BTC Markets

Fed FOMC comments and Bitcoin ‘bear channel’ could kickstart a decline to $28K

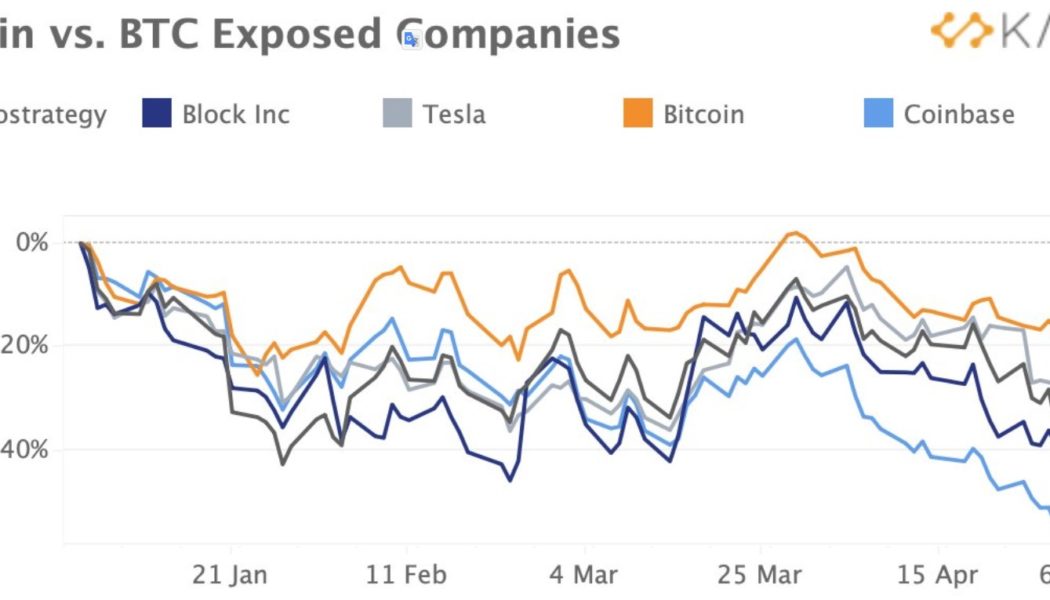

The start of May has seen a continuation of the weakness in crypto and equities markets and at the moment, there is no indication of any short-term factors that could reverse the bearish trend. Equities markets are also in a downtrend and according to researcher Clara Medalie, the price of stocks from companies with exposure to Bitcoin (BTC) have also taken a notable hit. Bitcoin vs. BTC exposed companies. Source: Twitter Medalie said: “Block, Tesla, Microstrategy and Coinbase are down between 20%–50%.” Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to rally above $39,000 was easily defended by bears, resulting in a pullback to the $38,200 level. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts ...

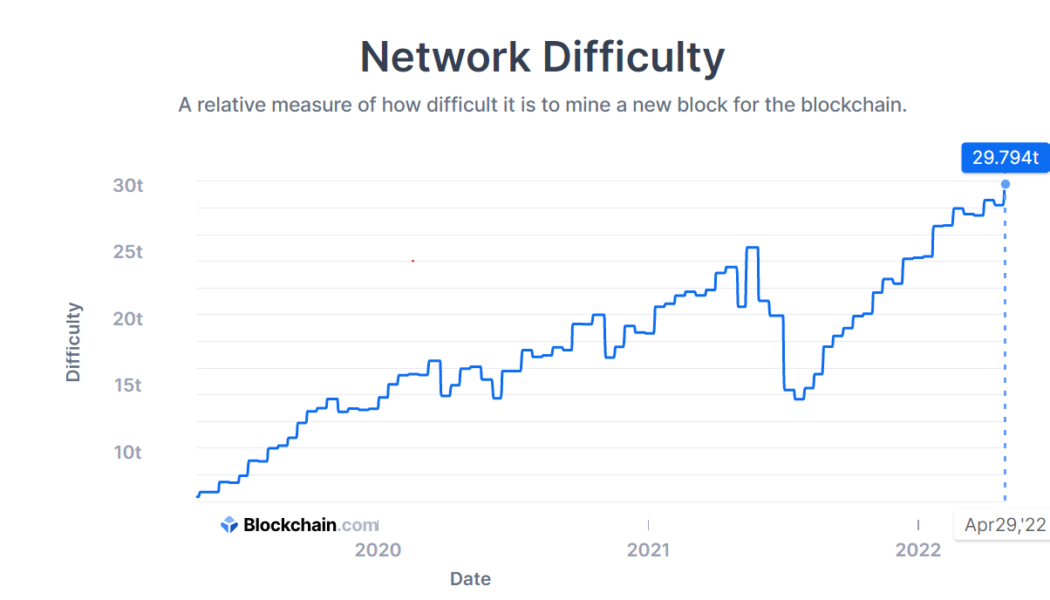

Bitcoin network difficulty breaks into a new all-time high of 29.794T

Reassuring its position as the most resilient blockchain network against attacks, the Bitcoin (BTC) network recorded a new all-time high network difficulty for the second time this month in April — jumping from its previous all-time high of 28.587 trillion to 29.794 trillion. Greater network difficulty demands greater computational power to successfully mine a BTC block, which prevents bad actors from taking over the network and manipulating transactions, also known as double-spending. As evidenced by data from blockchain.com, Bitcoin’s network difficulty has seen almost a year-long uptrend since August 1, 2021. Before that, between May and July 2021, was a timeline when BTC network difficulty fell nearly 45.5% from 25.046 trillion to 13.673 trillion — at the time raising momentary concern...

Altcoins sell-off as Bitcoin price drops to its ‘macro level support’ at $38K

The cryptocurrency market and wider global financial markets fell under pressure on April 26 after the hype surrounding Elon Musk’s purchase of Twitter began to fade and concerns about the state of the global economy took the forefront again. Tech-related stocks were some of the hardest-hit assets on April 26 and this pullback was followed by sharp declines in crypto prices as risk assets become persona non grata in these turbulent markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding support at $40,500 through the early trading hours on April 26, the price of Bitcoin (BTC) dumped 6.21% in afternoon trading to hit a low of $38,009. BTC/USDT 1-day chart. Source: TradingView April 26’s price action looks to be a continuation of the weakness se...

Bitcoin hits $40K, investors pump Dogecoin (DOGE) after Musk confirms Twitter purchase

The cryptocurrency market fell under pressure in the early trading hours on April 25, but a brief spurt of bullish price action sparked after media headlines announced that Elon Musk had reached a deal to purchase Twitter for $44 billion. Data from Cointelegraph Markets Pro and TradingView shows that after dropping as low as $38,210 in the opening trading hours on Monday, Bitcoin (BTC) price staged a 5.72% rally to hit an intraday high at $40,366 as news of Twitter’s sale spread across news outlets. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts and on-chain data have to say about Bitcoin’s short-term outlook. Declining exchange reserves point to strong accumulation The recent bearish sentiment that has dominated the crypto market was addressed b...

Analysts say Bitcoin has ‘already capitulated,’ target $41.3K as the most hold level

Traders’ struggle to build sustainable bullish momentum persisted across the cryptocurrency market on April 20 after prices slid lower during the afternoon trading session and ApeCoin (APE) appaers to be one of the few tokens that is defying the current market-wide downturn. Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to breakout above $42,000 was soundly rejected by bears, resulting in a pullback to a daily low of $40,825 before the price was bid back above $41,000. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several market analysts are saying about the weakness in Bitcoin and what levels traders are looking at as a good spot for opening new positions. Whales accumulate near $...

Bitcoin price slides below $40K following a ‘lackluster’ breakout

Extreme fear is once again the dominating sentiment across the cryptocurrency community after Bitcoin (BTC) faced another day of trading below the $40,000 level and the United States grapples with the highest Consumer Price Index (CPI) print since 1981. Crypto Fear & Greed Index. Source: Alternative.me Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt to rally above $40,000 ran into a wall of resistance at $40,650 and BTC price eventually tumbled back below $39,600. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the current state of Bitcoin and what could potentially come next as financial markets grapple with an increasing amount of uncertainty. Bitcoin is simply re-testing a major S/R zone ...

Bitcoin price dip to $39.2K places BTC back in ‘bear market’ territory

The cryptocurrency market took a turn for the worse on April 11 after concerns related to rising inflation, the prospect of several more interest rates by the U.S. Federal Reserve and fear of a global food shortage led to widespread weakness across global financial markets. Data from Cointelegraph Markets Pro and TradingView shows that bears broke through the bulls’ defensive line at $42,000 in the early trading hours on Monday to drop Bitcoin (BTC) to a daily low of $39,200 and several analysts project even lower prices in the short-term. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about Monday’s move lower and whether or not traders should expect more downside over the coming days. $40,000 or bust The dip below $40,000 was foreshadowed b...

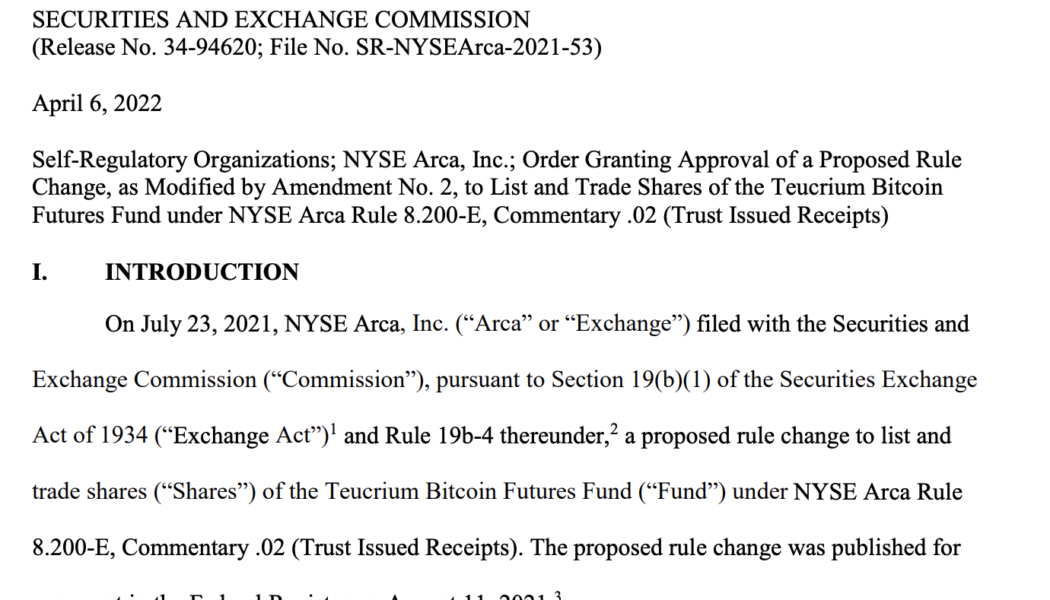

Grayscale CEO pleads Bitcoin spot ETF as SEC backs third BTC Futures ETF

Institutional investors rejoice, there is one more way to gain exposure to Bitcoin (BTC). The United States Securities and Exchange Commission (SEC) announced overnight the approval of a fourth Bitcoin futures exchange-traded fund (ETF). Fund group Teucrium is behind the most recently approved Bitcoin Futures ETF. The ETF joins a growing number of approved futures ETFs, complementing ProShares, Valkyrie, and VanEck Bitcoin Futures ETFs. The SEC filing for the Teucrium ETF. Source: SEC.gov Every Bitcoin spot ETF has been rejected to date, however, for one invested observer, the way in which the approval was made could be a boon for expectant spot investors. The plot thickens on the path to $GBTC’s spot #Bitcoin #ETF conversion… — Sonnenshein (@Sonnenshein) April 7, 2022 In a Tweet thread, G...

Bitcoin recovers the $46K level, but several factors could prevent a stronger breakout

After dropping below $45,000 on March 31, Bitcoin (BTC) surprised investors with a quicker-than-expected recovery to the $46,500 level. Data from Cointelegraph Markets Pro and TradingView shows that bears managed to drop BTC to an overnight low of $44,210 before bulls showed up in force to lift the price back above $46,500 by midday. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for Bitcoin moving forward and what developments could present headwinds for the top cryptocurrency as a new month gets underway. The macro environment continues to impact BTC price Events in the global financial market continue to have a large impact on cryptocurrency markets and are likely to continue to do so for the foreseeable future. Accord...

A retest is expected, but most analysts expect Bitcoin price to extend much higher

The mood across the cryptocurrency market has seen a notable improvement in the last week as prices are on the rise with Bitcoin (BTC) now trading near $48,000 while Ether (ETH) attempting to hold above $3,400. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has been oscillating around $48,000 since it broke out above $45,000 early on March 28 and bulls are now debating whether a bull run to $80,000 is on the cards. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the outlook for BTC moving forward and what levels to keep an eye on in case of a price pullback or another breakout to the upside. Bitcoin breaks above its 1-year moving average “Keeping it simple is often best” accordi...

Bitcoin hits $44K, but traders want to see a few daily closes here before a move higher

Morale across the cryptocurrency ecosystem is rising on March 24 as several days of positive moves have helped lift Bitcoin (BTC) back above $44,000 and Ether bulls took control at $3,100. The climbing price of BTC comes amid a backdrop of surging inflation and rising interest rates, which could see up to seven hikes over the course of 2022, according to Minneapolis Federal Reserve President Neel Kashkari. BTC/USDT 1-day chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after trading near $43,000 throughout the morning session on March , a midday spike lifted the price of BTC to an intraday high at $44,186 where it bumped up against a major resistance zone. Bitcoin needs to flip $44,000 into support A look at the weekly chart shows that “Bitcoi...

Bitcoin bulls take aim at $45K while some analysts warn of possible correction

The bullish narrative is beginning to build across the cryptocurrency ecosystem on March 22 as the price of Bitcoin (BTC) briefly spiked above $43,000 while Ether (ETH) has reclaimed support at $3,000 following a deposit of $110 million worth of ETH into Lido’s liquidity pools. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin rallied 6.15% from a low of $40,884 in the early hours of Tuesday to an intraday high at $43,380 before consolidating around support at $42,300. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about Bitcoin’s recent price action and which support and resistance levels to keep an eye on moving forward. BTC price could correct lower A foreshadowing of Bitcoin’s move on March 22 was pro...