BTC Markets

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

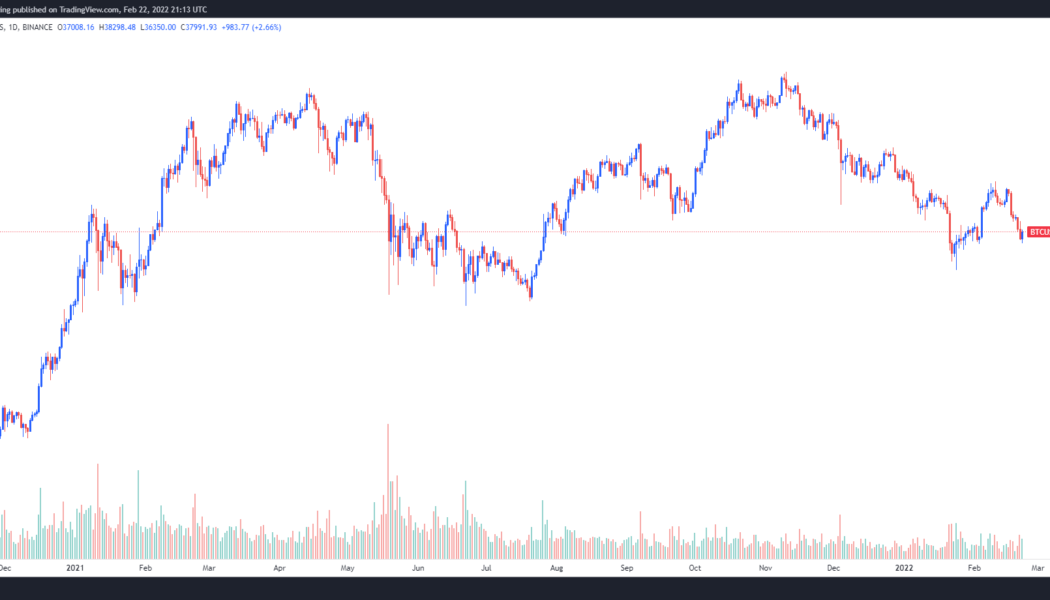

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...

Bitcoin slides under $39K, leading some traders to forecast a weekend ‘oversold bounce’

March 4 saw another day of seesaw price action for Bitcoin (BTC) and the wider cryptocurrency market as the global economic fallout from the ongoing conflict in Ukraine weighs heavily on a majority of the world’s financial markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding $41,000 in the early trading hours on March 4, a wave of selling in the afternoon dropped the price of BTC below $39,100. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts have to say about the outlook for BTC moving forward as the world faces a period of increased economic uncertainty. A potential retest of $38,000 BTC/USD 1-week chart. Source: Twitter According to Rekt Capital, $43,100 is an important level for BTC because the last time Bitcoin clo...

Analysts say bulls will aim for $48K now that Bitcoin’s ‘accumulation phase’ has begun

Investor sentiment across the cryptocurrency ecosystem has seen a significant shift in the positive direction over the past week, despite events in the wider world. Currently, Bitcoin (BTC) is back above $43,500 and many altcoins are also witnessing double-digit gains. Crypto Fear & Greed index. Source: Alternative The ongoing conflict in Ukraine and recent actions taken by governments to limit access to banking services may have helped to shine a light on the value of holding cryptocurrencies, which offers some protection against uncontrollable events and what some might perceive as government overreach. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has oscillated between $43,350 and $45,400 on March 2 as the world awaits some form of resolution to th...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

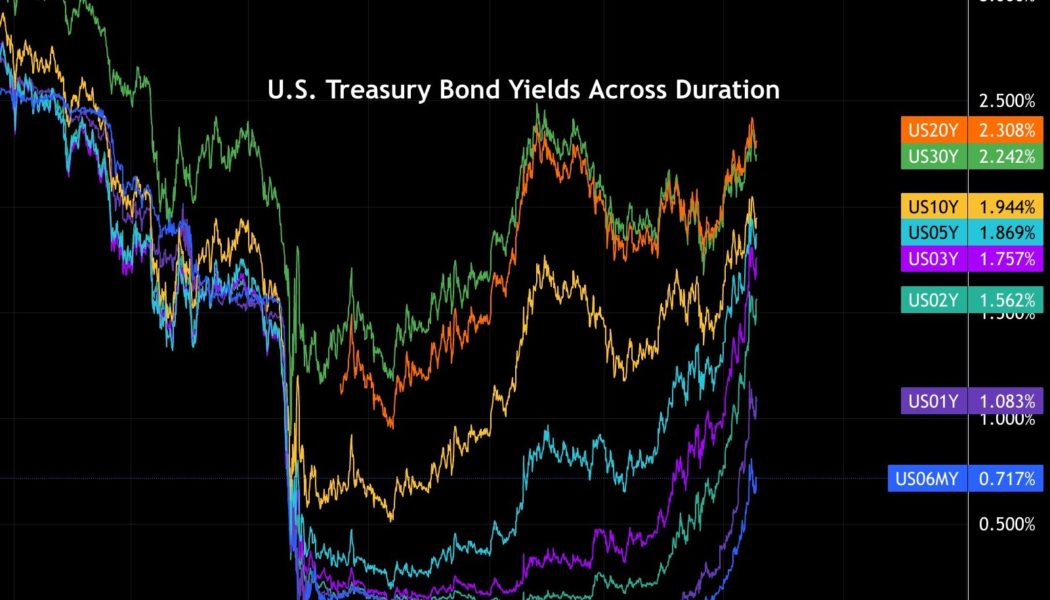

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

Bitcoin price could ‘probe lower’ as volumes dip and macroeconomic issues loom overhead

Bitcoin’s sell-off appears to be taking a pause even though the United States rolled out new sanctions against Russia on Feb 22. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) continues to hover slightly below $38,000, which some analysts have identified as a significant support and resistance zone. BTC/USDT 1-day chart. Source: TradingView Here’s a closer look at what analysts are saying about Bitcoin price and what levels to keep an eye on in the short-term. 25% of entities are underwater On-chain data outlet, Glassnode, posted the following chart analyzing the percentage of entities in profit and the analysts concluded “that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.” Percent...

U.S. inflation breaks 40-year record: Can Bitcoin serve as a hedge asset?

On Feb. 9, the United States Bureau of Labor Statistics reported that the Consumer Price Index, a key measure capturing the change in how much Americans pay for goods and services, has increased by 7.5% compared to the same time last year, marking the greatest year-on-year rise since 1982. In 2019, before the global COVID-19 pandemic broke out, the indicator stood at 1.8%. Such a sharp rise in inflation makes more and more people consider the old question: Could Bitcoin, the world’s largest cryptocurrency, become a hedge asset for high-inflation times? What’s up with the inflation spike? Ironically, the fundamental reason behind the unprecedented inflation spike is the U.S. economy’s strong health. Immediately after the COVID-19 crisis, when 22 million jobs were slashed and national econom...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

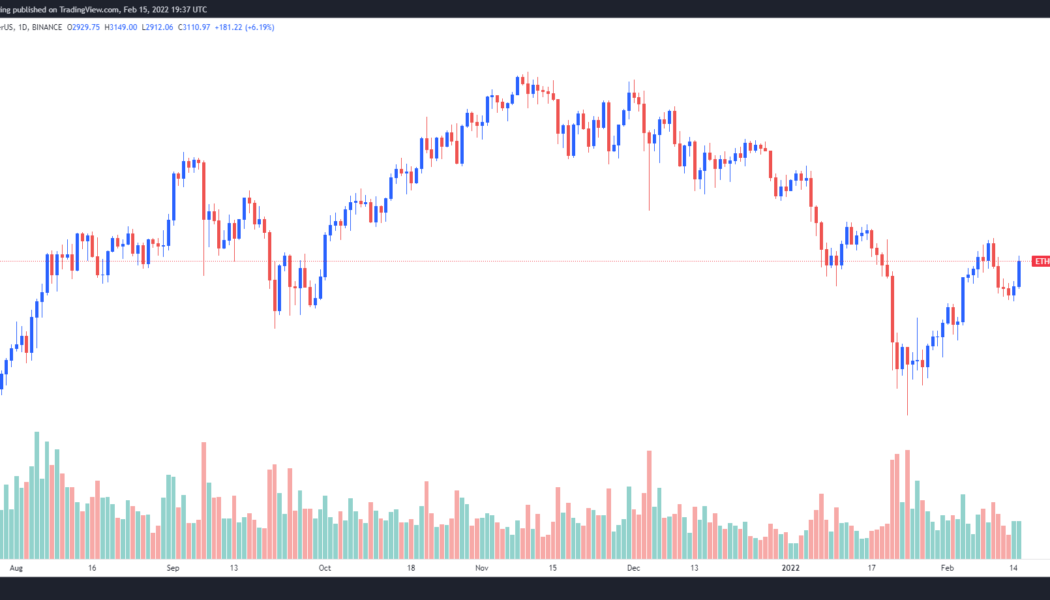

Traders say $4,000 Ethereum back on the cards ‘if’ this bullish chart pattern plays out

Global and macroeconomic concerns ranging from rising inflation rates in the United States to the prospect of Russia invading Ukraine continue to spark volatility in financial markets. To the surprise of many analysts, the mood in the cryptocurrency market shifted in a positive direction on Feb. 15 after Bitcoin (BTC) climbed to $44,500 and Ether (ETH) regained support at $3,100. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2,826 in the early trading hours on Feb. 15, the price of Ether rallied 11.4% to a daily high of $3,148. ETH/USDT 4-hour chart. Source: TradingView Here’s a look at what several traders in the market are saying about the recent price action for Ether and what to be on the lookout for in the weeks ahead. Ether is in a heavy ...

Bitcoin price consolidates in critical ‘make or break’ zone as bulls defend $42K

The waiting game continues for crypto traders after Bitcoin (BTC) is once again pinned below resistance at $43,000 and awaiting some spark in momentum that can sustain a rally back to the $50,000 range. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded in a range between $41,500 and $43,000 over the past couple of days and with tensions between Ukraine and Russia escalating, many traders are less than optimistic about Bitcoin’s short-term prospects. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about their short-term expectations for Bitcoin price. Is Bitcoin on a path to zero? Well-known cryptocurrency perma-bear Peter Schiff made sure to chime in on the latest struggles for Bitcoin by post...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...