Bitcoin

SBF ‘didn’t like’ decentralized Bitcoin — ARK Invest CEO Cathie Wood

Bitcoin (BTC) is too “decentralized and transparent” for former FTX CEO Sam Bankman-Fried, says Cathie Wood. In a tweet on Dec. 10, Wood, who is CEO of investment giant ARK Invest, delivered a fresh damning appraisal of the FTX saga. Wood: SBF “couldn’t control” Bitcoin As the legal ramifications of FTX and Bankman-Fried, also known as SBF, continue, Bitcoin loyalists are giving him little sympathy. ARK’s Wood is now firmly among them, not mincing her words as BTC price action continues to trade around 20% down over the month. “The Bitcoin blockchain didn’t skip a beat during the crisis caused by opaque centralized players,” she wrote. “No wonder Sam Bankman Fried didn’t like Bitcoin: it’s transparent and decentralized. He couldn’t control it.” Wood linked to ARK Invest’s...

Bitcoin bulls protect $17K as trader eyes key China BTC price catalyst

Bitcoin (BTC) maintained $17,000 support into Dec. 10 ahead of a critical week of macro data. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print will make Fed “slow down” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it traded sideways after the close of trading on Wall Street. The pair looked set for a quiet weekend, with all eyes focused on United States inflation readings and policy updates due from Dec. 13 onward. With the Producer Price Index (PPI) November print behind it, the month’s Consumer Price Index (CPI) results took center stage. As Cointelegraph reported, expectations remain that CPI will show U.S. inflation continuing to abate, sparking renewed strength in risk assets, including crypto. “My personal expectations are t...

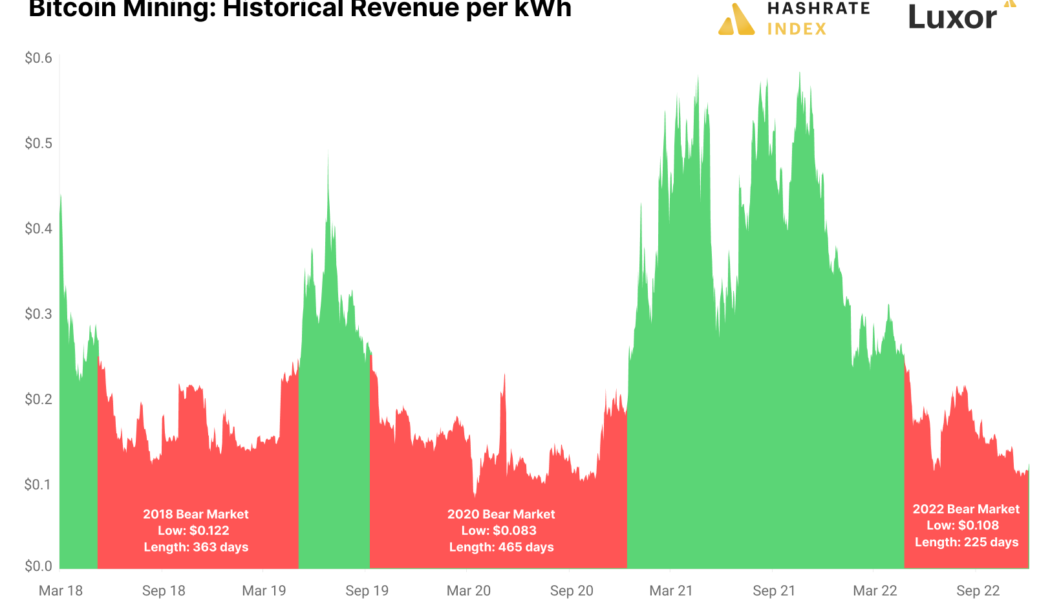

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

BTC price tests $17K on PPI as Bitcoin analysts eye CPI, FOMC catalysts

Bitcoin (BTC) fell on the Dec. 9 Wall Street open as United States economic data appeared to disappoint markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Attention turns to Bitcoin vs. CPI “big trigger” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to come closer to $17,000 after passing the level overnight. The pair reacted badly to U.S. Producer Price Index (PPI) data, which despite being above expectations still beat the readout from the month prior. “Bit of an over reaction towards PPI, which has been dropping significantly from last month, but less than expected,” Michaël van de Poppe, founder and CEO of trading firm Eight, responded. Van de Poppe, like others, noted that the crux of macro cues would come next week in the for...

What Paul Krugman gets wrong about crypto

In mid-November, as crypto markets reeled in the aftermath of FTX’s meltdown, Nobel Prize-winning economist Paul Krugman made use of his New York Times column to disparage crypto assets — again. Despite his unquestionable academic credentials, Krugman reiterated a common misunderstanding in his attempt to understand crypto assets — by conflating Bitcoin (BTC) with other cryptocurrencies. Despite being the oldest, most valuable and most well-known member of this emerging class of digital assets, Bitcoin has a unique use case that differs widely from all others. Therefore, in order to understand this asset class as a whole, it would make more sense to choose as your starting point an asset with more tangible utility. Filecoin, for instance, provides storage for digital files in a similar vei...

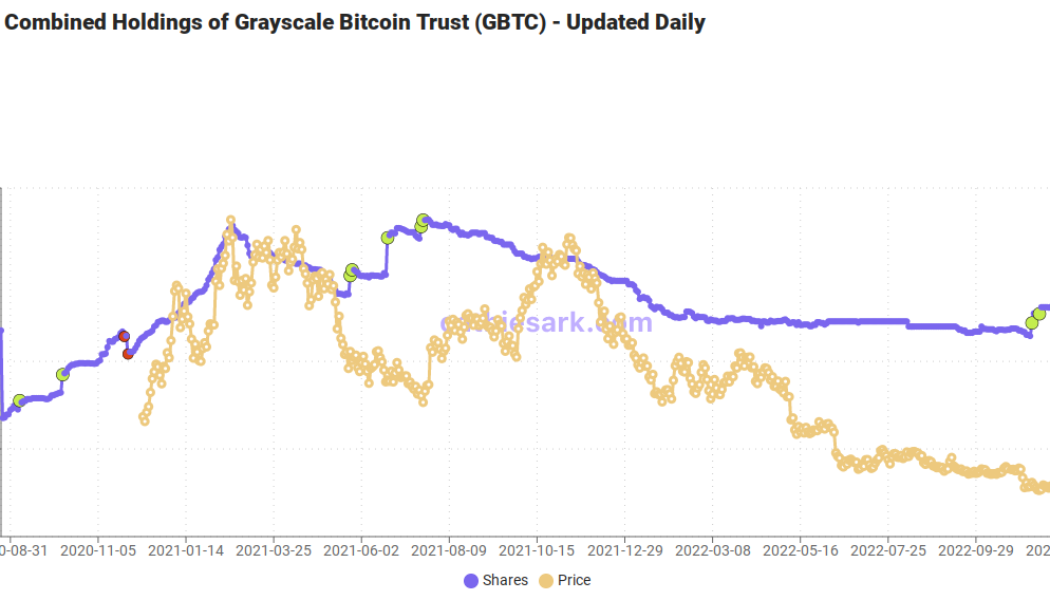

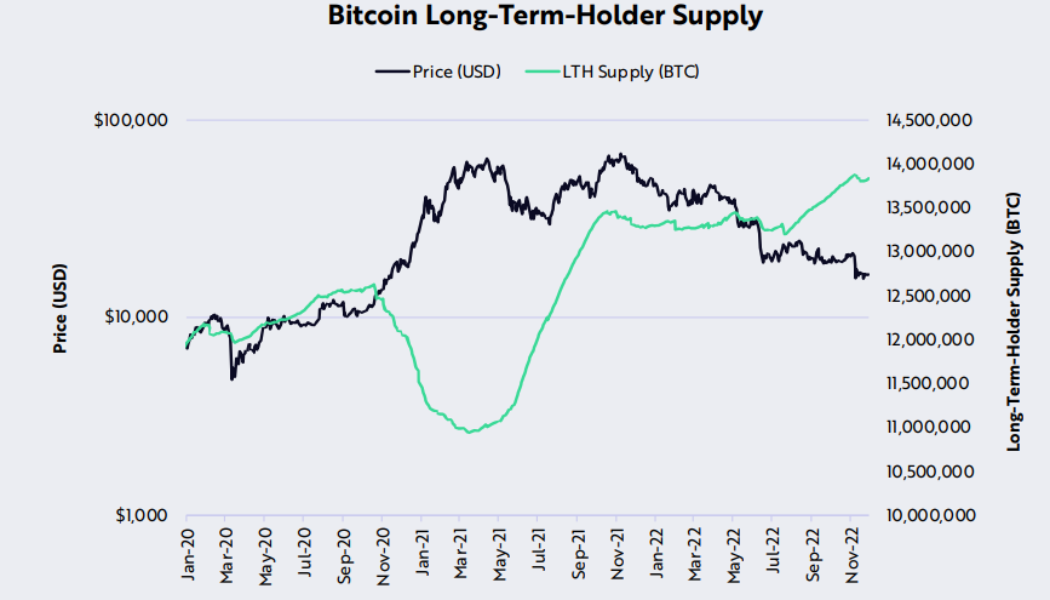

Bitcoin clings to $17K as ARK flags ‘historically significant capitulation’

Bitcoin (BTC) and decentralized blockchains are “as strong as ever” in the wake of the FTX meltdown, ARK Invest says. In the latest edition of its monthly newsletter, “The Bitcoin Monthly,” the investment giant came out firmly bullish on BTC. ARK: FTX scandal may be “most damaging event” ever With BTC price volatility ebbing into December, the industry is still reeling from ongoing FTX contagion. As lawmakers only begin to get to grips with the events, when it comes to Bitcoin, ARK is doubling down on its conviction — and setting it firmly apart from centralized alternatives. “The fall of FTX could be the most damaging event in crypto history,” one of the latest report’s “key takeaways” states. While acknowledging that even Digital Currency Group (DCG) — one of whose products, ...

How can UK-based businesses accept Bitcoin?

Accepting Bitcoin payments is advantageous due to lower fees than credit and debit cards, expansion of customer base and real-time bank balances. However, risks like volatility and cybercrime may undermine these benefits. Cryptocurrency payments help save excessive credit and debit card processing fees as they are decentralized and do not need intermediaries to verify the transaction. Moreover, merchants do not incur overseas currency exchange changes if payments are made in BTC or other cryptocurrencies. High transaction speed is another benefit of accepting Bitcoin payments, allowing businesses to receive payments in real-time. Moreover, with the increasing customer demand to pay in crypto, offering Bitcoin as a payment method will help acquire more shoppers. However, accepting cryptocur...

‘Imminent’ crash for stocks? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts its first full week of December at three-week highs as bulls and bears battle on. After a weekly close just above $17,000, BTC/USD seems determined to make the most of relief on stocks and a weakening U.S. dollar. As the United States gears up to release November inflation data, the dollar looks to be a key item to watch as BTC price action teases a recovery from the pits of the FTX meltdown. All may not be as straightforward as it seems — miners are facing serious hardship, data shows, and opinions on stocks’ own ability to continue higher are far from unanimous. As the end of the year approaches, will Bitcoin see a “Santa rally” or face a new year nursing fresh losses? Cointelegraph presents five areas worth watching in the coming days when it comes to BTC/USD perfor...

Standard Chartered forecasts ‘surprise’ Bitcoin downside after FTX collapse

The value of Bitcoin (BTC) is being touted to drop as low as $5,000 in 2023 according to Standard’s Chartered global research head and chief strategist. As initially reported by Bloomberg, a note to investors published on Dec. 4 from the multinational bank’s chief strategist Eric Robertsen weighed-up a potential drop in Bitcoin’s value correlated with a surge in physical Gold. Robertsen outlined prospective scenarios for 2023 that could see interest rate reversals from hikes in 2022, further cryptocurrency sector bankruptcies and negative sentiment towards the market. This could include further downside for Bitcoin next year, with a 70% decline from its current market value while Gold could see an upside of up to 30% to the $2,250 mark per ounce. The closing months of 2022 have been tumult...

Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data. Although the FTX crisis broke the positive correlation between the U.S. equities markets and Bitcoin (BTC), the recent strength in equities shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers. Crypto market data daily view. Source: Coin360 The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused by FTX’s collapse. Until then, bullish price action may be limited to select cryptocurrencies. Let’s lo...

How much is Bitcoin worth today?

Bitcoin (BTC) trades 24 hours a day, seven days a week. It is a market that never sleeps, and the BTC price is constantly changing. It doesn’t matter which currency or commodity is used to measure how much a bitcoin is worth — BTC is always live and the market is always open. It wasn’t always that way — in the beginning, before around 2010, there were no exchanges or even reliable price information, and BTC/USD traded at tiny prices — at one point even less than a single U.S. dollar cent. Since those days, however, the Bitcoin price has gone up millions of percent. As of December 2022, one bitcoin is worth (BTC). It’s also easy to compare different prices across the crypto market — there’s no need to rely on a single source, and the market is always at work finding consensus. Want to know ...

Margin trading vs. Futures: What are the differences?

Margin trading aims to amplify gains and allows experienced investors to potentially get them quickly. They may bring dramatic losses, too, if the trader doesn’t know how they work. When trading on margin, crypto investors borrow money from a brokerage firm to trade. They first deposit cash into a margin account that will be used as collateral for the loan, a kind of security deposit. Then they start paying interest on the borrowed money, which can be paid at the end of the loan or with monthly or weekly installments, based on current market conditions. When the asset is sold, proceeds are used to repay the margin loan first. The loan is necessary to raise investors’ purchasing power and buy larger amounts of crypto assets, and the assets purchased a...