BitConnect

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

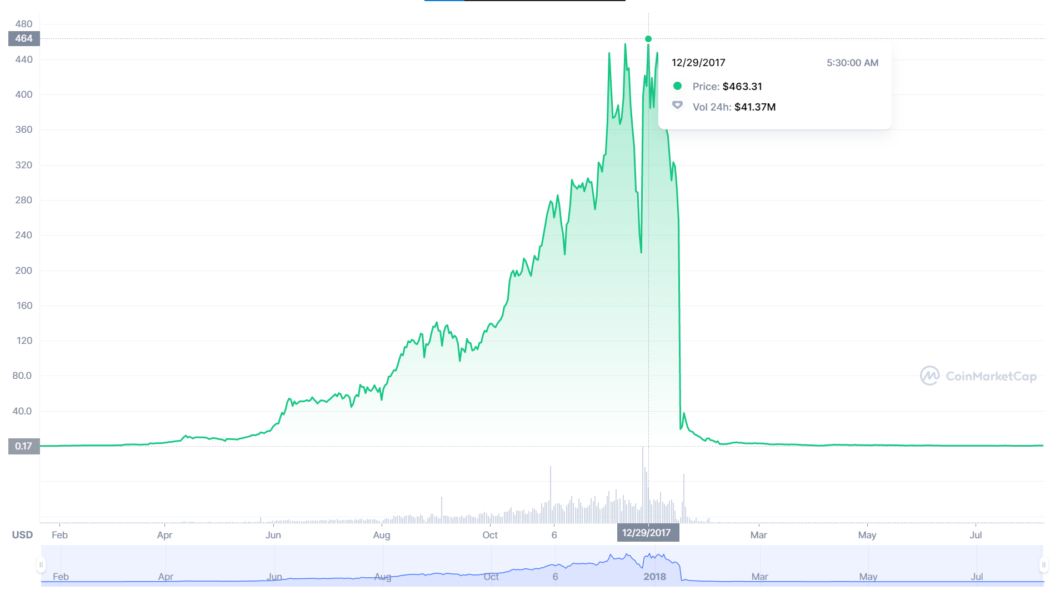

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...

Appellate court decision allows Bitconnect class action to proceed

The 11th Circuit Court of Appeals has ruled that victims of the Bitconnect Ponzi scheme can proceed with a class action suit by reversing a previous ruling that prohibited such a case. Bitconnect is the endlessly memed ICO from 2017 that collapsed in January, 2018. Appellate courts are superior courts that are used to review previously tried cases so the ruling may be reversed or confirmed. The alleged victims may now move forward with a class action case against BitConnect (BCC) and its promoters Glenn Arcaro, Ryan Maasen, Trevon James, Ryan HiIdreth, and Craig Grant. There is no word yet on whether the complainants will proceed with the case. The original complainants filed suit in order to be compensated for damages from being defrauded by BitConnect and its promoters. The complaint say...