Bitcoin

Bitcoin could become the foundation of DeFi with more single-sided liquidity pools

For many years, Ethereum reigned supreme over the decentralized finance (DeFi) landscape, with the blockchain serving as the destination of choice for many of the most innovative projects serving up their take on decentralized finance. More recently, however, DeFi projects have started to crop up across multiple ecosystems, challenging Ethereum’s hegemony. And, as we look to a future in which the technical problem of interoperability is solved, one unlikely contender for the role of DeFi power player emerges — Bitcoin (BTC). In that future, Bitcoin plays potentially the most important role in DeFi — and not in a triumphalist, maximalist sense. Rather, Bitcoin can complement the rest of crypto as the centerpiece of multichain DeFi. The key to this is connecting it all together so that Bitco...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

Bitcoin sets new 7-week high as BTC price jumps past $21K on US jobs

Bitcoin (BTC) passed $21,000 at the Nov. 4 Wall Street open as bulls tackled a formidable sell wall. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Sellers move aside for new multi-week highs Data from Cointelegraph Markets Pro and TradingView shows BTC/USD breaking through resistance to hit local highs of $21,262 on Bitstamp. The pair had struggled to return to higher levels during the week, but the latest order book data from Binance showed asks now shifting up to north of $21,500. BTC/USD order book data (Binance). Source: Material Indicators/Twitter The day’s high marked Bitcoin’s best performance since Sept. 13, beating previous local peaks. Material Indicators, which provided the order book charts, noted that above-expected United States unemployment figures may be a...

Bitcoin holds $20K post-Fed as rising dollar sparks BTC price warning

Bitcoin (BTC) lingered lower on Nov. 3 as the aftermath of the Federal Reserve interest rate hike subsided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trading range forms with $20,000 at center Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $20,000 on the day. The pair had seen flash volatility as the Fed hiked 0.75%, fakeout moves up and down triggering liquidations both long and short. Cross-crypto liquidations for the 24 hours to the time of writing totaled $165 million, data from Coinglass confirmed. Bitcoin ultimately finished slightly lower than its pre-Fed level, an area which continued to hold on the day as analysts awaited fresh cues. For popular Twitter trader Crypto Tony, there was little need to adjust an existing forecas...

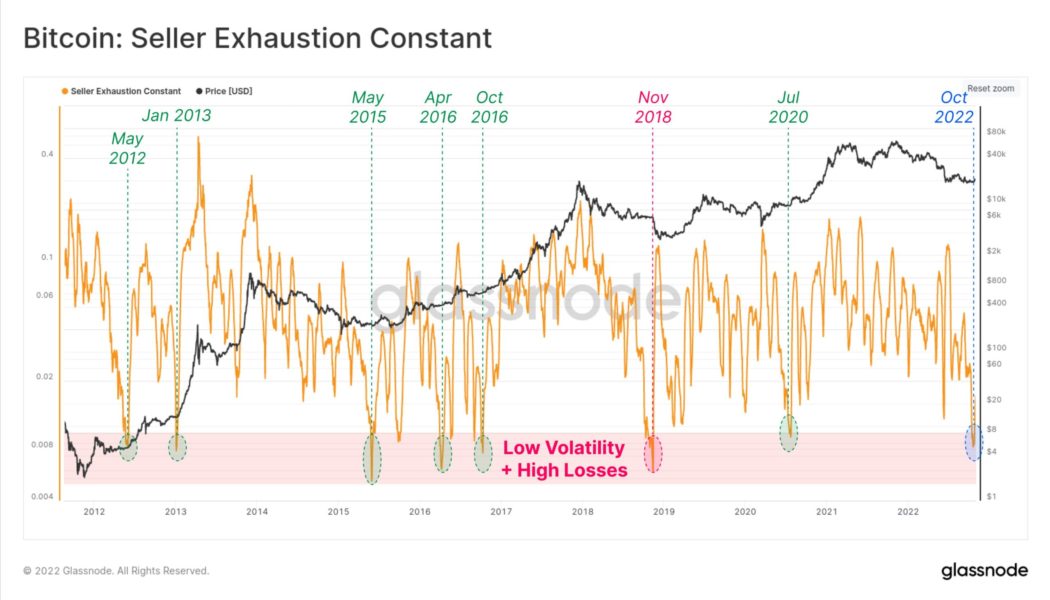

Bitcoin seller exhaustion hits 4-year low in ‘typical’ bear market move

Bitcoin (BTC) sellers may not have capitulated enough, but current trends are “typical” of the end of bear markets. According to data from on-chain analytics firm Glassnode, seller behavior suggests that a macro price bottom is forming. Analyst: Seller exhaustion “near” bear market lows In the latest hint that Bitcoin’s latest bear market is nearing its end, Glassnode has revealed that the network is currently weathering a “perfect storm” of low volatility and high on-chain losses. The Seller Exhaustion Constant, calculated from one-month rolling volatility and on-chain transaction profitability, is thus at long-term lows of its own. As a Twitter post explains, such lows are rare, having only appeared seven times before. Six of those times, upside volatility resulted, implying ...

Bitcoin price hits $20.8K as volatility ensues over Fed 75-point rate hike

Bitcoin (BTC) saw instant volatility on Nov. 2 as the United States Federal Reserve enacted a fourth consecutive 0.75% interest rate hike. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed hints more hikes to com Data from Cointelegraph Markets Pro and TradingView showed BTC/USD initially dropping to $20,200 before momentarily rebounding to $20,800. The Fed confirmed the 0.75% hike, which marks its most intensive hiking schedule in forty years, in a statement. “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3-3/4 to 4 percent,” it stated. “The Committee anticipates that ongoing increases in the target range wil...

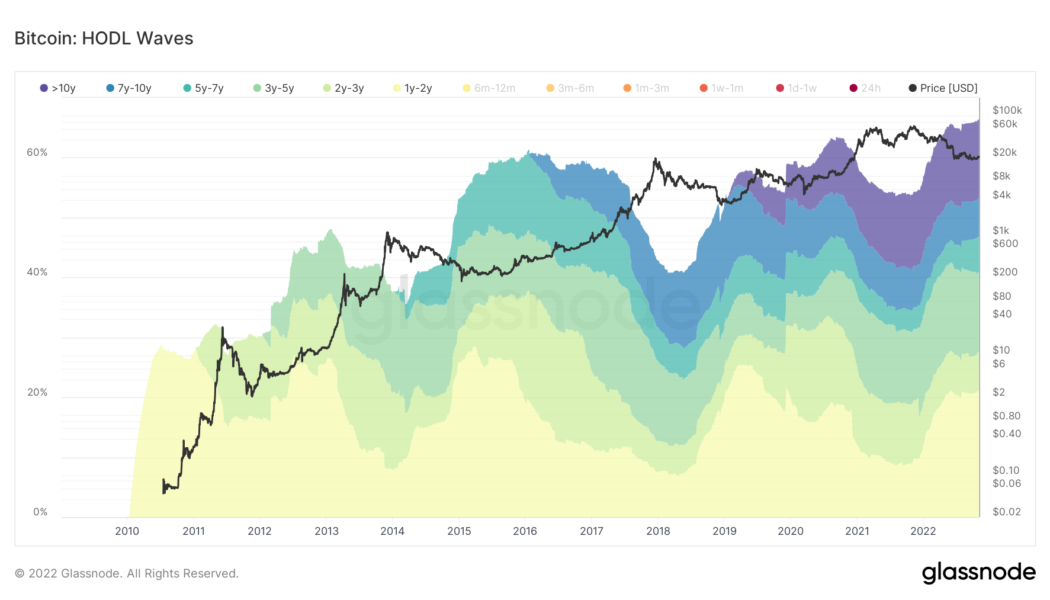

Bitcoin price bottom takes shape as ‘old coins’ hit a record 78% of supply

Bitcoin (BTC) and the rest of the crypto market have been in a bear market for almost a year. The top cryptocurrency has seen its market valuation plummet by more than $900 billion in the said period, with macro fundamentals suggesting more pain ahead. Another bear cycle produces more BTC hodlers But the duration of Bitcoin’s bear market has coincided with a substantial rise in the percentage of BTC’s total supply held by investors for at least six months to one year. Notably, the percentage of coins held for at least a year has risen from nearly 54% on Oct. 28, 2021, to a record high of 66% on Oct. 28, 2022, data shows. Bitcoin hodl waves. Source: Glassnode This evidence suggests that long-term investors are increasingly looking at Bitcoin as a store of value, asserts Charles Edward...

Record hash rates may see Big Oil become a major BTC mining player

Surging Bitcoin (BTC) network hash rates are causing problems for mining companies but might be rolling out the red carpet for energy giants. The Bitcoin hash rate, the amount of computing power given to the blockchain through mining, has reached another record peak. According to Blockchain.com, the metric hit an all-time high of 267 exahashes per second (EH/s) on Nov. 1 after increasing almost 60% since the beginning of the year. Commenting on the new peak, Capriole Fund founder Charles Edwards speculated that highly efficient government and oil company enterprises were entering the mining game at scale. New Bitcoin hash rate world record! 9% higher than the prior all time high set just a few days ago. I have no doubt that we have serious, highly efficient government & oil company ent...

Bitcoin resistance mounts pre-FOMC as Dogecoin sets 17-month BTC high

Bitcoin (BTC) stayed motionless at the Nov. 1 Wall Street open as traders rooted for clues over a possible direction. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopes of a breakout remain despite BTC sell wall Data from Cointelegraph Markets Pro and TradingView showed a narrow range in place for BTC/USD overnight, the day seeing local highs of $20,681 on Bitstamp. Markets were keenly awaiting news from the United States Federal Reserve on interest rates, which is scheduled for 2:00 pm Eastern Time on Nov. 2. Until then, it i a case of “wait and see,” while on-chain monitoring resource Material Indicators noted sell-orders already increasing. “The binance order book is starting to look like a game of Tetris,” it summarized. A chart showed resistance being added just below $...

Ethereum flashes a classic bullish pattern in its Bitcoin pair, hinting at 50% upside

Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023. Ether has a 61% chance of breaking out versus Bitcoin The bullish cues emerge primarily from a classic technical setup dubbed a “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline). Traditional analysts perceive the cup and handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level. The Ether-to...

Bitcoin ‘double bottom’ excites bulls as NVT signal predicts major move

Bitcoin (BTC) is delivering striking similarities to its last bear market, but the recent bottom may be its last, research says. In a tweet on Oct. 31, popular trading account Stockmoney Lizards furthered the bull case for BTC/USD. Bitcoin “repeats itself” in 2022 The past few days have seen talk of Bitcoin encountering a “double top,” with two spikes over $21,000. The implication is bearish: Declining volume suggests that bulls will not be able to flip the level to support, and many expect fresh macro lows to come next. New analysis offers an alternative, more optimistic, perspective. For Stockmoney Lizards, the similarities between 2022 and 2018 are hard to ignore. “Bitcoin repeats itself,” they summarized alongside a comparative BTC/USD chart. That chart compares what happened after Bit...

Why is the crypto market up today?

Bitcoin (BTC) has hit six-week highs and held onto its gains since — is it the start of a trend change? After passing $21,000 twice over the past week, BTC/USD is still lingering near the top of its multimonth trading range. The coming week promises to provide a fresh dose of volatility thanks to the United States Federal Reserve commenting on interest rates and the economic outlook. The key date is Nov. 2, which will see: Decision on key rate hikes Comments and economic projections Speech from Fed Chair Jerome Powell While opinions are mixed as to whether Bitcoin can stand the heat, the market has been caught in disbelief — liquidations in recent days made records for 2022. Should further upside ensue, traders may have to reassess their take on Bitcoin’s weakness in what many thought woul...