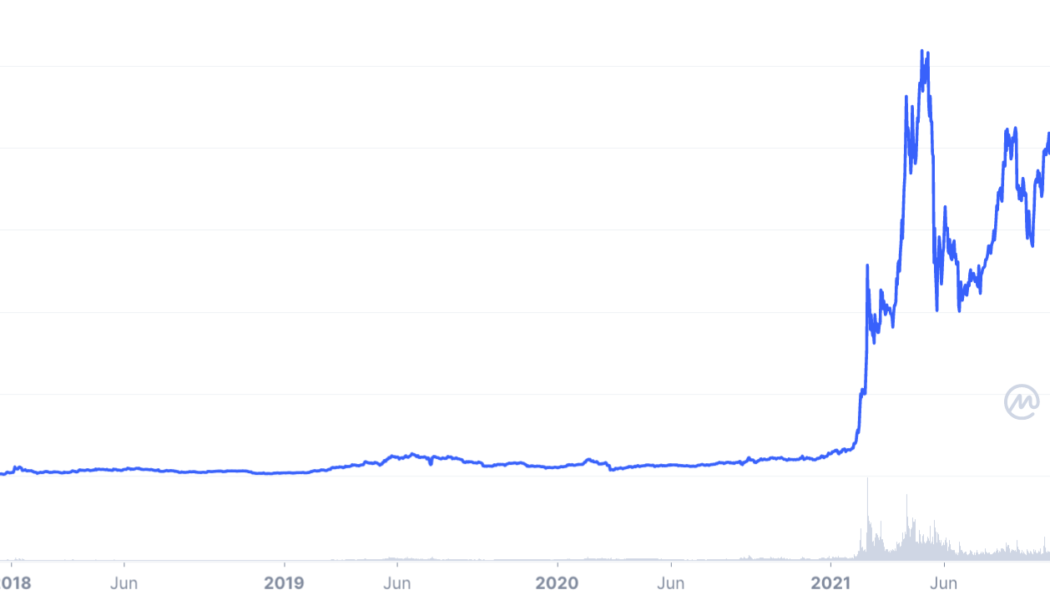

BTC price

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% loss

Bitcoin (BTC) saw further losses on June 12 as thin weekend trading volumes fueled an ongoing sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst likens risk asset ‘pump’ to 1929 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $27,150 on its sixth straight day of downside. With hours to go until the weekly close, the pair was in danger of resuming the losing streak, which had previously seen a record nine weeks of red candles in a row. To avoid that outcome and put in a second “green” close, BTC/USD needed to gain over $2,000 from current spot price, which at the time of writing was $27,400. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView With support levels failing to change the mood thanks to the thinner...

Bitcoin price threatens lowest weekly close since 2020 as inflation spooks markets

Bitcoin (BTC) dropped to two-week lows on June 11 as the week’s Wall Street trading ended with bears in control. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. inflation print proves setback Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it reached $28,528 on Bitstamp, its lowest since May 28. The pair had fallen in step with stock markets on June 10, these finishing the week noticeably down — the S&P 500 and Nasdaq Composite lost 2.9% and 3.5% respectively. This was on the back of surprisingly high inflation data from the United States, which took a turn for the worst in stark contrast to expectations. As Cointelegraph reported, at 8.6%, annual inflation came in at the highest since December 1981. Reacting, market commentators were thus firml...

Ethereum eyes fresh yearly lows vs. Bitcoin as bulls snub successful ‘Merge’ rehearsal

Ethereum’s native token Ether (ETH) resumed its decline against Bitcoin (BTC) two days after a successful rehearsal of its proof-of-stake (PoS) algorithm on its longest-running testnet “Ropsten.” The ETH/BTC fell by 2.5% to 0.0586 on June 10. The pair’s downside move came as a part of a correction that had started a day before when it reached a local peak of 0.0598, hinting at weaker bullish sentiment despite the optimistic “Merge” update. ETH/BTC four-hour price chart. Source: TradingView Interestingly, the selloff occurred near ETH/BTC’s 50-4H exponential moving average (50-4H EMA; the red wave) around 0.06. This technical resistance has been capping the pair’s bullish attempts since May 12, as shown in the chart above. Staked Ether behind ...

Wall Street sends BTC price to $30.8K as latest US dollar uptick fails

Bitcoin (BTC) showed strength at the June 8 Wall Street open as impatient traders waited for a trend to emerge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin still in “no trade zone” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD jumping to near $30,850 after the opening bell, helping claw back some of the ground lost in an overnight correction. Choppy trading conditions prevailed within a familiar range on the day, however, leading to both long and short traders seeing increased risk on low timeframes. For popular trader Crypto Chase, this was a prime period for the transfer of value to “smart money” — away from small-volume speculators and those with “weak hands.” A prior Twitter post had argued for a hands-off approach until a decisiv...

BNB price risks 40% drop as SEC launches probe against Binance

Binance Coin (BNB) price dropped by nearly 7.3% on June 7 to below $275, its lowest level in three weeks. What’s more, BNB price could drop by another 25%–40% in 2022 as its parent firm, Binance, faces allegations of breaking securities rules and laundering billions of dollars in illicit funds for criminals. Bad news twice in a row BNB was issued as a part of an initial coin offering (ICO) in 2017 that amassed $15 million for Binance. The token mainly behaves as a utility asset within the Binance ecosystem, primarily enabling traders to earn discounts on their trading activities. Simultaneously, BNB also functions as a speculative financial asset, which has made it the fifth-largest cryptocurrency by market capitalization. BNB market capitalization was $45.42 billion as of June ...

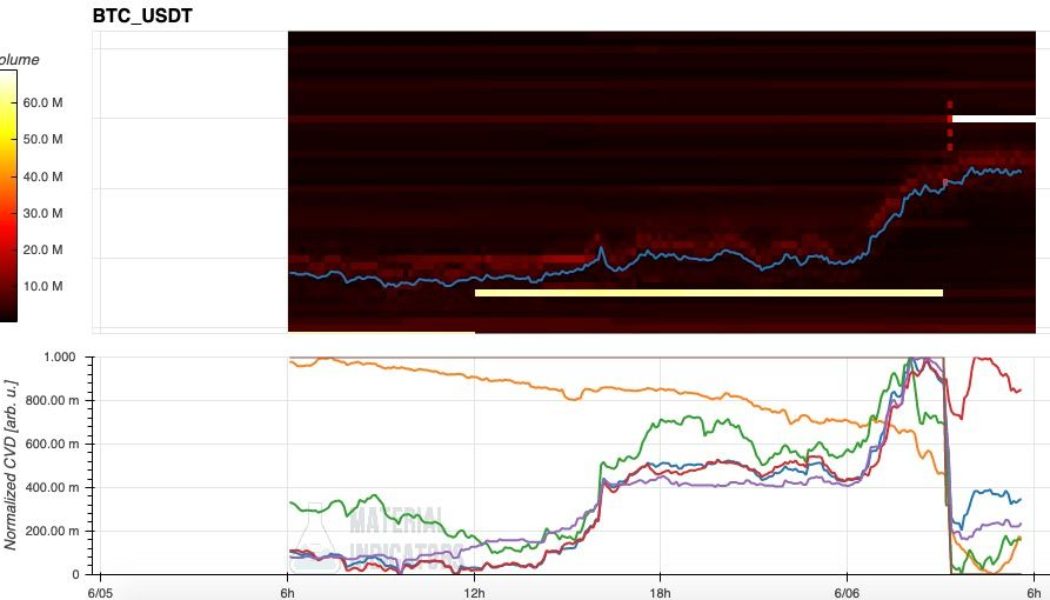

Coinbase balance drops by 30K BTC as Bitcoin price nurses 6% losses

Bitcoin (BTC) held steady at the June 7 Wall Street open after a night of losses cost bulls heavily. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Coinbase sees conspicuous outflows Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged near $30,000, still down 6% versus its prior highs. After underperforming versus United States equities on June 6, the pair nonetheless managed to avoid falling further in step with stocks. At the time of writing, the S&P 500 was down 0.6% from the open, with the Nasdaq Composite Index 0.5% lower. Analyzing order book data, on-chain analytics resource Material Indicators noted that a wall of bids from a whale “spoofing” the market in recent days had finally dissipated. Earlier, that entity had posted a support li...

Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours

Bitcoin (BTC) firmly recommitted to its trading range on June 7 after a fresh move higher was met with a swift sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Some of the best chop we’ve seen” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rejecting decisively at resistance it last encountered on June 1. The pair had delivered daily gains in excess of 6%, but the approach to $32,000 changed the mood, and Bitcoin gave back almost $2,500 in a matter of hours. A classic “Bart Simpson” structure thus formed on hourly timeframes as frustrated traders came to terms with the existing paradigm remaining unchallenged. “Standard price action again on Bitcoin in which all the lows are swept,” Cointelegraph contributor Michaël van de Poppe wrote in a Twitter ...

BTC price snaps its longest losing streak in history — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with some fresh hope for hodlers after halting what has been the longest weekly downtrend in its history. After battling for support throughout the weekend, BTC/USD ultimately found its footing to close out the week at $29,900 — $450 higher than last Sunday. The bullish momentum did not stop there, with the pair climbing through the night into June 6 to reach multi-day highs. The price action provides some long-awaited relief to bulls, but Bitcoin is far from out of the woods at the start of what promises to be an interesting trading week. The culmination will likely be United States inflation data, this itself a yardstick for the macroeconomic forces at world globally. As time goes on, the impact of anti-COVID policies, geopolitical tensions and supply shor...

Bitcoin price needs to close above $29,450 for its first green weekly candle since March

Bitcoin (BTC) kept traders guessing into the June 5 weekly close as BTC price action closely mimicked last weekend. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView BTC price traders $300 in the gree Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling its May 30 opening level at the time of writing, just $300 higher than seven days ago. With hours to go before the weekly candle closed, the pair thus retained the threat of sealing yet another lower low. This would take Bitcoin to a new record in terms of consecutive “red” weeks. Discussing the potential outcomes, traders had mixed opinions. Very hard to tell, again all about daily trend and the recent highs put @ 32k. Gaps above big enough to be interesting to play even > 32. A close li...

Bitcoin long-term hodlers begin ‘distribution’ which preceded BTC price bottoms

Bitcoin (BTC) stayed wedged in a tight range on June 4 as traders’ demands for a new macro low persisted. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Long-term holders begin ‘distribution’ Data from Cointelegraph Markets Pro and TradingView showed BTC/USD stuck between $29,000 and $30,000 into the weekend. The pair had managed a revival to near $31,000 the previous day, but the last Wall Street trading session of the week put pay to bulls’ efforts. As “out-of-hours” markets offered thin volumes but little volatility, eyes were on the potential direction of what would be an inevitable breakout. “The weekly chart on Bitcoin looks nothing short of horrific and so the trend continuation remains. I do think we consolidate a little l...

Bitcoin price risks $29K ‘nosedive’ as Wall Street opens with fresh losses

Bitcoin (BTC) lost bullish momentum at the June 1 Wall Street open as United States equities faced another day of retracement. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Zooming out, “nothing” has changed Data from Cointelegraph Markets Pro and TradingView captured a sharp U-turn for BTC/USD at the start of trading, $1,600 in three hours. At the time of writing, the pair traded at around $30,400, giving back the past days’ gains. For Cointelegraph contributor Michaël van de Poppe, $29,000 was now on the radar after support levels refused to cushion Bitcoin’s initial fall. “Very simple, Bitcoin needs to hold here to have a test at $33K area possible,” he tweeted as BTC/USD reached $31,150. “If not, this is going to nosedive qui...