BTC Markets

Why is Bitcoin price down today?

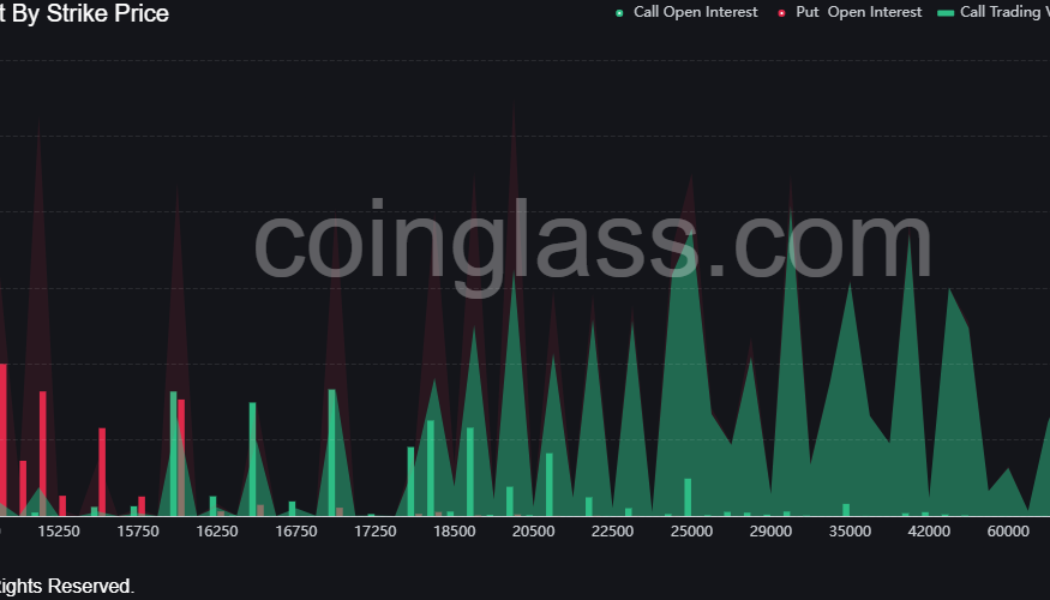

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

Will the Bitcoin mining industry collapse? Analysts explain why crisis is really opportunity

Bitcoin mining involves a delicate balance between multiple moving parts. Miners already have to face capital and operational costs, unexpected repairs, product shipping delays and unexpected regulation that can vary from country to country — and in the case of the United States, from state to state. On top of that, they also had to contend with Bitcoin’s precipitous drop from $69,000 to $17,600. Despite BTC price being 65% down from its all-time high, the general consensus among miners is to keep calm and carry on by just stacking sats, but that doesn’t mean the market has reached a bottom just yet. In an exclusive Bitcoin miners panel hosted by Cointelegraph, Luxor CEO Nick Hansen said, “There’s going to definitely be a capital crunch in publicly listed companies or at least ...

Bitcoin price falls under $21K, bringing more capitulation or just consolidation?

On July 26, Bitcoin (BTC) price dropped below $21,000, giving back the majority of the gains accrued in the previous week and returning to the $23,300 to $18,500 range that Glassnode analysts describe as “the Week 30 high and Week 30 low.” A handful of analysts and traders attribute the July 26 to July 27 Federal Open Market Committee (FOMC) meeting and the expected Federal Reserve rate hike as the primary reasons for the current sell-off. Barring the announcement that the United States economy has entered a recession, a few traders believe that the expected 75 to 100 basis point (BPS) hike will be followed by a relief rally that could see BTC, Ether and other large-cap altcoins snack back to the top of their current range. Of course, this sentiment reflects more speculation than sou...

Bitcoin price dips under $23K after earnings report reveals Tesla sold 75% of its BTC

Easy come, easy go was the story on July 20 as the day started on a positive note with Bitcoin (BTC) climbing above $24,300, only to end the official trading day in the red after less than stellar Q2 earning news showed Tesla sold 75% of its Bitcoin and Minecraft reversed course by deciding to ban NFTs on its platform. Daily cryptocurrency market performance. Source: Coin360 A potential source of the afternoon downturn can be traced to Tesla’s Q2 earnings data, which showed that the electric car company sold off 75% of its Bitcoin holdings in order to add $963 million in cash to its balance sheet. So, not only forced selling from 3AC, $LUNA & $UST, but also Voyager, BlockFi and Celsius have been causing the markets to crash. On top of that, Tesla did sell 75% of their #Bitcoin pur...

Bitcoin price holds $23.5K, leading bulls to say ‘it’s different this time’

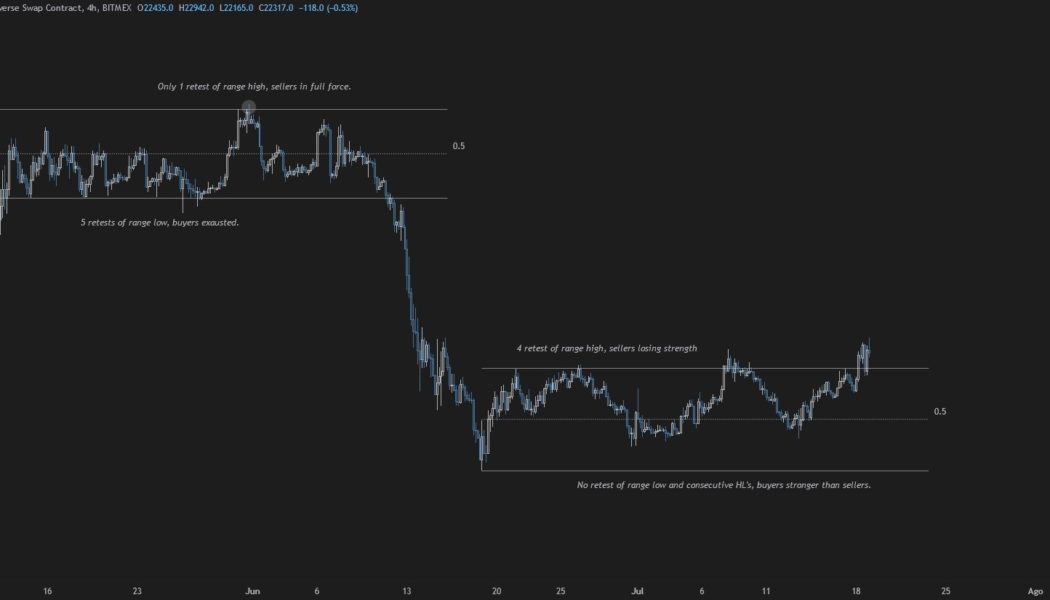

Similar to Stockholm syndrome where captives develop a psychological bond with their captors, crypto winters have a way of flipping even the most bullish cryptocurrency supporters bearish in a short period of time. Evidence of this reality was on full display on July 19 after the recovery of Bitcoin (BTC) back above $23,000 was met with widespread warnings that the move was merely a fakeout before the market heads for new lows $BTC Not bad. But keep in mind that this still can turn into a classical fake out. My general thesis still remains, bear market rally pic.twitter.com/VxnH4mo6hW — Jimie (@Your_NLP_Coach) July 19, 2022 While the possibility of new lows being set in the future can’t be ruled out, here’s a look at analysts’ opinions on how this BTC breakout could be different than...

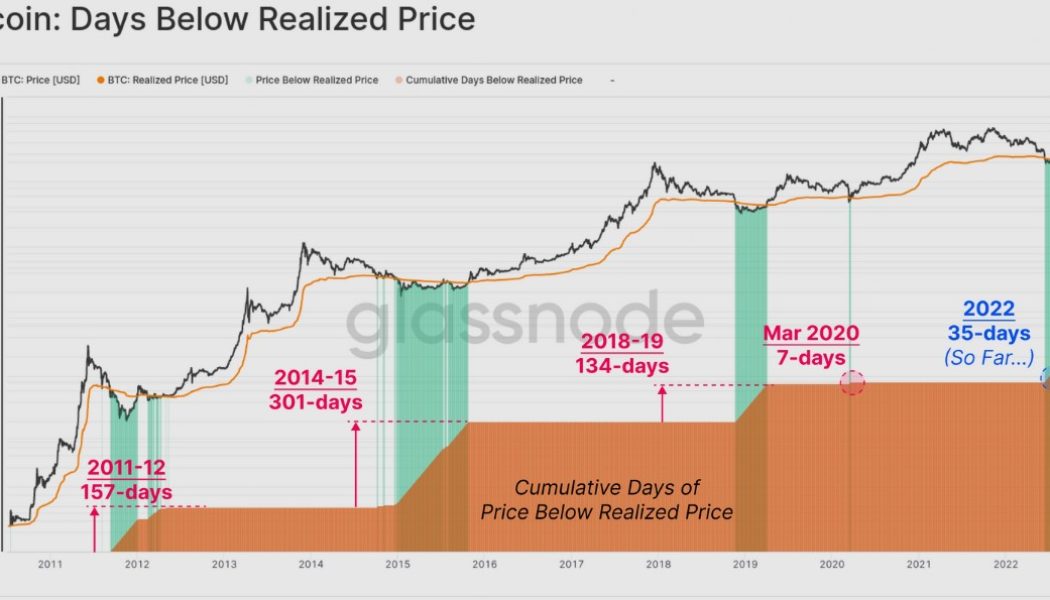

Data points to a Bitcoin bottom, but one metric warns of a final drop to $14K

“When will it end?” is the question that is on the mind of investors who have endured the current crypto winter and witnessed the demise of multiple protocols and investment funds over the past few months. This week, Bitcoin (BTC) once again finds itself testing resistance at its 200-week moving average and the real challenge is whether it can push higher in the face of multiple headwinds or if the price will trend down back into the range it has been trapped in since early June. According to the most recent newsletter from on-chain market intelligence firm Glassnode, “duration” is the main difference between the current bear market and previous cycles and many on-chain metrics are now comparable to these historical drawdowns. One metric that has proven to be a reliab...

BTC Markets becomes first Australian crypto firm to get a financial services license

Australian-based cryptocurrency exchange BTC Markets has become the first crypto company in the country to gain a financial services license. The license was issued by the country’s financial regulator, the Australian Securities and Investments Commission (ASIC), to BTC Markets’ sister company BTCM Payments. We have an exciting announcement to make: BTC Markets is the first Australian crypto exchange to successfully go through the full AFSL application process via our sister company, BTCM Payments! ✅AFSL attained✅ISO Certified✅SOC 2 on the way!#crypto #bitcoin #finance — BTC Markets (@BTCMarkets) June 21, 2022 An Australian Financial Services (AFS) license allows the holder to give advice, deal in, and create a market for a financial product. It also permits the provis...

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

Like clockwork, the onset of a crypto bear market has brought out the “Bitcoin is dead” crowd who gleefully proclaim the end of the largest cryptocurrency by market capitalization. If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it can just as easily fall another 70% down to $6,000. Given the excessive leverage in #crypto, imagine the forced sales that would take place during a sell-off of this magnitude. $3,000 is a more likely price target. — Peter Schiff (@PeterSchiff) June 14, 2022 The past few months have indeed been painful for investors, and the price of Bitcoin (BTC) has fallen to a new 2022 low at $20,100, but the latest calls for the asset’s demise are likely to suffer the same fate as the previous 452 predictions calling for its death. Bitcoin obitu...

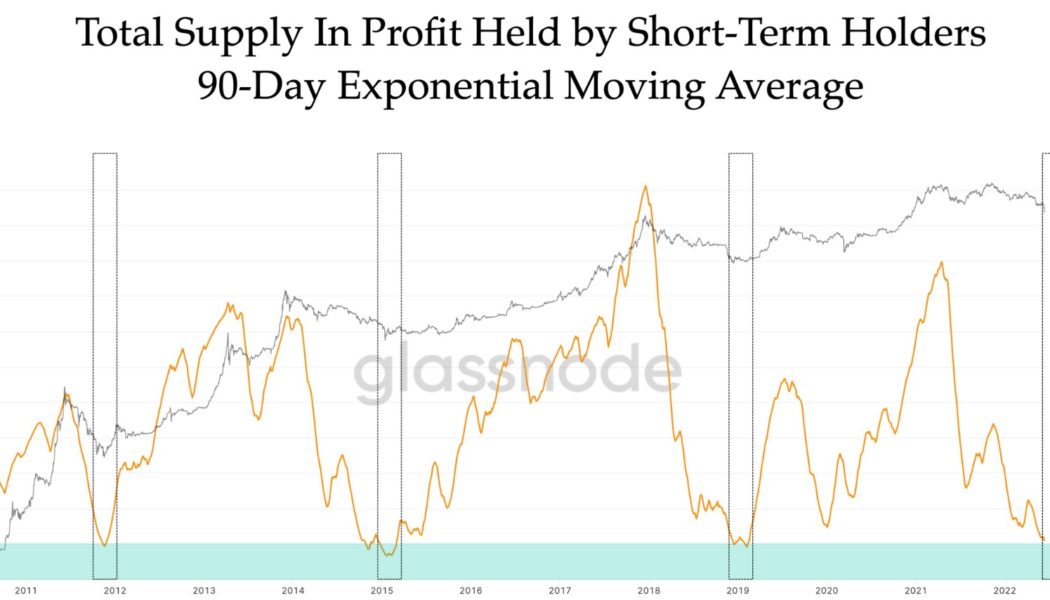

Further downside is expected, but multiple data points suggest Bitcoin is undervalued

The outlook across the cryptocurrency ecosystem continue to dim as the sharp downtrend that was initially sparked by the collapse of Terra now appears to have claimed the Singapore-based crypto venture capital firm Three Arrows Capital (3AC) as its next victim. As large crypto projects and investment firms begin to collapse on a weekly basis, the prospect of a long, drawn out bear market is a reality investors are beginning to accept. Based on a recent Twitter poll conducted by market analyst and pseudonymous Twitter user Plan C, 41.6% of respondents indicated that they thought the Bitcoin (BTC) bottom will fall between the $17,000 to $20,000 range. Total Bitcoin supply in profit held by short-term holders. Source: Twitter Addresses holding at least 1 BTC hits a new ...

Bitcoin price recovers $31.5K, but traders say ‘scam’ price action will bring more downside

Bitcoin’s (BTC) short-term price action has been dominated by whipsaws that trigger around the $31,000 to $32,000 level and the June 6 reversal at this point triggered a quick sell-off that pushed the price down to $29,200. Surprisingly, on June 7, the price rapidly reversed course as Bitcoin rallied back to $31,500, but given the current rejection at this level, traders are likely to proceed cautiously, rather than expect a quick surge to $35,000. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for BTC and what support levels to keep an eye on moving forward. A clear redistribution range The range-bound trading currently impacting Bitcoin was addressed by crypto analyst and pseudonymous Twitter user il Capo of Crypto, wh...

Traders think Bitcoin bottomed, but on-chain metrics point to one more capitulation event

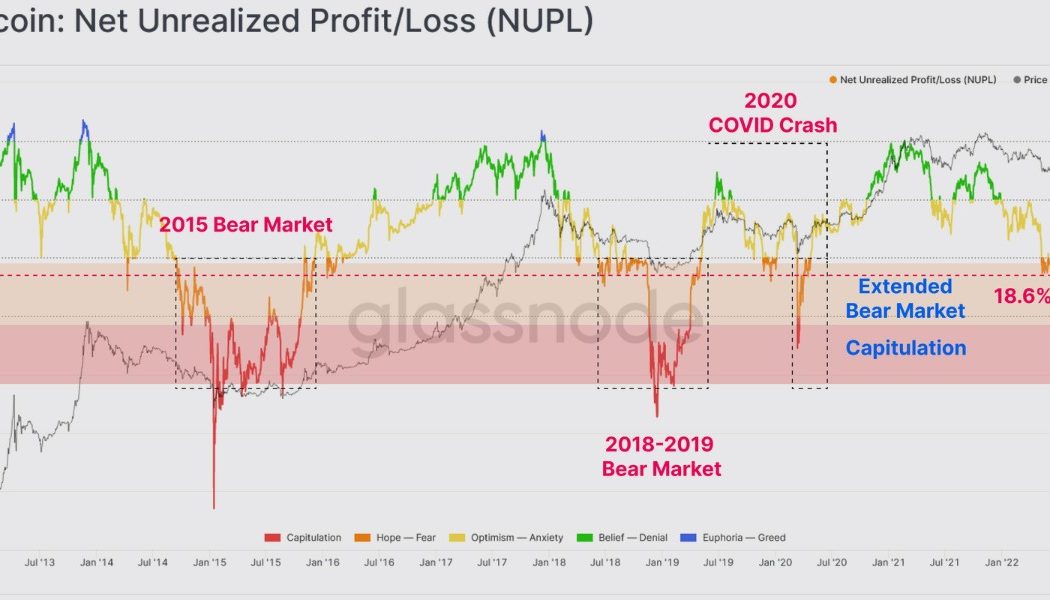

The bull market euphoria that carried prices to new highs throughout 2021 has given way to bear market doldrums for any Bitcoin (BTC) buyer who made a purchase since Jan. 1, 2021. Data from Glassnode shows these buyers “are now underwater” and the market is gearing up for a final capitulation event. Bitcoin net unrealized profit/loss. Source: Glassnode As seen in the graphic above, the NUPL, a metric tha is a measure of the overall unrealized profit and loss of the network as a proportion of the market cap, indicates that “less than 25% of the market cap is held in profit,” which “resembles a market structure equivalent to pre-capitulation phases in previous bear markets.” Based on previous capitulation events, if a similar move were to occur at the current levels, t...

On-chain data shows Bitcoin long-term holders continuing to ‘soak up supply’ around $30K

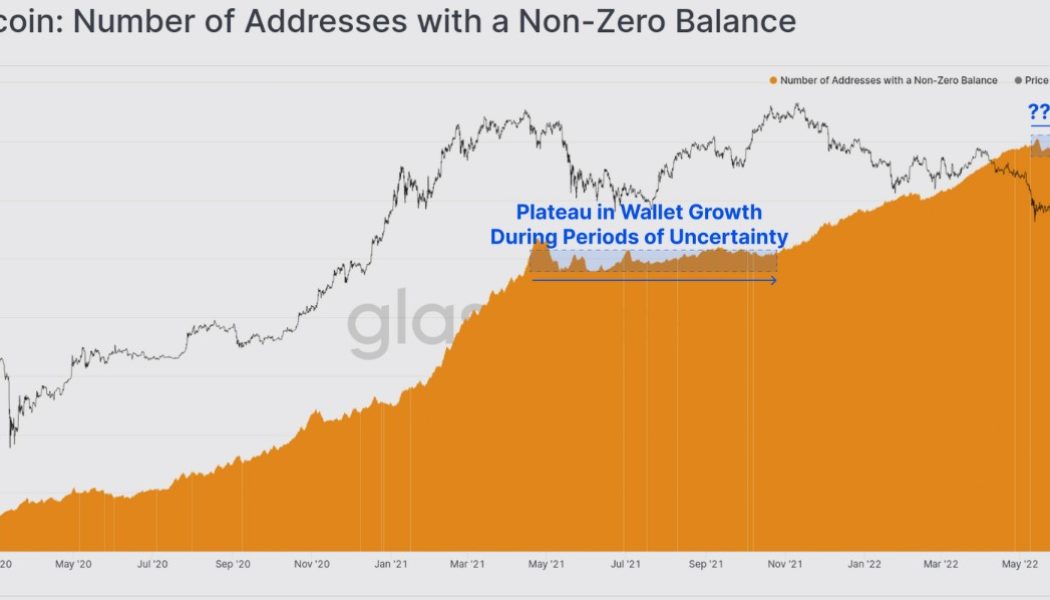

Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins. According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.” Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021. Number of Bitcoin addresses with a non-zero balance. Source: Glassnode Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity tha...