BTC price

3 Bitcoin trading behaviors hint that BTC’s rebound to $24K is a ‘fakeout’

Bitcoin (BTC) price rallied toward $24,200 on July 28 after a near 10.5% surge that began a day earlier. The gains appeared after Federal Reserve Chairman Jerome Powell signaled intentions to slow down their prevailing tightening spree. They prompted some Bitcoin analysts to predict short-term upside continuation, with CryptoHamster seeing BTC at $26,000 next. It seems that the downside breakout was a false one, and the bullish flag has been validated. Let’s see how fast $BTC can reach those targets. #bitcoin $BTCUSD $ETH $ETHUSD #ビットコイン #биткойн #比特币 https://t.co/v6x4Ka23L7 pic.twitter.com/nKoEV8440X — CryptoHamster (@CryptoHamsterIO) July 28, 2022 But BTC’s potential to recover entirely from its ongoing bearish slumber appears low for at least three key reasons. Bitcoin bulls...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

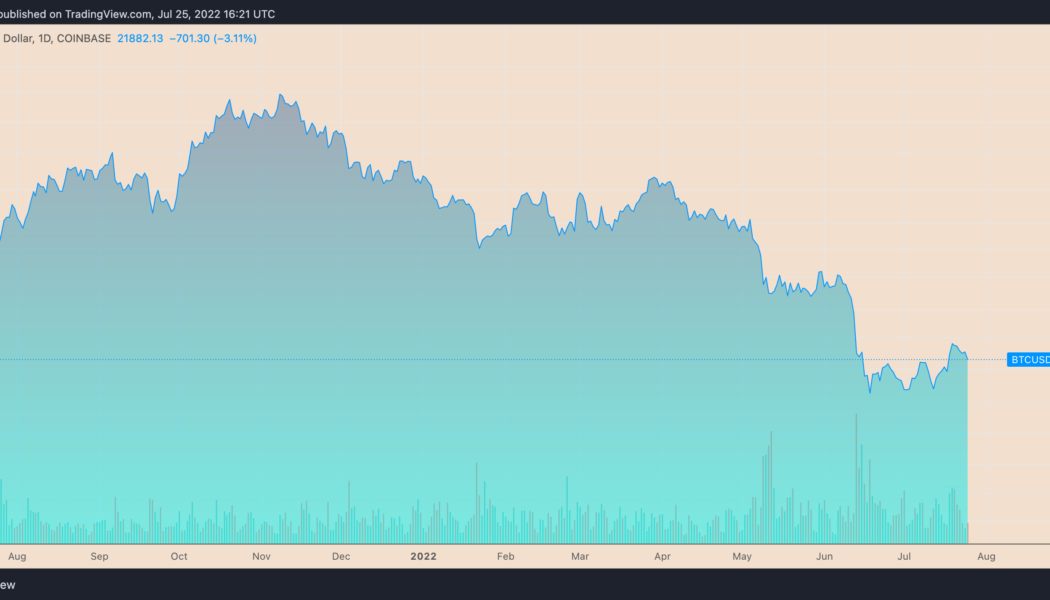

Bitcoin drops below $21.8K realized price as FOMC spooks markets

Bitcoin (BTC) stuck to its realized price just below $22,000 on July 25 as Wall Street opened with a flat performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin gives up more key levels Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it consolidated after falling from $23,000 overnight. The pair echoed equities in cool trading prior to the July 27 United States Federal Reserve decision on interest rates. Analysts were expecting several days of volatility, and despite buyer interest in Bitcoin being strong below spot price, everything could still change. No guarantee any support holds after Wednesday’s #FED announcement, but for now #FireCharts shows a ladder of #Bitcoin bids around these next technical support levels. https://t.co/Ng2R...

Bitcoin heads into FOMC day on 24-hour highs amid concern over $24.3K top

Bitcoin (BTC) attempted to claw back losses on July 27 as a macro day of reckoning arrived for risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analysis: $24,300 resistance “not a good sign” Data from Cointelegraph Markets Pro and TradingView confirmed a 24-hour high for BTC/USD prior to the Wall Street open on July 27. The pair had sunk below $21,000 in the first portion of the week, heightening nervousness among traders already wary of potential headwinds from the United States Federal Reserve. Likely chop for equities going into FOMC which expected $BTC and crypto chop around also today pic.twitter.com/GDj0GwlDXy — Rager (@Rager) July 26, 2022 July 27 is set to reveal the Federal Open Markets Committee‘s (FOMC) next base rate hike, expectations flitting between 7...

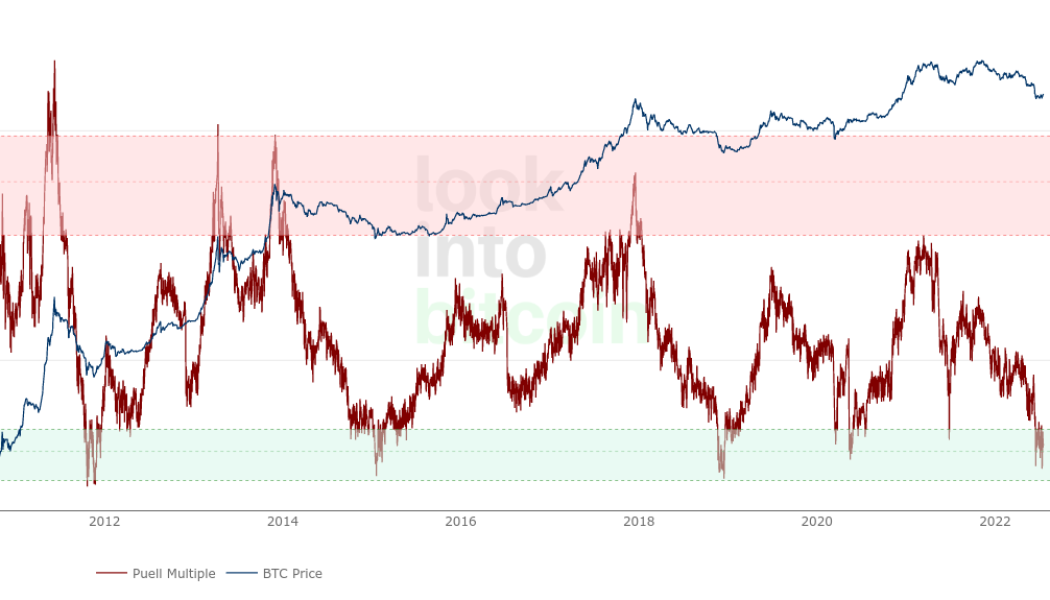

3 signs Bitcoin price is forming a potential ‘macro bottom’

Bitcoin (BTC) could be in the process of bottoming after gaining 25%, based on several market signals. BTC’s price has rallied roughly 25% after dropping to around $17,500 on June 18. The upside retrace came after a 75% correction when measured from its November 2021 high of $69,000. BTC/USD daily price chart. Source: TradingView The recovery seems modest, however, and carries bearish continuation risks due to prevailing macroeconomic headwinds (rate hike, inflation, etc.) and the collapse of many high-profile crypto firms such as Three Arrows Capital, Terra and others. But some widely tracked indicators paint a different scenario, suggesting that Bitcoin’s downside prospects from current price levels are minimal. That big “oversold” bounce The...

Bitcoin must close above $21.9K to avoid fresh BTC price crash — trader

Bitcoin (BTC) found strength at $22,000 into July 24 with bulls still aiming for a solid green weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Classic levels for end-of-week price focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD halting a weekend drop at $21,900 to return towards the $23,000 on the day. The pair held a trading range closely focused on key long-term trendlines, which analysts had previously described as essential to reclaim. These included the 50-day and 200-week moving averages (MAs), the latter particularly important as support during bear markets but which had acted as resistance since May. “Bullish that we perfectly held the 13d ema + horizontal 21.9k,” popular Twitter trading account CryptoMellany argued in part of her ...

Ethereum price ‘cup and handle’ pattern hints at potential breakout versus Bitcoin

Ethereum’s native token Ether (ETH) has rebounded 40% against Bitcoin (BTC) after bottoming out locally at 0.049 on June 13. Now, the ETH/BTC pair is at two-month highs and can extend its rally in the coming weeks, according to a classic technical pattern. ETH paints cup and handle pattern Specifically, ETH/BTC has been forming a “cup and handle” on its lower-timeframe charts since July 18. A cup and handle setup typically appears when the price falls and then rebounds in what appears to be a U-shaped recovery, which looks like a “cup.” Meanwhile, the recovery leads to a pullback move, wherein the price trends lower inside a descending channel called the “handle.” The pattern resolves after the price rallies to an approximately equal size to ...

Bitcoin traders eye levels to hold as ‘decision time’ looms for BTC price

Bitcoin (BTC) recovered above $23,000 into July 22 as attention increasingly focused on the upcoming weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price needs to preserve at least $22,400 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD finding renewed strength after briefly dipping towards $22,000. The pair traded in a critical zone for bulls on the day, with the 50-day and 200-week moving averages (MAs) still yet to flip from resistance to support. Analysts were holding out for the weekly candle close to determine the strength of Bitcoin’s latest uptrend which at one point delivered weekly gains of up to 25%. “To perform a reclaim of the 200-week MA as support, $BTC needs to Weekly Close above $22800,” popular trader and analyst Rekt Capi...

Bitcoin lurks by $22K as US dollar falls from peak, Ethereum gains 20%

Bitcoin (BTC) hugged $22,000 on July 19 as macro conditions slowly turned to favor risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto rise as dollar weakens Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cooling volatility immediately below the crucial 200-week moving average (WMA). The Wall Street open saw further gains for United States equities in the face of a declining U.S. dollar, which extended its retracement after hitting its latest two-decade peak. The U.S. dollar index (DXY) stood at around 106.5 at the time of writing, down 2.6% from the high seen July 14. For Bitcoin analysts, it was thus a case of wait and see as markets bided their time between buy and sell levels. $BTC / $USD – Update These are the op...

100X Bitcoin energy use would mean ‘absurd’ $20M BTC price — developer

A new contributor to the Bitcoin (BTC) energy debate says that 1 BTC would have to cost $20 million to use 100 times its current energy demands. In a Twitter debate on July 18, Sjors Provoost, a Bitcoin developer and author of “Bitcoin: A Work in Progress,” cast doubt on the largest cryptocurrency’s future energy use. Bitcoin could survive on “waste energy breadcrumbs” How much energy Bitcoin uses to survive has become a topic of friction which has gone from within the industry to global government. Throughout the process, Bitcoin proponents have complained that a combination of bias and lack of understanding of network principles are leading those in power to make incorrect conclusions about how and why Bitcoin uses the energy it does. While critics argue that Bitcoin must red...

Bitcoin hodlers will ‘soon see why’ $21.6K BTC price pump is fake — trader

Bitcoin (BTC) spiked to one-week highs on July 17 amid warnings that traders should not trust current BTC price action. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Binance inflows see multi-week high Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $21,600 on Bitstamp, its best performance since last Sunday. The pair saw a fresh leg up during the weekend, this nonetheless coming on the back of thin, retail-driven “out-of-hours” liquidity with institutions out of the picture. Weekend pumps typically are not to be trusted Let’s see how this one holds going into the weekly close tomorrow — Rager (@Rager) July 16, 2022 With Bitcoin prone to “fakeout” moves both up and down in such conditions, there was thus lit...

Bitcoin ready to attack key trendline, says data as BTC price holds $20K

Bitcoin (BTC) consolidated higher on July 16 after the Wall Street trading week finished with modest gains for United States equities. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Can Bitcoin bulls reclaim the 200-week moving average? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD ranging between $20,500 and $21,000 into the weekend. The pair thus preserved the majority of its comeback from the week’s lows, these following shock U.S. inflation data and sparking weakness across risk assets. Now, out-of-hours trading meant that the classic scenario of breakouts and fakeouts on thin liquidity could accompany Bitcoin into the weekly close. Eyeing order book data from Binance, the largest global exchange by volume, showed key resistance clustered ar...