BTC price

Bitcoin dips below $47K but one trader is eyeing ‘solid risk/reward’ for longing BTC now

Bitcoin (BTC) added to its losses on Dec. 29 with a fresh tumble briefly taking BTC/USD below $46,600. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI flashes “oversold” Data from Cointelegraph Markets Pro and TradingView showed the pair giving up ground prior to the Wall St. open to increase its 48-hour correction to 10.4%. The latest move in a familiar pattern of behavior, the market showed that the range in which Bitcoin has acted in December remains very much in play. As market participants resigned themselves to a lackluster end to the year, popular trader and analyst Scott Melker noticed a possible buying opportunity at current levels on short timeframes. Bitcoin’s relative strength index (RSI), in addition to other bullish signals, had entered...

‘Net neutral’ — Rising Bitcoin exchange balances could be due to Huobi Chinese user block

Bitcoin (BTC) balances rising on exchanges may not be a sign of investors preparing to sell, new research argues. Unveiling the latest data from across exchanges on Dec. 28, Glassnode on-chain analyst TXMC pointed the finger at fresh changes in China for rising balances elsewhere. Binance “absorbing” orphaned Huobi users The end of December is seeing nerves fray as a rangebound BTC price combines with increased inflows to exchanges. A classic indicator that traders are at least arming themselves to de-risk in the event of further price weakness, Binance has been particularly closely eyed as its BTC stocks rise. At the same time, however, Chinese investors are being frozen out of international spot trading venues in the aftermath of China’s ongoing crackdown on cryptocurre...

Bitcoin daily losses near $4K as S&P 500 hits 69th all-time high of 2021

Bitcoin (BTC) dropped nearly $4,000 on Dec. 28 as the market offered a sharp reminder that the bull run would need to wait. BTC analysts eyes $44,000 BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $48,335 on Bitstamp at Dec. 28’s Wall Street open. The pair had passed $52,000 the previous day, this marking a three-week high, before pressure from sellers halted progress. At the time of writing, Bitcoin circled $49,000 as traders took the opportunity to remind audiences of Bitcoin’s ongoing active range. “Humans get bullish at resistance. It’s a thing,” Scott Melker summarized. “Still ranging. Nothing has changed.” The $52,000 trip indeed failed ...

Bitcoin rises above $51K as the dollar flexes muscles against the euro

Bitcoin (BTC) regained its bullish strength after reclaiming $50,000 last week and continued to hold the psychological level as support on Dec. 27. Meanwhile, its rival for the top safe-haven spot, the U.S. dollar, also bounced off a critical price floor, hinting that it would continue rallying through into 2022. Triangle breakout The U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, has been trending towards the apex of a “symmetrical triangle” pattern on its daily chart. In doing so, the index has been treating the structure’s lower trendline as its solid support level, thus hinting that its next breakout would resolve to the upside. DXY daily price chart featuring symmetrical triangle setup. Source: Tradi...

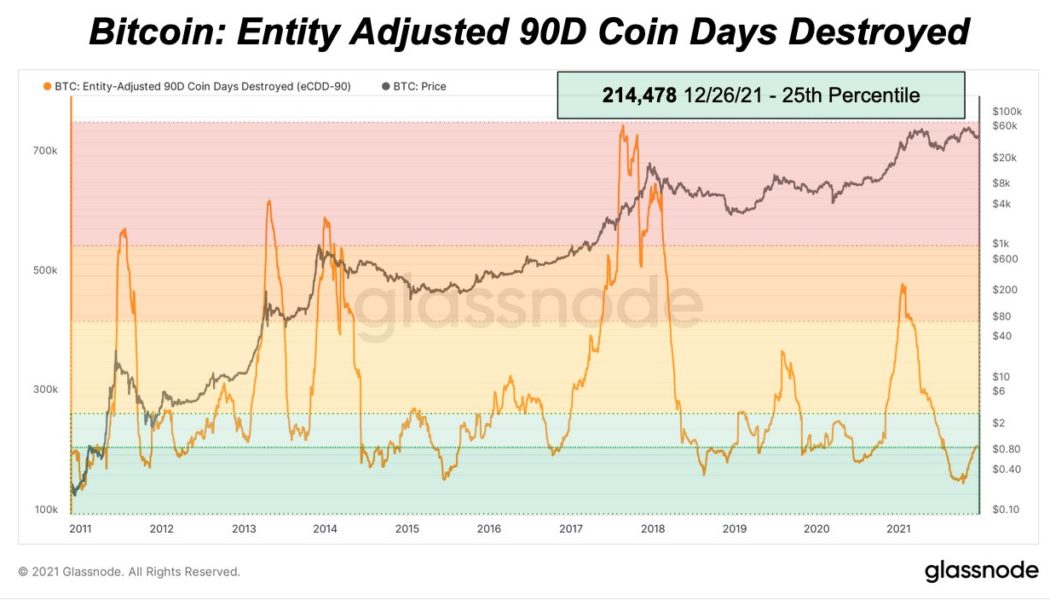

Veteran Bitcoin hodlers are still selling record low amounts of BTC despite 70% gains in 2021

Seasoned Bitcoin (BTC) hodlers have hardly spent any coins despite $69,000 all-time highs this year, data shows. According to the Coin Days Destroyed (CDD) metric from on-chain analytics firm Glassnode, the proportion of coins being spent by old hands remains near record lows. Strong hands knuckle down throughout 2021 In the latest sign of the conviction of those who invest in and hold Bitcoin over multiple years, CDD remains extremely calm. The indicator refers to how long each BTC has been dormant each time it moves. This provides an alternative to simple volume measurements to determine market trends. Older coins are thus more “important” than younger ones with a history of active movement. “Despite a rise over the last few months, the current value is still around historic lows,” Twitt...

Bitcoin slips under $50K amid warning ‘new player’ Binance whale is pressuring BTC price

Bitcoin (BTC) lost $50,000 for the first time in several days on Dec. 26 as exchange inflows caught up with the cautiously optimistic mood. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “New player” beefs up $50,000 sell wall Data from Cointelegraph Markets Pro and TradingView showed volatility hitting BTC/USD overnight on Saturday. The pair had reached $51,500 before starting to retrace, this culminating in a dip to $49,644. At the time of writing, Bitcoin was back circling $50,000. The move came in tandem with a rise in inflows to major exchange Binance, with order book data showing a new wall of resistance being built at $50,000. Binance order book heatmap chart. Source: Material Indicators The behavior points to a large-volume investor shaping market bias...

Bitcoin battles bears ‘on offense’ as Christmas delivers a $50K BTC gift

Bitcoin (BTC) held $50,000 into Dec. 25 as BTC bulls avoided an unwelcome Christmas Day surprise. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Bears become bulls” short term? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maintaining $50,000 support into the weekend, having ranged after local highs above $51,500. The pair was calm as the holiday season got underway, with thinner liquidity yet to show itself in the form of volatile price moves. With most taking a break from trading and analysis, the nearest target to the upside remained the $1 trillion market cap valuation level at $53,000. For popular trader Pentoshi, a point of friction could come in the form of sellers actively driving down BTC/USD to liquidity at $46,000, only to then...

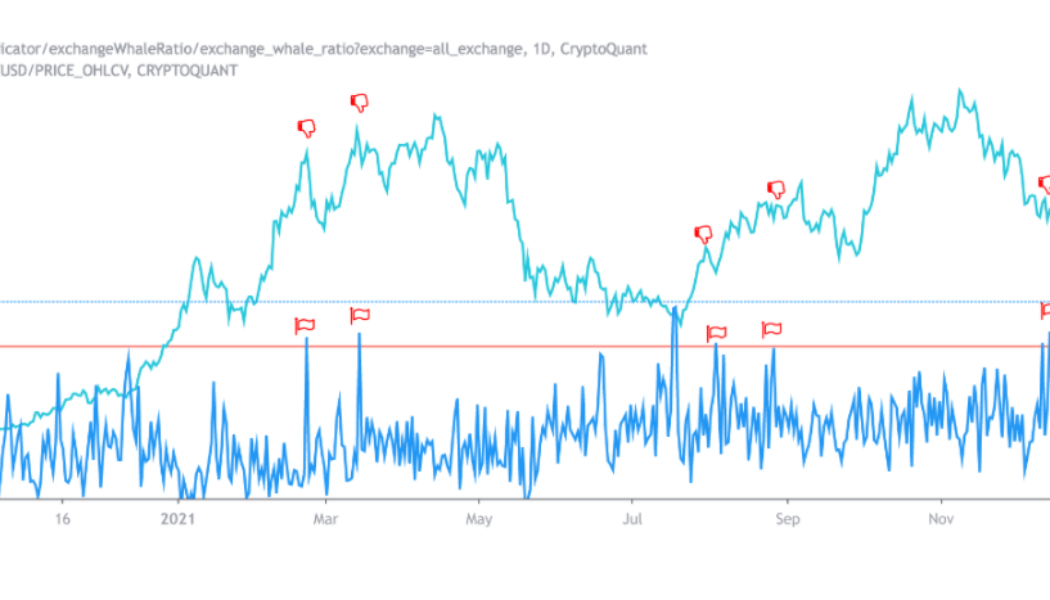

Bitcoin needs to clear $51K to reduce the chance of new sell-off from BTC whales

Bitcoin (BTC) whales are the center of attention again this week as large transactions flow back to exchanges. Data from on-chain analytics platform CryptoQuant on Dec. 24 shows that relatively, whales are increasing their presence as potential sellers. Action stations as Bitcoin climbs to $51,000 According to CryptoQuant’s Exchange Whale Ratio indicator, the proportion of large inflows to exchanges out of total inflows is now at a one-year high. Inflows sped up significantly as BTC/USD rose to $51,000 overnight on Thursday, and the implication could be that large-volume investors plan to take profits at the top end of Bitcoin’s current range. “It is better to watch out until BTC breaks $51k levels,” one CryptoQuant analyst cautioned. “Once we surpass this level next significant resistance...

Bitcoin price flatlines as XRP hits $1 with ‘massive’ altcoin move set for 2022

Bitcoin (BTC) stuck rigidly to its tight range on Dec. 23 as price action continued to contradict strong buying activity. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hodlers busy accumulating Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to hold $49,000 after hitting 10-day highs. The pair remained stuck in a trading zone only around $4,000 wide, a key factor fuelling bets that a “short squeeze” would hit over the holiday period. Against declining volatility, data reinforced conviction among investors, with the supply being bought up at roughly three times the rate of new BTC being mined. “Strong handed HODLers are absorbing supply at more than triple the rate of new coins being mined each day,” on-chain analytics firm Glassnode summarized ...

Bitcoin nears $50K — Here are the BTC price levels to watch next

Bitcoin (BTC) neared $50,000 on Dec. 22 as hopes began to appear that the price correction could be over. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Get bullish once $50,500 breaks — Analyst Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hit highs of $49,600 on Bitstamp — its highest since Dec. 13. A cross-crypto boost from turmoil in the Turkish lira Monday lingered in spirit as Bitcoin and altcoins stayed higher, with attention now focusing on the new year and price levels above $50,000. “The first breakthrough has happened on Bitcoin. But, we still need to break enough levels to state that we’re bullish,” Cointelegraph contributor Michaël van de Poppe declared overnight. “Overall, a breakthrough at $50.5-51.5K and I’m convinced. Also, 2022...

Biggest GBTC discount ever — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with analysts looking for a bottom — but one which may not mean a dip to $40,000 or lower. After an unremarkable weekend, Bitcoin bulls now face a fresh week of bearish sentiment across the global economy as risk appetite stays tepid. Amid the lack of a “Santa rally” for practically anyone, there seem to be few triggers to help BTC/USD return higher in time for the new year. At the same time, on-chain metrics remain strong, and miners are refusing to spend. With Christmas almost here, Cointelegraph takes a look at what to look out for this week when it comes to assessing where Bitcoin may be headed. $50,000 seems far away for Bitcoin bulls Bitcoin failed to produce any significant moves over the weekend, but now, attention is turning to a potenti...

Bitcoin tests yearly moving average as $100K by Christmas needs ‘small miracle’

Bitcoin (BTC) prepared a showdown with a key moving average (MA) price trend on Dec. 19 with time running out for a strong 2021 close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “I vote we bounce and stay bull” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading at $47,000 Sunday, still firmly in an established range. That price is currently the location of Bitcoin’s one-year MA trendline, an important historical line in the sand that has enabled considerable upside if BTC/USD preserves it as support. “The 1yr MA is a pretty important bitcoin bull/bear pivot level historically and we are sat right on it now,” Philip Swift, creator of on-chain data resource Look Into Bitcoin, commented. “I vote we bounce and st...