Bitcoin

Price analysis 12/22: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

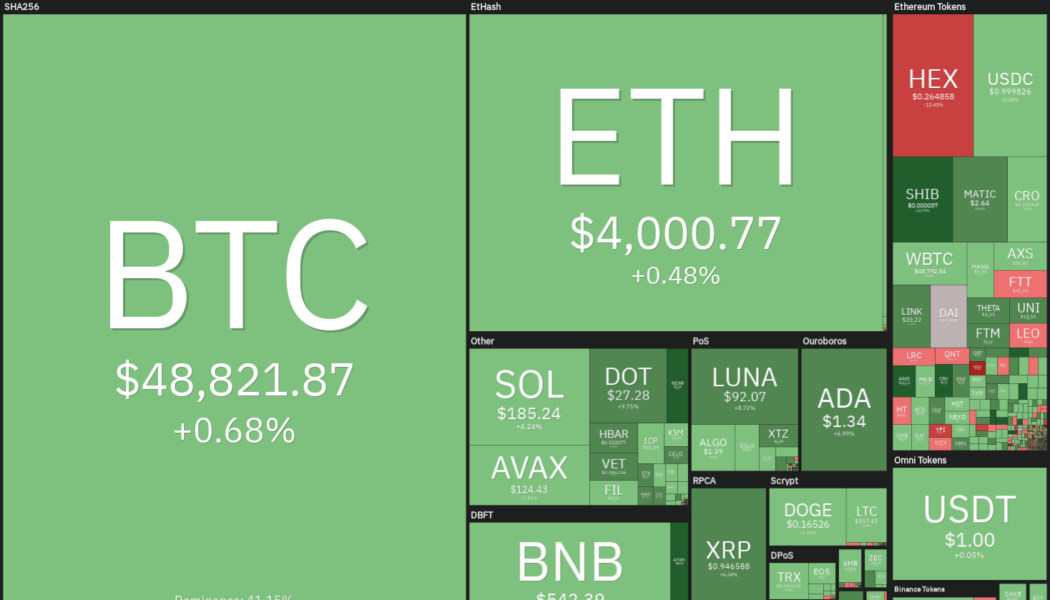

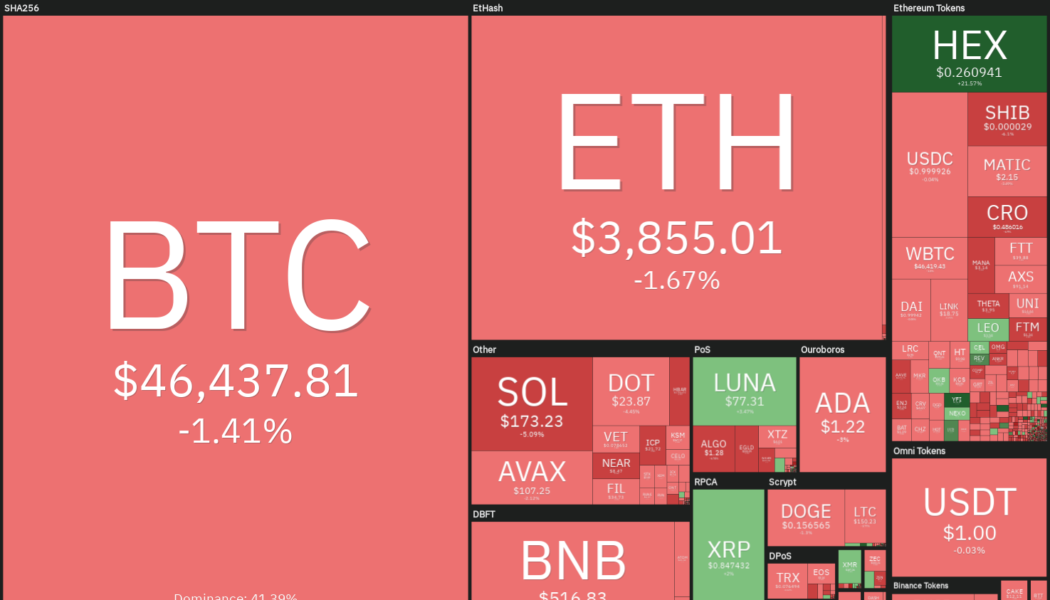

Bitcoin (BTC) is attempting to break above the psychologically critical level at $50,000 and close the year on a strong note. The up-move in Bitcoin has led to a sharp recovery in the value of the Crypto Fear & Greed Index from 27 to 45 within a day, signaling improving sentiment. BlockFi co-founder Flori Marquez said in a recent interview that new talent, regulatory clarity and higher crypto prices could lead to a feeling of FOMO, boosting crypto adoption in 2022. Marquez added that the “majority of Blockfi’s clients—when they receive a BTC reward, they’re not selling that for cash.” Daily cryptocurrency market performance. Source: Coin360 In another positive news that could boost crypto adoption further, popular internet browser Opera announced an integration with Polygon (MATIC), ex...

Bitcoin nears $50K — Here are the BTC price levels to watch next

Bitcoin (BTC) neared $50,000 on Dec. 22 as hopes began to appear that the price correction could be over. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Get bullish once $50,500 breaks — Analyst Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hit highs of $49,600 on Bitstamp — its highest since Dec. 13. A cross-crypto boost from turmoil in the Turkish lira Monday lingered in spirit as Bitcoin and altcoins stayed higher, with attention now focusing on the new year and price levels above $50,000. “The first breakthrough has happened on Bitcoin. But, we still need to break enough levels to state that we’re bullish,” Cointelegraph contributor Michaël van de Poppe declared overnight. “Overall, a breakthrough at $50.5-51.5K and I’m convinced. Also, 2022...

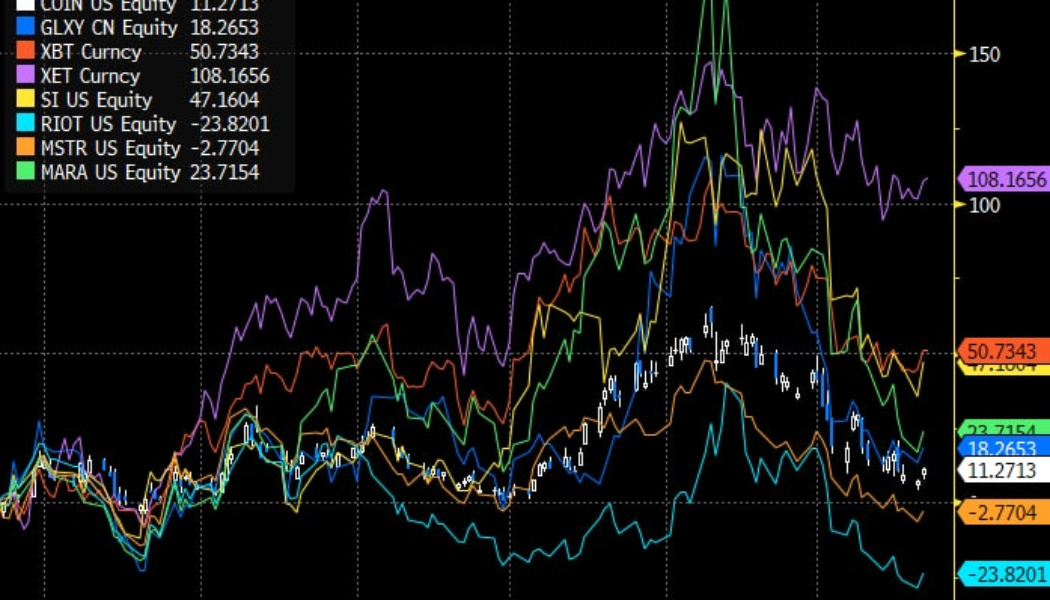

Missed out on hot crypto stocks in 2021? It paid just to buy Bitcoin and Ethereum, data shows

Bitcoin (BTC) may have fluctuated in price this year, but BTC remains a better play than the biggest crypto stocks. New data currently circulating shows that for all the growth in the industry surrounding Bitcoin, it still pays simply to buy and hold. Stocks fail to compete with BTC, ETH Looking at the stock performance of firms with the largest BTC allocations on their balance sheets, it becomes immediately apparent that it was more profitable to hold BTC than those equities — at least this year. “Buying crypto stocks to outperform coins is hard,” Three Arrows Capital CEO Zhu Su commented alongside comparative performance data from Bloomberg. Both Bitcoin and Ether (ETH) have fared significantly better than stocks from companies, such as MicroStrategy (MSTR) and Coinbase (COIN), despite t...

‘You don’t own Web 3.0,’ says Jack Dorsey, criticizing its centralized nature

In a series of tweets posted on Tuesday, Jack Dorsey, the co-founder and former CEO of Twitter, as well as the founder and CEO of Square (now Block), voiced his criticism over the direction of Web 3.0 development. Elon Musk, the CEO of Tesla, joined Dorsey in the mockery. On an unrelated note, the same day, Dorsey replied, “Bitcoin will” when asked if crypto will replace the dollar. Within context, Web 3.0 is a decentralized version of the virtual world that will, in part, feature public blockchains, metaverse technology, nonfungible tokens and decentralized finance free from the grasp of centralized power sources, such as corporate servers. You don’t own “web3.” The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity wit...

Indian parliament’s agenda for winter session no longer includes crypto bill

The Indian government may still be considering a bill that could ban certain cryptocurrencies in the country, but lawmakers are unlikely to vote on any legislation in the current parliamentary session. According to a Friday publication, India’s lower house of parliament, Lok Sabha, will likely not be looking at a bill proposing the prohibition of “all private cryptocurrencies” before its winter session ends on Thursday. The Cryptocurrency and Regulation of Official Digital Currency Bill does not appear as one of the seven bills on the government body’s agenda over the last days of its 2021 session. A Nov. 23 bulletin for the Lok Sabha stated that Indian lawmakers could vote on legislation that creates “a facilitative framework for creation of the official digital currency” issued by ...

Price analysis 12/20: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) continues to lose ground in December, a signal that traders may be locking in their gains before the end of the year. The lack of a Santa rally in the U.S. equity markets indicates that the risk-off sentiment prevails due to the uncertainty regarding the spread of the COVID-19 omicron variant in several parts of the world. Even after the sharp drop in Bitcoin’s price, the demand from institutional investors remains tepid, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), is trading at a discount of more than 20%. Daily cryptocurrency market performance. Source: Coin360 Veteran trader Peter Brandt said that “high volume panic capitulations” usually signal a bottom in Bitcoin and that has not yet happened during the current decli...

IGP Orders investigation into alleged Extortion of N22 Million Worth of Bitcoin by Police in Lagos

Facebook WhatsApp Reddit Twitter Shares IGP ORDERS INVESTIGATIONS INTO ALLEGED EXTORTION OF 22 MILLION NAIRA WORTH OF BITCOIN Assures discreet and transparent investigationsThe Nigeria Police Force has commenced investigations into the alleged professional misconduct, abuse of office and extortion of Twenty-Two Million Naira worth of Bitcoin from some citizens in Lagos State, levelled against a Deputy Superintendent of Police, Nwawe Cordelia and others, serving at the Force Criminal Investigations Department (FCID), Alagbon, Lagos. This follows the setting up of a Special Investigation Panel by the Inspector General of Police, IGP Usman Alkali Baba, psc (+), NPM, fdc to carryout a discreet and transparent investigation into the allegation. This development has become imperative following t...

Biggest GBTC discount ever — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with analysts looking for a bottom — but one which may not mean a dip to $40,000 or lower. After an unremarkable weekend, Bitcoin bulls now face a fresh week of bearish sentiment across the global economy as risk appetite stays tepid. Amid the lack of a “Santa rally” for practically anyone, there seem to be few triggers to help BTC/USD return higher in time for the new year. At the same time, on-chain metrics remain strong, and miners are refusing to spend. With Christmas almost here, Cointelegraph takes a look at what to look out for this week when it comes to assessing where Bitcoin may be headed. $50,000 seems far away for Bitcoin bulls Bitcoin failed to produce any significant moves over the weekend, but now, attention is turning to a potenti...

Crypto mainstream adoption: Is it here already? Experts Answer, Part 1

Sameep is the founder of QuickSwap, a decentralized exchange on Polygon that allows users to swap, earn, stack yields, lend, borrow and leverage all on one decentralized, community-driven platform. “Just compare the overall market caps from the beginning of 2021 until today to illustrate how much crypto has grown this year. According to CoinMarketCap, on Jan. 1, crypto’s market cap was about $773 billion. Now it’s over $2.3 trillion. Despite the dollar’s rapid inflation, to me, annual growth of more than $1.5 trillion definitely suggests that mass adoption has begun, but there’s still a lot of room for crypto to continue to grow. To enable that growth, more people need to learn about the alternatives to expensive layer-o...

Bitcoin tests yearly moving average as $100K by Christmas needs ‘small miracle’

Bitcoin (BTC) prepared a showdown with a key moving average (MA) price trend on Dec. 19 with time running out for a strong 2021 close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “I vote we bounce and stay bull” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading at $47,000 Sunday, still firmly in an established range. That price is currently the location of Bitcoin’s one-year MA trendline, an important historical line in the sand that has enabled considerable upside if BTC/USD preserves it as support. “The 1yr MA is a pretty important bitcoin bull/bear pivot level historically and we are sat right on it now,” Philip Swift, creator of on-chain data resource Look Into Bitcoin, commented. “I vote we bounce and st...

Tom Lee reiterates his bullish stance on the global stock market and prediction of BTC hitting $100K

The Fundstrat Global Advisors co-founder and head of research Tom Lee have maintained his bullish outlook about the crypto market and his Bitcoin prediction of hitting $100K. The Wall Street strategist affirmed that the global market was in an “everything rally” and the value of investment vehicles is expected to rise because of favorable economic conditions. Lee had predicted that Bitcoin would reach $100K before the year-end. And while speaking to CNBC this week, he reiterated his prediction was still intact besides his outlook for the stock markets. Global Stock market Lee cited the Federal Reserve Bank approach as the bullish driver for the global stock market. According to the analyst, FED’s confirmation that the interest rates would remain unchanged despite the risk that the COVID-19...

Bears pull Bitcoin’s end of year expectations down from $100K to $50K

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for d...