BTC price

US will see new ‘inflation spike’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins the first week of 2023 in an uninspiring place as volatility stays away — along with traders. After failing to budge throughout the Christmas and new year break, BTC price action remains locked in a narrow range. Having sealed yearly losses of nearly 65% in 2022, Bitcoin has arguably seen a classic bear market year, but for the time being, few are actively predicting a recovery. The situation is complex for the average hodler, who is watching for macro triggers courtesy of the United States Federal Reserve and economic policy impact on dollar strength. Prior to Wall Street returning on Jan. 3, Cointelegraph takes a look at the factors at play when it comes to BTC price performance in the coming week and beyond. Bitcoin traders fear new lows amid flatlining price Bitcoi...

These 4 altcoins may attract buyers with Bitcoin stagnating

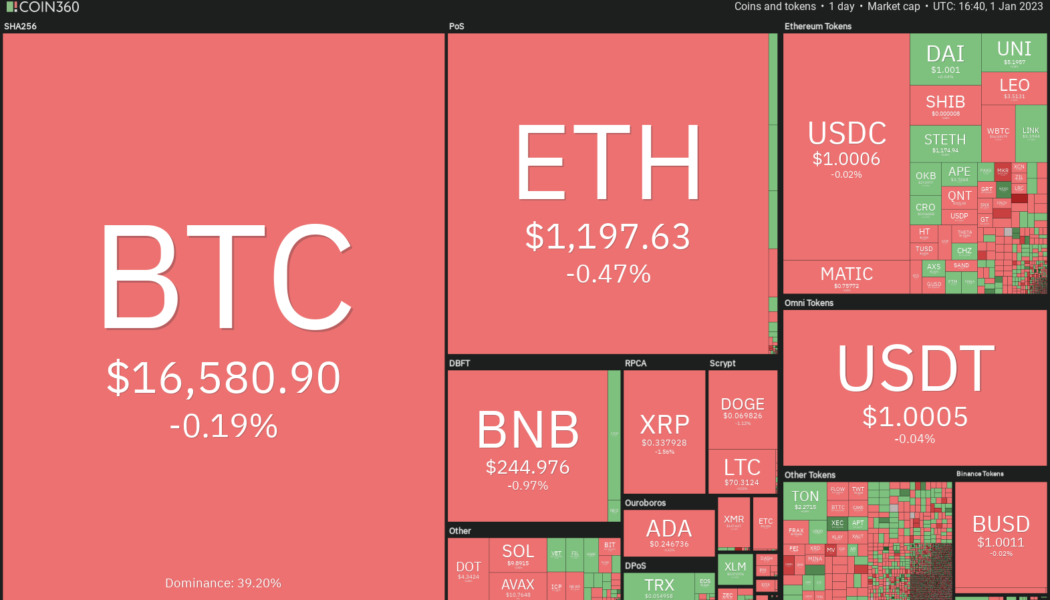

Bitcoin’s (BTC) volatility remained subdued in the final few days of the last year, indicating that investors were in no hurry to enter the markets. Bitcoin ended 2022 near $16,500 and the first day of the new year also failed to ignite the markets. This suggests that traders remain cautious and on the lookout for a catalyst to start the next trending move. Several analysts remain bearish about Bitcoin’s near-term price action. David Marcus, CEO and founder of Bitcoin firm Lightspark, said in a blog post released on Dec. 30 that he does not see the crypto winter ending in 2023 and not even in 2024. He expects that it will take time to rebuild consumer trust but believes the current reset may be good for legitimate firms over the long term. Crypto market data daily view. Source: Coin360 The...

Bitcoin ‘not undervalued yet,’ says research as BTC price drifts nearer to $16K

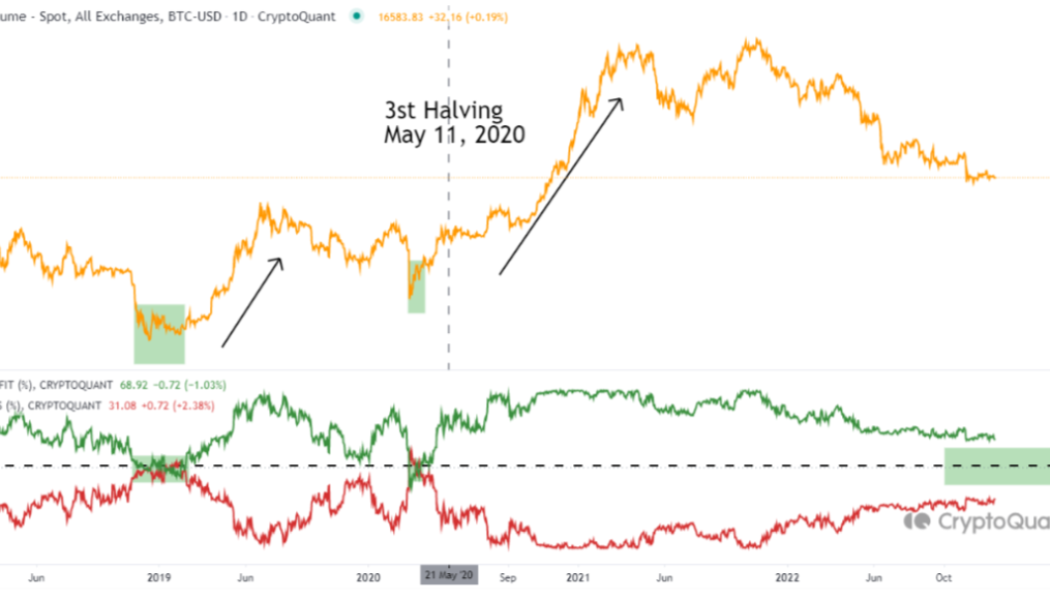

Bitcoin (BTC) may not be at a good value enough for a macro price bottom, according to analysis from CryptoQuant. In a blog post on Dec. 29, a contributor to the on-chain analytics platform flagged one BTC price indicator with further left to fall. Profitability indicator lacks key cross At nearly 80% below all-time highs, BTC/USD is nearing the zone in which it bottomed during previous bear markets. As CryptoQuant’s MAC_D notes, there is no shortage of instruments pointing to the 2022 bear market bottom already forming. Despite this, however, the signs are not yet unanimous, and pointing to transactions in profit and loss, he warns that cheaper BTC prices may still enter. CryptoQuant’s unspent transaction outputs (UTXOs) in profit and loss indicator currently shows around 30% of transacti...

Bitcoin stays put with yearly close set to seal 60% YTD BTC price loss

Bitcoin (BTC) kept traders guessing to the last minute into the 2022 yearly close as volatility remained absent from the market. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price: Where’s the volatility? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a familiar area around $16,500. The pair continued to disappoint players on both sides of the trade after a sideways Christmas, ignoring the potential significance of the simultaneous weekly, monthly, quarterly and yearly candle close. “Technical resistance and overhead liquidity suggests sub $17k local top, but anything goes in the Wild Wild West,” on-chain analytics resource Material Indicators wrote in part of commentary on the Binance BTC/USD order book. An accompanying chart nonethe...

‘Crypto winter’ won’t end in 2023 — Bitcoin advocate David Marcus

Bitcoin (BTC) and crypto will need until at least 2024 to “recover from the abuse of unscrupulous players,” says one of the industry’s best-known names. In a blog post released on Dec. 30, David Marcus, CEO and founder of Bitcoin firm Lightspark, disappointed bulls with his outlook for the coming years. Marcus: “Crypto winter” will likely last until 2025 Less than two months after the FTX meltdown, the repercussions continue to unsettle sentiment and price performance alike. For Marcus, famous for his crypto role at Meta and before that PayPal, bad actors have a lot to answer for, and their specter will remain with the crypto industry beyond 2023. While mentioning FTX only once, he referenced what he called “unscrupulous players” dragging out marke...

BTC price lurches toward $16K as stocks, dollar wobble in final session

Bitcoin (BTC) teased more volatility at the Dec. 30 Wall Street open with BTC/USD heading ever closer to $16,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Will new year deliver “long-awaited volatility?” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD wicking down to lows of $16,337 on Bitstamp. The pair had been gradually upping the volatility in the days after Christmas, as analysts eyed the likelihood of a final burst of action before the yearly close. “Last trading day of the year for TradFi, but crypto will trade through the holiday weekend. Perhaps we may see some of that long awaited BTC volatility around the Weekly/Monthly close and the start of 2023,” on-chain analysis resource Material Indicators ventured. Popular trader and analy...

BTC price preserves $16.5K, but funding rates raise risk of new Bitcoin lows

Bitcoin (BTC) staged a modest recovery on Dec. 29 as United States stock markets rebounded in step. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $10,000 BTC price targets stick Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering above $16,600 at the Wall Street open after wicking below $16,500 for a second day. The pair remained unappealing to traders, many of whom feared a deeper retracement may still occur around the new year. In a list of potential “capitulation targets,” Crypto Tony doubled down on a price of $10,000 and lower for Bitcoin, while also revealing expectations for Ether (ETH) to dip as low as $300. “Things change quick, but if we hit these areas I begin to ladder,” part of accompanying commentary read. Daan Crypto Trades, meanwhile,...

Bitcoin beats Tesla stock in 2022 as BTC price heads for 60% losses

Bitcoin (BTC) circled $16,750 after the Dec. 28 Wall Street open after stocks dragged markets lower. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin analysts stick to downside fears Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it recovered from local lows of $16,559 on Bitstamp. After days of barely any movement up or down, Bitcoin finally saw a flicker of action as traditional markets opened after the Christmas break. Unfortunately for bulls, volatility was to the downside, with BTC/USD seeing its lowest levels since Dec. 20. On equities markets, United States indexes improved after a weak first day, which nonetheless failed to leave much of an impression on BTC commentators, many of whom stuck to grim short-term price forecasts. “I can’...

BTC price dips 1% on Wall Street open as Bitcoin miners worry analysts

Bitcoin (BTC) saw a fresh hint of volatility at the Dec. 27 Wall Street open as United States equities began the final trading week of the year. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin ekes out fresh volatility Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped around 1% at the opening bell. Despite involving a move of only $150, the event was still noticeable on lower timeframes, Bitcoin having shunned any form of volatility for multiple days. The move came in response to a 0.6% drop in the S&P 500 at the open, with the Nasdaq Composite Index dropping 1.4%. The U.S. Dollar Index (DXY) responded in kind, making up for ground lost earlier to return to its position from Dec. 25. U.S. Dollar Index (DXY) 1-hour candle chart....

Bitcoin price volatility due within days, new take says as BTC flatlines at $16.8K

Bitcoin (BTC) hodlers are enjoying another day of zero volatility on Dec. 26 as hopeful forecasts se signs of a trend change. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Opinions diverge further over BTC price bottom Data from Cointelegraph Markets Pro and TradingView confirmed more sideways action near $16,800 for BTC/USD on Boxing Day. The pair took the holiday period in stride, with reduced volumes having no impact on an already deflated market experiencing its lowest volatility on record. With few trading opportunities in the last week of “Do Nothing December,” analysts attempted to ready the ship for potential headwinds to come. “If BTC fails to reclaims ~$17,150 as support before the end of the year… Then $BTC will establish the $13900-$17150 range as its new playgrou...

BTC price levels to watch as Bitcoin limps into Christmas under $17K

Bitcoin (BTC) entered the Christmas holiday period unchanged at $16,800 as an eerie lack of volatility persevered. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopeful price target sees Bitcoin at $17,400 Data from Cointelegraph Markets Pro and TradingView confirmed another day of an almost imperceptible range for BTC/USD just below $17,000. The pair had struggled to break out despite multiple potential catalysts coming from United States economic data prints. With the holiday season ahead, a Santa rally appeared unlikely, while a lack of significant events to come further reduced the chances of flash volatility. In weekend analysis, however, Michaël van de Poppe, founder and CEO of trading firm Eight, nonetheless reiterated the possibility of a step higher to ne...

BTC price ignores US PCE data at $16.8K as Bitcoin rejects volatility

Bitcoin (BTC) saw a flicker of volatility around the Dec. 23 Wall Street open as the latest United States inflation data came in line with expectations. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin sees “crumb” of volatility on PCE Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly decoupling from solid sideways action to dip to $16,750 on Bitstamp. The impact of the November U.S. Personal Consumption Expenditures (PCE) Price Index print was notably muted, despite the data forming a key component of Federal Reserve policy. Even in the low-volume, low-volatility environment thatBitcoin continues to trade in, PCE barely moved markets as traders began to accept that Christmas 2022 may be an underwhelming one. “Hope you enjoyed that little crumb o...