BTC

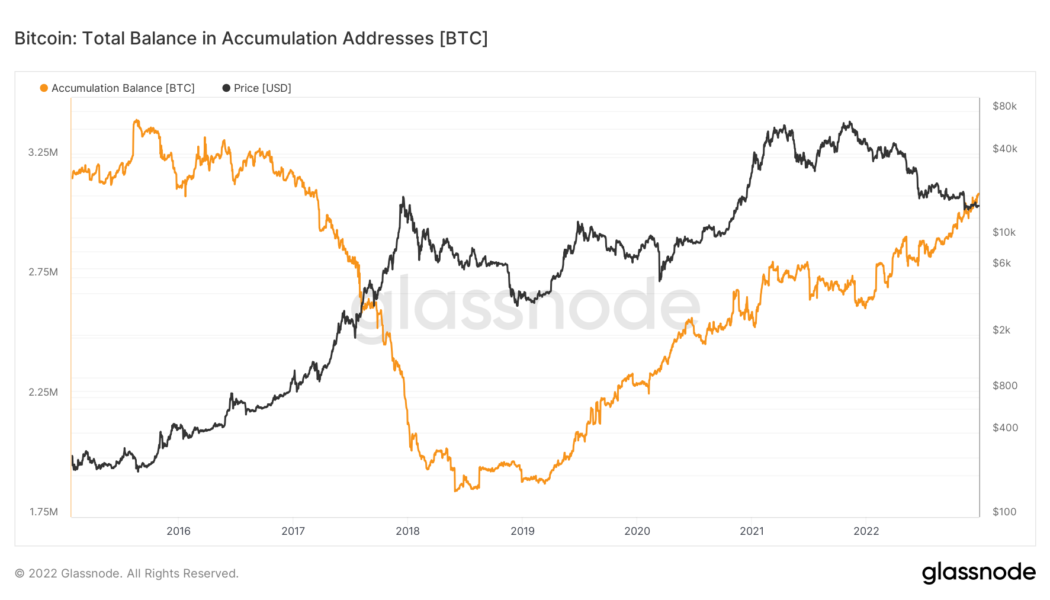

Bitcoin accumulation addresses near record 800K despite whale selling

Bitcoin (BTC) accumulation is nearing a new milestone this Christmas as the redistribution of the BTC supply continues. Data from on-chain analytics firm Glassnode shows that the total BTC balance of so-called “accumulation addresses” is nearing all-time highs. “HODL-only’ BTC addresses climb closer to 1 million mark Behind the scenes in the 2022 Bitcoin bear market, certain entities are in no doubt about their BTC investment strategy. According to Glassnode, Bitcoin accumulation addresses are more numerous than ever before, while the BTC balance they contain is almost at a record high. “Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds,” the firm’s description explains. Glassnode adds that exchange wallets and those...

$1.7M of Bitcoin tied to QuadrigaCX reawakens after years of dormancy

Five wallets tied to the defunct Canadian cryptocurrency exchange QuadrigaCX, previously thought to be inaccessible, have just been spotted moving around $1.7 million worth of Bitcoin after years of dormancy. Crypto researcher ZachXBT alerted the crypto community in a Twitter post on Dec. 19, highlighting the five wallets have transferred around 104 Bitcoin (BTC) on Dec. 17 to various wallets. Blockchain records show the wallets had not sent BTC since at least April 2018. Five wallets attributed to QuadrigaCX unexpectedly moved ~104 BTC on Dec 17 for the first time in years. 1ECUQLuioJbFZAQchcZq9pggd4EwcpuANe1J9Fqc3TicNoy1Y7tgmhQznWrP5AVLXj9R1MhgmGaHwLAvvKVyFvy6zy9pRQFXaxwE9M1HyYMMCdCcHnfjwMW2jE4cv9qVkVDFUzVa1JPtxSGoekZfLQeYAWkbhBhkr2VEDADHZB — ZachXBT (@zachxbt) December 19, 2022 Once Can...

Eco-friendly Bitcoin mining pool PEGA Pool set for public launch in Q1 2023

PEGA Pool, a Bitcoin mining pool that will allow ASIC miners to connect and cooperate in mining bitcoin, is set for public launch in Q1 2023. The mining pool is currently in the pre-launch phase. KEY TAKEAWAYS PEGA Pool is a Bitcoin mining pool. ASIC miners will be able to connect to the pool and cooperate in Bitcoin mining. PEGA Pool is currently in the pre-launch phase and will be open to public launch in Q1 2023. Those interested in mining bitcoin using the pool can join the early access waiting list. At the moment, the only clients mining bitcoin with PEGA Pool are a few beta testers and PEGA Mining, which is a sister company to PEGA Pool. PEGA Pool features PEGA Pool stands out since it is British-owned and operated in an era when most mining pools are Chinese. This makes PEGA Pool mo...

Cybercrooks to ditch BTC as regulation and tracking improves: Kaspersky

Bitcoin (BTC) is forecasted to be a less enticing payment choice by cybercriminals as regulations and tracking technologies improve, thwarting their ability to safely move funds. Cybersecurity firm Kaspersky in a Nov. 22 report noted that ransomware negotiations and payments would rely less on Bitcoin as a transfer of value as an increase in digital asset regulations and tracking technologies will force cybercriminals to rotate away from Bitcoin and into other methods. As reported by Cointelegraph, ransomware payments using crypto topped $600 million in 2021 and some of the biggest heists such as the Colonial Pipeline attack demanded BTC as a ransom. Kaspersky also noted that crypto scams have increased along with the greater adoption of digital assets. However, it said that people have be...

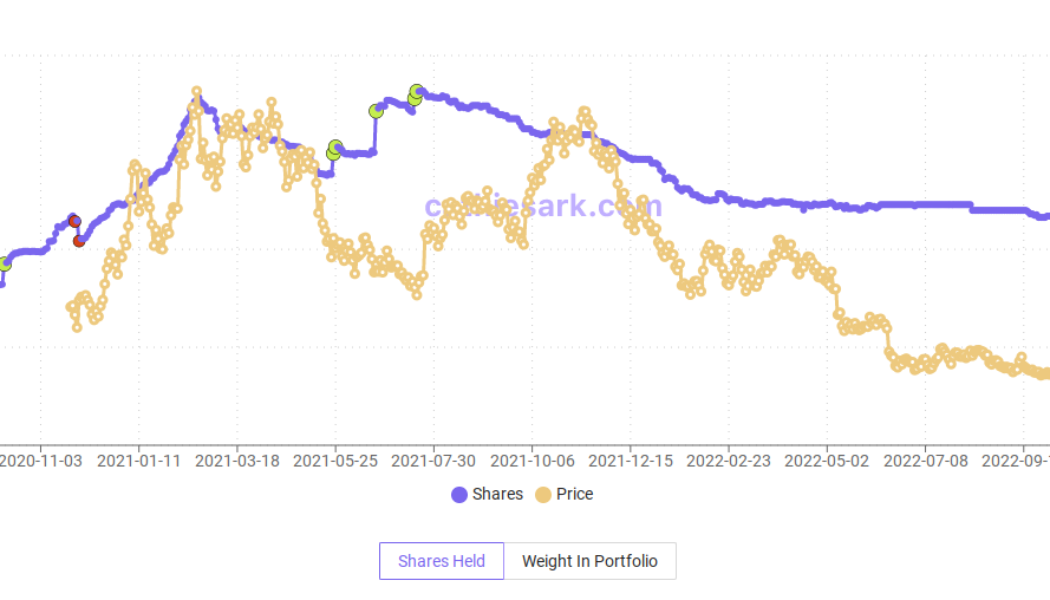

Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

Bitcoin (BTC) firms’ shares are a major “buy” for asset manager ARK Invest in the midst of the FTX meltdown. The latest data confirms that ARK continues to up its holdings of both exchange Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). Cathie Wood buys the dip With FTX contagion still rippling through the crypto industry, ARK’s decision to add exposure to two firms caught in the firing line stands out. According to numbers supplied by CEO Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on Nov. 21. These join a larger tranche of 273,327 shares from Nov. 15, that purchase completed just a week after FTX fell apart. ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s Ark Since then, GBTC has come under the spotlight as ...

GBTC Bitcoin discount nears 50% on FTX woes as investors stock up

The largest Bitcoin (BTC) institutional investment vehicle is coming under suspicion as it trades at a record discount. The Grayscale Bitcoin Trust (GBTC) is the latest Bitcoin industry entity to feel the heat from the debacle over defunct exchange FTX. FTX woes see Coinbase pledge trust in GBTC owner With contagion and fears over a deeper market rout everywhere in Bitcoin and altcoins at present, misgivings are impacting even the best-known — and trusted — crypto industry names. In recent days, it was the turn of GBTC, the long-embattled Bitcoin investment fund, amid problems at a related crypto firm, Genesis Trading. As Cointelegraph reported, parent company Digital Currency Group (DCG), as well as operator Grayscale itself, swiftly sought to reassure investors and the market that its fl...

US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in one week

Bitcoin (BTC) has flooded out of exchanges in the past week as users become wary of security and regulatory scrutiny. Data from on-chain monitoring resource Coinglass shows United States exchanges in particular seeing heavy BTC balance reductions. U.S. exchanges lead BTC exodus In the wake of the FTX scandal, efforts to draw attention to the risk involved in custodial BTC storage stepped up on social media. Users appeared to heed the warning, withdrawing over $3 billion in cryptocurrency in the week immediately following the solvency debacle and ordering record numbers of hardware wallets. The aftermath of FTX is only just beginning, meanwhile, and as regulators plan investigative action and more attention to crypto as a whole, investors angst continues to grow. The data shows the trend is...

Bitcoin miners send less BTC to exchanges since 2020 halving despite FTX

Bitcoin (BTC) miners may be sending more BTC to exchanges this month — but overall, their sales have crashed since 2020. Data from on-chain analytics platform CryptoQuant confirms that daily miner transfers to exchanges have decreased by two thirds or more. Miners cool BTC exchange sales after FTX spike After BTC/USD lost 25% in days last week, existing concerns over miner solvency have heightened. Given their cost basis and rising hash rate, commentators warned that many mining participants may not be able to make ends meet — block subsidies and fees would not be enough to cancel out expenses, chiefly electricity. Network fundamentals, however, tell a curious story — hash rate continues to circle all-time highs and not fall significantly, indicating that at least certain miners are mainta...

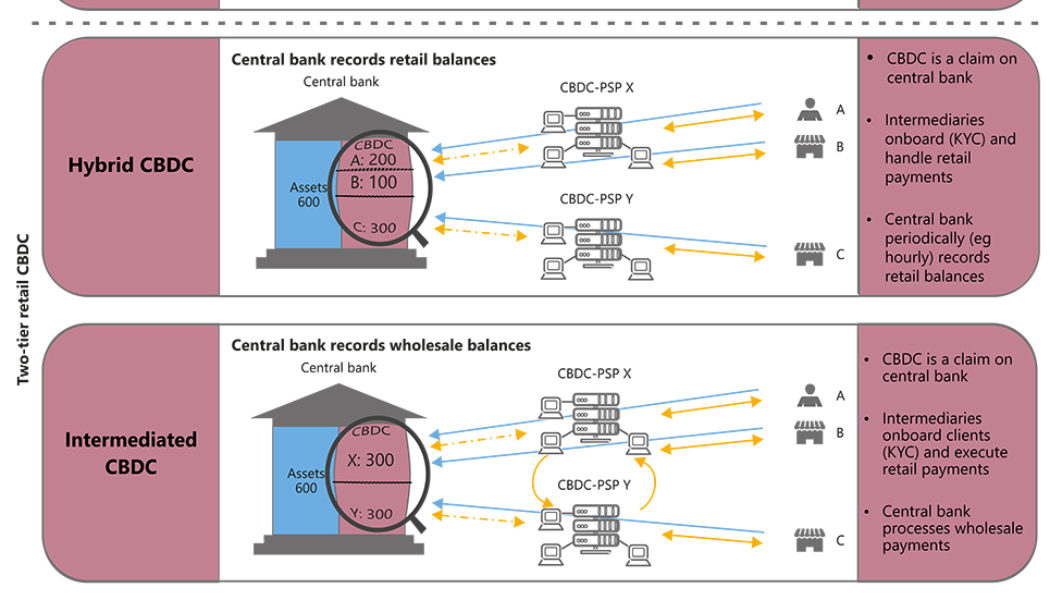

Buying Bitcoin ‘will quickly vanish’ when CBDCs launch — Arthur Hayes

Bitcoin (BTC) holders looking to avoid Central Bank Digital Currencies (CBDCs) may have gained a surprise ally — banks. In his latest blog post, “Pure Evil,” Arthur Hayes, ex-CEO of crypto derivatives platform BitMEX, argued that banks may limit the impact of the CBDC “horror story.” Hayes: Bitcoiners and banks stand against CBDC “dystopia” CBDCs are currently in various stages of development worldwide. Fans of financial sovereignty naturally fear and even despise them, as they imply total government control over everyone’s money and purchasing power — “a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves,” says Hayes. Among opponents of CBDCs are not only Bitcoiners, however. Sharing the cause will likely be the commercial banks ...

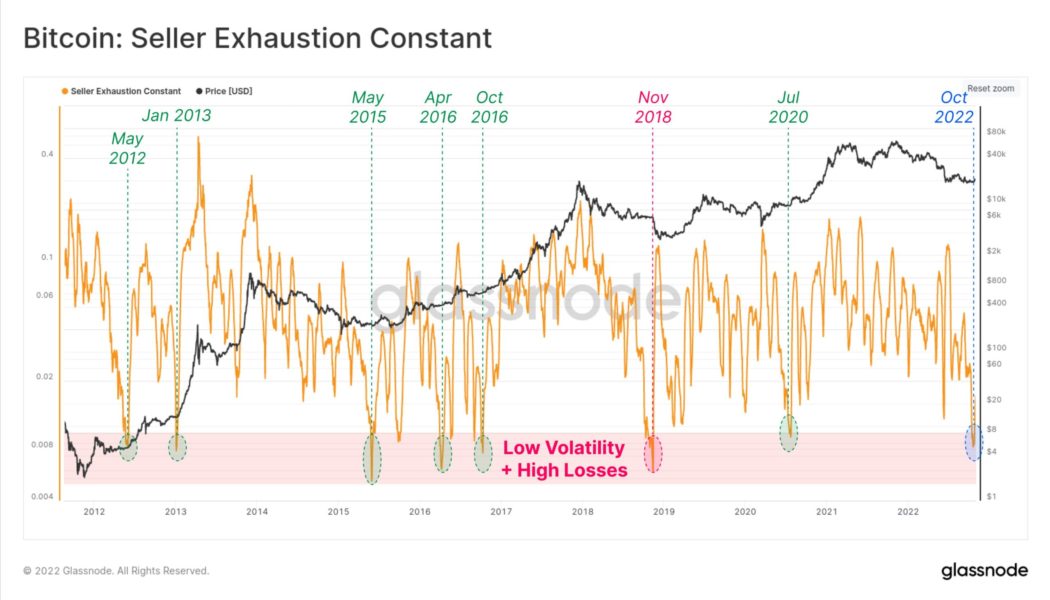

Bitcoin seller exhaustion hits 4-year low in ‘typical’ bear market move

Bitcoin (BTC) sellers may not have capitulated enough, but current trends are “typical” of the end of bear markets. According to data from on-chain analytics firm Glassnode, seller behavior suggests that a macro price bottom is forming. Analyst: Seller exhaustion “near” bear market lows In the latest hint that Bitcoin’s latest bear market is nearing its end, Glassnode has revealed that the network is currently weathering a “perfect storm” of low volatility and high on-chain losses. The Seller Exhaustion Constant, calculated from one-month rolling volatility and on-chain transaction profitability, is thus at long-term lows of its own. As a Twitter post explains, such lows are rare, having only appeared seven times before. Six of those times, upside volatility resulted, implying ...

BNB jumps to new BTC all-time high as Elon Musk’s Twitter fuels DOGE bulls

BNB (formerly known as Binance Coin) has hit new all-time highs against Bitcoin (BTC) as excitement grows over the cryptocurrency’s future role on Twitter. BNB/BTC 1-month candle chart (Binance). Source: TradingView BNB sets new record against BTC Data from Cointelegraph Markets Pro and TradingView confirms that BNB/BTC briefly spiked above 0.15 BTC to a record 0.15267 BTC on Oct. 30. BNB, the in-house token of Binance, the largest crypto exchange by volume, has gained around 10% in the past 72 hours. The strong performance came on the back of reports that Binance was preparing to assist Twitter in eradicating bots as part of its new direction under Elon Musk. Binance had contributed $500 million to Musk’s takeover of the social media platform. “Our intern says we wired the $500 ...

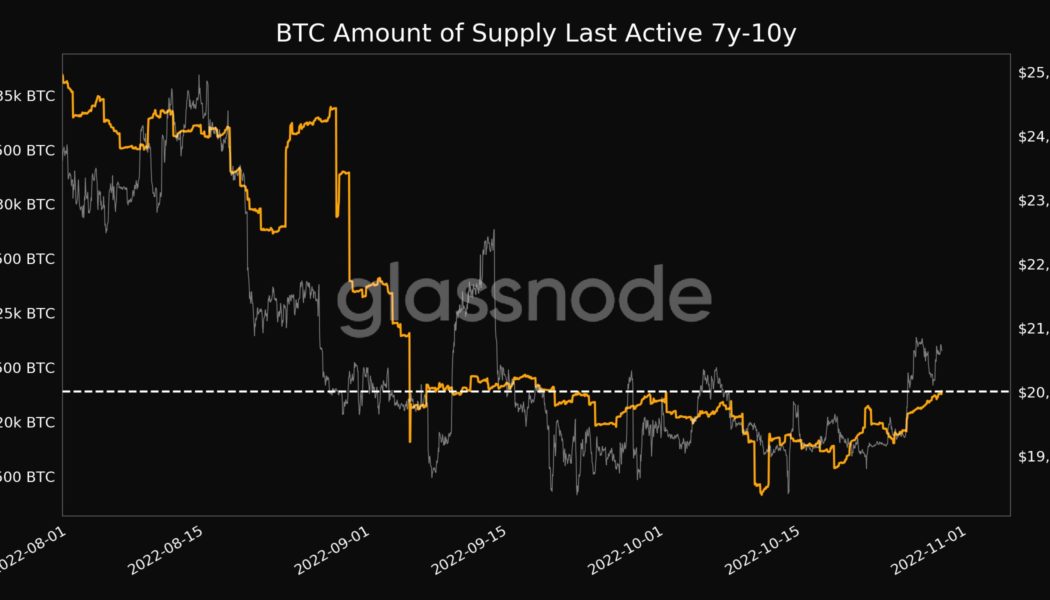

Bitcoin metric warns of $21K profit-taking as decade-old BTC wakes up

Bitcoin (BTC) asleep for up to a decade is waking up this week as BTC price action sees six-week highs. Data from on-chain analytics firm Glassnode shows some of the oldest “dormant” Bitcoin returning to circulation. BTC trends out of hibernation As BTC/USD stages something of a comeback in the second half of October, hodlers are changing their behavior after a year-long bear market. According to Glassnode, the number of Bitcoin previously stationary in their wallet for 7-10 years but not active again reached a one-month high on Oct. 29. This is in fact the latest in a series of such highs, with the previous one seen on Oct. 1. BTC amount of supply last active 7-10 years ago chart. Source: Glassnode/ Twitter Further numbers reveal that the unspent transaction outputs (UTXOs) in profit reac...