Bonds

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

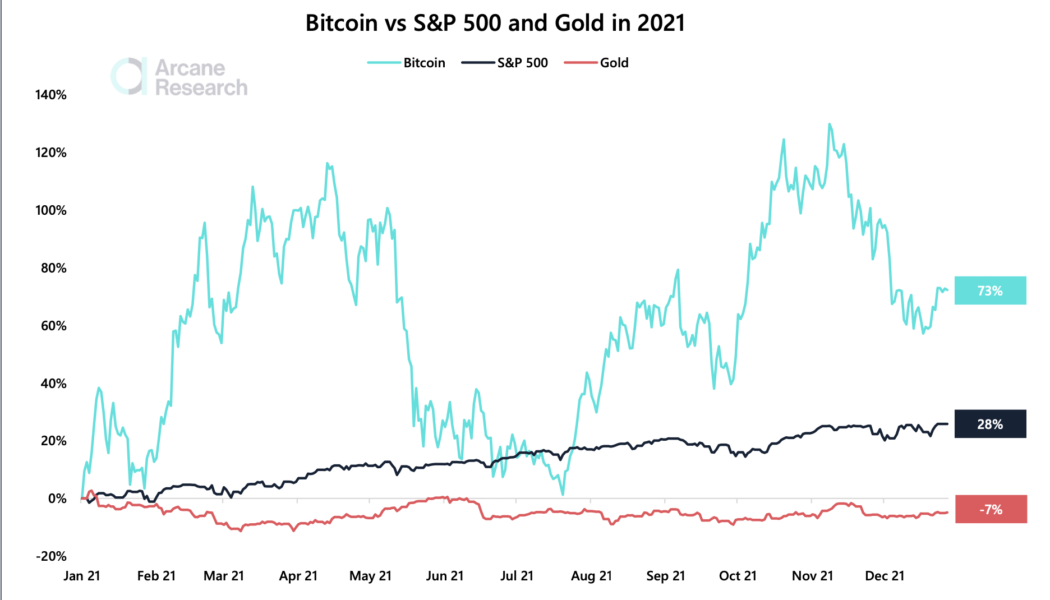

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...

Fish food? Data shows retail investors are buying Bitcoin, whales are selling

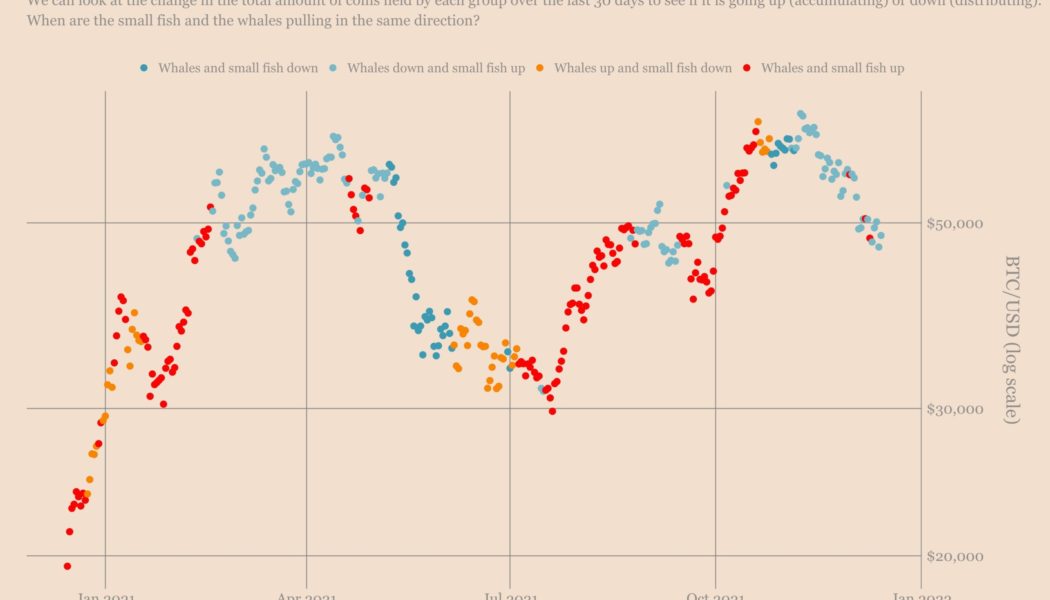

Bitcoin (BTC) staged an impressive recovery after dropping to its three-month low of $42,333 on Dec. 4, rising to as high as $51,000 since. The BTC price retracement primarily surfaced due to increased buying activity among addresses that hold less than 1 BTC. In contrast, the Bitcoin wallets with balances between 1,000 BTC and 10,000 BTC did little in supporting the upside move, data collected by Ecoinometrics showed. “Bitcoin is still stuck in a situation where small addresses are willing to stack sats [the smallest unit account of Bitcoin], while the whale addresses aren’t really accumulating,” the crypto-focused newsletter noted after assessing the change in Bitcoin amounts across small and rich wallet groups, as shown in the graph below. Bitcoin on-chain ...

Cardano’s ADA price eyes 30% rally with a potential ‘triple bottom’ setup

Cardano (ADA) may rally by nearly 30% in the coming days as it forms a classic bullish reversal pattern. Sharp ADA rebound underway Dubbed “triple bottom,” the pattern typically occurs at the end of a downtrend and consists of three consecutive lows printed roughly atop the same level. This means triple bottoms indicate sellers’ inability to break below a specific support level on three back-to-back attempts, which ultimately paves the way for buyers to take over. In a perfect scenario, the return of buyers to the market allows the instrument to retrace sharply toward a higher level, called the “neckline,” that connects the highs of the previous two rebounds. The move follows up with another breakout, this time taking the price higher by as much as the distance between the pattern’s bottom...

Dangote Cement completes issuance of N50 billion bond programme

Dangote Cement Plc has announced the successful issuance of N50 billion series 1 fixed rate senior unsecured bonds, under its new N300 billion multi-instrument issuance programme. In a statement on Tuesday, the cement producer said the bonds were issued on May 26, 2021 at coupon rates of 11.25 percent, 12.50 percent and 13.50 percent for the three, five and seven-year tranches respectively. The bonds will be listed on the Nigerian Exchange Limited and FMDQ Securities Exchange. Dangote Cement said that the proceeds of the bond issuance will be deployed for the company’s expansion projects, short-term debt refinancing and working capital requirements. “Aside from this first issuance of a traditional bond under the new Multi-Instruments Programme, Dangote Cement has registered a programme ena...

Expert: Corporal punishment impedes autistic child’s development

Baerbel Jaja, Head, Government Special School, Lafia, Nasarawa State, says corporal and psychological punishments should not be meted to special needs persons. Jaja told newsmen in Lafia on Friday that corporal and psychological punishments hamper the overall functionality and the development of such persons. She said: “If you flog an autistic child, that’s the end of the development for that child. “You have killed his spirit. “Even for a normal child, if you keep flogging him, you have actually killed the spirit of that child and that will make him not to function well. “If an autistic child does not function the way you want, you have to be patient with him. “You cannot use force on any of this special need kids because it doesn’t work; it will rather close up the little you have achiev...

Seplat issues $650 million oil and gas bond

Seplat Petroleum Development Company, a Nigerian independent oil and gas firm, has issued $650 million in aggregate principal amount of senior notes due in 2026. It is said to be the largest ever Nigerian oil and gas bond issuance. A senior note is a type of bond that must be repaid before most other debts in the event that the issuer declares bankruptcy. It is more secure than other bonds. The dual listed company said the five-year bond was well-received in the market with orders from high quality institutional investors. “The notes priced at a yield of 7.75%, representing a significant pricing reduction from its $350 million debut issuance in 2018, which priced at a yield of 9.50% , with a coupon of 9.25%,” a statement by the company read. “The offering was well oversubscribed with deman...

DMO: Nigerian roads financed with Sukuk not repaying debt as planned

File Photo The Debt Management Office (DMO) has decried the country’s debt service to revenue ratio, describing it as a major issue of concern. Patience Oniha, the Director-General of DMO, said this in Abuja on Thursday at the fifth Budget Seminar (webinar) organised by the Securities and Exchange Commission (SEC). The theme of the budget seminar was, “Financing Nigeria’s Budget and Infrastructure Deficit through the Capital Market.” Oniha stressed the need for infrastructure built with borrowed funds to generate revenue to service the debts. According to her, “We have done the Sukuk, for instance, but the government is the one servicing the debt of those Sukuk. “They (the debts) are not being serviced with revenue from those sources (infrastructure). “I think that when we are talking abou...

Nigerian government borrows over N2 trillion from bond investors in 2020

Leveraging on excess liquidity that persisted in the banking system and the near zero yields on treasury bills (TBs), the Federal Government, through the Debt Management Office (DMO), raised N2.1 trillion from investors in its monthly bond issuance programme in 2020. This represents 33 percent, year-on-year, (y/y) increase when compared with the N1.58 trillion raised by the DMO in 2019. The N2.1 trillion raised in 2020 also represents 31 percent more than the N1.6 trillion funding target for the DMO under the Revised 2020 Budget. Meanwhile, the monthly bond auctions conducted by the DMO in 2020 recorded 275 percent oversubscription, reflecting scramble for the high yielding FGN bonds by investors. Newsmen report on monthly bond auction results show that the DMO offered N1.825 trillion wort...

Rollercoaster: Bitcoiners who missed rally feel relief and regret

Arianna O’Dell, a 30-year-old entrepreneur and songwriter based in New York City, had a tumultuous four-year journey in cryptocurrency before selling her investments in February. During her rollercoaster ride, bitcoin prices swung from less than $1,000 to nearly $20,000. O’Dell may not have made optimal decisions about when to buy or sell, and missed out on the recent rally – but said she does not regret that. Investing $2,705 worth of proceeds into her business was better than enduring the stress of daily fluctuations, even though the price has since doubled, she said. “Honestly, I’ve had more luck in Vegas than I’ve had with cryptocurrencies,” O’Dell said in an interview. She is part of a relatively new class of retail investors who joined the cryptocurrency market years ago, helping pro...

- 1

- 2