BlackRock

BlackRock CEO: FTX Token caused downfall, but tech still revolutionary

The CEO of the worlds largest asset management firm, BlackRock, believes that the reason why FTX failed is because it created its own FTX Token (FTT), which was centralized and therefore at odds with the “whole foundation of what crypto is.” Larry Fink, who serves as chairman and CEO of the $8 billion investment company — made the remarks during New York Times’ 2022 Dealbook Summit held on Nov. 30, and added that despite his belief that FTX’s own-created token caused its downfall, he believes that crypto and the blockchain technology which underpins it will be revolutionary. BlackRock CEO Larry Fink speaking at the 2022 DealBook Summit. Source: New York Times. Centralized exchange tokens, such as Binance Coin (BNB) and fellow exchange Crypto.com’s Cronos (CRO), account for over $57 b...

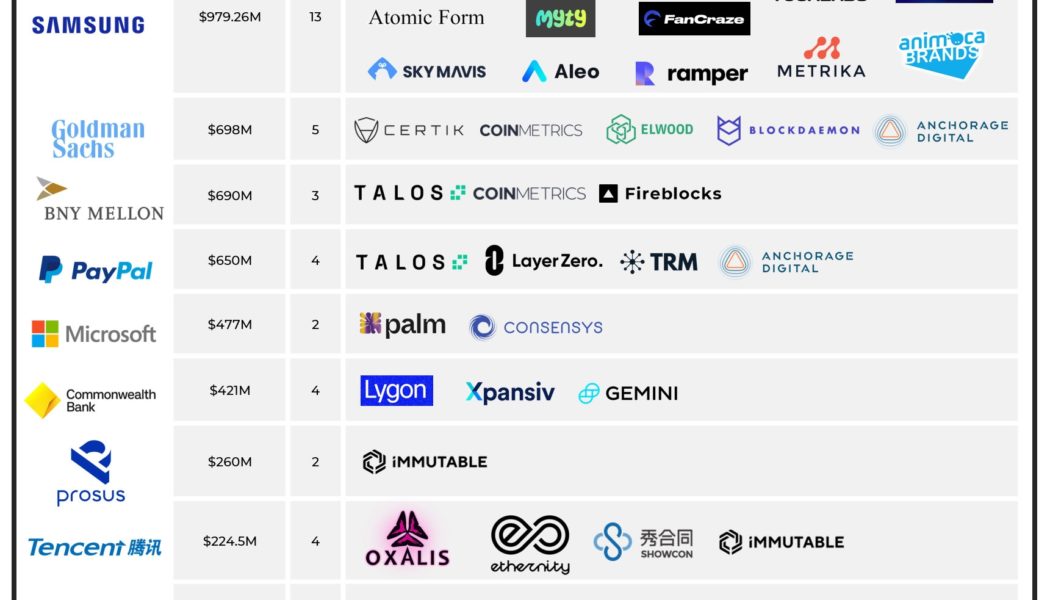

Google invested a whopping $1.5B into blockchain companies since September

Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows. In an updated blog published by Blockdata on Aug. 17, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period. The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage, and venture capital company Digital Currency Group. This is in stark contrast to last year, where Google diversified its much smaller $60...

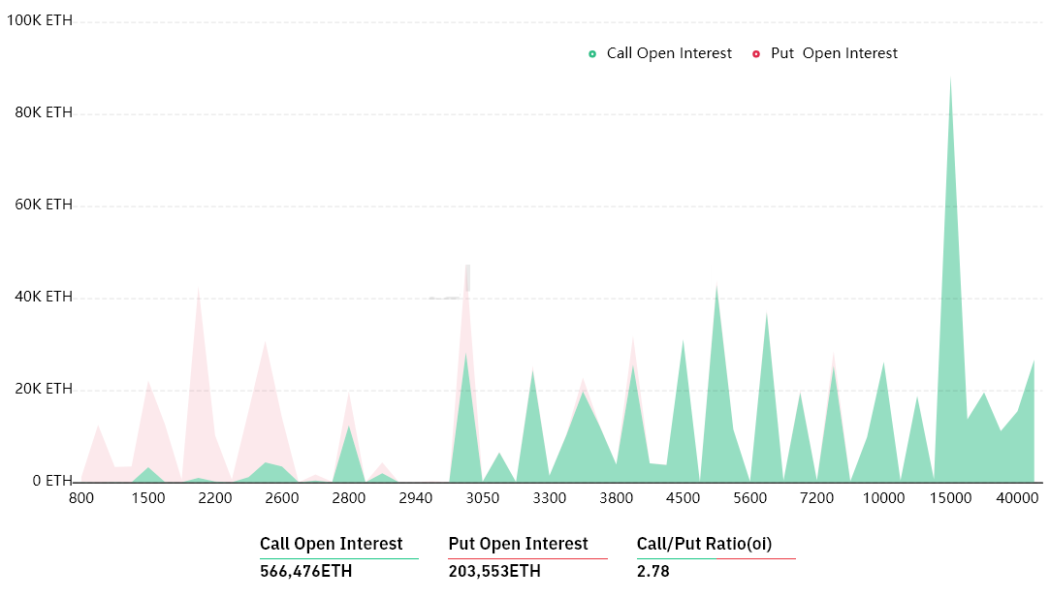

2 metrics signal the $1.1T crypto market cap resistance will hold

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally. Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading. Total crypto market cap, USD billions. Source: TradingView While the two leading cryptoassets were unable to print weekly gains, traders’ appetite...