Bitmex

Arthur Hayes: Bitcoin bottomed as ‘everyone who could go bankrupt has gone bankrupt’

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, thinks the worst might be over for Bitcoin (BTC) this cycle as the “largest most irresponsible entities” have run out of BTC to sell. “Looking forward, pretty much everyone who could go bankrupt has gone bankrupt,” he said in the Dec. 11 interview with crypto advocate and podcaster Scott Melker. Hayes elaborates on his stance by explaining that when centralized lending firms (CELs) have financial troubles, they will often call in loans first, then sell BTC first because it operates as the “reserve asset of crypto” and “the most pristine asset and the most liquid.” “When you look at the balance sheet of any of these of the heroes, there’s no Bitcoin on it because what do they do, they sold...

Moonvember kicks off with sweeping staff layoffs across crypto

The crypto and tech industry has seen a slew of staff cuts this week against a backdrop of difficult market conditions, though on a positive note, some are bucking the trend. Crypto companies, including crypto exchanges, venture capital firms and blockchain developers, have been forced to reduce headcount in order to stay nimble amid the bear market. Some, however, have done the opposite, opening up offices in new locations and markets. It comes a few weeks after multiple high-level executives, such as OpenSea’s former chief financial officer, Kraken’s co-founder Jesse Powell and Ripple Labs’ engineering director, have all made headlines for either exiting or stepping down from their roles in the space. Stripe cuts around 1,000 staff Patrick Collison, CEO of payments processor Stripe...

Institutional appetite continues to grow amid bear market — BitMEX CEO

In a recent interview, BitMEX chief executive Alexander Höptner shared his thoughts about institutional investors who, in his view, still have an appetite for crypto and Ethereum. Speaking at the Token2049 conference in Singapore on Sept. 28, the crypto executive told Cointelegraph that there has not been a “single slowdown of institutional push into crypto” during this bear market. He added that institutions and finance industry players typically use bear markets for innovation. There is a lot more pressure to deliver in a bull market, but bear markets offer the luxury of more time. Höptner also commented that adoption for the finance industry has a long horizon which is why institutions will be buying and holding crypto assets while the opposite can currently be said for the retail secto...

BitMEX former executive pleads guilty to violating the Bank Secrecy Act

Another top executive joins three co-founders of the crypto exchange BitMEX, pleading guilty in the United States District Court for the Southern District of New York. The court case under the headline “U.S. v. Hayes et al.” goes on for two years, with BitMEX management being indicted for violating the U.S. Bank Secrecy Act. According to the Wall Street Journal, on Aug. 8, a one-time head of business development at BitMEX, Gregory Dwyer, admitted his guilt of violating the Bank Secrecy Act in court. As part of a plea deal, Dwyer would pay a $150,000 fine. As Manhattan Attorney Damian Williams commented on this development: “Today’s plea reflects that employees with management authority at cryptocurrency exchanges, no less than the founders of such exchanges, cannot willfu...

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

Arthur Hayes to serve 2-year probation owning up to BitMEX’s AML mishap

Bringing closure to the long-awaited judgment related to the money laundering activities over the BitMEX crypto exchange, one of the four federal district courthouses in New York reportedly sentenced two-year probation and six months of home detention to founder and ex-CEO Arthur Hayes. Arthur Hayes, along with the other BitMEX co-founders — Benjamin Delo and Samuel Reed — and the company’s first non-employee Gregory Dwyer, pleaded guilty to the Bank Secrecy Act (BSA) violations on Feb 24, admitting to “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program at BitMEX.” Indictment against BitMEX co-founders and employees for violating BSA. Source: Justice.gov Pleading guilty to supporting money laundering is a punishable offense, often carrying a ...

BitMEX to diversify by offering spot crypto trading services

The Seychelles-based crypto exchange unveiled its spot trading platform today The BitMEX founding trio was recently fined $30 million for conducting business in the US illegally BitMEX exchange now allows traders to buy and sell crypto assets offered on its newly launched spot trading platform. Prior to today, the exchange did not support spot crypto trading despite being founded more than half a dozen years ago and having spread to over 100 countries. “Today, BitMEX is one step closer to providing our users with a full crypto ecosystem to buy, sell, and trade their favourite digital assets,” CEO Alexander Höpner said. “We will not rest as we aim to deliver more features, more trading pairs, and more ways for our clients to take part in the crypto revolution.” Seven crypto products tr...

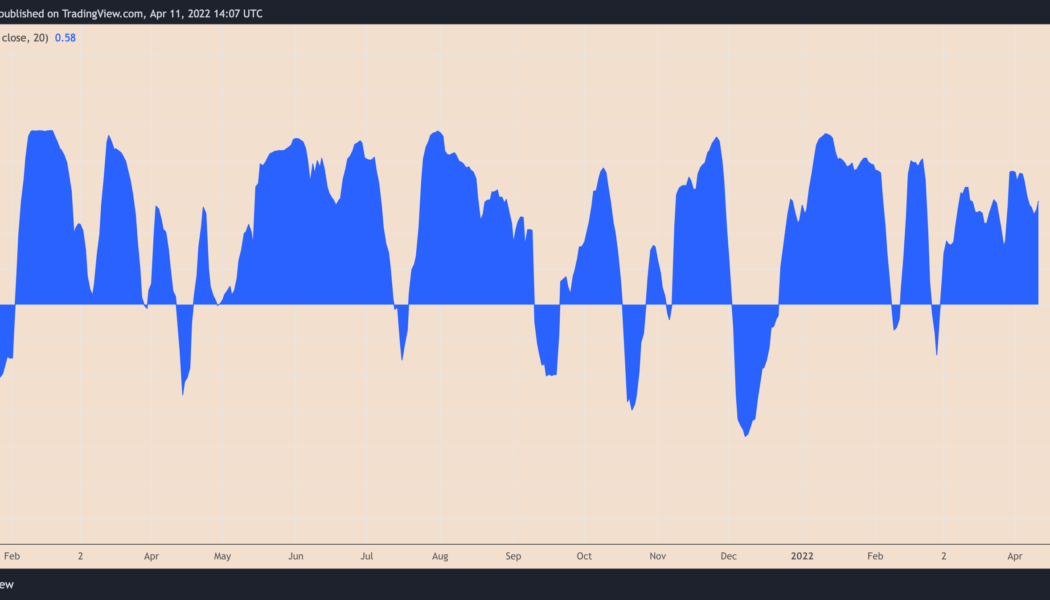

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

Nifty News: AC Milan launches NFT collection, Magic Eden accepts Solana projects’ tokens and more

Italian professional soccer club AC Milan will be releasing its first-ever nonfungible token (NFT) project in collaboration with the BitMEX crypto exchange. Proceeds will go to Fondazione Milan, the clubs’ charity arm. The limited-edition collection will feature 75,817 NFTs, a number representative of the capacity of the club’s home ground, San Siro stadium. It will depict a 3D image of a jersey found in South Sudan by Danish war photographer Jan Grarup who was in the country documenting widespread flooding last December. BitMEX partnered with AC Milan to contribute to the project by providing trading discounts and “other benefits” to the first 10,000 pre-orders. BitMEX will also donate to Fondazione Milan by purchasing a “large number” of the NFTs. As per the announcement, the club says t...

BitMEX acquires a German bank in line with its Europe expansion plans

The agreement of purchase is subject to regulatory approval by Federal Financial Supervisory Authority (BaFin) BMX Operations AG, an affiliate firm created by BitMEX Group execs yesterday, revealed plans to acquire a 268-year-old German bank, Bankhaus von der Heydt. Though financial details were not disclosed, the purchase is to be finalised by the end of Q2 this year. BMX Operations, owned by BitMEX Group CEO Alexander Höptner and CFO Stephan Lutz, said it had signed a purchase agreement with the current owner of the bank, Dietrich von Boetticher. The acquisition of the bank is, however, tentative at present as it hasn’t been given the green light by Germany’s financial regulatory authority BaFin. “Through combining the regulated digital assets expertise of Bankhaus von ...