Bitstamp

Banks still show interest in digital assets and DeFi amid market chaos

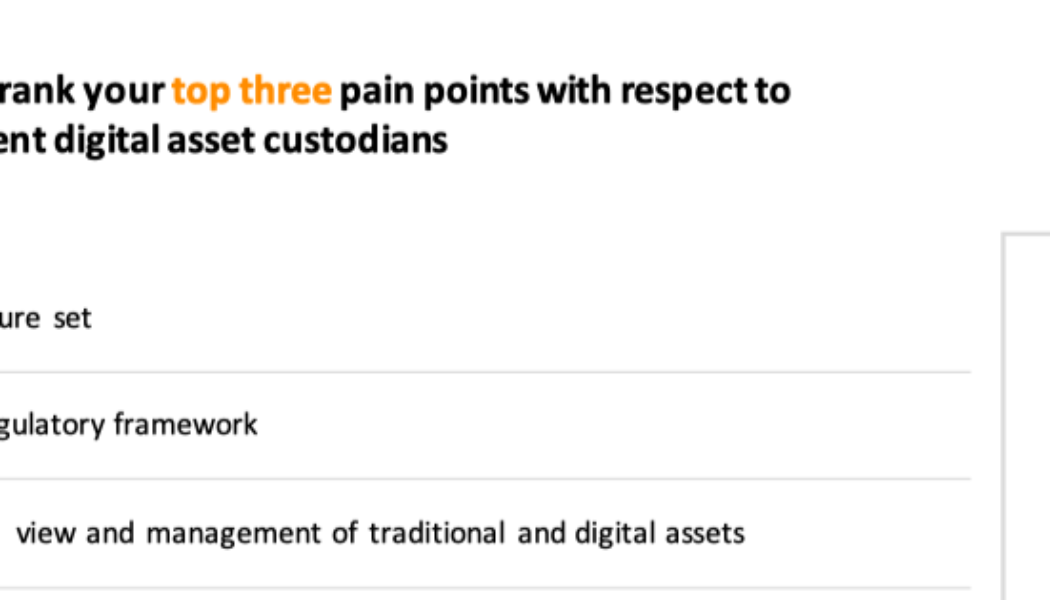

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

Head of Bitstamp’s European arm becomes latest CEO of global crypto exchange

Bitstamp, one of the oldest crypto exchanges in the world, has announced the appointment of Jean-Baptiste (JB) Graftieaux as its new global CEO following the departure of Julian Sawyer. In a Monday announcement, Bitstamp said Sawyer, who first became CEO of the crypto exchange in October 2020, “has decided to pursue other opportunities.” Graftieaux took over the position on May 7, having been the Bitstamp Europe CEO since May 2021. According to the exchange, Graftieaux has 20 years of experience in “crypto, payments, and financial sectors,” having first joined Bitstamp in November 2014 as the firm’s chief compliance officer following five years at PayPal. “JB was with Bitstamp in its early days, and has admirably led our European business over the past year,” said Bitstamp’s board of direc...

Leading centralized exchanges extend market share in 2022

The top centralized cryptocurrency exchanges have reached all-time highs for market share this year as the trading volume in crypto consolidates onto the platforms of only a few trusted companies. These named “top-tier” crypto exchanges have increased their market share from 89% in August 2021 to 96% in February 2022, according to data collected by United Kingdom analytics company CryptoCompare published on Monday. The firm analyzed over 150 active centralized exchanges, ranking them on security, number of assets available, regulatory compliance, Know Your Customer checks and more, grading them from a top score of AA to a low of F, with “top tier” receiving a grade B or above. A total of 78 exchanges received a “top tier” grade, with Coinbase, Gemini, Bitstamp and Binance as the only four ...

Terra sponsors Washington Nationals, Bitstamp backs Immortals esports

Sports and esports fans will soon see more crypto ads during games as Terra has partnered up with the Washington Nationals MLB team and crypto exchange Bitstamp is now partnered with esports organization Immortals. Terra (LUNA) is the 10th largest cryptocurrency by market cap and the blockchain that produces the UST stablecoin. The project is governed by a decentralized autonomous organization (DAO), which is now an official partner of the Washington Nationals. The Terra community committed $38.2 million in UST over the next five years to secure the deal. The partnership was proposed by Terra founder Do Kwon on Feb. 1 through the community’s governance platform. As part of the partnership, there are plans to allow fans at games to make purchases with UST at the team’s home stadium, N...