Bitcoin

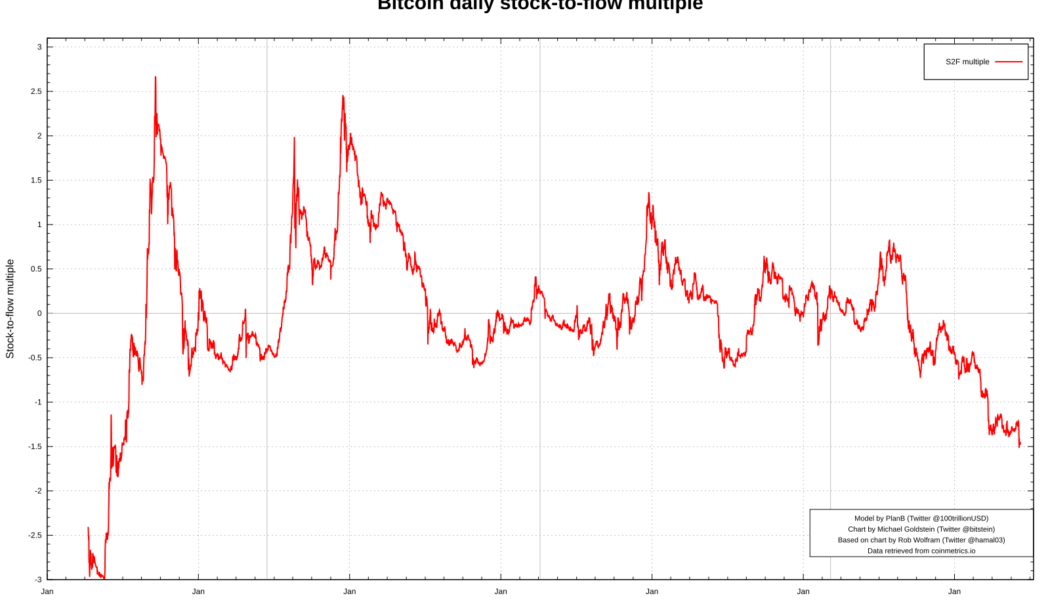

Bitcoin sees record Stock-to-Flow miss — BTC price model creator brushes off FTX ‘blip’

Bitcoin (BTC) is now further than ever from its target price according to the Stock-to-Flow (S2F) model. The latest data shows that BTC/USD has deviated from planned price growth to an extent never seen before. Stock-to-Flow sets grim new record With BTC price suppression ongoing in light of the FTX scandal, an already bearish trend has only strengthened. This has implications for many core aspects of the Bitcoin network, notably miners, but some of its best-known metrics are also feeling the heat. Among them is S2F, which is seeing its price forecasts come under increasing strain — and criticism. Enjoying great popularity until Bitcoin’s last all-time high in November 2021, the model uses block subsidy halving events as the central element in plotting exponential price growth through the ...

Grayscale cites security concerns for withholding on-chain proof of reserves

Cryptocurrency investment product provider Grayscale Investments has refused to provide on-chain proof of reserves or wallet addresses to show the underlying assets of its digital currency products citing “security concerns.” In a Nov. 18 Twitter thread addressing investor concerns, Grayscale laid out information regarding the security and storage of its crypto holdings and said all crypto underlying its investment products are stored with Coinbase’s custody service, stopping short of revealing the wallet addresses. 6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure. — Grays...

Bitcoin price may still drop 40% after FTX ‘Lehman moment’ — Analysis

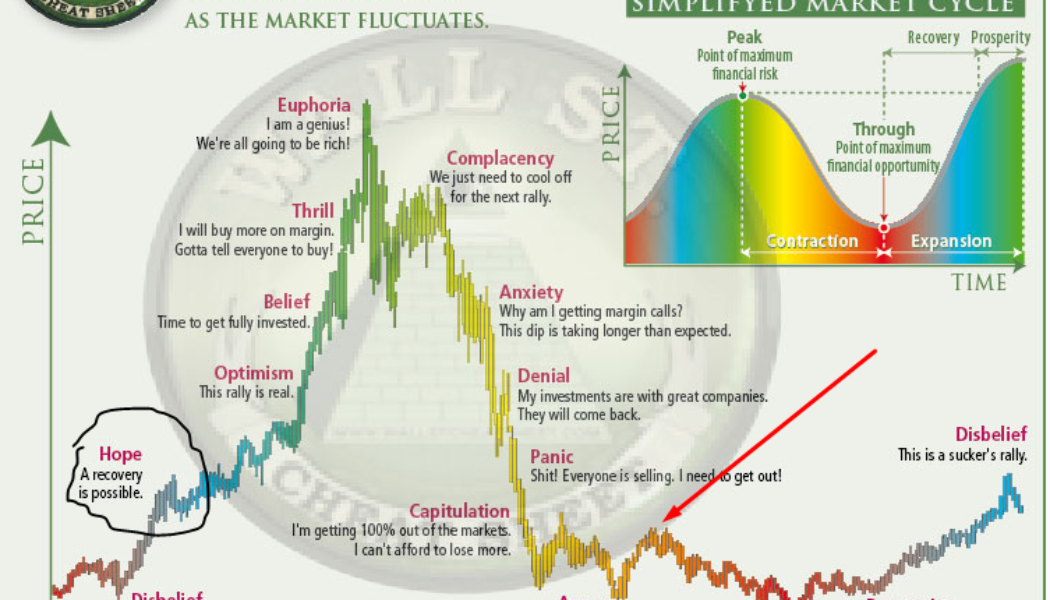

Bitcoin (BTC) saw a fresh rejection at $17,000 on Nov. 18 as nervous markets weathered more FTX fallout. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC gets a $12,000 price target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to flip $17,000 to support — a trend in place for almost a week. The pair, like major altcoins, remained firmly tied down by cold feet over the FTX debacle and its knock-on effects for various crypto businesses. For analysts, the outlook remained just as grim, with already dismal forecasts worsening in light of recent events. “This underperformance of all crypto assets is here to stay until the bulk of uncertainly has cleared up — likely only near the turn of the new year,” trading firm QCP Capital wrote in its latest circ...

3 reasons why the FTX fiasco is bullish for Bitcoin

The “Bitcoin-is-dead” gang is back and at it again. The fall of the FTX cryptocurrency exchange has resurrected these infamous critics that are once again blaming a robbery on the money that was stolen, and not the robber. “We need regulation! Why did the government allow this to happen?” they scream. For instance, Chetan Bhagat, a renowned author from India, wrote a detailed “crypto” obituary, comparing the cryptocurrency sector to communism that promised decentralization but ended up with authoritarianism. Perhaps unsurprisingly, his column conveniently used a melting Bitcoin (BTC) logo as its featured image. Hi all,“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,” my colum...

Bitcoin price target now $13.5K as BTC trader says ‘exit all the markets’

Bitcoin (BTC) ranged around $16,500 on Nov. 17 as markets digested the latest events surrounding exchange FTX. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView FTX CEO tells of “complete failure of corporate controls” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD seeing only mild volatility at the Wall Street open. The pair showed acclimatization to events around the FTX insolvency, the latest including revelations that Alameda Research had been immune from liquidation while trading on the platform. After the departure of Sam Bankman-Fried, new CEO John Ray III wasted no time in acknowledging the extent of the problems left in his wake. In a filing with the U.S. Bankruptcy Court for the District of Delaware, Ray describes the corporate control of FTX as a “c...

US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in one week

Bitcoin (BTC) has flooded out of exchanges in the past week as users become wary of security and regulatory scrutiny. Data from on-chain monitoring resource Coinglass shows United States exchanges in particular seeing heavy BTC balance reductions. U.S. exchanges lead BTC exodus In the wake of the FTX scandal, efforts to draw attention to the risk involved in custodial BTC storage stepped up on social media. Users appeared to heed the warning, withdrawing over $3 billion in cryptocurrency in the week immediately following the solvency debacle and ordering record numbers of hardware wallets. The aftermath of FTX is only just beginning, meanwhile, and as regulators plan investigative action and more attention to crypto as a whole, investors angst continues to grow. The data shows the trend is...

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

Bitcoin miners send less BTC to exchanges since 2020 halving despite FTX

Bitcoin (BTC) miners may be sending more BTC to exchanges this month — but overall, their sales have crashed since 2020. Data from on-chain analytics platform CryptoQuant confirms that daily miner transfers to exchanges have decreased by two thirds or more. Miners cool BTC exchange sales after FTX spike After BTC/USD lost 25% in days last week, existing concerns over miner solvency have heightened. Given their cost basis and rising hash rate, commentators warned that many mining participants may not be able to make ends meet — block subsidies and fees would not be enough to cancel out expenses, chiefly electricity. Network fundamentals, however, tell a curious story — hash rate continues to circle all-time highs and not fall significantly, indicating that at least certain miners are mainta...

SEC pushes deadline to decide on ARK 21Shares spot Bitcoin ETF to January 2023

The United States Securities and Exchange Commission, or SEC, has extended its window to decide on whether shares of ARK 21Shares’ Bitcoin exchange-traded fund could be listed on the Chicago Board Options Exchange BZX Exchange. In a Nov. 15 announcement, the SEC issued a notice for a longer designation period for the application of ARK 21Shares’ Bitcoin (BTC) ETF, originally filed with federal regulator on May 13. The SEC twice extended its window to approve or disapprove of the crypto investment vehicle in July with an extension and in August with a comment period. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and...

What are crypto whale trackers and how do they work?

There are dedicated solutions to track the actions of crypto whales. These solutions can provide analytics on whale actions and, in some instances, can also make investment/trading decisions for the user. Crypto traders and investors constantly track the amount of cryptocurrencies going in and out of exchanges. When a cryptocurrency like Bitcoin or Ether (ETH) is moved in large quantities into an exchange, it is expected to see some sell action resulting in a fall in price. Conversely, if cryptocurrencies flow out of exchanges into wallets, it is considered a precursor to a rise in price. This is because when exchanges have a high net outflow of cryptocurrencies, they have reduced supply resulting in an increase in price. Oftentimes, a whale could buy cryptocurrencies on an exchange and mo...

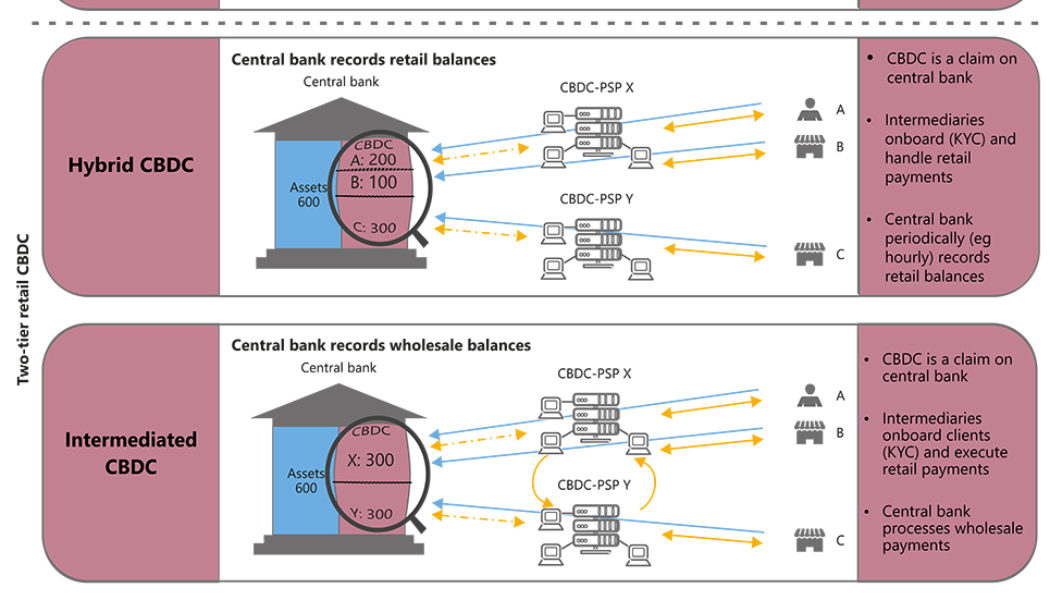

Buying Bitcoin ‘will quickly vanish’ when CBDCs launch — Arthur Hayes

Bitcoin (BTC) holders looking to avoid Central Bank Digital Currencies (CBDCs) may have gained a surprise ally — banks. In his latest blog post, “Pure Evil,” Arthur Hayes, ex-CEO of crypto derivatives platform BitMEX, argued that banks may limit the impact of the CBDC “horror story.” Hayes: Bitcoiners and banks stand against CBDC “dystopia” CBDCs are currently in various stages of development worldwide. Fans of financial sovereignty naturally fear and even despise them, as they imply total government control over everyone’s money and purchasing power — “a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves,” says Hayes. Among opponents of CBDCs are not only Bitcoiners, however. Sharing the cause will likely be the commercial banks ...