Bitcoin

Bitcoin teases weekly highs as traders eye BTC price leg up to $17.3K

Bitcoin (BTC) inched closer to $17,000 on Jan. 3 as the first Wall Street open of the year loomed. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Consensus builds for fresh attack on $17,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching highs of $16,766 on Bitstamp — its best performance since Dec. 27. Analysts and traders were keenly awaiting the start of Wall Street trading after European stocks posted gains the day prior and United States futures followed suit. As Cointelegraph reported, both equities and gold had looked considerably more appetizing than Bitcoin since the FTX meltdown in November. “If BTC is finally ready to join the party, I could see it run to 17.3K~ as drawn below,” popular trader Crypto Chase wrote in part of an analysis on...

US will see new ‘inflation spike’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins the first week of 2023 in an uninspiring place as volatility stays away — along with traders. After failing to budge throughout the Christmas and new year break, BTC price action remains locked in a narrow range. Having sealed yearly losses of nearly 65% in 2022, Bitcoin has arguably seen a classic bear market year, but for the time being, few are actively predicting a recovery. The situation is complex for the average hodler, who is watching for macro triggers courtesy of the United States Federal Reserve and economic policy impact on dollar strength. Prior to Wall Street returning on Jan. 3, Cointelegraph takes a look at the factors at play when it comes to BTC price performance in the coming week and beyond. Bitcoin traders fear new lows amid flatlining price Bitcoi...

These 4 altcoins may attract buyers with Bitcoin stagnating

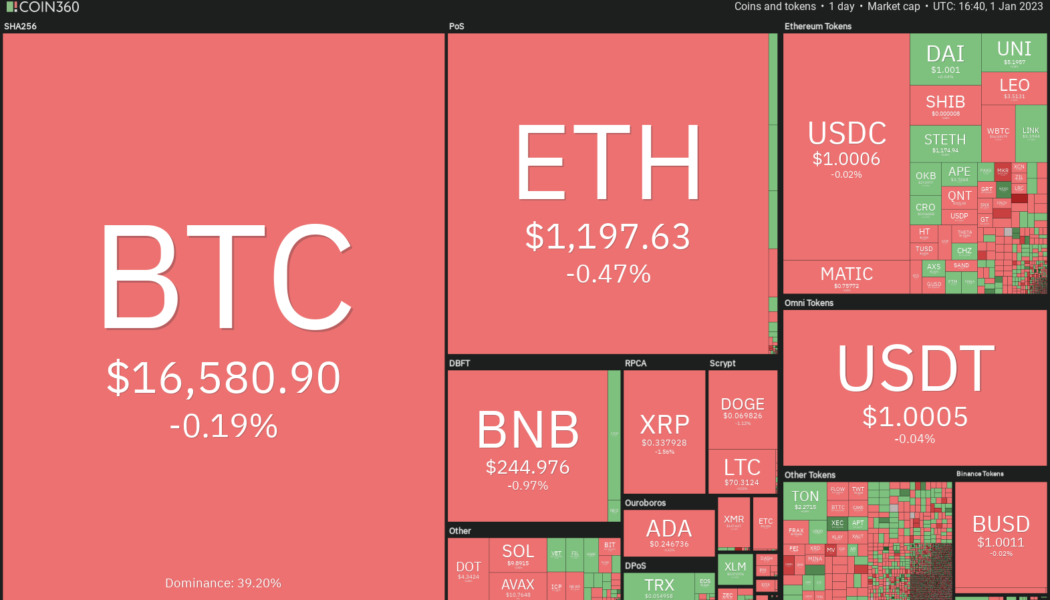

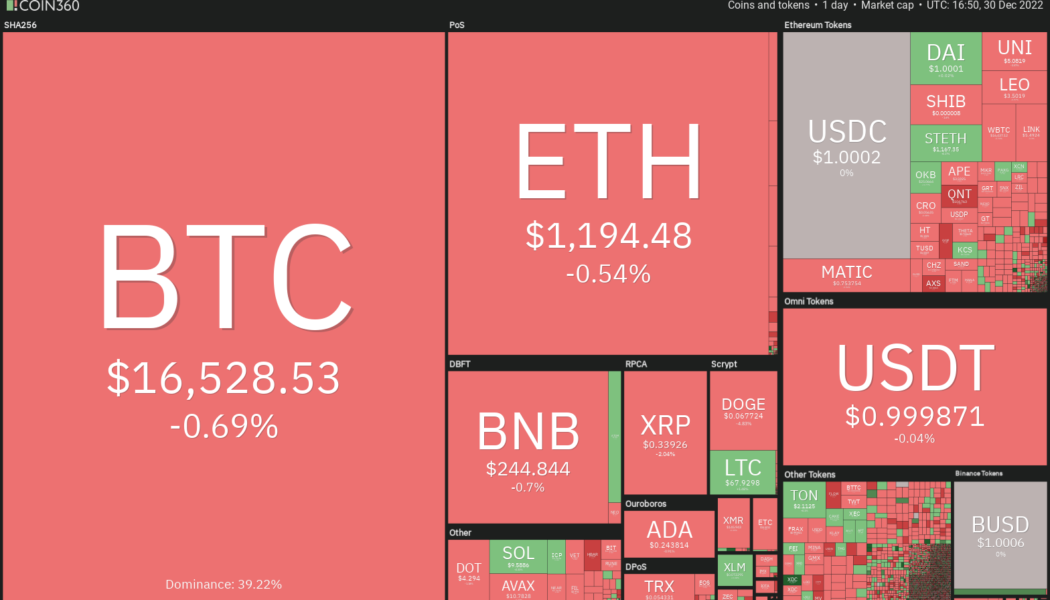

Bitcoin’s (BTC) volatility remained subdued in the final few days of the last year, indicating that investors were in no hurry to enter the markets. Bitcoin ended 2022 near $16,500 and the first day of the new year also failed to ignite the markets. This suggests that traders remain cautious and on the lookout for a catalyst to start the next trending move. Several analysts remain bearish about Bitcoin’s near-term price action. David Marcus, CEO and founder of Bitcoin firm Lightspark, said in a blog post released on Dec. 30 that he does not see the crypto winter ending in 2023 and not even in 2024. He expects that it will take time to rebuild consumer trust but believes the current reset may be good for legitimate firms over the long term. Crypto market data daily view. Source: Coin360 The...

Bitcoin ‘not undervalued yet,’ says research as BTC price drifts nearer to $16K

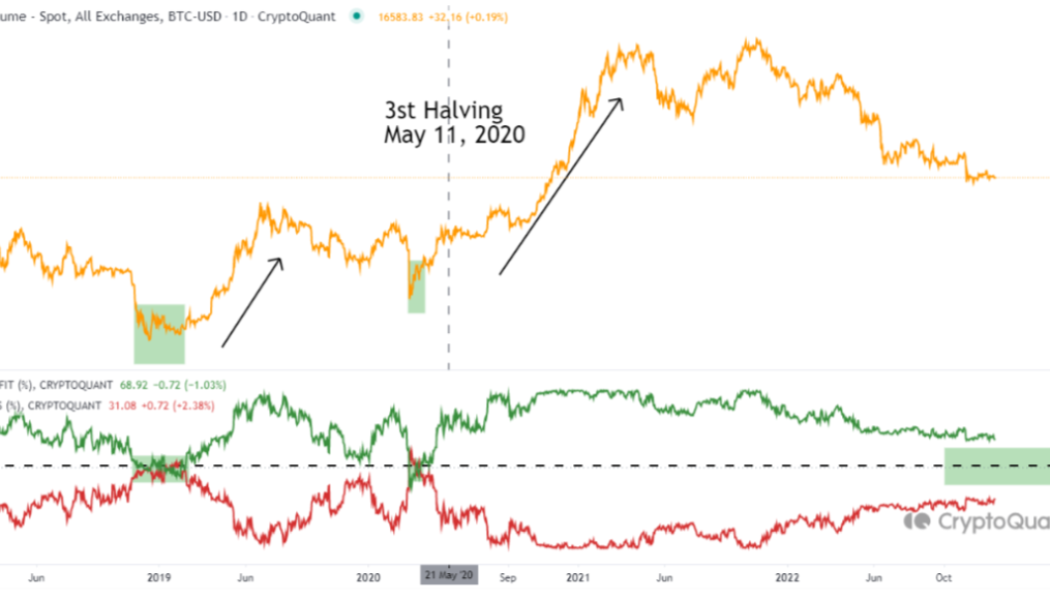

Bitcoin (BTC) may not be at a good value enough for a macro price bottom, according to analysis from CryptoQuant. In a blog post on Dec. 29, a contributor to the on-chain analytics platform flagged one BTC price indicator with further left to fall. Profitability indicator lacks key cross At nearly 80% below all-time highs, BTC/USD is nearing the zone in which it bottomed during previous bear markets. As CryptoQuant’s MAC_D notes, there is no shortage of instruments pointing to the 2022 bear market bottom already forming. Despite this, however, the signs are not yet unanimous, and pointing to transactions in profit and loss, he warns that cheaper BTC prices may still enter. CryptoQuant’s unspent transaction outputs (UTXOs) in profit and loss indicator currently shows around 30% of transacti...

Bitcoin stays put with yearly close set to seal 60% YTD BTC price loss

Bitcoin (BTC) kept traders guessing to the last minute into the 2022 yearly close as volatility remained absent from the market. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price: Where’s the volatility? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD clinging to a familiar area around $16,500. The pair continued to disappoint players on both sides of the trade after a sideways Christmas, ignoring the potential significance of the simultaneous weekly, monthly, quarterly and yearly candle close. “Technical resistance and overhead liquidity suggests sub $17k local top, but anything goes in the Wild Wild West,” on-chain analytics resource Material Indicators wrote in part of commentary on the Binance BTC/USD order book. An accompanying chart nonethe...

‘Crypto winter’ won’t end in 2023 — Bitcoin advocate David Marcus

Bitcoin (BTC) and crypto will need until at least 2024 to “recover from the abuse of unscrupulous players,” says one of the industry’s best-known names. In a blog post released on Dec. 30, David Marcus, CEO and founder of Bitcoin firm Lightspark, disappointed bulls with his outlook for the coming years. Marcus: “Crypto winter” will likely last until 2025 Less than two months after the FTX meltdown, the repercussions continue to unsettle sentiment and price performance alike. For Marcus, famous for his crypto role at Meta and before that PayPal, bad actors have a lot to answer for, and their specter will remain with the crypto industry beyond 2023. While mentioning FTX only once, he referenced what he called “unscrupulous players” dragging out marke...

BTC price lurches toward $16K as stocks, dollar wobble in final session

Bitcoin (BTC) teased more volatility at the Dec. 30 Wall Street open with BTC/USD heading ever closer to $16,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Will new year deliver “long-awaited volatility?” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD wicking down to lows of $16,337 on Bitstamp. The pair had been gradually upping the volatility in the days after Christmas, as analysts eyed the likelihood of a final burst of action before the yearly close. “Last trading day of the year for TradFi, but crypto will trade through the holiday weekend. Perhaps we may see some of that long awaited BTC volatility around the Weekly/Monthly close and the start of 2023,” on-chain analysis resource Material Indicators ventured. Popular trader and analy...

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

BTC price preserves $16.5K, but funding rates raise risk of new Bitcoin lows

Bitcoin (BTC) staged a modest recovery on Dec. 29 as United States stock markets rebounded in step. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $10,000 BTC price targets stick Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering above $16,600 at the Wall Street open after wicking below $16,500 for a second day. The pair remained unappealing to traders, many of whom feared a deeper retracement may still occur around the new year. In a list of potential “capitulation targets,” Crypto Tony doubled down on a price of $10,000 and lower for Bitcoin, while also revealing expectations for Ether (ETH) to dip as low as $300. “Things change quick, but if we hit these areas I begin to ladder,” part of accompanying commentary read. Daan Crypto Trades, meanwhile,...

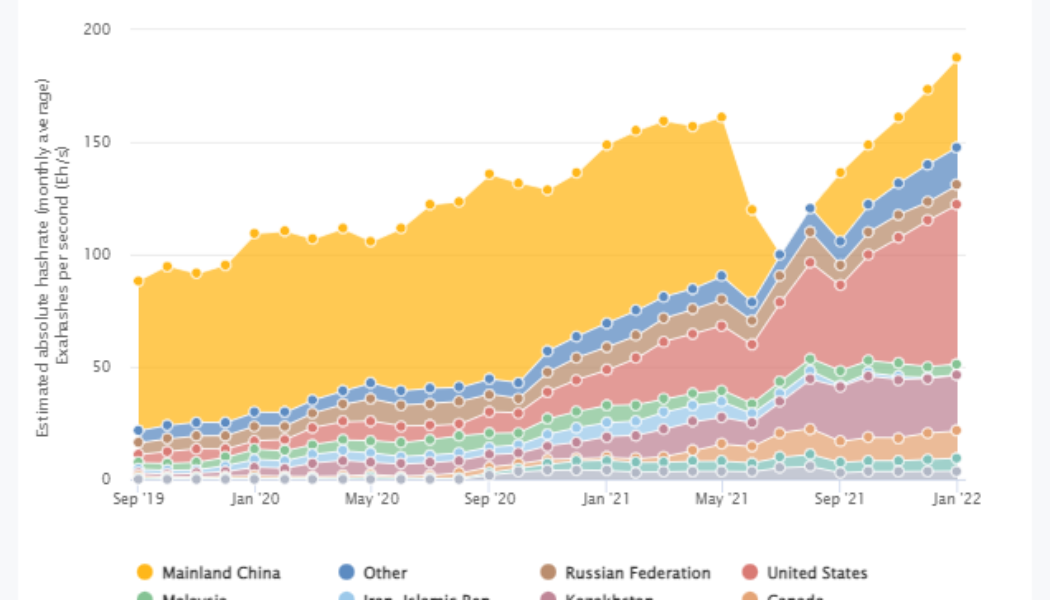

Chinese Communist Party official pleads guilty to helping Bitcoin miners

According to a report published by state-owned daily news program Xinwen Lianbo on Dec. 29, Xiao Yi, the former Communist Party secretary of the City of Fuzhou, pleaded guilty to corruption charges in the Zhejiang Hangzhou Intermediate People’s Court. During his tenure as director from 2008 to 2021, Yi was accused of accepting over 125 million Chinese yuan ($18 million) in bribes related to construction programs and illicit promotions. In addition to the aforementioned counts, Yi also pleaded guilty to charges related to business transactions between himself and Bitcoin (BTC) miners from 2017 to 2021. It is unclear if the series of charges were related. As reported by Xinwen Lianbo: “During his 2017 to 2021 tenure as the Communist Party Secretary of the City of Fuzhou, Xiao Yi provided sup...

Bitcoin price would surge past $600K if ‘hardest asset’ matches gold

Bitcoin (BTC) is due to copy gold’s explosive 1970s breakout as it becomes the world’s “hardest asset” in 2024. That was one forecast from the latest edition of the Capriole Newsletter, a financial circular from research and trading firm Capriole Investments. Bitcoin due big moves “and more” in 2020s Despite BTC price action flagging at nearly 80% below its latest all-time high, not everyone is bearish about even its mid-term outlook. While calls for a further drop before BTC/USD finds its new macro bottom remain, Capriole believes that 2023 will be bright for Bitcoin as a reserve asset. The reason, it says, lies in the world economy’s financial history of the past century, and in particular, the United States after the dollar deanchored from gold completely in 1971. Gold, as t...

Bitcoin beats Tesla stock in 2022 as BTC price heads for 60% losses

Bitcoin (BTC) circled $16,750 after the Dec. 28 Wall Street open after stocks dragged markets lower. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin analysts stick to downside fears Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it recovered from local lows of $16,559 on Bitstamp. After days of barely any movement up or down, Bitcoin finally saw a flicker of action as traditional markets opened after the Christmas break. Unfortunately for bulls, volatility was to the downside, with BTC/USD seeing its lowest levels since Dec. 20. On equities markets, United States indexes improved after a weak first day, which nonetheless failed to leave much of an impression on BTC commentators, many of whom stuck to grim short-term price forecasts. “I can’...