BTC price

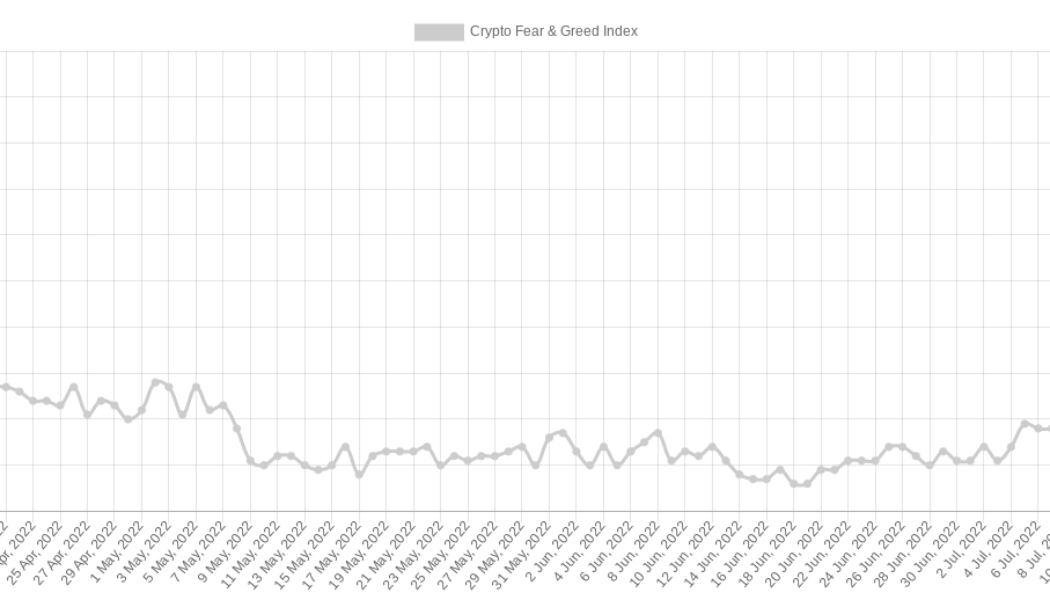

Bitcoin is now in its longest-ever ‘extreme fear’ period

Bitcoin (BTC) may have avoided fresh losses since falling to $17,600 last month, but the sentiment is on the floor. Now, one classic crypto market mood gauge is showing just how long and hard the average investor has suffered. 70 days of “extreme fear” While crypto market sentiment was already “comparable to funeral” before the start of 2022, the subsequent price drawdown in Bitcoin and altcoins produced cold feet like never before. This has now been quantified by the Crypto Fear & Greed Index, a tool that takes multiple sources into account to create an overall score of how the markets are feeling. As of July 15, Fear & Greed has spent 70 days in its lowest bracket — “extreme fear” — marking of a new bearish record. The Index consists of f...

Bitcoin fights key trendline near $20K as US dollar index hits new 20-year high

Bitcoin (BTC) found a new focus just under $20,000 on July 14 as U.S. dollar strength hammered out yet another two-decade high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView DXY moves bring yen, euro into focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding from lows sparked by a fresh 40-year high for U.S. inflation as per the Consumer Price Index (CPI). After briefly dipping under $19,000, the pair took a flight above $20,000 before consolidating immediately below that psychologically significant level. For on-chain analytics resource Material Indicators, it was now “do or die” for BTC price action when it came to a key rising trendline in place since mid-June. On the day, that trendline stood at around $19,600, with BTC/USD n...

Bitcoin price indicator that marked 2015 and 2018 bottoms is flashing

Bitcoin (BTC) could undergo a massive price recovery in the coming months, based on an indicator that marked the 2015 and 2018 bear market bottoms. What’s the Bitcoin Pi Cycle bottom indicator? Dubbed “Pi Cycle bottom,” the indicator comprises a 471-day simple moving average (SMA) and a 150-period exponential moving average (EMA). Furthermore, the 471-day SMA is multiplied by 0.745; the outcome is pitted against the 150-day EMA to predict the underlying market’s bottom. Notably, each time the 150-period EMA has fallen below the 471-period SMA, it has marked the end of a Bitcoin bear market. For instance, in 2015, the crossover coincided with Bitcoin bottoming out near $160 in January 2015, followed by an almost 12,000% bull run toward $20,000 in December 2017....

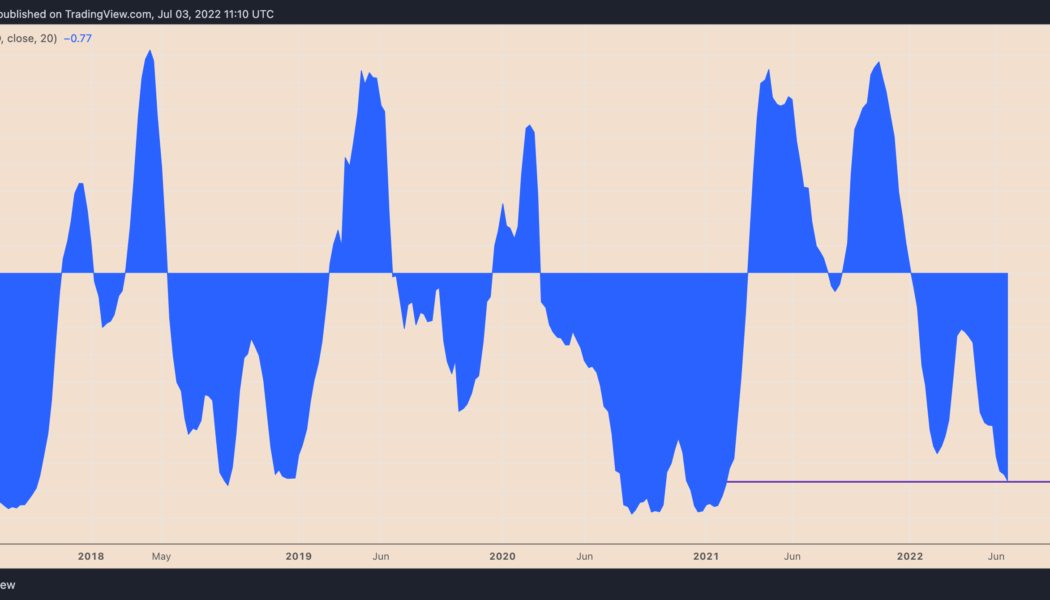

Bitcoin’s inverse correlation with US dollar hits 17-month highs — what’s next for BTC?

Bitcoin (BTC) has been moving in the opposite direction of the U.S. dollar since the beginning of 2022 — and now that inverse relationship is more extreme than ever. Bitcoin and the dollar go in opposite ways Notably, the weekly correlation coefficient between BTC and the dollar dropped to 0.77 below zero in the week ending July 3, its lowest in seventeen months. Meanwhile, Bitcoin’s correlation with the tech-heavy Nasdaq Composite reached 0.78 above zero in the same weekly session, data from TradingView shows. BTC/USD and U.S. dollar correlation coefficient. Source: TradingView That is primarily because of these markets’ year-to-date performances amid the fears of recession, led by the Federal Reserve’s benchmark rate hikes to curb rising inflation. Bitcoin, for example,...

Bitcoin addresses in loss hit all-time high amid $18K BTC price target

Bitcoin (BTC) meandered into the weekly close on July 3 after weekend trading produced a brief wick below $18,800. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bollinger bands signal volatility due Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it stuck to $19,000 rigidly for a third day running. The pair had gone light on volatility overall at the weekend, but at the time of writing was still on track for the first weekly close below its prior halving cycle’s all-time high since December 2020. The previous weekend’s action had produced a late surge which saved bulls from a close below $20,000. Momentum remained weak throughout the following week’s Wall Street trading, however, and traders were unconvinced about the potential for a significant relief...

Bitcoin will see ‘long bear market’ says trader with BTC price stuck at $19K

Bitcoin (BTC) failed to reclaim recent losses into July 2 as traders prepared for stagnant price action to continue. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Downtrend acceleration” still in force Data from Cointelegraph Markets Pro and TradingView tracked a limp BTC/USD as it chopped around the $19,000 mark into the weekend. The Wall Street trading week had finished without surprises, with United States equities practically stagnant — providing little impetus for crypto volatility. The U.S. dollar index, or DXY, fresh from a retest of twenty-year highs, ran out of steam to circle 105 points. U.S. dollar index (DXY) 1-hour candle chart. Source: TradingView Order book data from largest global exchange Binance showed BTC/USD caught between buy and sell liquidi...

Bitcoin price: June close barely beats 2017 high as Coinbase Premium flips positive

Bitcoin (BTC) finished June 2022 just below $20,000 after a last-minute pump saw bulls escape 40% monthly losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: Bitcoin could stay “boring” for months Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking higher into the monthly close, which came in at $19,924 on Bitstamp. With that, the pair narrowly avoided its first-ever monthly close below a previous halving cycle’s all-time high. On Bitstamp in November 2017, Bitcoin reached approximately $19,770. Right on time. #BTC pic.twitter.com/KxZiOF0kF8 — Material Indicators (@MI_Algos) June 30, 2022 The success was, at best, touch-and-go for a market that nonetheless sealed its worst monthly losses since September 2011, these coming in at around 37.3%. ...

Bitcoin price limps under $20K as Asia extends global stocks weakness

Bitcoin (BTC) returned under $20,000 on June 29 as analysts stayed hopeful of a trip higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders looks to $19,500 for support Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it crossed below the $20,000 mark for the first time in nearly a week in Asian trading hours. The weakness followed rangebound behavior near $21,000, this characterizing a market still in tune with moves in global equities. The S&P 500 had finished its previous session down 2%, while the Nasdaq Composite Index lost 3%. On the day, Hong Kong’s Hang Seng was likewise 2.1% lower, while China’s Shanghai Composite Index traded down 1.4%. With few bullish cues coming from macro, Bitcoin thus had little stopping it from revisiting the ...

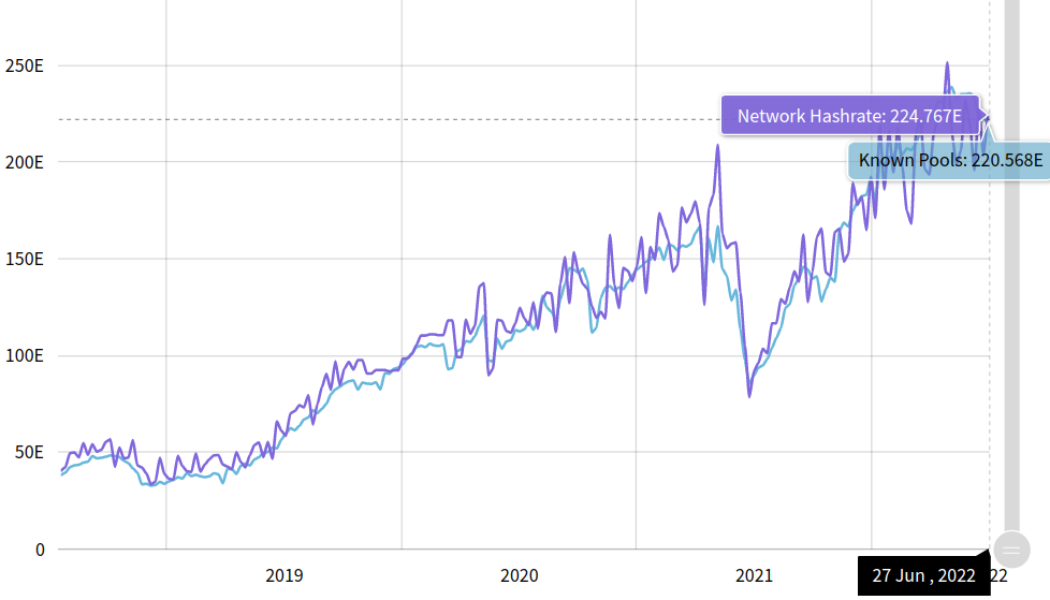

3 charts showing this Bitcoin price drop is unlike summer 2021

Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic. BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks. Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last. Hash rate Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas. While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of week...

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

BTC price tops 10-day highs as Bitcoin whale demand sees ‘huge spike’

Bitcoin (BTC) made the most of weekend volatility on June 26 as a squeeze saw BTC/USD reach its highest in over a week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Unusual whale activity” flagged Data from Cointelegraph Markets Pro and TradingView followed the largest cryptocurrency as it hit $21,868 on Bitstamp. Just hours from the weekly close, a reversal then set in under $21,500, Bitcoin still in line to seal its first “green” weekly candle since May. The event followed warnings that volatile conditions both up and down could return during low-liquidity weekend trading. On-chain data nonetheless fixed what appeared to be buying by Bitcoin’s largest-volume investor cohort prior to the uptick. “Unusual whale activity detected in B...