BTC price prediction

Bitcoin gained 300% in year before last halving — Is 2023 different?

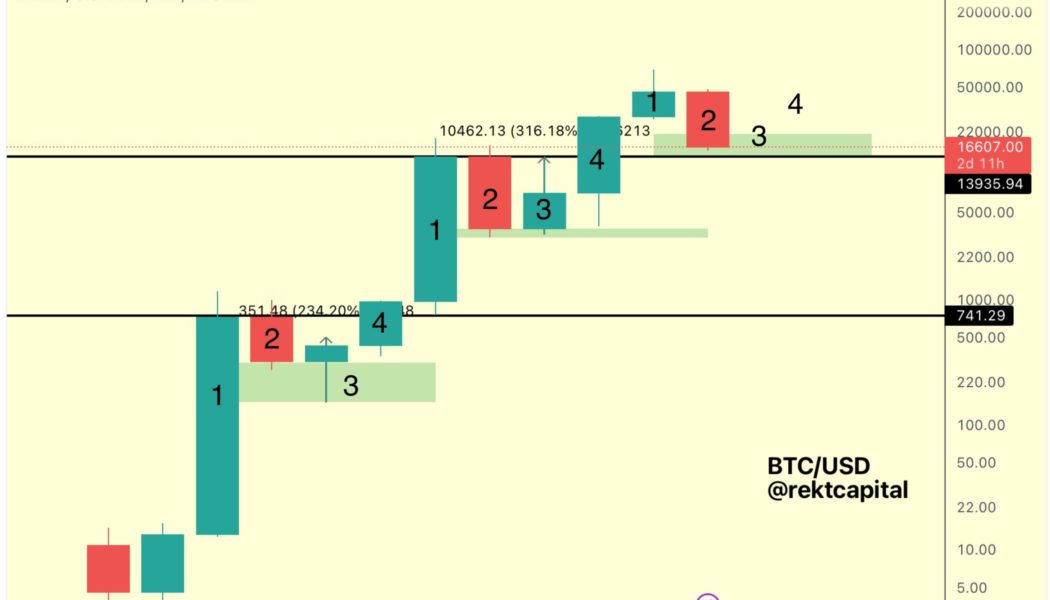

Bitcoin (BTC) is facing a “bottoming candle” in 2023, but BTC price action is still more than able to surprise the market. In a tweet on Jan. 11, popular trader and analyst Rekt Capital predicted that BTC/USD could see “decent upside” this year. Chart teases serious Bitcoin upside potential Analyzing Bitcoin’s four-year market cycles around block subsidy halving events, Rekt Capital drew attention to 2023 being the deadline for its next “bottoming candle.” With the next halving due in 2024, the coming 12 months should see a price floor, followed by a rally as the event draws nearer. 2024 thus forms the fourth candle in Bitcoin’s current cycle, and 2023 the third. “Candle 3 is a Bottoming Candle in the BTC Four Year Cycle. But it can still generate decent upside,” Rekt Capital commented. Th...

Bitcoin price would surge past $600K if ‘hardest asset’ matches gold

Bitcoin (BTC) is due to copy gold’s explosive 1970s breakout as it becomes the world’s “hardest asset” in 2024. That was one forecast from the latest edition of the Capriole Newsletter, a financial circular from research and trading firm Capriole Investments. Bitcoin due big moves “and more” in 2020s Despite BTC price action flagging at nearly 80% below its latest all-time high, not everyone is bearish about even its mid-term outlook. While calls for a further drop before BTC/USD finds its new macro bottom remain, Capriole believes that 2023 will be bright for Bitcoin as a reserve asset. The reason, it says, lies in the world economy’s financial history of the past century, and in particular, the United States after the dollar deanchored from gold completely in 1971. Gold, as t...

BTC price foregoes Santa rally as Bitcoin volatility hits record low

Bitcoin (BTC) failed to deliver a Santa rally for Christmas 2023 as Dec. 25 offered even more sideways BTC price action. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin volatility index plumbs lowest ever levels Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a tight trading range around $16,800. The pair had stubbornly refused to offer any form of volatility through much of the week, with an absence of a macro trigger reinforcing lackluster performance. “Bitcoin’s volatility is at an all-time low,” William Clemente, founder of crypto research firm Reflexivity, noted alongside a chart of the Bitcoin historical volatility index. Bitcoin historical volatility index 1-week candle chart. Source: TradingView He added that the total crypto...

How low can the Bitcoin price go?

Bitcoin is a “buy the dip” opportunity with the BTC price at $16,000 or a bear market capitulation waiting to happen, depending on who you ask. Bitcoin (BTC) has spent over a year in a downtrend since its $69,000 all-time highs in November 2021. BTC price performance has given investors up to 77% losses, but how much lower can BTC/USD really go? Bitcoin traders and analysts have long agreed that 2022 is the year of the largest cryptocurrency’s newest bear market. After coming off all-time highs to start the year at around $46,000, BTC/USD has offered little relief and has since returned to levels not seen since November 2020, data from Cointelegraph Markets Pro and TradingView confirms. That has placed the pair in historical bear market bottom territory — having lost a maximum ...

Bitcoin will shoot over $100K in 2023 before ‘largest bear market’ — trader

Bitcoin (BTC) will top $100,000 next year but a record-breaking bear market will follow, a popular trader believes. In a Twitter discussion on Oct. 22, Credible Crypto endorsed a theory that Bitcoin’s next halving will also see macro lows of just $10,000. BTC bulls need only wait a year for $100,000 With consensus calling for Q4 2022 to match the end of the 2018 Bitcoin bear market, few are in the mood to call a trend change. While a bold prediction from LookIntoBitcoin creator Philip Swift recently gave the current bear market just months to live, most commentators continue to target new lows. For Credible Crypto, however, the really interesting territory lies further ahead — but 2023 will constitute a major turning point. After setting new all-time highs (ATHs) of at least $100,000, BTC/...

Bitcoin price ‘easily’ due to hit $2M in six years — Larry Lepard

Bitcoin (BTC) is on track to hit a massive $2 million within six years, asset management guru Lawrence “Larry” Lepard believes. In his latest appearance on the Quoth the Raven podcast Oct. 16, Lepard said that BTC/USD could “easily” deliver 100X returns from current prices. Lepard: “I personally believe Bitcoin’s going to go up 100X” With Bitcoin in a downtrend for almost a year, bullish BTC price predictions are few and far between. Lepard, already known for his optimism on both Bitcoin and precious metals, has become one of the lone voices forecasting a seven-figure BTC price tag in the current environment. In his podcast appearance, the Equity Management Associates founder revealed that he is still dollar-cost averaging into BTC — buying a fixed amount every week, regardless of the pric...

Bitcoin analyst who called 2018 bottom warns ‘bad winter’ may see $10K BTC

Bitcoin (BTC) could dive another 50% from current levels if the upcoming winter proves a major test for Europe. That was the conclusion of a veteran crypto market analyst this week, with BTC/USD failing to reclaim $20,000 support. In an interview with Cointelegraph, Filbfilb, creator of trading suite Decentrader, forecast a potential BTC price bottom coming in at as low $10,000 in 2022. As the European energy crisis intensifies, risk assets face a major test, he believes, and the extent to which crypto suffers depends considerably on how diplomacy can win out to avert a major emergency into 2023. The figures are not just pie in the sky; at the height of the last halving cycle’s bear market in 2018, Filbfilb perfectly timed the market bottom as BTC/USD put in a floor of $3,100. Cointe...

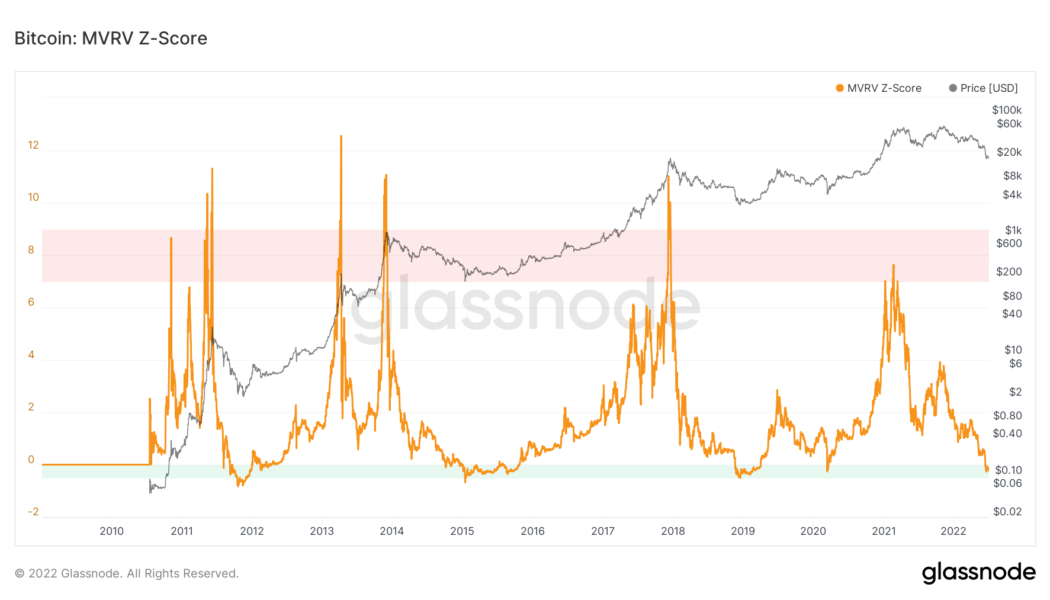

Bitcoin indicator that nailed all bottoms predicts $15.6K BTC price floor

Bitcoin (BTC) needs to go lower before putting in a macro bottom, one of the market’s most accurate indicators shows. Data from sources including on-chain analytics firm Glassnode shows Bitcoin’s MVRV-Z Score is almost — but not quite — signaling a price reversal. MVRV-Z Score inches towards macro bottom Amid ongoing debate whether if, or when, BTC/USD will go beyond its current macro lows of $17,600, new figures suggest that the market easily has further to fall. As noted by Filbfilb, co-founder of trading suite Decentrader, the MVRV-Z score is now in its classic green zone, but not yet at the point which has accompanied price bottoms in the past. MVRV-Z measures how high or low the Bitcoin spot price is relative to what is referred to as its “fair value.” It uses market cap and realized ...

Bitcoin price may bottom at $15.5K if it retests this lifetime historical support level

Bitcoin (BTC) could be in for a return to levels not seen since before its 2020 bull market if history repeats itself. That was according to new analysis released on May 24, which studied Bitcoin’s interaction with its 200-week moving average (WMA). Bitcoin floor target could be between $15,500 and $19,000 In a Twitter thread, popular trader and analyst Rekt Capital explained how BTC/USD could behave should it fall to retest the 200WMA. A lifeline throughout Bitcoin’s history, the 200WMA is a constantly rising line of last support that has never been definitively broken. Currently sitting at around $22,000, data from Cointelegraph Markets Pro and TradingView shows that the level continues to act as a line in the sand when it comes to bear markets. In times past, Rekt Capi...

Bitcoin ‘Santa rally’ pauses at $51.5K as funds bet on a sub-$60K BTC price for January 2022

Bitcoin (BTC) lost momentum at $51,500 on Dec. 24 as traders weighed the odds of a “Santa rally” coming true for Christmas. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC sees potent long-term retest Data from Cointelegraph Markets Pro and TradingView saw BTC/USD preserve its gains from Dec. 23, these totaling 6% with resistance most recently kicking in at just above $51,500. Opinions were mixed among weary traders about the strength of the rally and whether it could endure for long. Still in its familiar range despite the overnight uptick, Bitcoin needed to show its muscle on longer timeframes, Cointelegraph reported analysis as saying earlier. For filbfilb, co-founder of trading platform Decentrader, a combination of low funding rates and top ...