Bitcoin

Bitcoin price blasts past $21K as 3-day short liquidations near $300M

Bitcoin (BTC) continued a stunning comeback on Jan. 14 as $21,000 appeared for the first time since early November. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin cracks key trend line for first time since $69K Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it hit highs of $21,247 on Bitstamp overnight. The pair had faced major suspicion after it began to make up some serious lost ground through the week, with analysts warning that a retracement could occur at any time. Nonetheless, only brief periods of consolidation accompanied Bitcoin’s ascent, with weekly gains sitting at nearly 25%. In doing so, BTC/USD took out its realized price at $19,700, old all-time high from 2017, $20,000 and the 200-day moving average. The latter saw its...

Bitcoin price rally over $21K prompts analysts to explore where BTC price might go next

After Bitcoin (BTC) hit a yearly high of $21,095 on Jan. 13, where is it headed next? Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market. The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode. Is the Bitcoin bear market over? While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high. Bitcoin Fear and Greed index. Source: alternative.me Bitco...

Bitcoin price wants to retest 2017 all-time high near $20K — Analysis

Bitcoin (BTC) stayed near $19,000 at the Jan. 13 Wall Street open as traders hoped a week of swift gains would stick. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price “breakout or fakeout remains to be seen” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD crisscrossing the $19,000 mark as United States equities began trading. The pair rapidly took out sell-side liquidity overnight, gapping higher to what on-chain analytics resource Material Indicators forecast could be a retest of the $20,000 mark. “Seems like BTC is setting up for a retest of resistance at the 2017 Top,” it wrote in part of a Twitter discussion on Jan. 12, the day prior. “Whether we see a bonafide breakout or fakeout remains to be seen. Time for patience and discipline.” An accompany...

Climate tech VC argues Bitcoin’s ESG positives outweigh its negatives 31:1

A climate tech investor has painted a bright view of the Bitcoin network, suggesting its environmental positives outweigh its negatives by a whopping 31:1 ratio. On Jan. 12, self-proclaimed philanthropist and environmentalist Daniel Batten claimed in a Twitter thread that “Bitcoin is probably the most important ESG technology of our time.” According to Batten, the 31:1 positive impact ratio was calculated by researching and interviewing grid engineers, climate scientists, Bitcoin mining engineers, methane abatement experts and solar and wind installers. The findings discovered 21 ways Bitcoin (BTC) could be environmentally positive and just five ways it could be environmentally negative. 1/7 Environmentally, Bitcoin has a positive:negative ratio of 31:1 This mean Bitcoin is probably t...

Bitcoin price fails to seal fresh CPI gains as $18K support hangs in balance

Bitcoin (BTC) wobbled at $18,000 at the Jan. 12 Wall Street open despite United States inflation continuing to fall. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin traders stay wary post-CPI Data from Cointelegraph Markets Pro and TradingView showed BTC/USD encountering predictable volatility around the release of Consumer Price Index (CPI) data for December. The first such release of 2023, the event preceded the start of trading on Wall Street, with Bitcoin briefly gapping higher before returning to threaten a breakdown below the $18,000 mark. In so doing, the largest cryptocurrency copied behavior from one month prior, with resistance at $18,500 remaining untested. CPI came in at 6.5% year-on-year, in line with the majority of predictions. According to CME Group’s Fe...

From Bernie Madoff to Bankman-Fried: Bitcoin maximalists have been validated

Long before Bitcoin (BTC), Bernie Madoff sat atop the longest-running, largest fraud in history. The rise and real-time fall of Sam “SBF” Bankman-Fried, former CEO of crypto exchange FTX, were expedited in comparison. While the similarities are profound, the storyline is not: Create organizations under false pretenses, develop relationships with people in authority positions, defraud clients, survive as long as possible, and try not to get caught. Madoff advisers experienced a “liquidity” problem in 2008, around late November into early December, where the fund was unable to meet client redemption requests. On its surface, the fourth-quarter timing of the Madoff collapse more than a decade ago appears eerily similar to FTX’s 2022 implosion. Bitcoiners who hold their keys will never experie...

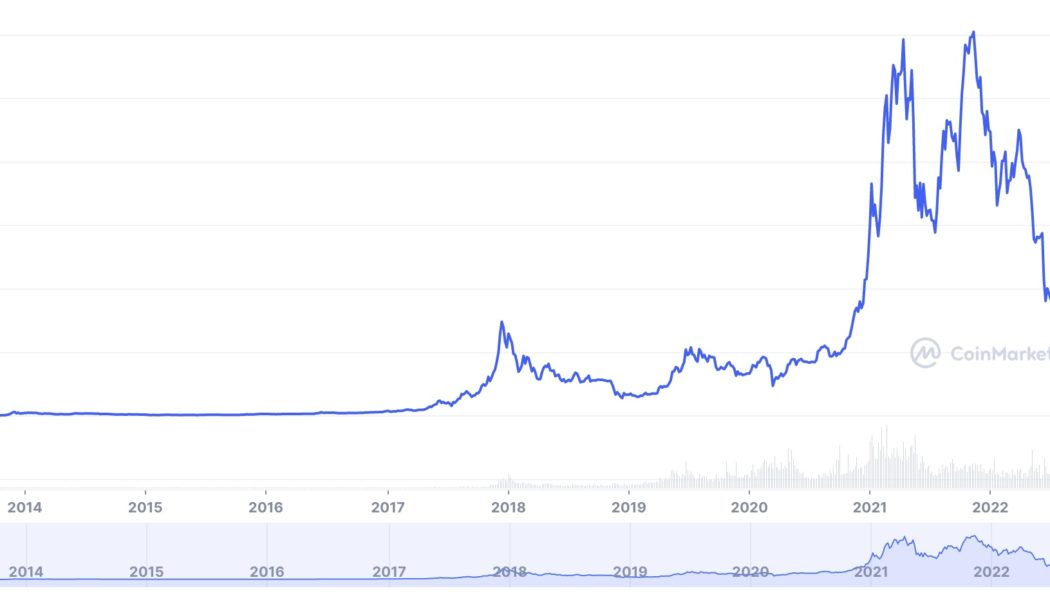

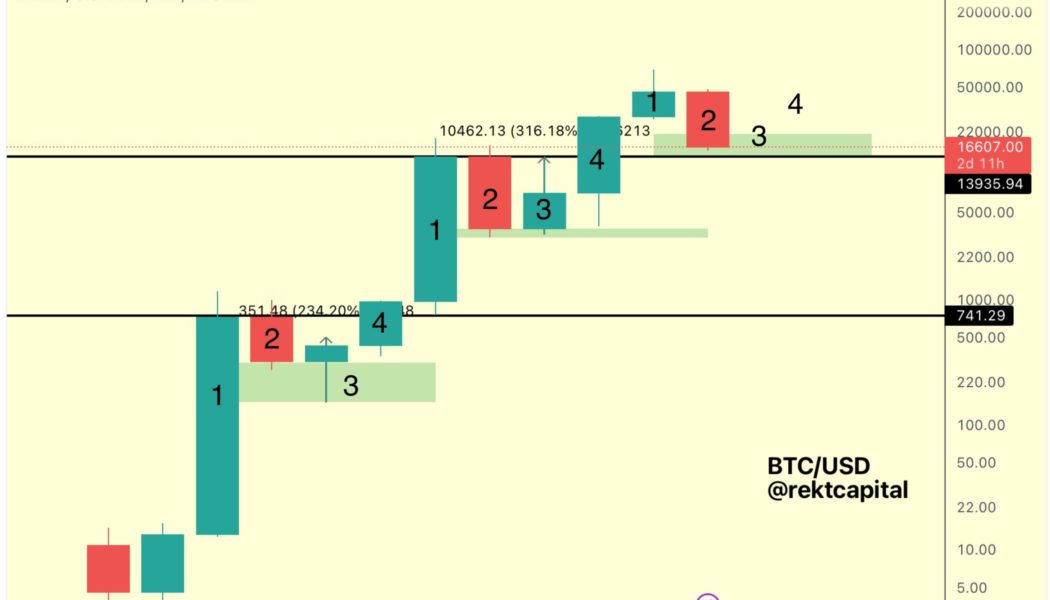

Bitcoin gained 300% in year before last halving — Is 2023 different?

Bitcoin (BTC) is facing a “bottoming candle” in 2023, but BTC price action is still more than able to surprise the market. In a tweet on Jan. 11, popular trader and analyst Rekt Capital predicted that BTC/USD could see “decent upside” this year. Chart teases serious Bitcoin upside potential Analyzing Bitcoin’s four-year market cycles around block subsidy halving events, Rekt Capital drew attention to 2023 being the deadline for its next “bottoming candle.” With the next halving due in 2024, the coming 12 months should see a price floor, followed by a rally as the event draws nearer. 2024 thus forms the fourth candle in Bitcoin’s current cycle, and 2023 the third. “Candle 3 is a Bottoming Candle in the BTC Four Year Cycle. But it can still generate decent upside,” Rekt Capital commented. Th...

BTC price 3-week highs greet US CPI — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week on a promising footing with BTC price action near one-month highs — can it last? In a new year’s boost to bulls, BTC/USD is currently surfing levels not seen since mid-December, with the weekly close providing cause for optimism. The move precedes a conspicuous macroeconomic week for crypto markets, with the December 2022 Consumer Price Index (CPI) print due from the United States. Jerome Powell, Chair of the Federal Reserve, will also deliver a speech on the economy, with inflation on everyone’s radar. Inside the crypto sphere, FTX contagion continues, with Digital Currency Group (DCG) at odds with institutional clients over its handling of solvency problems at subsidiary Genesis Trading. At the same time, under the hood, Bitcoin still shows signs of recove...

Price analysis 1/6: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

The United States December nonfarm payrolls report showed a growth of 223,000 jobs, above the market’s expectation of an increase of 200,000 jobs. While this shows that the economy remains strong, market observers shifted their focus to the slower wage growth of 0.3% for the month, below economists’ expectation of 0.4%. In addition, the euro zone’s headline inflation dropped from 10.1% in November to 9.2% in December. Both economic data boosted hopes that the central bank’s aggressive rate tightening may slow down. This triggered a rally in the U.S. and European stock markets. Daily cryptocurrency market performance. Source: Coin360 However, the reaction in the cryptocurrency space remains muted, with Bitcoin (BTC) continuing to trade inside a narrow range. The crypto investors...

Bitcoin price nears 3-week high as trader says sub-7% CPI may see $19K

Bitcoin (BTC) traded nearer $17,000 on Jan. 7 after the end of the year’s first trading week delivered a spike higher. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView All eyes on CPI Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it briefly passed the $17,000 mark the day prior. The pair had seen flash volatility on the back of fresh economic data from the United States, this nonetheless fading to leave the key level “unflipped” as resistance. Nonetheless, the brief uptick delivered Bitcoin’s highest price point since Dec. 20, 2022. Reacting, market participants continued to look to next week’s Consumer Price Index (CPI) print as a key potential catalyst for risk assets. “Unemployment will rally in the coming months. Yields will fall of a cliff if CPI is...

‘Big move brewing’ for BTC price? Bitcoin may stay flat, hints analyst

Bitcoin (BTC) traders are desperate for fresh BTC price volatility, but opinions are diverging on when it will come. BTC/USD is currently seeing some of the least volatile conditions in its history, price metrics show. Volatility far from guaranteed Since the FTX crisis, Bitcoin has settled into a historically narrow trading range which refuses to budge. Despite macro triggers, low-volume holiday trading and a yearly candle close, BTC price action has stuck rigidly to a zone focused on $17,000. This is the least volatile period in the history of the Bitcoin historical volatility index (BVOL), and other data likewise shows that such sideways behavior is extremely rare. Two months after FTX, traders and analysts alike are hotly debating when the breakout will come for BTC/USD — and in which ...

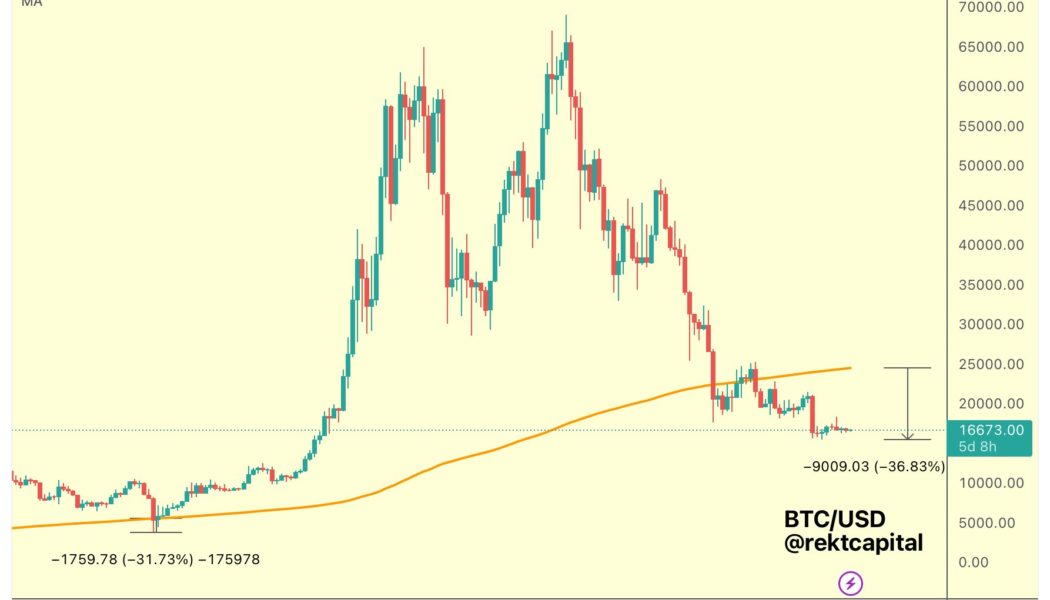

$16.8K Bitcoin now trades further below this key trendline than ever

Bitcoin (BTC) is now further below a key moving average than it was at the pit of the March 2020 COVID-19 crash. In a tweet on Jan. 4, popular trader and analyst Rekt Capital revealed just how remarkable the current Bitcoin bear market really is. BTC price 200-week moving average out of reach Not only has Bitcoin now spent more time below its 200-week moving average (WMA) than ever before, it is now further beneath it than at any time in history. Looking at the weekly BTC/USD chart, Rekt Capital confirmed that as of Jan. 4, BTC/USD traded around 37% below the 200 WMA. This, he noted, was “Deeper than the -31% retracement in March 2020.” The numbers provide interesting reading in a bear market which has yet to see BTC price retracements from all-time highs rival previous bottoms in percenta...