BTC Markets

Bitcoin price dips below $37K as a descending channel pattern comes back into play

The crypto market is once again in the red on Feb. 2 as global financial markets continue to see increased volatility. Data from Cointelegraph Markets Pro and TradingView shows that after spending the morning hovering around $38,200, BTC was hit with a wave of selling that pushed the price to $36,800. BTC/USDT 1-day chart. Source: TradingView Here is what several analysts and traders are saying about Wednesday’s Bitcoin price action and what areas to keep an eye on moving forward. Bulls are in trouble below $36,700 Insight into the major support and resistance zones of note for Bitcoin was provided by crypto trader and pseudonymous Twitter user ‘HornHairs’, who posted the following chart indicating a solid level of support near $37,400. BTC/USDT 1-hour chart. Source: Twitter Ac...

Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’

Bears remain in full control of the cryptocurrency market on Jan. 24 and to the shock of many, they managed to pound the price of Bitcoin (BTC) to a multi-month low at $32,967 during early trading hours. This downside move filled a CME futures gap that was left over from July 2021. Data from Cointelegraph Markets Pro and TradingView shows that the $36,000 level was overwhelmed in the early trading hours on Monday, leading to a sell-off that dipped below $33,000 before dip buyers arrived to bid the price back above $35,500. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the macro factors at play in the global financial markets and what to be on the lookout for in the months ahead. “Rate hikes don’t kill risk assets” F...

Bitcoin falls to $36K, traders say bulls need a ‘Hail Mary’ to avoid a bear market

Bitcoin (BTC) price continues to sell-off and the knock-on effect is an even sharper correction in altcoins and DeFi tokens. At the time of writing, BTC price has sank to its lowest level in 6 months and most analysts are not optimistic about an immediate turn around. Data from Cointelegraph Markets Pro and TradingView shows that a wave of selling that began late in the day on Jan. 20 continued into midday on Friday when BTC hit a low of $36,600. BTC/USDT 1-day chart. Source: TradingView Here’s a check-in with what analysts have to say about the current downturn and what may be in store for the coming weeks. Traders expect consolidation between $38,000 and $43,000 The sudden price drop in BTC has many crypto traders predicting various dire outcomes along the lines of an ext...

Was $39,650 the bottom? Bitcoin bulls and bears debate the future of BTC price

Bitcoin (BTC) price made a quick pop above $43,100 in the U.S. trading session but uncertainty is still the dominant sentiment among traders on Jan. 11 and bulls and bears are split on whether this week’s drop to $39,650 was BTC’s bottom. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded tightly around the $42,000 level as the global financial markets digested U.S. Federal Reserve Chair Jerome Powell’s statements on the upcoming fiscal policy changes. BTC/USDT 1-day chart. Source: TradingView Powell indicated that the central bank is prepared to “raise interest rates more over time” if inflation continues to persist at high levels, but analysts were quick to note further comments, suggesting that a low...

Australia’s largest crypto exchange will sponsor tennis star Ajla Tomljanovic

BTC Markets, the largest digital assets exchange in Australia, has announced it will be sponsoring professional tennis player Ajla Tomljanovic for the Australian Open and Sydney Tennis Classic tournaments taking place this month. In a Tuesday announcement, BTC Markets said it would be backing Tomljanovic as part of a partnership inspired in part by “increased investor activity from female investors in the last financial year.” Users from the crypto exchange will have the chance to win tickets to the tournaments and a meeting with the tennis star with a nonfungible token showing proof of attendance. Flash Competition to win 2 tix to see @Ajlatom play tomorrow at the Sydney Classic! Yup, you read that right, tennis & crypto united at last Gotta love how Aussies support their own – ...

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...

Binance buys the dip adding over 43K Bitcoin to wallet

Bitcoin billionaires continue to accumulate during the dip. As Bitcoin (BTC) filled the $42 thousand December price wick this morning, Bitcoin whales were busy stacking sats. One address belonging to Binance added 43,000 BTC on Tuesday at an average price of $46,553.68, bringing the wallet’s total value to $5.5 billion. Elsewhere, the third-largest Bitcoin address continued its spending spree, adding another 551 BTC since Cointelegraph last reported it bought the dip, just two days ago. The wallet continues to aggressively accumulate in the $40 thousand range, now owning a total of 121,396 BTC or roughly $5 billion. There was some consternation on social media platforms about the wallet owner behind the $43,000 BTC buy, but Binance confirmed ownership of the address in a tw...

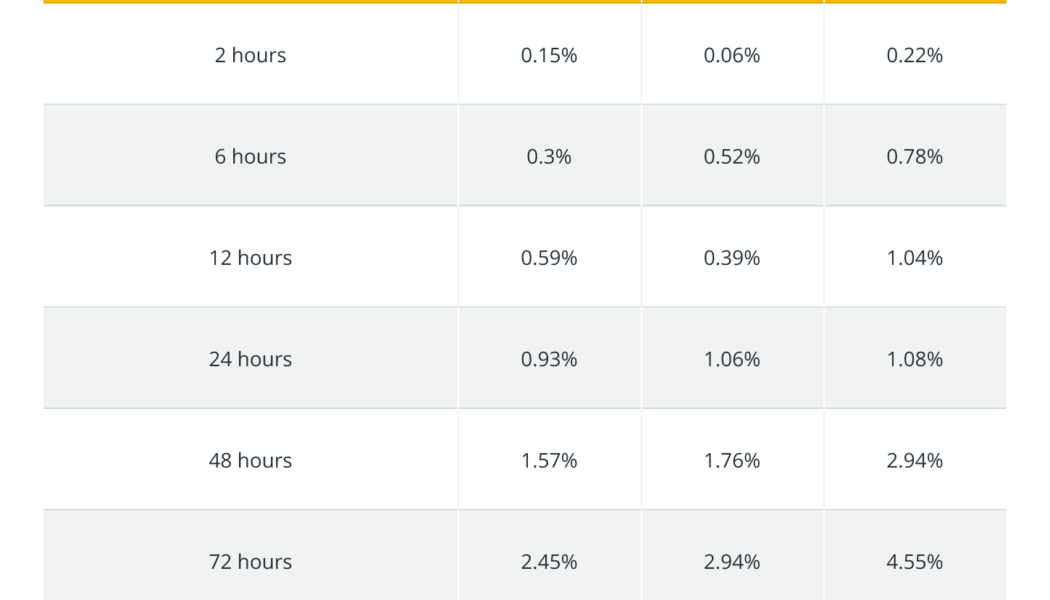

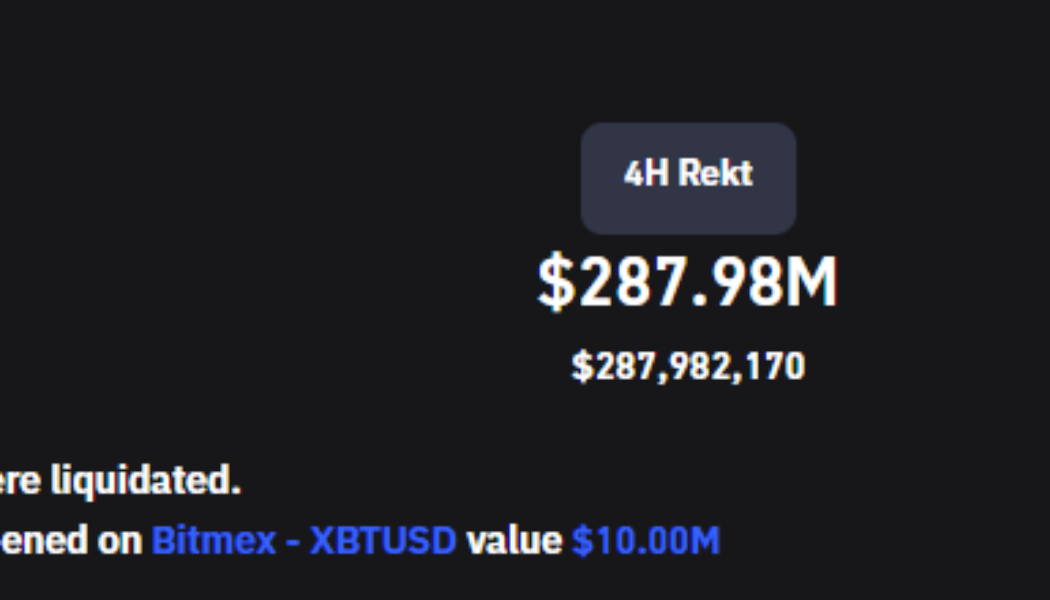

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

Institutional tax-loss harvesting weighs on the Bitcoin price as 2021 comes to a close

2021 has been a breakout year for the cryptocurrency market as a whole despite the year-end struggles that have kept the price of Bitcoin (BTC) pinned below $48,000, much to the chagrin of the cadre of folks who had been calling for a $100,000 BTC moonshot. Data from Cointelegraph Markets Pro and TradingView shows that the past 24 hours have been a rollercoaster ride for the top cryptocurrency after a brief dip below $46,000 in the early trading hours on Dec. 30 was quickly bought up to push the BTC price back above $47,500 by midday. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the year-end price action for Bitcoin and what to expect in 2022 as the mass adoption of blockchain technology and cryptocurrencies continue...

Analysts warn that possible downside wick could push BTC price as low as $44K

It looks as though the year-end rally that many crypto traders had hoped for will have to wait until 2022, as Bitcoin (BTC) bears gained the upper hand on Dec. 28 and hammered the price of BTC below support at $48,000. Data from Cointelegraph Markets Pro and TradingView shows that an early morning wave of selling broke through BTC support at $50,000 and was followed by a second wave in the early afternoon that dropped the top cryptocurrency to a daily low of $47,318 before bulls managed to stem the outflow. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several market analysts are saying about the reasons behind this latest correction and what to look out for as 2021 comes to a close. A bearish RSI divergence prior to the reversal Insight into the technical reasons ...

Traders delay $100K Bitcoin prediction, but still expect a blow-off top in 2022

Bullish traders that drank the “Bitcoin to $100,000 by year-end” Kool-Aid are now coming to terms with the fact that there may be no Santa Claus rally to wrap up 2021. At the moment, the pipe dream has morphed into simple hopes that the top cryptocurrency can at least finish the year above $50,000. Data from Cointelegraph Markets Pro and TradingView shows that the bounce in price seen in BTC following remarks from Federal Reserve Chair Jerome Powell has pretty much evaporated and over the past 48-hours the price has swept fresh lows at $45,500 and from the look of things, the price could drop even further. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what traders think about Bitcoin’s current price action and what could be in store for the remainder o...

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...