Bitcoin

MicroStrategy adds to Bitcoin stake despite steep loss

According to a new filing with the U.S. Securities and Exchange Commission, software analytics firm MicroStrategy said that it acquired 2,395 Bitcoins (BTC) at an average price of $17,181 for a total of $42.8 million during the period Nov. 1 and Dec. 21. Subsequent to the development, the company sold 704 BTC at $16,776 per coin for a total of $11.8 million on Dec. 22. On Dec. 24, MicroStrategy acquired approximately 810 BTC for $13.6 million in cash, at an average price of $16,845 per coin. In a Bloomberg interview published earlier this year, CEO and blockchain personality Michael Saylor told reporters: “We’re only acquiring and holding Bitcoin, right? That’s our strategy. We’re not sellers.” Today’s filing represents the first publicly reported ...

Price analysis 12/28: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Gold has been an outperformer in 2022 compared to the United States equities markets and Bitcoin (BTC). The yellow metal is almost flat for the year while the S&P 500 is down more than 19% and Bitcoin has plunged roughly 64%. The sharp fall in Bitcoin’s price has hurt both short-term and long-term investors alike. According to Glassnode data, 1,889,585 Bitcoin held by short-term holders was at a loss as of Dec. 26 while the loss-making tally of long-term holders was 6,057,858 Bitcoin. Daily cryptocurrency market performance. Source: Coin360 In spite of gold’s good showing and Bitcoin’s dismal performance in 2022, billionaire investor Mark Cuban continues to favor Bitcoin over gold. While speaking on Bill Maher’s Club Random podcast, Cuban told Maher, “If you have gold, you’re dum...

BTC price dips 1% on Wall Street open as Bitcoin miners worry analysts

Bitcoin (BTC) saw a fresh hint of volatility at the Dec. 27 Wall Street open as United States equities began the final trading week of the year. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin ekes out fresh volatility Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped around 1% at the opening bell. Despite involving a move of only $150, the event was still noticeable on lower timeframes, Bitcoin having shunned any form of volatility for multiple days. The move came in response to a 0.6% drop in the S&P 500 at the open, with the Nasdaq Composite Index dropping 1.4%. The U.S. Dollar Index (DXY) responded in kind, making up for ground lost earlier to return to its position from Dec. 25. U.S. Dollar Index (DXY) 1-hour candle chart....

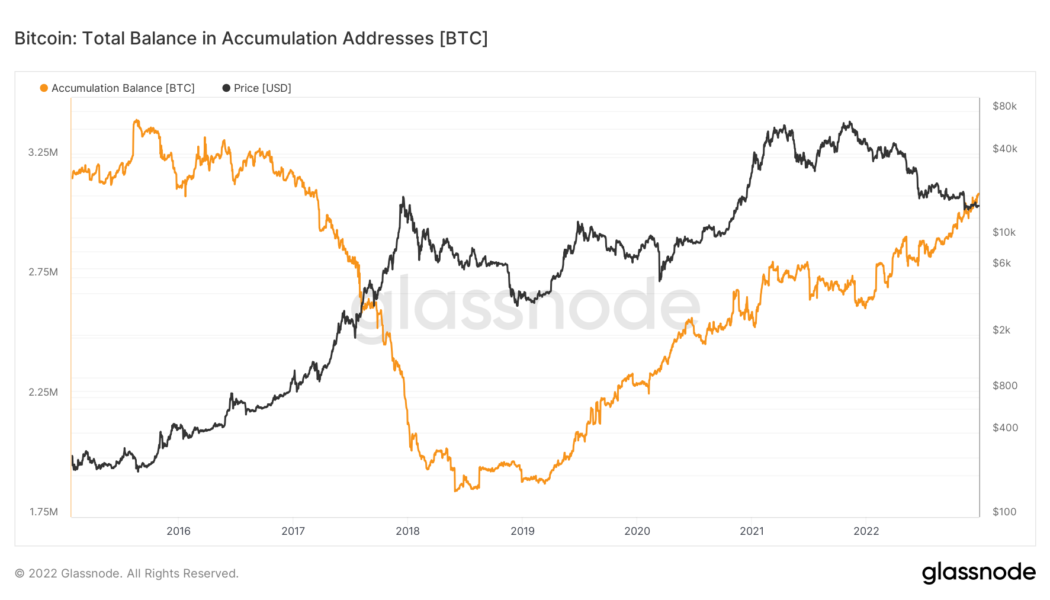

Bitcoin accumulation addresses near record 800K despite whale selling

Bitcoin (BTC) accumulation is nearing a new milestone this Christmas as the redistribution of the BTC supply continues. Data from on-chain analytics firm Glassnode shows that the total BTC balance of so-called “accumulation addresses” is nearing all-time highs. “HODL-only’ BTC addresses climb closer to 1 million mark Behind the scenes in the 2022 Bitcoin bear market, certain entities are in no doubt about their BTC investment strategy. According to Glassnode, Bitcoin accumulation addresses are more numerous than ever before, while the BTC balance they contain is almost at a record high. “Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds,” the firm’s description explains. Glassnode adds that exchange wallets and those...

Bitcoin price volatility due within days, new take says as BTC flatlines at $16.8K

Bitcoin (BTC) hodlers are enjoying another day of zero volatility on Dec. 26 as hopeful forecasts se signs of a trend change. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Opinions diverge further over BTC price bottom Data from Cointelegraph Markets Pro and TradingView confirmed more sideways action near $16,800 for BTC/USD on Boxing Day. The pair took the holiday period in stride, with reduced volumes having no impact on an already deflated market experiencing its lowest volatility on record. With few trading opportunities in the last week of “Do Nothing December,” analysts attempted to ready the ship for potential headwinds to come. “If BTC fails to reclaims ~$17,150 as support before the end of the year… Then $BTC will establish the $13900-$17150 range as its new playgrou...

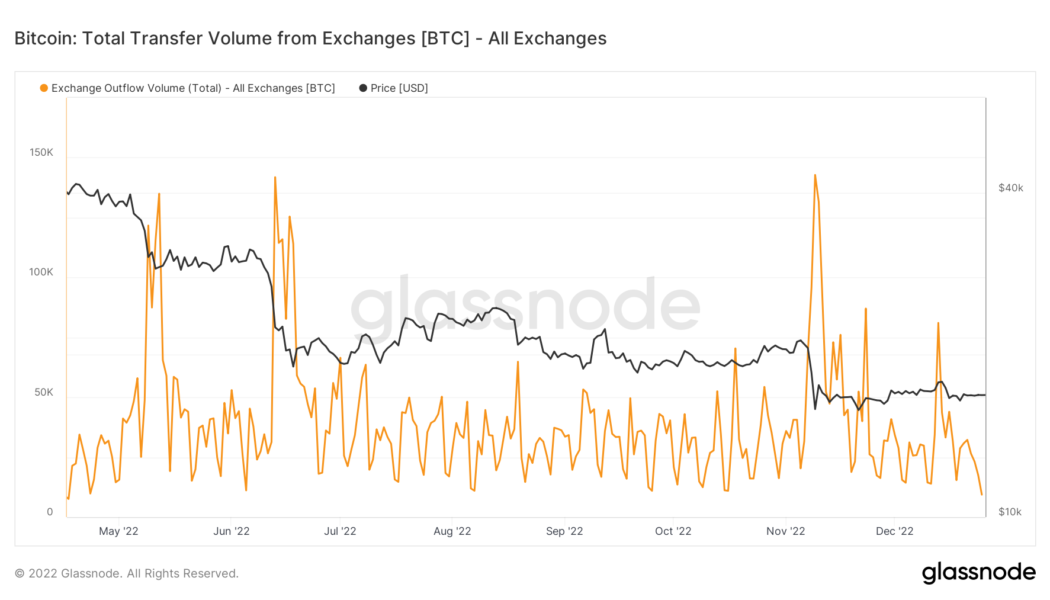

Bitcoin exchange withdrawals sink to 7-month low as users forget FTX

Bitcoin (BTC) exchange users have forgotten all about the FTX scandal this Christmas, data shows. According to on-chain analytics firm Glassnode, exchange outflows have now hit their lowest levels in over six months. Still not your keys, still not your coins? As Bitcoin volatility sets a new record low in what is being called “Do Nothing December,” exchange users’ habits are also rapidly adjusting to the current climate. After seeing an overwhelming surge in light of the FTX meltdown, BTC withdrawals from exchange wallets have entirely reversed the spike which began around six weeks ago. Having hit a peak of 142,788 BTC on Nov. 14, outflows from the trading platforms tracked by Glassnode have declined over ten times. On Dec. 25, the latest date for which numbers are available, total exchan...

BTC price foregoes Santa rally as Bitcoin volatility hits record low

Bitcoin (BTC) failed to deliver a Santa rally for Christmas 2023 as Dec. 25 offered even more sideways BTC price action. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin volatility index plumbs lowest ever levels Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a tight trading range around $16,800. The pair had stubbornly refused to offer any form of volatility through much of the week, with an absence of a macro trigger reinforcing lackluster performance. “Bitcoin’s volatility is at an all-time low,” William Clemente, founder of crypto research firm Reflexivity, noted alongside a chart of the Bitcoin historical volatility index. Bitcoin historical volatility index 1-week candle chart. Source: TradingView He added that the total crypto...

Bitcoin and these 4 altcoins are showing bullish signs

Cryptocurrency markets lack any signs of volatility going into the year-end holiday season. This suggests that both the bulls and the bears are playing it safe and are not waging large bets due to the uncertainty regarding the next directional move. This indecisive phase is unlikely to continue for long because periods of low volatility are generally followed by an increase in volatility. Willy Woo, creator of on-chain analytics resource Woobull, anticipates that the duration of the current bear market may “be longer than 2018 but shorter than 2015.” Crypto market data daily view. Source: Coin360 The crypto winter has resulted in a loss of more than $116 billion to the personal equity of 17 investors and founders in the cryptocurrency space, according to estimates by Forbes. The carnage ha...

BTC price levels to watch as Bitcoin limps into Christmas under $17K

Bitcoin (BTC) entered the Christmas holiday period unchanged at $16,800 as an eerie lack of volatility persevered. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Hopeful price target sees Bitcoin at $17,400 Data from Cointelegraph Markets Pro and TradingView confirmed another day of an almost imperceptible range for BTC/USD just below $17,000. The pair had struggled to break out despite multiple potential catalysts coming from United States economic data prints. With the holiday season ahead, a Santa rally appeared unlikely, while a lack of significant events to come further reduced the chances of flash volatility. In weekend analysis, however, Michaël van de Poppe, founder and CEO of trading firm Eight, nonetheless reiterated the possibility of a step higher to ne...

Economic frailty could soon give Bitcoin a new role in global trade

The chaos we’ve experienced in global markets this year — global geopolitical upheaval magnified by the confluence of broken supply chains, inflation and heavy national debt loads — seems to signal the beginning of a new era. All of this is within the context of the United States dollar serving as the primary global reserve currency, currently accounting for about 40% of global exports. But monetary history tells us that multiple global reserve currencies can exist at one time. Many countries are actively seeking a reserve settlement that is insulated from global political strife. Bitcoin (BTC) may fit the bill, and if it is adopted as an alternative reserve currency — even at the margins — we will see the unleashing of Bitcoin-based trade and the rise of a new geopolitical reality. The Bi...

BTC price ignores US PCE data at $16.8K as Bitcoin rejects volatility

Bitcoin (BTC) saw a flicker of volatility around the Dec. 23 Wall Street open as the latest United States inflation data came in line with expectations. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin sees “crumb” of volatility on PCE Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly decoupling from solid sideways action to dip to $16,750 on Bitstamp. The impact of the November U.S. Personal Consumption Expenditures (PCE) Price Index print was notably muted, despite the data forming a key component of Federal Reserve policy. Even in the low-volume, low-volatility environment thatBitcoin continues to trade in, PCE barely moved markets as traders began to accept that Christmas 2022 may be an underwhelming one. “Hope you enjoyed that little crumb o...

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Bitcoin (BTC) is on track to end the year with a loss of about 65%. This would mark the third negative year for Bitcoin with the other two being 2014 and 2018. In comparison, the S&P 500 has fared much better but that is also down close to 20% in 2022. Although cryptocurrency prices have seen deep cuts this year, traders have continued to plow money into the space. An online survey conducted by Blockchain.com shows that 41% of the respondents bought crypto this year and 40% plan to purchase crypto in the next year. Daily cryptocurrency market performance. Source: Coin360 However, a sustained recovery in risk-assets may happen only after inflation shows signs of cooling. That would raise expectations of a pivot by the United States Federal Reserve from its aggressive monetary ...