Black Rock

ETH products grow in August as BTC products dip: CryptoCompare report

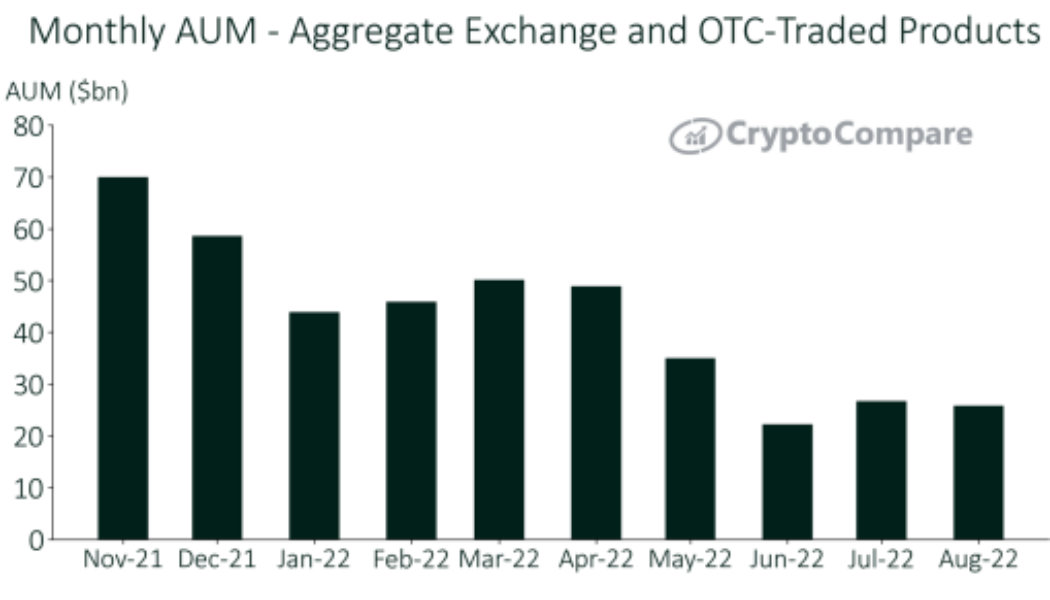

Ethereum investment products increased by 2.36% to $6.81 billion in assets under management (AUM) throughout August, outperforming Bitcoin products which saw a 7.16% drop off to $17.4 billion. The figures were contained in a new report by CryptoCompare. This was also reflected in the Bitcoin (BTC) and Ethereum (ETH)-product trading volumes, with Grayscale’s most notable Bitcoin product, GBTC experiencing a 24.4% drop in volume, while its Ethereum product, GETH actually increased 23.2%. CryptoCompare’s report suggeste the highly anticipated Ethereum Merge was the cause behind the change in trading volumes: Indeed, even at a more granular level, no Bitcoin products covered in this report saw AUM or volume gains in the month of August. We could be seeing interest move away from Bi...

JPMorgan trials blockchain for collateral settlement in after-hours trading

Multinational investment bank JPMorgan Chase & Co is reportedly trialing the use of its own private blockchain for collateral settlements. According to Bloomberg JPMorgan conducted a pilot transaction last Friday which saw two of its entities transfer a tokenized representation of Black Rock Inc. money market fund shares A money market fund is a type of mutual fund that is considered as a low risk investment as it offers exposure to liquid and short term assets such as cash, cash equivalents and debt-securities with high credit ratings. In terms of JPMorgan’s broader vision for its private blockchain, the bank said that it intends to enable investors to put forward a wide range of assets as collateral that can also be used outside of regular market hours. It pointed to equities and fix...