Bitcoin

Top 5 cryptocurrencies to watch in 2022: BTC, ETH, BNB, AVAX, MATIC

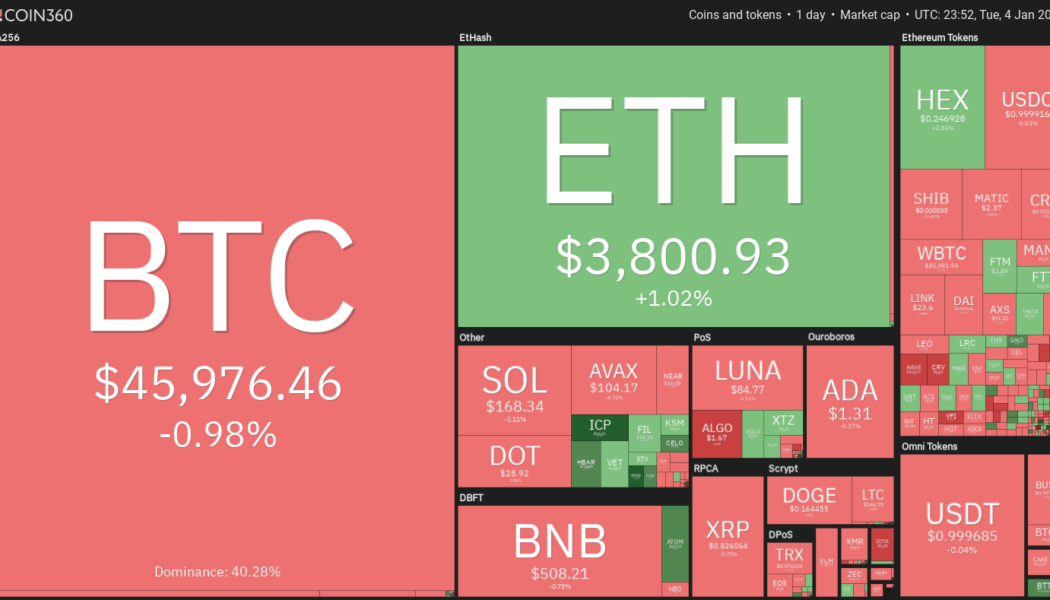

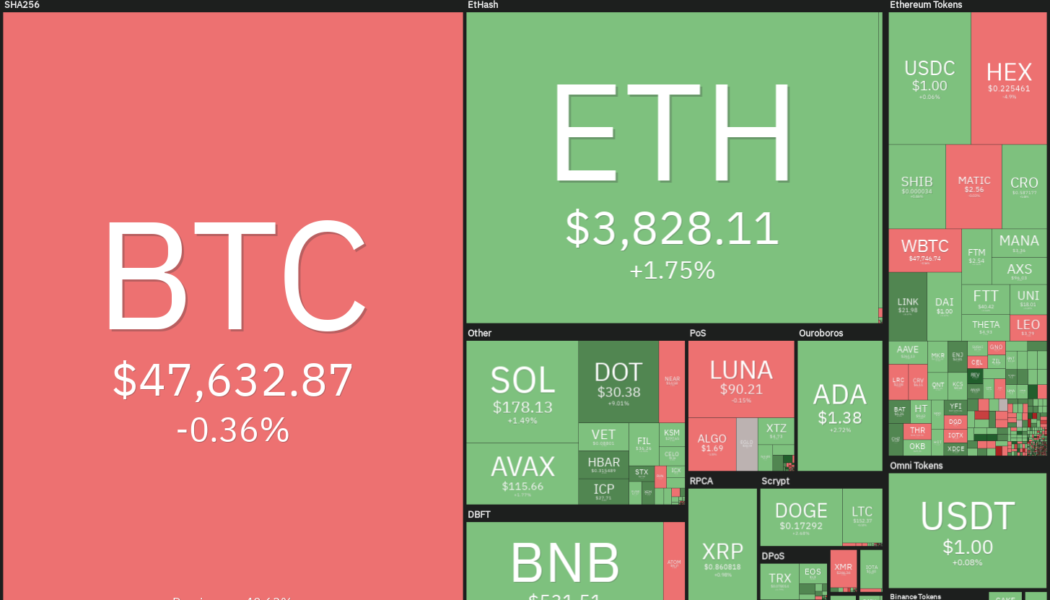

Bitcoin (BTC) witnessed a roller coaster ride in 2021 and even though BTC has corrected sharply from its all-time high at $69,000, the digital asset is still up by 60% year-to-date. During the same period, gold has dropped more than 5%. With inflation soaring in the United States and several other parts of the world, Bitcoin’s outperformance over gold shows that investors may be considering it to be a better hedge against inflation when compared to gold. During the year, the total crypto market capitalization surged to about $3 trillion, but Bitcoin’s dominance fell from about 70% at the start of the year to 40%. This shows that several altcoins have outperformed Bitcoin by a huge margin. Crypto market data daily view. Source: Coin360 As cryptocurrencies gain wider adoption, multiple...

REN price at risk of 50% drop after a bearish trading pattern shows up

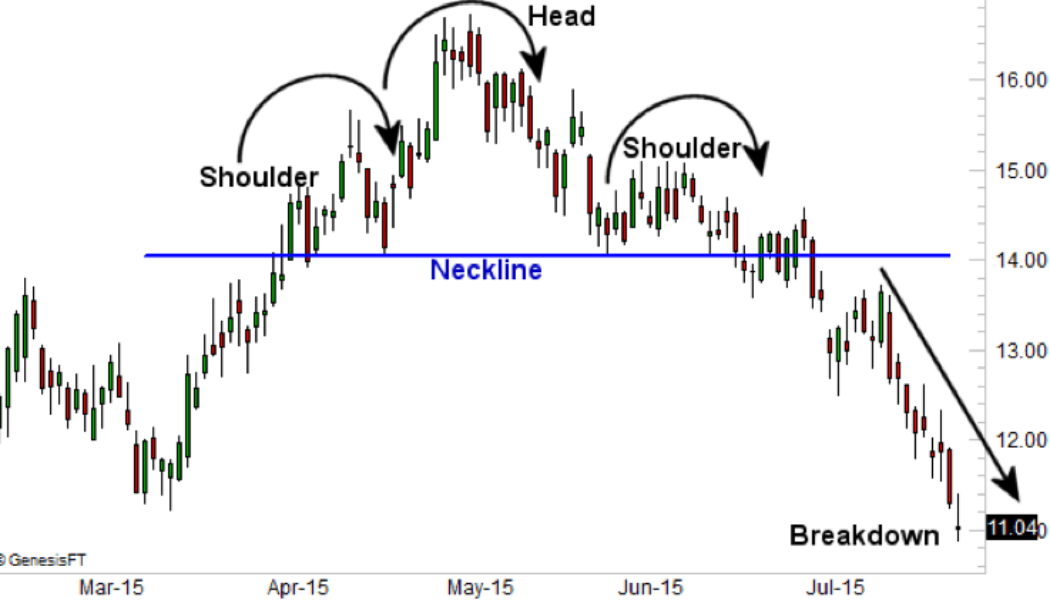

The prospects of Ren (REN) continuing its ongoing rebound to fresh highs appear slim as a classic bearish reversal pattern begins to emerge. Dubbed head and shoulders, the setup appears when the price forms three peaks, with the middle peak (called the head) longer than the other two peaks described as the left and right shoulders. The bottoms of these peaks are supported by a neckline. An illustration of the head and shoulders pattern. Source: Corporate Finance Institute The pattern comes into play primarily when the price breaks below the neckline in a correction that follows the formation of the right shoulder. That prompts traders to open short entries below the neckline, with their ideal target at a length equal to the distance between the head’s high point and the neckline. Wha...

Wait and see approach: 3/4 of Bitcoin supply now illiquid

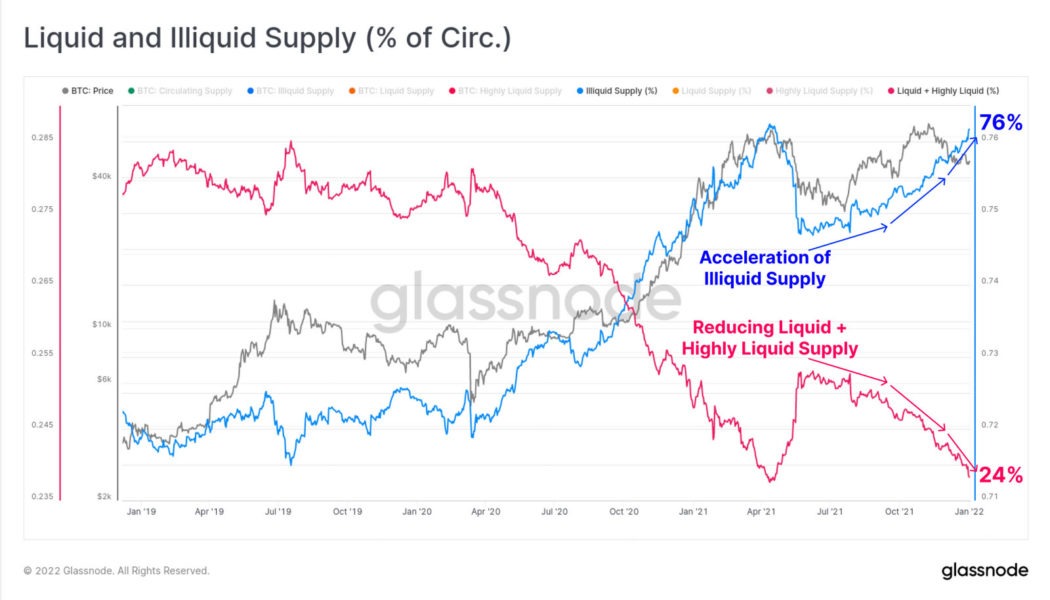

Bitcoin markets have been consolidating since the beginning of the year, but on-chain metrics are painting a more positive picture as more of the asset is becoming illiquid. On-chain analytics provider Glassnode has been delving into Bitcoin supply metrics to get a better view of the longer-term macro trends in its weekly report on Jan. 3. The findings revealed that although the asset has been trading sideways so far this year, more BTC has become illiquid. There has been an acceleration in illiquid supply growth which now comprises more than three quarters, or 76%, of the total circulating supply. Glassnode defines illiquidity as when BTC is moved to a wallet with no history of spending. Liquid supply BTC, which makes up 24% of the total, is in wallets that spend or trade regularly such a...

Nexo’s Antoni Trenchev predicts a $100k Bitcoin price point by mid this year

Anthony Trenchev sees Bitcoin as an inflation hedge equivalent to gold Antoni Trenchev, the co-founder of crypto lending platform Nexo, has given his predictions on the world’s most dominant digital asset. In an interview published yesterday, Trenchev told CNBC that he sees the world’s largest crypto coin doubling in value by the end of June this year. “I’m quite bullish on bitcoin. I think it’s going to reach $100K this year, probably by the middle of it,” he said. Institutional adoption and Macroeconomic realities are the key drivers The Bulgarian crypto businessman bases his prediction to two major reasons. First, he explained that many major businesses are shifting part of their portfolios into Bitcoin investment and that this would be the major reason that would bo...

Price analysis 1/3: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

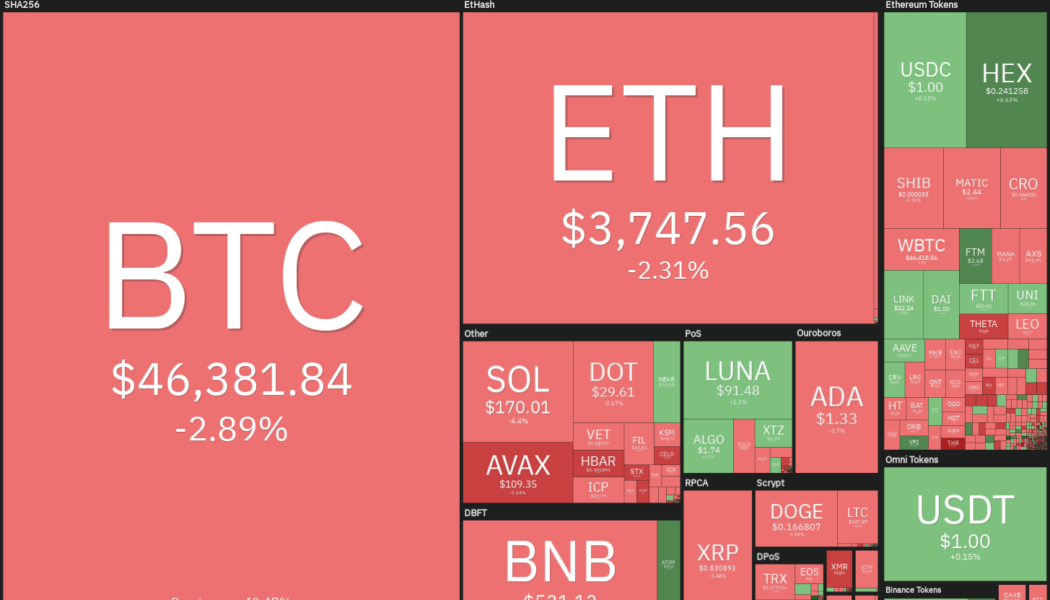

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100. On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.” Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials. Daily cryptocurrency market performance. Source: Coin360 Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hung...

Bitcoin traders expect $60K by month’s end, marking $45K as ‘accumulation’

The bearish pressures facing the cryptocurrency market at the end of 2021 have continued into the first week of 2022 after the price of Bitcoin (BTC) dropped below $47,000 on Jan. 1 and the asset still faces stiff headwinds on the shorter timeframe charts. Data from Cointelegraph Markets Pro and TradingView shows that, after climbing above $47,500 to start the new year, the price of BTC fell under pressure in the afternoon on Dec. 3. Currently, the price has dropped to $46,500 where bulls now look to mount a defense. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path ahead for Bitcoin in 2022 as the global economic system continues to grapple with inflation. BTC needs to reclaim support at $48,670 Analy...

El Salvador’s Nayib Bukele predicts Bitcoin to hit $100k this year

Bukele, a Bitcoin proponent, also said he expects to see two other countries take up Bitcoin as legal tender this year Nayib Bukele’s Bitcoin campaign soldiers into the New Year, with the El Salvador President giving his predictions on the coin yesterday. Though most of the predictions were seemingly quite bold and ambitious, Bukele has never been irresolute in his belief in Bitcoin. The El Salvador president said he expects Bitcoin to notch a price point of $100,000 this year and that two additional countries would adopt it as legal tender. His country, El Salvador, became the first and sole country in the world, so far, to assume the use of Bitcoin as an accepted official currency at the beginning of September last year. The move was plagued with criticism and technical hitches, bu...

New year, same ‘extreme fear’ — 5 things to watch in Bitcoin this week

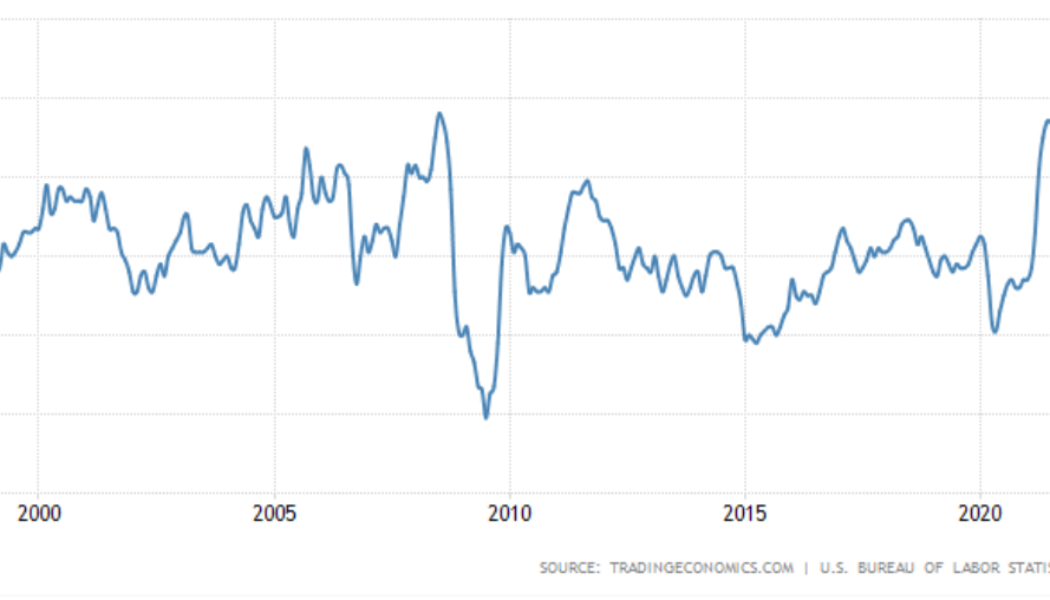

Bitcoin (BTC) begins its first full week of 2022 in familiar territory below $50,000. After ending December at $47,200 — far below the majority of bullish expectations — the largest cryptocurrency has a lot to live up to as signs of a halving cycle peak remain nowhere to be found. With Wall Street set to return after stocks conversely ended the year on a high, inflation rampant and interest rate hikes looming, 2022 could soon turn out to be an interesting market environment, analysts say. So far, however, all is calm — BTC/USD has produced no major surprises for weeks on end. Cointelegraph takes a look at what could change — or continue — the status quo in the coming days. Stocks could see 6 months of “up only” Look no further than the S&P 500 for an example of the state of...

Bitcoin holdings of public companies have surged in 2021

The quantity of Bitcoin held by private corporations has increased significantly during 2021, building on increases from the previous year. In a Jan. 3 tweet, on-chain analyst Willy Woo claimed that public companies holding “significant BTC have gained market share from spot ETFs as a way to access BTC exposure on public equity markets”. This has been more noticeable since MicroStrategy’s “Bitcoin for Corporations” conference on Feb. 3 and 4, 2021. The online seminar aimed to explain the legal considerations for firms seeking to integrate Bitcoin into their businesses and reserves. Michael Saylor’s MicroStrategy is a leading business intelligence firm and is known for being particularly bullish on BTC, owning almost $6 billion in crypto assets. On Dec 30, Saylor’s firm pu...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, FTM, ATOM, ONE

Bitcoin (BTC) continues to languish below the psychological level at $50,000 in the first few days of the New Year, indicating a lack of aggressive buying by traders. Former BTCC CEO Bobby Lee said the exodus of the Chinese traders who had until Dec. 31 to exit Chinese exchanges may have kept prices lower into the year-end. However, President Nayib Bukele of El Salvador, the first country to adopt Bitcoin as legal tender, believes that Bitcoin could rally to $100,000 this year. President Bukele also said that two more countries will accept Bitcoin as legal tender in 2022. Crypto market data daily view. Source: Coin360 The increased crypto adoption by institutional investors in 2021 is another long-term positive. According to CoinShares, net inflows into crypto funds in 2021 were more than ...

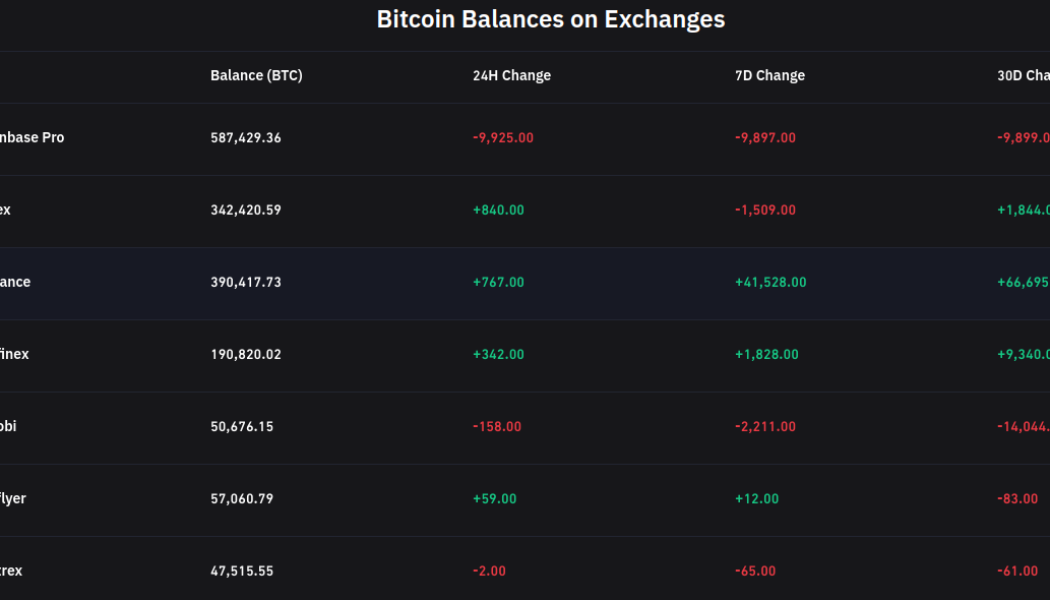

Bitcoin sees ‘non-stop’ end-of-year buying as 10K BTC leaves Coinbase in a single day

Almost 10,000 Bitcoin (BTC) left major United States-based exchange Coinbase on Dec. 30 in a sign that investor appetite is returning to the sphere. Data from on-chain monitoring resource Coinglass shows Coinbase’s professional trading arm, Coinbase Pro, shedding 9,925 BTC in the 24 hours to New Year’s Eve. Binance adds 66,000 BTC in December The buy-in, which runs in contrast to rising or flat balances on other major exchanges, marks a conspicuous short-term trend shift. The latter half of December has been characterized by platforms such as Binance and OKEx seeing increased inflows of BTC — something commentators feared could be a forewarning of a sell-off. While such a mass sale of BTC has not yet occurred, not everyone believes that it will stay that way. At the same time, the ex...