Bitcoin

7 NFL players that chose crypto over cash salaries

For NFL fans, 2021 was a great year. Stadiums returned to capacity crowds after the 2020 season was shortened with limited attendance. Stadium parking lots were again filled with the enthusiastic anticipation of tailgaters and their barbequed camaraderie. It was also a great year for Bitcoin (BTC) investors as the largest cryptocurrency by market capitalization reached all-time high prices multiple times throughout 2021, eventually topping out at $69,000 in early November. This led to a dramatic increase in media coverage of Bitcoin. Seven NFL players in 2021 decided to call the audible and begin either being paid in crypto or having their cash salary partially converted to crypto. These players have capitalized on the return of the regular season and the increased profitability of B...

Bitcoin slips under $50K amid warning ‘new player’ Binance whale is pressuring BTC price

Bitcoin (BTC) lost $50,000 for the first time in several days on Dec. 26 as exchange inflows caught up with the cautiously optimistic mood. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “New player” beefs up $50,000 sell wall Data from Cointelegraph Markets Pro and TradingView showed volatility hitting BTC/USD overnight on Saturday. The pair had reached $51,500 before starting to retrace, this culminating in a dip to $49,644. At the time of writing, Bitcoin was back circling $50,000. The move came in tandem with a rise in inflows to major exchange Binance, with order book data showing a new wall of resistance being built at $50,000. Binance order book heatmap chart. Source: Material Indicators The behavior points to a large-volume investor shaping market bias...

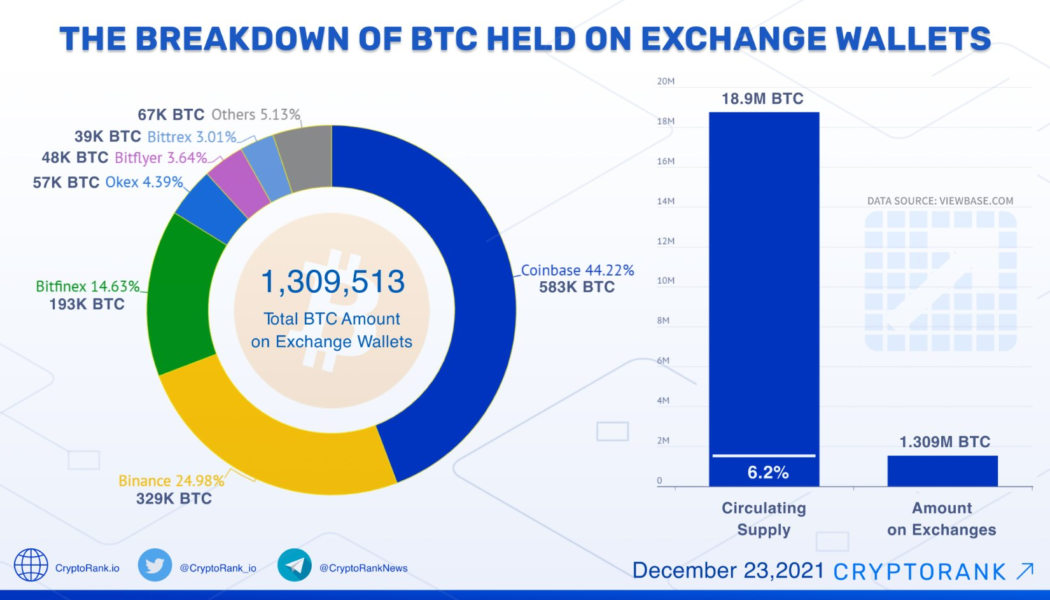

Just 1.3 million Bitcoin left circulating on crypto exchanges

In glad tidings for an orange Christmas, Bitcoin (BTC) supply is drying up to lows not seen for years. In a recent tweet by CryptoRank, just 6.3% of the total Bitcoin supply, or 1.3 million BTC, is held on cryptocurrency exchanges. The decreasing supply is nothing new, trending down since the Bitcoin halving in 2020 when the BTC block reward was cut in two. BTC availability on exchanges followed suit, slowly trending down over the past year. Exchange wallets accounted for 9.5% of the BTC supply in October 2020, just before the 2020 Christmas all-time highs, and 7.3% in July this year. The 6.3% December figure is the lowest recorded in 2021. Interestingly, Coinbase’s BTC wallet dominance is also slipping. The American exchange used to custody more BTC than all other exchanges combined...

Industry experts reveal a possible method for Bank of Russia to block crypto

Amid the ongoing uncertainty about the future of cryptocurrencies in Russia, one local industry executive has disclosed a potential method for the Bank of Russia to block crypto transactions. Andrey Mikhaylishin, CEO of the local crypto payment startup Joys, said that the Russian central bank is now considering several potential options to make its crypto ban possible, Forbes Russia reported Friday. One of the possible restriction methods includes blocking debit card payments to crypto exchanges or wallets using merchant category codes (MCC), Mikhaylishin said. The report notes that the executive became aware of this blocking method from Bank of Russia employees. MCC codes are four-digit numbers used by credit card processors such as Visa or Mastercard to describe a merchant’s primary...

Bitcoin ‘Santa rally’ pauses at $51.5K as funds bet on a sub-$60K BTC price for January 2022

Bitcoin (BTC) lost momentum at $51,500 on Dec. 24 as traders weighed the odds of a “Santa rally” coming true for Christmas. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC sees potent long-term retest Data from Cointelegraph Markets Pro and TradingView saw BTC/USD preserve its gains from Dec. 23, these totaling 6% with resistance most recently kicking in at just above $51,500. Opinions were mixed among weary traders about the strength of the rally and whether it could endure for long. Still in its familiar range despite the overnight uptick, Bitcoin needed to show its muscle on longer timeframes, Cointelegraph reported analysis as saying earlier. For filbfilb, co-founder of trading platform Decentrader, a combination of low funding rates and top ...

Bitcoin battles bears ‘on offense’ as Christmas delivers a $50K BTC gift

Bitcoin (BTC) held $50,000 into Dec. 25 as BTC bulls avoided an unwelcome Christmas Day surprise. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Bears become bulls” short term? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maintaining $50,000 support into the weekend, having ranged after local highs above $51,500. The pair was calm as the holiday season got underway, with thinner liquidity yet to show itself in the form of volatile price moves. With most taking a break from trading and analysis, the nearest target to the upside remained the $1 trillion market cap valuation level at $53,000. For popular trader Pentoshi, a point of friction could come in the form of sellers actively driving down BTC/USD to liquidity at $46,000, only to then...

‘Twas the Night before Christmas: A Cointelegraph Story

‘Twas the night before Christmas, when all thro’ the Twittersphere Not a troll was stirring, not even a financier; The crypto was HODLed in cold storage with care, In hopes that Satoshi would soon reappear; The newbies avoided FUD and slept in their beds, While visions of lambos danc’d in their heads. And Pomp being occupied, and Schiff spewing crap, Weren’t calling attention to traders stacking sats. When in the trends came mentions of Nakamoto, I had to be sure it wasn’t just FOMO. Away to my portfolio my fingers did fly, And checked on the prices — man, were they high! Then, for a moment, I thought I was wrong. But no — a huge bull run, and eight altcoins going along. Who could have done this? Who answered my prayer? I knew in an instant the answer: Michael Saylo...

Price analysis 12/24: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) bounced back above the psychological level at $50,000 and the S&P 500 hit a new all-time closing high on Dec. 23, suggesting that the panic selling caused due to the omicron variant is subsiding and the much-awaited “Santa rally” may have started. Data from on-chain analytics firm Glassnode shows that about 100,000 Bitcoin are going from “liquid” to “illiquid” state every month, which means that the coins are being sent to addresses “with little history of spending.” This suggests accumulation by investors. Daily cryptocurrency market performance. Source: Coin360 In another sign that investors are not dumping their coins on small corrections, data from CryptoRank shows that the total Bitcoin on crypto exchanges has dropped from 9.5% of the total Bitcoin supply in October ...

President Bukele fires back at critics on ‘Bitcoin experiment’

On Thursday, Salvadoran President Nayib Bukele reaffirmed his belief for Bitcoin (BTC) supremacy on Twitter once again, this time stating that after widespread adoption occurs, “it’s game over for fiat.” The Salvadoran president has been a mainstay in news headlines due to his government’s regular BTC purchases and absolute pro-Bitcoin stance. He has made frequent statements and comments to support the original cryptocurrency while refusing to budge in the face of criticism that Bitcoin is a bad idea for the nation. Related: El Salvador buys a smokin’ hot 420 more Bitcoin President Bukele’s recent tweet comes as the international community launches a barrage against El Salvador for its “Bitcoin experiment.” The International Monetary Fund criticized El Salvador’s move t...

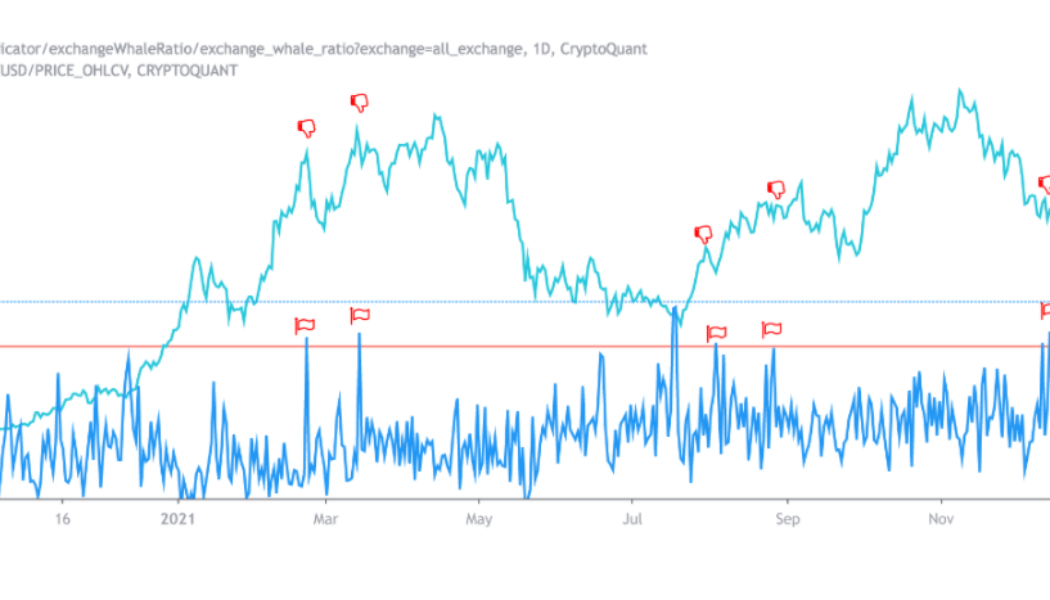

Bitcoin needs to clear $51K to reduce the chance of new sell-off from BTC whales

Bitcoin (BTC) whales are the center of attention again this week as large transactions flow back to exchanges. Data from on-chain analytics platform CryptoQuant on Dec. 24 shows that relatively, whales are increasing their presence as potential sellers. Action stations as Bitcoin climbs to $51,000 According to CryptoQuant’s Exchange Whale Ratio indicator, the proportion of large inflows to exchanges out of total inflows is now at a one-year high. Inflows sped up significantly as BTC/USD rose to $51,000 overnight on Thursday, and the implication could be that large-volume investors plan to take profits at the top end of Bitcoin’s current range. “It is better to watch out until BTC breaks $51k levels,” one CryptoQuant analyst cautioned. “Once we surpass this level next significant resistance...

Retailers to drive crypto payments adoption: Survey

Crypto payments might be the innovation companies are looking for. A recent survey by payment network Mercuryo revealed that 57% of respondents believe accepting cryptocurrency payments would give companies a competitive edge. Among the other standout statistics, more than one-third of businesses reported that customers had asked to pay in Bitcoin (BTC), Ether (ETH) or another digital currency. Hot on the heels of news that Dogecoin (DOGE) will trial for Tesla merchandise payments and WhatsApp began testing payments with Meta’s Novi wallet, the Mercuryo report highlights that retail payment services will continue to be a key crypto adoption driver. The report surveyed 501 senior financial decision-makers in the United Kingdom. Almost half of the sample size consisted of large businesses em...

Bitcoin price flatlines as XRP hits $1 with ‘massive’ altcoin move set for 2022

Bitcoin (BTC) stuck rigidly to its tight range on Dec. 23 as price action continued to contradict strong buying activity. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hodlers busy accumulating Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to hold $49,000 after hitting 10-day highs. The pair remained stuck in a trading zone only around $4,000 wide, a key factor fuelling bets that a “short squeeze” would hit over the holiday period. Against declining volatility, data reinforced conviction among investors, with the supply being bought up at roughly three times the rate of new BTC being mined. “Strong handed HODLers are absorbing supply at more than triple the rate of new coins being mined each day,” on-chain analytics firm Glassnode summarized ...