming around the potential for testing lower levels next. “Bearish as long as it stays below the $19k,” Crypto Poseidon summarized alongside a chart. BTC/USD annotated chart. ...

‘Wave lower’ for all markets? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the week before Christmas with a whimper as a tight trading range gives BTC bulls little cheer. A weekly close just above $16,700 means BTC/USD remains without major volatility amid a lack of overall market direction. Having seen erratic trading behavior around the latest United States macroeconomic data print, the pair has since returned to an all-too-familiar status quo. What could change it? That is the question on every analyst’s lips as markets limp into Christmas with little to offer. The reality is tough for the average Bitcoin hodler — BTC is trading below where it was two years and even five years ago. “FUD” is hardly in short supply thanks to FTX fallout and concerns over Binance. At the same time, there are signs that miners are recovering, while on-chain in...

Bitcoin targets $16.7K amid fear BNB may ‘drag whole crypto market down’

Bitcoin (BTC) looked set to ditch $17,000 after the Dec. 16 Wall Street open as United States equities continued to fall. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: $240 BNB “has nothing but air below it” Data from Cointelegraph Markets Pro and TradingView tracked new intraday lows of $16,743 for BTC/USD on Bitstamp. The pair had abruptly dived nearly 3% earlier in the day, compounding losses, which immediately followed one-month highs. Ongoing concerns over largest global exchange Binance pervaded the mood, these coming despite the best efforts of CEO, Changpeng Zhao, to dispel what he called “FUD.” As Cointelegraph reported, longtime crypto traders were similarly skeptical of the credibility of the “craziest rumors” about the crypto exchange sector. Nonetheless,...

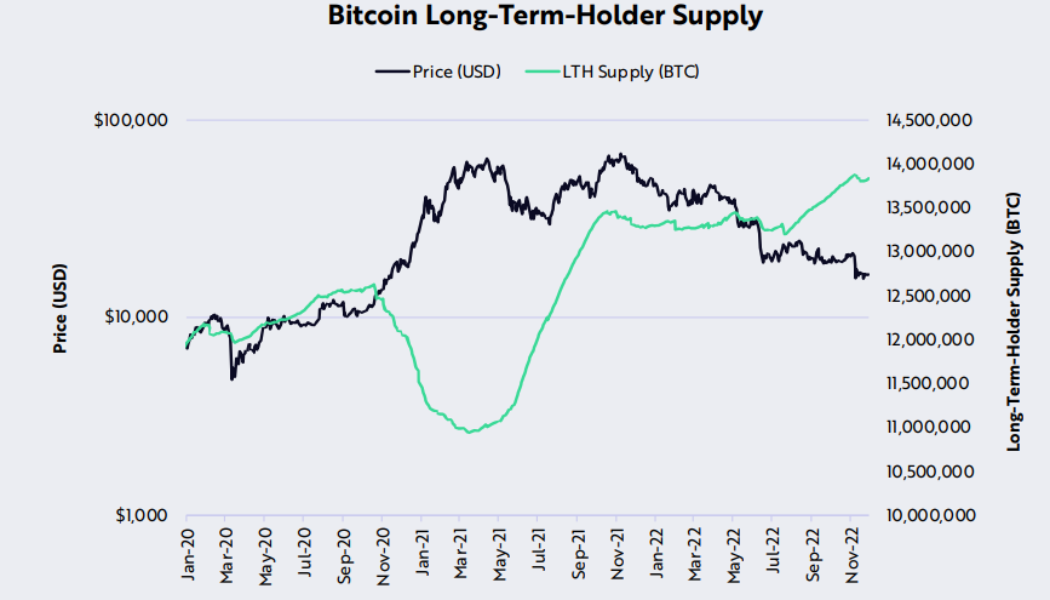

Bitcoin still lacks this on-chain signal for BTC bull market — David Puell

Bitcoin (BTC) only needs one more key on-chain signal for a classic bull market to begin, analyst David Puell says. In a tweet on Dec. 17, the Puell Multiple creator argued that the stage is almost set for the end of the BTC price bear market. Puell: Bitcoin network activity “underwhelming” Despite many calling for new BTC/USD lows of $12,000 or less this cycle, not everyone is wholly bearish on the outlook for Bitcoin. For Puell, two essential on-chain phenomena necessary for BTC price recovery are already in evidence. Long-term holders (LTHs) are resisting the urge to sell despite Bitcoin being down over 70% from its last all-time high. At the same time, short-term “speculators” are feeling acute pain from recent price action. As Cointelegraph reported, these “tourists”...

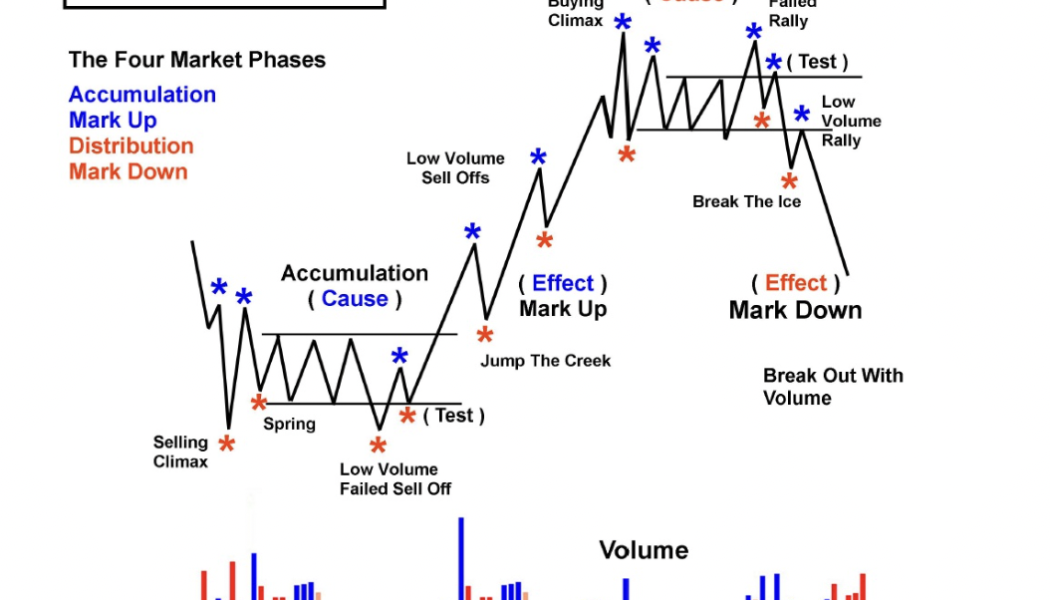

How to trade crypto using Wyckoff accumulation theory

On Dec. 2, independent market analyst Stockmoney Lizards said Bitcoin (BTC) had entered the process of bottoming out inside its current $15,500-$18,000 price range, citing Wyckoff Accumulation. Wyckoff Accumulation is a classic technical analysis setup, named after Richard Wyckoff, a technical analysis pioneer in the first half of the twentieth century, who broke down the market cycle into four distinct phases. But is Wyckoff a reliable pattern, particularly for trading cryptocurrency? Let’s find o. What is Wyckoff accumulation? Wyckoff accumulation is one of the four phases listed in the Wyckoff market cycle theory, with the other three being markup, distribution and markdown. In layman’s terms, each phase determines when large entities drive the direction of the ma...

BTC price shakes off Binance ‘FUD’ as analysts eye Q1 2023 Bitcoin bottom

Bitcoin (BTC) stayed steady near $17,000 at the Dec. 12 Wall Street open as news involving Binance failed to spark BTC price downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Factors line up to “scare” Bitcoin trade Data from Cointelegraph Markets Pro and TradingView showed BTC/USD avoiding fresh volatility as United States markets opened. Having traded sideways throughout the weekend, the pair offered few cues to analysts, who were waiting for U.S. macroeconomic data to shake up the status quo. This, in the form of the November Consumer Price Index (CPI) print, would nonetheless be a pivotal moment for crypto assets, they agreed, with the potential for significant upside and downside hinging on the numbers, due Dec. 13. Subsequent events involving the Feder...

Bitcoin bulls protect $17K as trader eyes key China BTC price catalyst

Bitcoin (BTC) maintained $17,000 support into Dec. 10 ahead of a critical week of macro data. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print will make Fed “slow down” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it traded sideways after the close of trading on Wall Street. The pair looked set for a quiet weekend, with all eyes focused on United States inflation readings and policy updates due from Dec. 13 onward. With the Producer Price Index (PPI) November print behind it, the month’s Consumer Price Index (CPI) results took center stage. As Cointelegraph reported, expectations remain that CPI will show U.S. inflation continuing to abate, sparking renewed strength in risk assets, including crypto. “My personal expectations are t...

Bitcoin clings to $17K as ARK flags ‘historically significant capitulation’

Bitcoin (BTC) and decentralized blockchains are “as strong as ever” in the wake of the FTX meltdown, ARK Invest says. In the latest edition of its monthly newsletter, “The Bitcoin Monthly,” the investment giant came out firmly bullish on BTC. ARK: FTX scandal may be “most damaging event” ever With BTC price volatility ebbing into December, the industry is still reeling from ongoing FTX contagion. As lawmakers only begin to get to grips with the events, when it comes to Bitcoin, ARK is doubling down on its conviction — and setting it firmly apart from centralized alternatives. “The fall of FTX could be the most damaging event in crypto history,” one of the latest report’s “key takeaways” states. While acknowledging that even Digital Currency Group (DCG) — one of whose products, ...

‘Imminent’ crash for stocks? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts its first full week of December at three-week highs as bulls and bears battle on. After a weekly close just above $17,000, BTC/USD seems determined to make the most of relief on stocks and a weakening U.S. dollar. As the United States gears up to release November inflation data, the dollar looks to be a key item to watch as BTC price action teases a recovery from the pits of the FTX meltdown. All may not be as straightforward as it seems — miners are facing serious hardship, data shows, and opinions on stocks’ own ability to continue higher are far from unanimous. As the end of the year approaches, will Bitcoin see a “Santa rally” or face a new year nursing fresh losses? Cointelegraph presents five areas worth watching in the coming days when it comes to BTC/USD perfor...

How much is Bitcoin worth today?

Bitcoin (BTC) trades 24 hours a day, seven days a week. It is a market that never sleeps, and the BTC price is constantly changing. It doesn’t matter which currency or commodity is used to measure how much a bitcoin is worth — BTC is always live and the market is always open. It wasn’t always that way — in the beginning, before around 2010, there were no exchanges or even reliable price information, and BTC/USD traded at tiny prices — at one point even less than a single U.S. dollar cent. Since those days, however, the Bitcoin price has gone up millions of percent. As of December 2022, one bitcoin is worth (BTC). It’s also easy to compare different prices across the crypto market — there’s no need to rely on a single source, and the market is always at work finding consensus. Want to know ...

Bitcoin shrugs off BlockFi, China protests as BTC price holds $16K

Bitcoin (BTC) held crucial $16,000 support into Nov. 29 as bulls weathered ongoing FTX fallout and macro triggers. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader teases BTC long as $16,500 reappears Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD leaving lower levels untouched overnight. The pair had seen a flash downturn after the Nov. 27 weekly close thanks to uncertainty from China over COVID-19 measures. A recovery nonetheless took the market higher, with $16,500 coming into play at the time of writing. As Cointelegraph reported, traders and analysts had warned that it was all but essential to preserve current support, with a violation opening up the road to $14,000 or lower. Popular trader Crypto Tony even felt comfortable going long BTC on th...