Bloomberg

Erik Voorhees tips $40K BTC by June, but little consensus among pundits

There is little agreement among Bitcoin’s commentators over the last few weeks, with crypto execs, research analysts and billionaire investors offering wildly different takes on what’s in store for Bitcoin for the year ahead. One crypto exchange founder expects Bitcoin (BTC) to spike to $40,000 by the summer, while a Bitcoin billionaire has renewed his bullish $250,000 BTC price prediction for the year. Erik Voorhees — $40,000 by the “summer” Erik Voorhees, founder and CEO of cryptocurrency exchange ShapeShift, was optimistic about a potential recovery of Bitcoin’s price during an interview with Bankless on Jan. 2, stating he “wouldn’t be surprised” if Bitcoin (BTC) hit “like $40K” by the “summer.” Voorhees noted that if his prediction were to come true that would be “2.5X” fro...

Bitcoin’s discount to hash rate highest since early 2020 — Mike McGlone

Bloomberg Intelligence senior commodity strategist Mike McGlone says Bitcoin’s (BTC) relative discount to its high hash rate in October — the largest since the first quarter of 2020 — could soon see Bitcoin return to “its propensity to outperform most assets.” In an Oct. 19 Twitter post, the Bloomberg analyst suggested that Bitcoin’s ever-increasing hash rate — a measure of the processing power and security of a blockchain — relative to its price points “to risk/reward leaning favorably.” Many believe that in theory, Bitcoin’s hash rate should go up relative to its price. McGlone pointed to a graph noting that the 10-day average of Bitcoin’s hash rate in October is “roughly equivalent” to the level it should be at around $70,000. However, the price is instead currently at $19,500...

‘FED sledgehammer’ will further batter BTC, ETH prices — Bloomberg analyst

The United States Federal Reserve’s inflation “sledgehammer” is about to batter the prices of Bitcoin (BTC) and Ether (ETH) down even further, before reaching back to new all-time highs in 2025, according to Bloomberg analyst Mike McGlone. Ahead of the latest Fed interest rate hike to be announced this week, the market is expecting a minimum of a 75-basis-point increase, however some fear it could be as high as 100 basis points, which would represent the biggest rate hike in 40 years. Speaking with financial news outlet Kitco News on Saturday, McGlone, senior commodity strategist of Bloomberg Intelligence, suggested that further market carnage is on the cards for BTC, ETH and the broader crypto sector as Fed’s actions will continue to dampen investor sentiment: “We have to turn over to the...

The ‘launch of a rocket’ — Observers on the future of Ethereum post-Merge

The Ethereum Merge is set to occur later today with the energy-efficiency focused transition expected to have a major impact on crypto investment and adoption, experts say. Speaking to Cointelegraph in the lead up to the Merge, StarkWare president and co-founder Eli Ben-Sasson noted that the Ethereum Merge will be the “first step in a process that will lead to exceedingly widespread adoption of Ethereum.” The immediate importance of the Merge is the dramatic effect on energy consumption. The Merge is expected to see Ethereum’s energy cut by 99.95% compared to its current Proof-of-Work (PoW) consensus mechanism, which requires large amounts of energy to be used in a competition to solve arbitrary mathematical puzzles. “I think of the Merge like the development of the first solar field...

BNB price risks 40% drop as SEC launches probe against Binance

Binance Coin (BNB) price dropped by nearly 7.3% on June 7 to below $275, its lowest level in three weeks. What’s more, BNB price could drop by another 25%–40% in 2022 as its parent firm, Binance, faces allegations of breaking securities rules and laundering billions of dollars in illicit funds for criminals. Bad news twice in a row BNB was issued as a part of an initial coin offering (ICO) in 2017 that amassed $15 million for Binance. The token mainly behaves as a utility asset within the Binance ecosystem, primarily enabling traders to earn discounts on their trading activities. Simultaneously, BNB also functions as a speculative financial asset, which has made it the fifth-largest cryptocurrency by market capitalization. BNB market capitalization was $45.42 billion as of June ...

SkyBridge goes all in on crypto, betting on ‘tremendous growth’ ahead

SkyBridge Capital is working on pivoting the majority of its assets under management (AUM) to digital assets, as the sector represents “tremendous growth” for the firm. The hedge fund was founded by former U.S. politician Anthony Scaramucci in 2005, and first delved into Bitcoin (BTC) in late 2020. The firm also has money deployed in other hedge funds, late-stage private tech companies and real estate, with its total AUM reported being around $7.3 billion. Skybridge now manages a $7 million Bitcoin Fund among others and has been actively working to get a spot BTC exchange-traded fund (ETF) approved by the U.S. Securities and Exchange Commission (SEC). Speaking with Bloomberg in the lead up to the annual SkyBridge Alternatives Conference (SALT) this week, Scaramucci said that the firm is re...

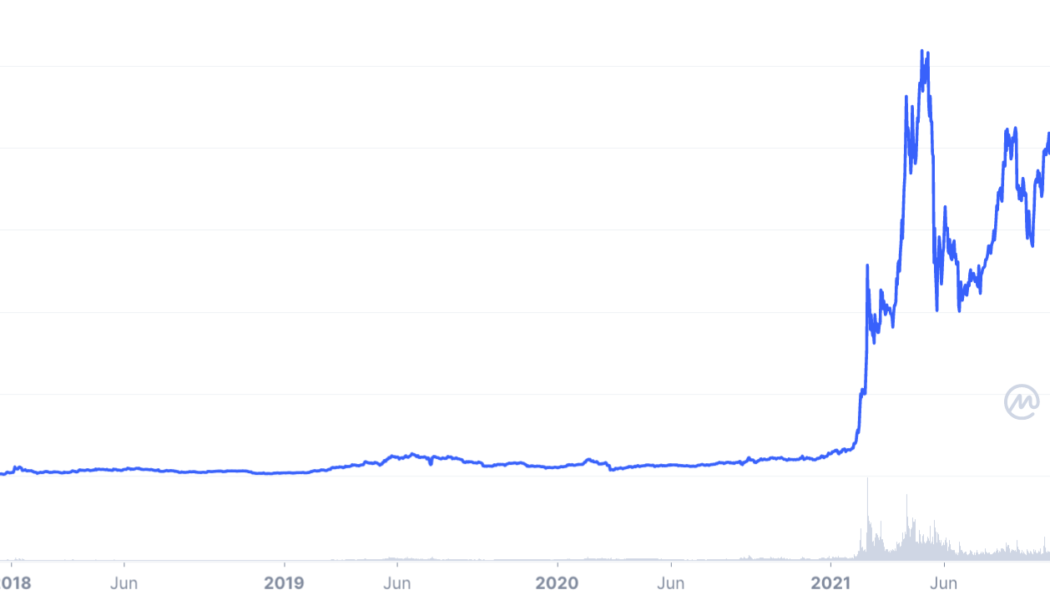

Dogecoin signals bottoming out as DOGE rebounds 30% in two weeks — What’s next?

A brutal correction witnessed in the Dogecoin (DOGE) market between May 2021 and February 2022, which saw the price dropping by almost 85%, appears to have come to a halt this month. DOGE/USD rebounds 30% in two weeks DOGE experienced strong dip-buying when its price crashed to levels around $0.10 two weeks ago, resulting in a 30% rebound move to $0.14 as of March 27. Meanwhile, the coin’s upside retracement originated at a support level that constitutes a “falling wedge” setup, signaling an extended bullish reversal in the weekly sessions ahead. In detail, a falling wedge pattern occurs when the price trends lower while fluctuating between two downward sloping, converging trendlines. In a perfect scenario, the setup results into the price breaking out of the descending r...

Bukele’s Bitcoin trade raises El Salvador’s sovereign credit risk: Moody’s

El Salvador’s historic embrace of Bitcoin (BTC) could have negative consequences on the country’s sovereign credit outlook, according to Moody’s Investors Service. Moody’s analyst Jaime Reusche told Bloomberg this week that El Salvador’s Bitcoin gambit “certainly adds to the risk portfolio” of a country that has struggled with liquidity issues in the past. Under the leadership of President Nayib Bukele, El Salvador has recognized Bitcoin as legal tender and issued a state-run crypto wallet to facilitate payments, transfers and ownership. Along the way, El Salvador has amassed a treasure chest of 1,391 BTC, with President Bukele famously “buying the dip” on several occasions by using Bitcoin’s volatility to add to his country’s holdings. Buying the dip 150 new coins added.#BitcoinDay ...

Presidency: Atiku Abubakar can’t extricate himself from Nigeria’s rot

The Presidency has attacked former Vice President Atiku Abubakar for his comment on the Bloomberg report that Nigeria may emerge the country with the highest unemployment rate in the world. The position of the Presidency was stated by the Special Adviser to President Muhammadu Buhari on Media and Publicity, Femi Adesina, on a Channels Television programme: Sunday Politics, on Sunday. Adesina said the recent report released by the National Bureau of Statistics that 23.2 million Nigerians are unemployed was not new. He said: “You will recall that in the build-up to the 2015 elections, when the APC (All Progressives Congress) was campaigning, the figure that was used by then candidate Buhari was that a minimum of 30 million Nigerians were unemployed, particularly youths, and that his governme...

Presidency: President Buhari never promised to make N1 equal $1

The Presidency has said that there was not a time when President Muhammadu Buhari promised to make N1 equivalent to $1. The Special Adviser to the President on Media and Publicity, Femi Adesina, said this on a Channels Television programme, Sunday Politics, on Sunday. Adesina, who also addressed complaints about the economy by Nigerians, including former Vice President Atiku Abubakar, said of the often quoted promise by Buhari to make N1 exchange for $1: “It does not exist, it is fake, it is false, it is apocryphal, it doesn’t exist.” He further told Channels Television that the Minister of Information and Culture, Alhaji Lai Mohammed, has debunked the claim several times and challenged anyone with clips and publications of the President promising such to make them available. On the critic...

- 1

- 2