Bitcoin

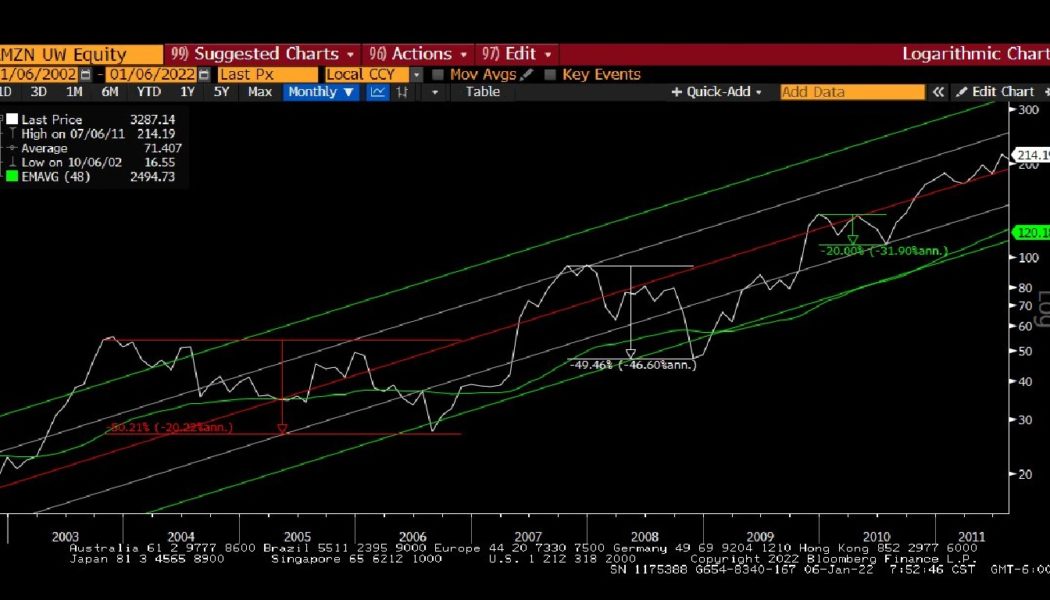

Raoul Pal: Bitcoin is charting a path similar to Amazon’s stock

Raoul Pal also suggested that Bitcoin is grossly undervalued and should ideally be around $100,000 Former hedge fund manager Raoul Pal provided an interesting observation in the relation between the historical price action of Amazon and that of Bitcoin since 2013 on Saturday. The Real Vision co-founder and chief executive cited Metcalfe’s Law which positions that the value of a network increases exponentially as the number of users on the network grows. The investment strategist first reviewed Bitcoin’s current price relative to Metcalfe’s Law. He opined that the world’s leading digital asset is highly undervalued. An extrapolation based on the Global Macro Investor’s Metcalfe Model indicated that the crypto should be tied around the $100,000 price point...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...

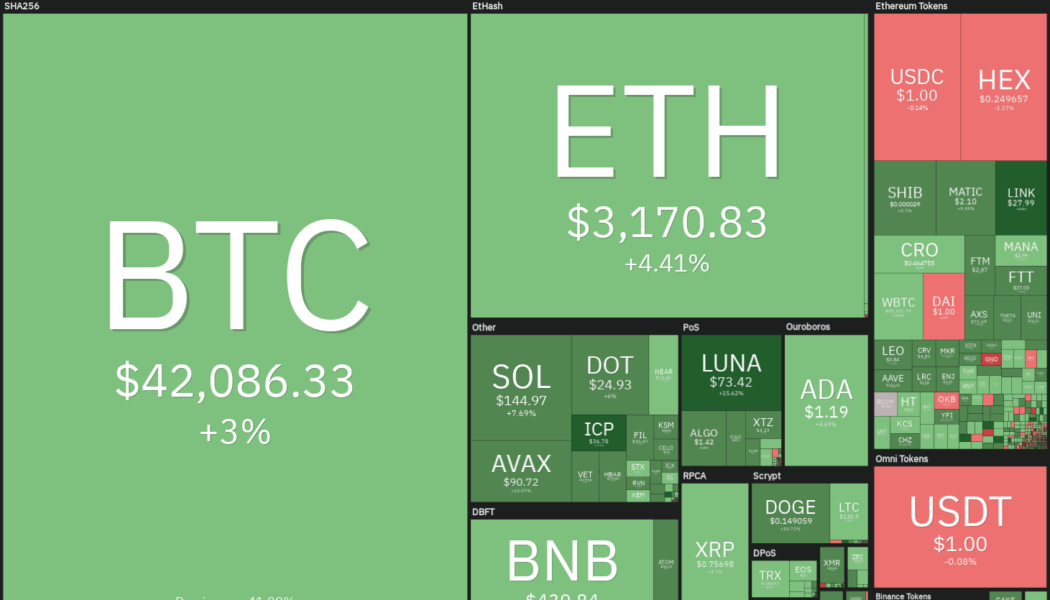

Top 5 cryptocurrencies to watch this week: BTC, LINK, ICP, LEO, ONE

Bitcoin (BTC) and most major altcoins remain under pressure as supports give way and bears sell at each rally attempt. This negative sentiment pulled the Crypto Fear & Greed Index to 10/100 on Jan. 8, one of its lowest readings ever. In comparison, 2021 had started on a bullish note with the reading hitting levels of 93/100, indicating “extreme greed.” This weak opening in the new year has not unnerved Bloomberg Intelligence analyst Mike McGlone who remains bullish. He said in a recent analysis that Bitcoin may rally to $100,000 and Ether (ETH) to $5,000 this year. Crypto market data daily view. Source: Coin360 However, some analysts argue that Bitcoin may struggle to maintain its bullish trend in an environment where interest rates are rising. Holger Zschaepitz questioned whether Bitc...

Bitcoin performs classic bounce at $40.7K as BTC price comes full circle from January 2021

Bitcoin (BTC) bounced off what is for some a key level on Jan. 9, closely mimicking events from September 2021. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Shorters will get rekt” at $40,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing course at around $40,700 to subsequently pass $42,000. The behavior, while uninspiring for some, firmly reminded others of Bitcoin price behavior at the end of September, when $40,700 acted as a springboard which ultimately produced $69,000 all-time highs seven weeks later. History and Context 40.7k $BTC https://t.co/LqlkxxJ0BF pic.twitter.com/neJlH6mnmN — Pentoshi DM’S ARE SCAMS (@Pentosh1) January 8, 2022 “Months have passed since September. And yet, BTC finds itself in the...

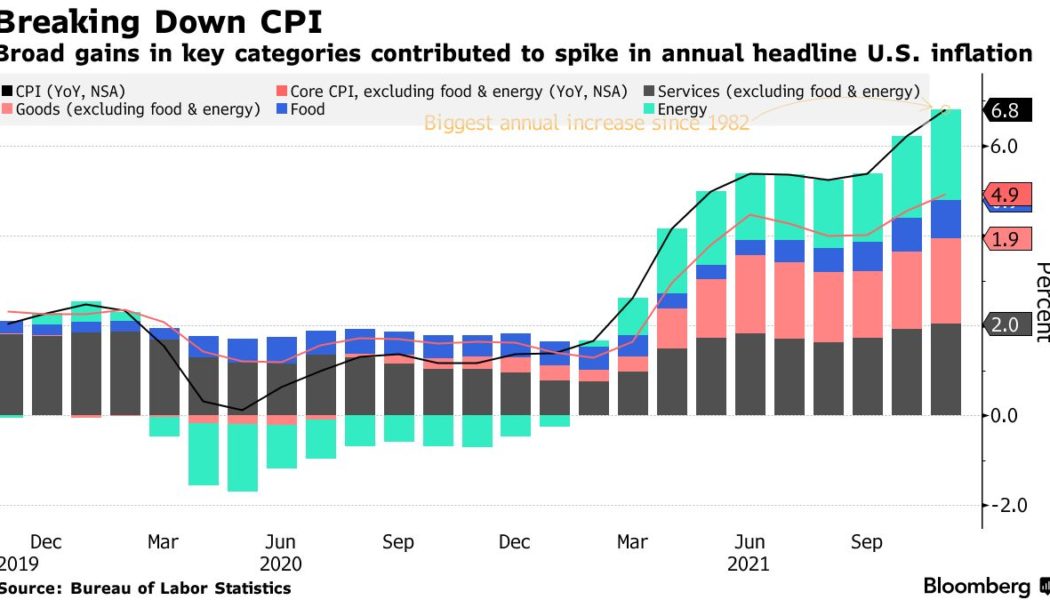

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 1

Hatu is the co-founder and chief strategy officer of DAO Maker, which creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors. “2021 has been a stop-start year for crypto and DeFi, as regulatory bodies have not clarified their stance on the industry. This has held back the retail population from getting involved, and this is a huge opportunity cost for the industry. However, with El Salvador adopting Bitcoin as legal tender and more countries embracing crypto, the future looks brighter. In 2021, yes, there have been multiple deliberations at various levels regarding crypto and its regulatory status. Governments and regulatory authorities across the globe have expressed reservations against the mainstreaming of crypto. Howe...

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

Mozilla puts crypto support on hold following intensified heat on initial decision

Distanced Mozilla founder vehemently lambasted the move in a tweeted response to the tweet announcing the decision The Mozilla Foundation yesterday announced that it was putting a hold on crypto donations following a discussion with involved parties and the larger community. On New Year’s Eve, the foundation revealed that it had partnered with crypto payment service BitPay to introduce support for crypto donations. The announcement was followed with heavy backlash and trenchant criticism as many users expressed their disapproval of the decision. Some brought to the fore a company blog from January last year in which the chief executive Mitchell Baker asserted that the organisation was devoted to positive climate efforts. Others even noted that they would entirely stop donating to the devel...

Bitcoin clings to $42K as key moving average break from July reappears

Bitcoin (BTC) consolidated above $42,000 prior to Wall Street’s opening bell on Jan. 7 as more similarities to last year’s lows emerged. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC “very closely” mimicking May behavior Data from Cointelegraph Markets Pro and TradingView tracked a nervous Bitcoin market as BTC/USD avoided another retest of $40,000 support. Earlier, after briefly falling below $41,000, analysts had warned that a further capitulation event may occur, this having the potential to bring the pair down to $30,000 or even lower. That figure rings true for market participants, having formed the bottom of a protracted capitulation which lasted from May to July last year. Then, as now, miner upheaval combined with macroeconomic factors...

Here’s why Ray Dalio considers 1% to 2% allocation to crypto investment ideal

The billionaire investor has his toe in Bitcoin and Ethereum but has in the past declined to disclose how much he has put into them Ray Dalio, the co-chief of investment at hedge fund Bridgewater Associates recently told The Investor’s Podcast Network that he agrees with fellow billionaire Bill Miller’s proposition. In the episode published on January 2, Dalio suggested that investors shift about 1 to 2% of their portfolios into crypto – Bitcoin. The American investor tied his optimism on Bitcoin to the asset’s insusceptibility to hacking, lack of close competition, and satisfying adoption rates that will make its valuation battle gold’s market cap. “Bitcoin now is worth about $1 trillion, whereas gold that is not held by central banks and not used for je...

Weekly Report: Shark Tank’s Kevin O’Leary argues that NFTs are growing bigger than Bitcoin

This week, top cryptocurrencies suffered a massive dip as the broader market pulled back following confirmation of plans to hike interest rates. Minutes from the FOMC meeting hinted that the US Federal Reserve was considering a potential rate increase in March. The top crypto assets (not including Tether and USD Coin stables) are all down by double figures over the last 7-days. Solana (SOL), Ethereum (ETH), and Binance Coin (BNB) lead the way in losses with 19.47%, 13.97%, and 13.15% plunges, respectively as of writing. The leading cryptocurrency is also trading in the red – down by 12.01% in the last 7-days. Here’s a look at the top headlines outside the market in the first week of the year. Shark Tank’s Kevin O’Leary bets on NFTs getting bigger than Bitcoin Popular Shar...