Blockchain analysis

FTX hires forensics team to find customers’ missing billions: Report

The new management for bankrupt crypto exchange FTX has reportedly hired a team of financial forensic investigators to track down the billions of dollars worth of missing customer crypto. Financial advisory company AlixPartners was chosen for the task and is led by former Securities and Exchange Commission (SEC) chief accountant, Matt Jacques, according to a Dec. 7 report from the Wall Street Journal. It is understood that the forensics firm will be tasked with conducting “asset-tracing” to identify and recover the missing digital assets and will complement the restructing work being undertaken by FTX. On Nov. 11 hackers drained wallets owned by FTX and FTX.US of over $450 million worth of assets. Former CEO Sam Bankman-Fried claimed in an interview recorded on Nov. 16 with crypto blogger ...

Taliban had a ‘massive chilling effect’ on Afghan crypto market: Report

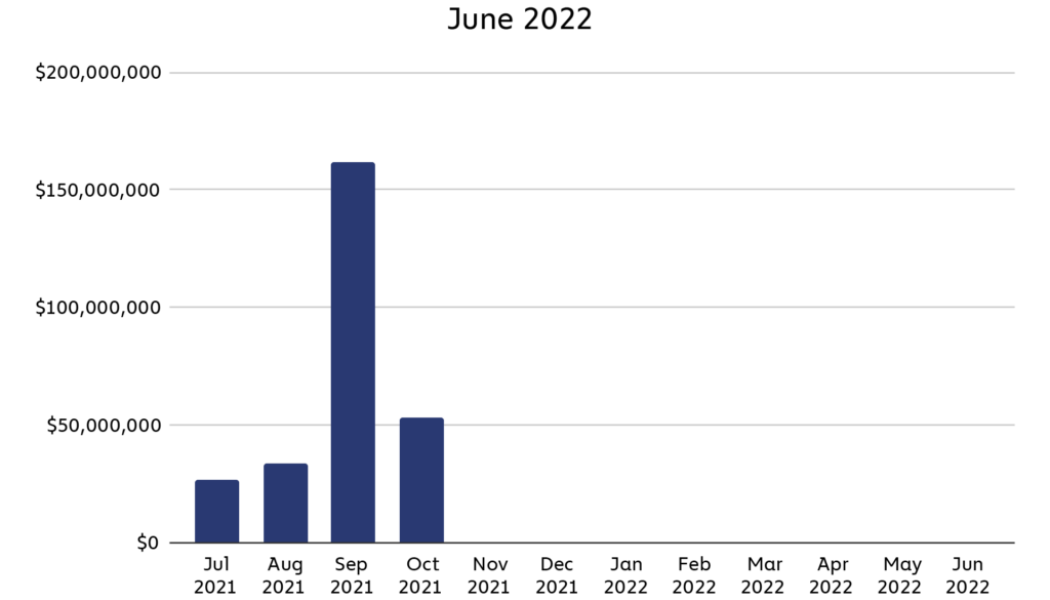

The Taliban’s takeover of Afghanistan has had a “massive chilling effect” on the local cryptocurrency market, bringing it to an effective “standstill,” according to a recent report. Blockchain analytics firm Chainalysis in an Oct. 5 report stated the Middle East and North Africa (MENA) region saw the largest crypto market growth in 2022 but noted that Afghani crypto dealers had three options: “flee the country, cease operations, or risk arrest.” The report states after the Taliban seized power in August 2021, crypto value received in August and September that year spiked to a peak of over $150 million, then fell sharply the following month. Before the takeover, Afghani citizens would on average receive $68 million per month in crypto value mainly used for remittances. That ...

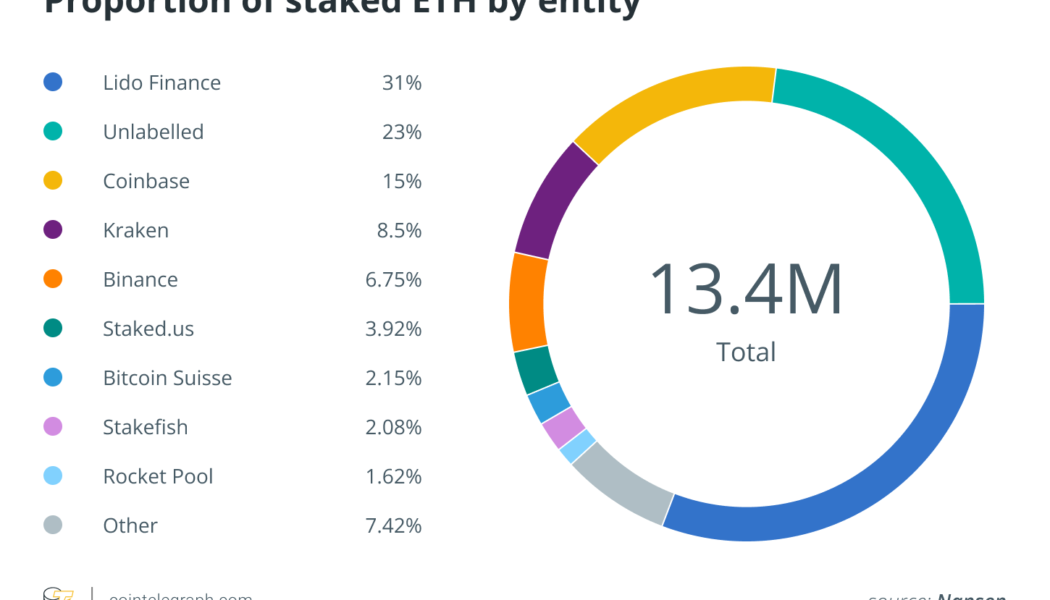

64% of staked ETH controlled by five entities — Nansen

A report from blockchain analytics platform Nansen highlights 5 entities that hold 64% of staked Ether (ETH) ahead of Ethereum’s highly anticipated Merge with the Beacon Chain. Ethereum’s shift from proof-of-work to proof-of-stake is set to take place in the coming days after final updates and shadow forks have bee completed in early September. The key component of The Merge sees miners no longer used as validators, replaced by stakers that commit ETH to maintain the network. Nansen’s report highlights that just over 11% of the total circulating ETH is staked, with 65% liquid and 35% illiquid. There are a total of 426,000 validators and some 80,000 depositors, while the report also highlights a small group of entities that command a significant portion of staked ETH. Three major crypt...

Curve Finance exploit: Experts dissect what went wrong

Decentralized finance protocols continue to be targeted by hackers, with Curve Finance becoming the latest platform to be compromised after a domain name system (DNS) hijacking incident. The automated market maker warned users not to use the front end of its website on Tuesday after the incident was flagged online by a number of members of the wider cryptocurrency community. While the exact attack mechanism is still under investigation, the consensus is that attackers managed to clone the Curve Finance website and rerouted the DNS server to the fake page. Users who attempted to make use of the platform then had their funds drained to a pool operated by the attackers. Curve Finance managed to remedy the situation in a timely fashion, but attackers still managed to siphon what was origi...