Bitcoin

Human Rights Foundation to grant 425M satoshis as part of its Bitcoin Development Fund

The Human Rights Foundation announced on Tuesday that it intends to distribute 425 million satoshis — the smallest divisible unit of a Bitcoin — to various contributors as a part of its ongoing Bitcoin Development Fund. Launched in May 2020, the Bitcoin Development Fund is primarily focused on improving the Bitcoin network’s privacy, usability and security. The Foundation said that it will focus this particular round of grants on expanding Bitcoin education and translation as well as Bitcoin core, lightning and wallet development. According to the organization’s press release, it will divide these grants between a number of recipients, including developers Jarol Rodriguez, Farida Nabourema, Roya Mahboob, Anita Posch and Meron Estefanos. Several projects will also receive a grant from the F...

Here’s why Bitcoin traders say a drop to $38K is the worst case scenario

The fallout from the Federal Reserve’s recent hawkish comments about raising interest rates as soon as March continued to weigh heavily on the cryptocurrency market on Jan. 6. The Crypto Fear & Greed index has been dialed down to 15 and some traders are lamenting the possible start of an extended bear market. Crypto Fear & Greed Index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that bears attempted to challenge the lows set on Jan.5, bringing BTC price down to $42,439 during early trading on Jan. 6. BTC/USDT daily chart. Source: TradingView Let’s take a quick look at where analysts think the price might go in the next few days. Bitcoin could bottom between $38,000 and $40,000 According to Mike Novogratz, the CEO of Galaxy Di...

Bitcoin price bounces off $42K as order book imbalance turns ‘crazy’

Bitcoin (BTC) briefly touched $43,000 prior to Wall Street opening on Jan. 6 as new market analysis offered bad news for bears. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Very similar to $30,000” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged after hitting its lowest levels in nearly six weeks. Amid six-month lows for sentiment and a feeling of foreboding on social media, analysis investigating trader behavior nonetheless concluded that all is not as bad as it seems. In a series of posts on the day, popular Twitter account Byzantine General argued that for all the downside, sellers are practically exhausted. “This is starting to feel very similar to the 30k range now,” he summarized. “The imb...

BTCS stock jumps 44% after announcing first-ever dividend payable in Bitcoin

On Wednesday, Nasdaq Composite logged its biggest daily loss since February last year. But for one of its listed companies, the day turned out to be extremely bullish. Blockchain stock soars The share value of BTCS Inc. (BTCS), a blockchain technology company, surged nearly 44% to $4.36 at the New York closing bell, thus becoming the third-best performer on Nasdaq after Lixte Biotechnology (LIXT) and Mainz Biomed BV (MYNZ). Top Nasdaq performers as of Jan. 5, 2022’s close. Source: TheStockMarketWatch.com In contrast, Nasdaq plunged 3.3% Wednesday, its losses driven primarily by the release of the minutes of the Federal Open Market Committee (FOMC) meeting in mid-December last year. In detail, the minutes revealed the Federal Reserve officials’ intention to rais...

NYC mayor getting paid in Bitcoin suggests buying the dip

Newly sworn-in New York City Mayor Eric Adams is already using his influence to publicly speak about buying the recent Bitcoin dip. In a Thursday interview with CNBC’s Squawk Box, Adams said he had not yet received his first paycheck as the mayor of New York City, but reiterated his aim to make the city a Bitcoin (BTC) and crypto hub. When co-anchor Andrew Ross Sorkin pointed out that the price of the crypto asset has “come down” — dipping as low as $43,000 earlier today — the NYC mayor seemed to be undeterred. “Sometimes the best time to buy is when things go down, so when they go back up, you made a good profit,” said Adams. “We need to use the technology of blockchain, Bitcoin, of all other forms of technology. I want New York City to be the center of that technology.” “Some...

Why Kevin O’Leary thinks NFTs could become bigger than Bitcoin

Millionaire investor and crypto proponent Kevin O’Leary thinks that the NFT sector could be worth more than Bitcoin in the future. Speaking with CNBC’s Capital Connection on Jan. 5, O’Leary — also known as Mr. Wonderful — argued that NFTs provide a greater potential to attract capital than Bitcoin due to their ability to tokenize and authenticate physical assets such as cars, watches and real estate: “You’re going to see a lot of movement in terms of doing authentication and insurance policies and real estate transfer taxes all online over the next few years, making NFTs a much bigger, more fluid market potentially than just Bitcoin alone.” Mr. Wonderful admitted however, that he is not tied to that bet and will still be investing on “both sides of that equation.” The former cr...

Raoul Pal says ‘reasonable chance’ crypto market cap could 100X by 2030

Former Goldman Sachs hedge fund manager and Real Vision CEO Raoul Pal thinks that the crypto market cap could increase 100X by the end of this decade. At the time of writing, the total market cap of the global crypto sector stands at $2.2 trillion, and Pal told podcast Bankless Brasil “there’s a reasonable chance” this figure could grow to around $250 trillion if the crypto network adoption models continue on their current trajectory. Pal drew comparisons between the current benchmarks of other markets and asset classes such as equities, bonds and real estate, noting that they all have a market cap between “$250-$350 trillion.” “If I look at the total derivatives market, it’s $1 quadrillion. I think there’s a reasonable chance of this being a $250 trillion asset class, which is 100X from h...

SEC delays decision on NYDIG Bitcoin ETF for another 60 days

The commission previously punted two other Bitcoin ETF products for an additional 45 days The US Securities and Exchange Commission on Tuesday revealed that it had pushed the deadline for reviewing the spot ETF proposal from technology and financial services firm NYDIG for another 60 days. The regulator explained that it saw it appropriate to delay the decision to either approve or reject the application until March 15th. The extended period, according to the commission, would provide enough time to review and make a determination on the ETF. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the iss...

Kazakh government resigns, shuts down internet amid protests, causing Bitcoin network hash rate to tumble 13.4%

On Wednesday, Kazakhstan, the second-largest country in the world when it comes to Bitcoin (BTC) mining hash rate, experienced unprecedented political unrest due to a sharp rise in fuel prices. As a result, the country’s presiding cabinet resigned, but not before the state-owned Kazakhtelecom shut down the nation’s internet, causing network activity to plunge to 2% of daily heights. The move dealt a severe blow to Bitcoin mining activity in the country. As per data compiled by YCharts.com, the Bitcoin network’s overall hash rate declined 13.4% in the hours after the shutdown from about 205,000 petahash per second (PH/s) to 177,330 PH/s. The country accounts for 18% of the Bitcoin network’s hash activity. Just days prior, the Kazakh government removed price cap...

Bitcoin monthly RSI lowest since September 2020 in fresh ‘oversold’ signal

A key Bitcoin (BTC) metric has just reached its lowest levels since the months after the March 2020 market crash. As noted by popular analysts on Jan. 5, Bitcoin’s relative strength index (RSI) is printing a “hidden bullish divergence” on monthly timeframes — and if it plays out, they say, the result will be very pleasing for hodlers. RSI falls below summer 2021 floor Amid frustration at the lack of direction on BTC/USD, it is no secret that a host of on-chain indicators has long demanded higher price levels. The current $46,000 may slide further, but the classic RSI metric now shows just how comparatively “oversold” Bitcoin is at that price. “Bitcoin monthly RSI is currently lower than the May–July 2021 correction,” popular analyst Matthew Hyland ...

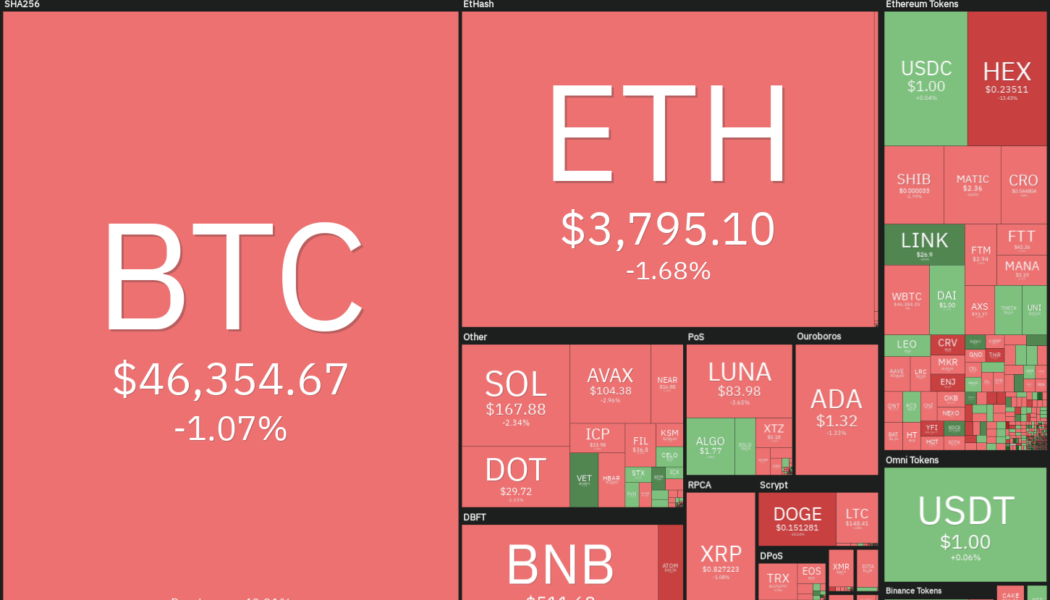

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...