BTC price today

Bitcoin sees new 4-month high as US PPI, retail data posts ‘big misses’

Bitcoin (BTC) set yet another multi-month high before the Jan. 18 Wall Street open as United States macroeconomic data fell far wide of expectations. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView U.S. PPI numbers fall wide of the mark Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking to $21,646 on Bitstamp. A subsequent correction saw the pair moving around $21,400 at the time of writing, with U.S. stocks reacting to surprise data surrounding economic activity in December. Specifically, the Producer Price Index (PPI) showed cost rises cooling faster than consensus predicted, with retail sales also declining beyond estimates. “PPI comes in at 6.2%, while expectation was 6.8%. Core PPI comes in at 5.5%, while expectation was 5.7%,” Cointelegraph contribu...

BTC price cancels FTX losses — 5 things to know in Bitcoin this week

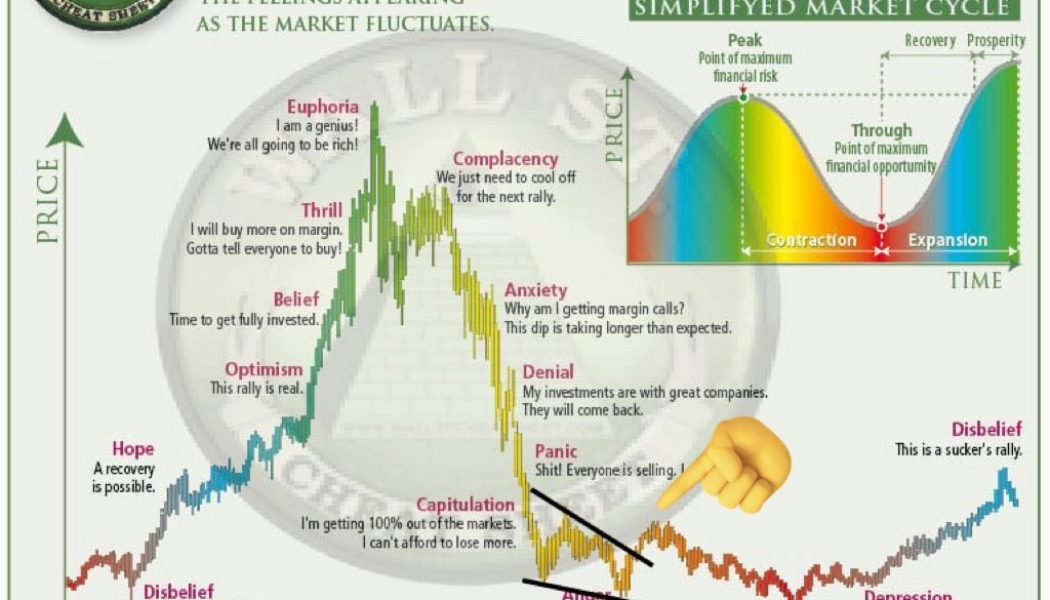

Bitcoin (BTC) starts a new week at new 2023 highs but still dividing opinion after a blistering price rally. In what is shaping up to be the antidote to last year’s slow bleed lower, January has delivered the volatility Bitcoin bulls were hoping for — but can they sustain it? This is the key question for market participants going into the third week of the month. Opinion remains divided on Bitcoin’s fundamental strength; some believe outright that the march to two-month highs is a “sucker’s rally,” while others are hoping that the good times will continue — at least for the time being. Beyond market dynamics, there is no shortage of potential catalysts waiting to assert themselves on sentiment. United States economic data will keep coming, while corporate earnings could deliver some fresh ...

Bitcoin fails to convince that bottom is in with $12K ‘still likely’

Bitcoin (BTC) may be circling its highest levels in months, but few are convinced that the bull market is back. Ahead of a key weekly close, BTC/USD remains near $21,000, data from Cointelegraph Markets Pro and TradingView shows, with analysts nervous about the good times ending all too soon. Bitcoin to see new “depression” before bull run resumes Bitcoin is dividing opinion after its week of brisk gains. Warnings over a potential pullback abound, while others are already commiserating bears ahead of time. “Now bears will be caught in the vicious cycle of praying for pullbacks to go lower, not realizing the tides have shifted for a time and we’re going higher,” Chris Burniske, former head of crypto at ARK Invest, summarized. Even more optimistic takes such as that of Burniske, however, do ...

Bitcoin price fails to seal fresh CPI gains as $18K support hangs in balance

Bitcoin (BTC) wobbled at $18,000 at the Jan. 12 Wall Street open despite United States inflation continuing to fall. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin traders stay wary post-CPI Data from Cointelegraph Markets Pro and TradingView showed BTC/USD encountering predictable volatility around the release of Consumer Price Index (CPI) data for December. The first such release of 2023, the event preceded the start of trading on Wall Street, with Bitcoin briefly gapping higher before returning to threaten a breakdown below the $18,000 mark. In so doing, the largest cryptocurrency copied behavior from one month prior, with resistance at $18,500 remaining untested. CPI came in at 6.5% year-on-year, in line with the majority of predictions. According to CME Group’s Fe...

‘Big move brewing’ for BTC price? Bitcoin may stay flat, hints analyst

Bitcoin (BTC) traders are desperate for fresh BTC price volatility, but opinions are diverging on when it will come. BTC/USD is currently seeing some of the least volatile conditions in its history, price metrics show. Volatility far from guaranteed Since the FTX crisis, Bitcoin has settled into a historically narrow trading range which refuses to budge. Despite macro triggers, low-volume holiday trading and a yearly candle close, BTC price action has stuck rigidly to a zone focused on $17,000. This is the least volatile period in the history of the Bitcoin historical volatility index (BVOL), and other data likewise shows that such sideways behavior is extremely rare. Two months after FTX, traders and analysts alike are hotly debating when the breakout will come for BTC/USD — and in which ...

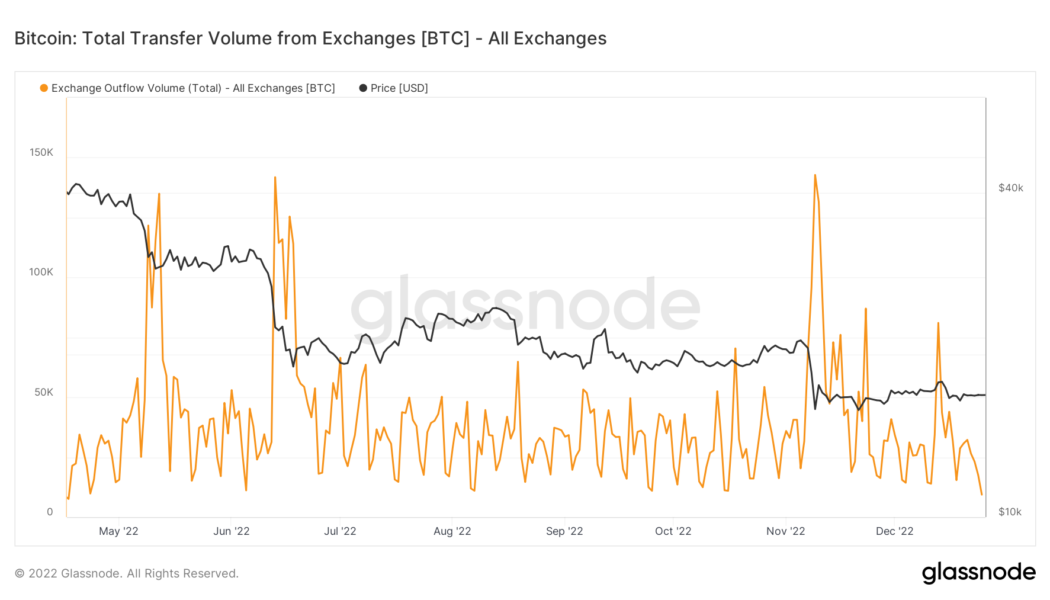

Bitcoin exchange withdrawals sink to 7-month low as users forget FTX

Bitcoin (BTC) exchange users have forgotten all about the FTX scandal this Christmas, data shows. According to on-chain analytics firm Glassnode, exchange outflows have now hit their lowest levels in over six months. Still not your keys, still not your coins? As Bitcoin volatility sets a new record low in what is being called “Do Nothing December,” exchange users’ habits are also rapidly adjusting to the current climate. After seeing an overwhelming surge in light of the FTX meltdown, BTC withdrawals from exchange wallets have entirely reversed the spike which began around six weeks ago. Having hit a peak of 142,788 BTC on Nov. 14, outflows from the trading platforms tracked by Glassnode have declined over ten times. On Dec. 25, the latest date for which numbers are available, total exchan...