Bitcoin

Bitcoin bears lack ‘balls’ to continue selling into 2022 — analyst

Bitcoin (BTC) bears will probably be too “stoneless” to keep prices down much longer, fresh BTC price analysis argues. In a Twitter series published Dec. 18, popular account Light summarized the events which led to Bitcoin’s recent 39% correction. Sheep in bear’s clothing A combination of macro factors and smart action from big players left retail investors holding the bags in both Bitcoin and altcoins, Light explained. This was apparent before the comedown from $69,000 accelerated into December’s liquidation cascade — smart money knew that such levels were unsustainable, and reacted accordingly. “25% of derivatives OI was closed or liquidated. Billions upon billions lost. If people were cautious before, they were now properly risk averse,” the acc...

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...

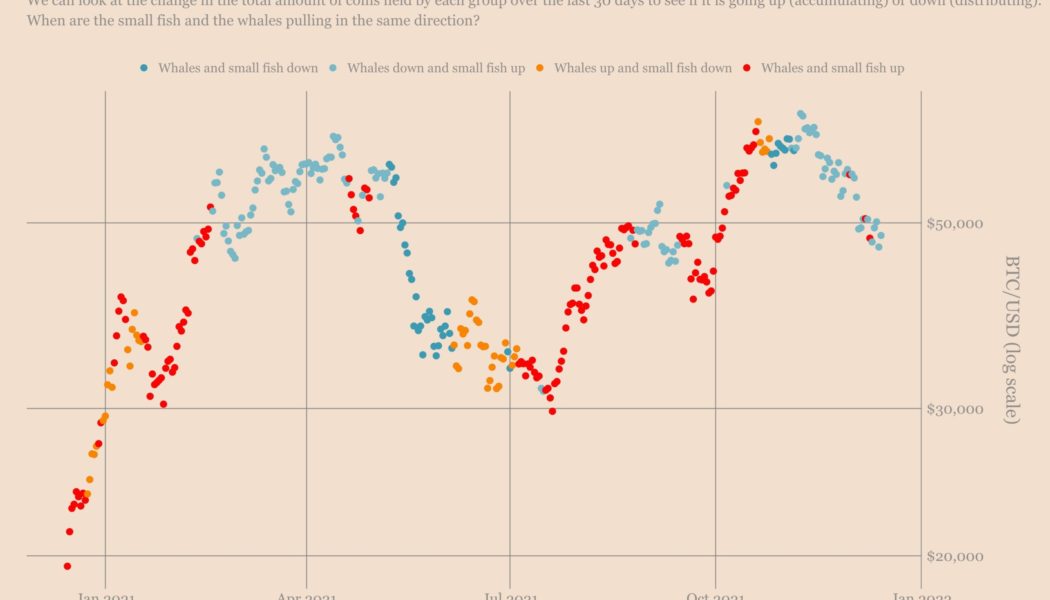

Retail investors are buying Bitcoin while whales are selling says Ecoinometrics

As Bitcoin (BTC) price struggles to retake $50K, the number of Bitcoin addresses holding less than 1BTC has been increasing. Since hitting an all-time high above $69K, Bitcoin has seen a drastic drop that has sent it struggling below $50,000. On December 4, BTC dropped to its three-month low of $42,333 rising fears that the coin could drop below $40K. Addresses with less than 1BTC responsible for the current BTC price Data obtained by crypto-focused newsletter Ecoinometrics after evaluating the change in Bitcoin amounts across small and rich wallet groups shows that the bounce back from $42K to the current price is being attributed to the increased buying activity among the addresses holding less than 1BTC. The addresses holding 1000BTC to 10,000BTC are said to have done very little in sup...

Valkyrie’s latest ETF offering has exposure to Bitcoin

Crypto asset manager Valkyrie has launched an exchange-traded fund with exposure to Bitcoin on the Nasdaq Stock Market. In a Wednesday SEC filing, Valkyrie said its Balance Sheet Opportunities ETF will not invest directly in Bitcoin (BTC) but 80% of its net assets would offer exposure to the crypto asset through securities of U.S. companies with BTC on their balance sheets. These companies may include custodians, crypto exchanges, and traders. The filing specifies that Valkyrie’s ETF may invest up to 10% of its net assets in securities of Bitcoin mining firms, as well as up to 5% in the securities of pooled investment vehicles in the U.S. that hold BTC. At the time of publication, shares of the fund under the ticker VBB are trading for $24.48, having fallen more than 1.5% since launch...

Happy ‘bearday,’ Bitcoin: It’s been 3 years since BTC bottomed at $3.1K

Bitcoin (BTC) may be flagging below $50,000, but its bull market is actually three years old this month. Data from Cointelegraph Markets Pro and TradingView confirms that Bitcoin bulls have at least something to celebrate as 2021 draws to a close. Three years, 2,125% upside Despite disappointing when it comes to end-of-year price expectations, BTC/USD remains an order of magnitude higher than where it was even 18 months ago. March 2020 marked a brief return to near cycle lows in what had otherwise been a solid bull market ever since December 2018. At that time, Bitcoin capitulated to lows of $3,100 — a level that was never seen, and likely never will be seen again. SAME DAY THREE YEARS AGO #Bitcoin BOTTOMED OUT THE BEAR MARKET OF 2018 — CRYPTO₿IRB (@crypto_birb) December 15, 202...

Fish food? Data shows retail investors are buying Bitcoin, whales are selling

Bitcoin (BTC) staged an impressive recovery after dropping to its three-month low of $42,333 on Dec. 4, rising to as high as $51,000 since. The BTC price retracement primarily surfaced due to increased buying activity among addresses that hold less than 1 BTC. In contrast, the Bitcoin wallets with balances between 1,000 BTC and 10,000 BTC did little in supporting the upside move, data collected by Ecoinometrics showed. “Bitcoin is still stuck in a situation where small addresses are willing to stack sats [the smallest unit account of Bitcoin], while the whale addresses aren’t really accumulating,” the crypto-focused newsletter noted after assessing the change in Bitcoin amounts across small and rich wallet groups, as shown in the graph below. Bitcoin on-chain ...

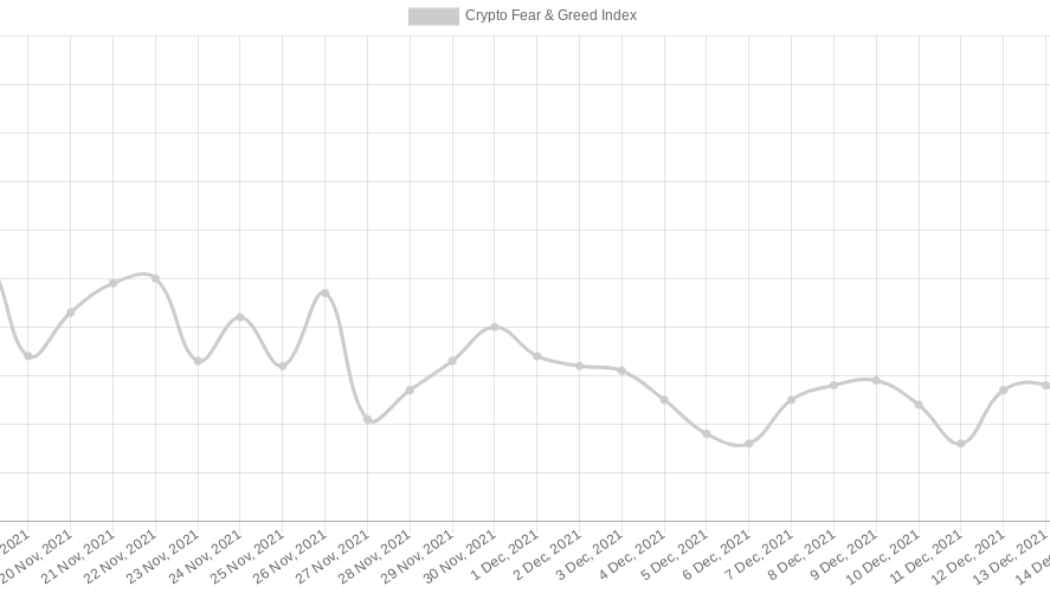

Analyst lists 21 factors calling for Bitcoin price upside — But just 4 bearish signals

Bitcoin (BTC) traders may be experiencing some “extreme panic,” but one analyst argues that practically all the technical metrics point to price upside. Speaking to Cointelegraph on Dec. 16, filbfilb, co-founder of trading platform Decentrader, listed more than 20 signs that bullish momentum should be next for Bitcoin. “Enough there” for Bitcoin upside breakout BTC/USD gained with equities late Wednesday thanks to comments on policy from the United States Federal Reserve. Reaching $49,300, the pair then began to consolidate below the $49,000 mark, a point at which it remains at the time of writing. Crypto Fear & Greed Index. Source: Alternative.me Sentiment, however, has yet to show any faith in the short-term future of BTC price action, with the Crypto Fear &am...

Only a paper moon: Bitcoin price briefly shows $870B on CoinMarketCap

Crypto traders experienced a moment of joy, followed by confusion, when a glitch caused several data aggregators to briefly display enormous gains for Bitcoin (BTC), Ether (ETH) and other cryptocurrencies. CoinMarketCap and several other price indexes showed Bitcoin’s price closing to $900 billion as ETH showed over $81 billion. The momentary glitch also impacted Cointelegraph’s price indexes. Hey @CoinMarketCap, you doing ok there buddy? pic.twitter.com/WfXwpSmURU — Cointelegraph (@Cointelegraph) December 14, 2021 Displayed numbers didn’t affect the trading prices on exchanges, and the platforms quickly solved the issue. CoinMarketCap explained on Twitter that the data provider is rebooting its servers as part of the remediation plan. “CoinMarketCap is now back to normal after an issue th...

Block, formerly Square, will allow users to gift BTC for the holidays using Cash App

Digital payments company Block, formerly called Square, has announced that Cash App users will be able to gift friends and family both crypto and stock over the holiday season. According to a Tuesday tweet, Cash App said its users — roughly 40 million active monthly — could send as little as $1 in Bitcoin (BTC) or stock as a gift in the same way they had been sending cash. The payments firm joins others including PayPal and Coinbase in allowing users to send crypto as payments or gifts to third parties. With Cash App, you can now send as little as $1 in stock or bitcoin. It’s as easy as sending cash, and you don’t need to own stock or bitcoin to gift it. So this holiday season, forget the scented candles or novelty beach towel, and help your cousin start investing. pic.twitter.com/HS...

Cardano’s ADA price eyes 30% rally with a potential ‘triple bottom’ setup

Cardano (ADA) may rally by nearly 30% in the coming days as it forms a classic bullish reversal pattern. Sharp ADA rebound underway Dubbed “triple bottom,” the pattern typically occurs at the end of a downtrend and consists of three consecutive lows printed roughly atop the same level. This means triple bottoms indicate sellers’ inability to break below a specific support level on three back-to-back attempts, which ultimately paves the way for buyers to take over. In a perfect scenario, the return of buyers to the market allows the instrument to retrace sharply toward a higher level, called the “neckline,” that connects the highs of the previous two rebounds. The move follows up with another breakout, this time taking the price higher by as much as the distance between the pattern’s bottom...

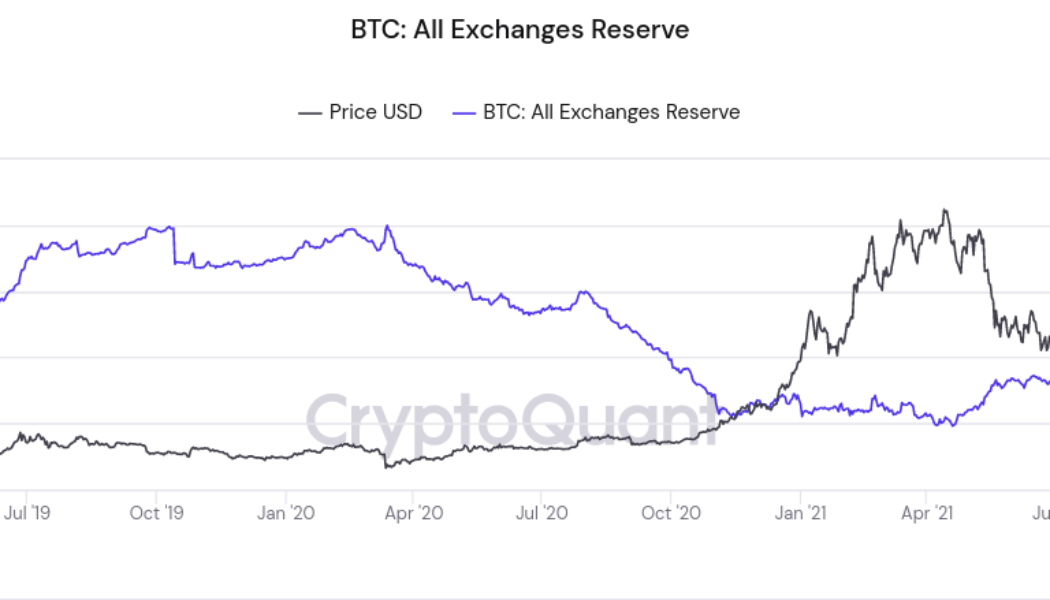

‘Monster bull move’ means whales could secure the next Bitcoin price surge

Bitcoin (BTC) whales are the center of attention this week as buying and selling habits split the BTC price narrative. New findings from on-chain analytics firm CryptoQuant show derivatives investors leading the way when it comes to bullish bets on Bitcoin. “Sick” BTC price indicator favors bulls The second half of November produced a marked uptick in the buy/sell ratio on major derivatives trading platform Deribit, and for contributing analyst Cole Garner, this is a sure sign that price action will react positively in the near term. “I recently discovered the ratio of market buys & sells of perpetuals on Deribit Exchange is a sick leading indicator,” he commented. “This is a 30 day WMA. Strong bullish trends in the metric have preceded every strong bullish price trend of this bull. An...

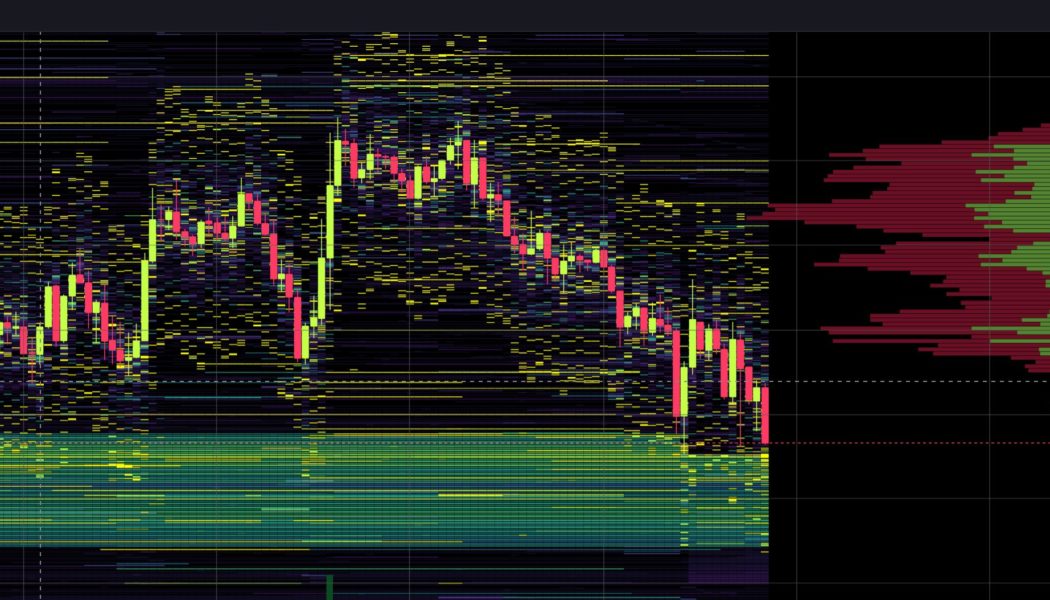

Bitcoin loses $48K on Wall Street open as trader warns altcoins look ‘REKT’ against BTC

Bitcoin (BTC) declined into the Wall Street open on Dec. 13 as stocks came off Friday’s record close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD diving below $48,000 to reach multi-day lows at the time of writing. Equities had been tipped to add to all-time highs prior to the start of trading, this getting off to a cold start on the day with gains slipping. Correspondingly, Bitcoin added to losses which totaled over $3,000 in 24 hours. Traders thus continued to eye sideways or consolidatory movements for the near term, steering clear of any outright bullish calls. “Something like this would drive people nuts,” Scott Melker, known as the Wolf of all Streets, commented on a fresh chart ...