Bitcoin

Mt. Gox rumors panic Bitcoin Twitter as BTC price returns below $20K

Bitcoin (BTC) failed to keep $20,000 support on Aug. 27 as fears over a sell-off by users of defunct exchange Mt. Gox added to price pressures. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Mt. Gox rumors dismissed as “typical crypto” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it headed to new six-week lows, reaching $19,766 on Bitstamp. Thin weekend liquidity appeared to exacerbate already jittery markets, which reacted badly to unconfirmed rumors that Mt. Gox funds were due for release to creditors on Aug. 28. Claims varied widely at the time of writing, with some believing that a tranche of 137,000 BTC was set for release in one go. Others said that funds would be sent piecemeal, but that payouts would nonetheless begin this wee...

US stocks lose $1.25T in a day — more than entire crypto market cap

Bitcoin (BTC) and altcoins lost big on Aug. 26 after the United States Federal Reserve delivered hawkish remarks on economic policy. Across the board, risk assets took a major hit — U.S. equities shed around $1.25 trillion in a single session. Analyst: Powell retiring “soft landing” rhetoric As comments by Fed Chair, Jerome Powell, suggested that larger rate hikes were still firmly on the table despite recent data hinting that inflation was already slowing, investors rushed to cut risk. “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Powell said at the annual Jackson Hole economic symposium. The S&P 500 closed down 3.4% on the...

Bitcoin price briefly loses $20K on ‘bunch of nothing’ Powell speech

Bitcoin (BTC) analysts were keen to draw fresh price targets on Aug. 27 after the largest cryptocurrency briefly fell below $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Sub-$20,000 BTC price targets stay in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $19,945 on Bitstamp the night after hawkish comments from the United States Federal Reserve. Intraday losses for the pair neared 9% and United States equities cratered over the outlook for inflation policy, which looks to increasingly abandon the “soft landing” narrative. “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained...

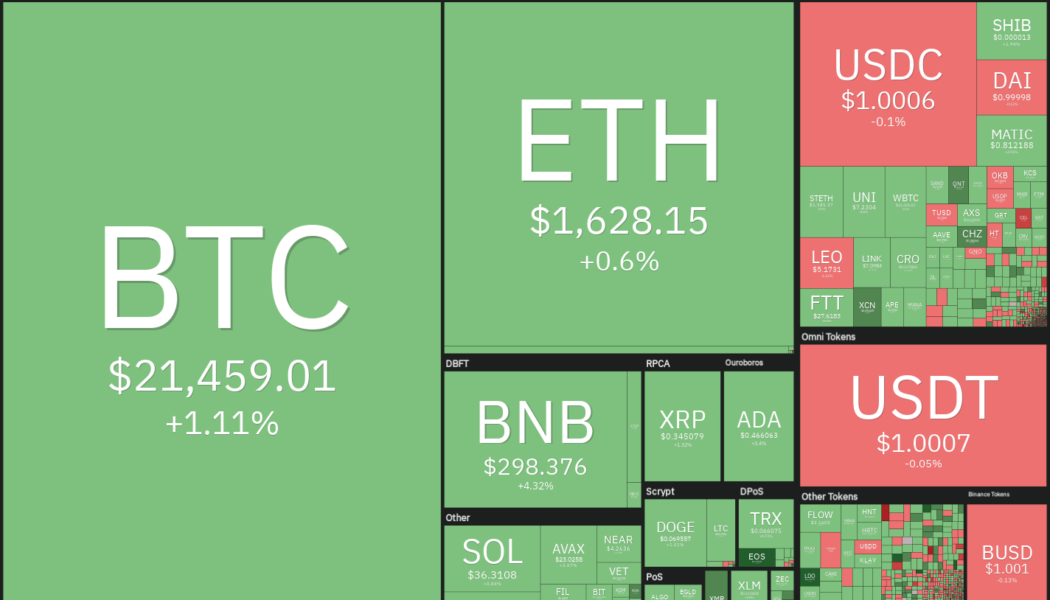

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Bitcoin price gains 3.5% as US PCE data supports shrinking inflation

Bitcoin (BTC) rose rapidly later on Aug. 26 as fresh economic data from the United States furthered hopes of a pivot from the Federal Reserve. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin bounces but preserves intraday trend Data from Cointelegraph Markets Pro and TradingView tracked a 3.55% rise for BTC/USD on the day, allowing the pair to match highs from earlier in the week. The move marked a surprise about-turn for Bitcoin, which hours before had seen selling pressure as markets awaited cues from Fed Chair Jerome Powell’s Jackson Hole symposium speech. With that speech still to come at the time of writing, abullish catalyst came in the form of the latest Personal Consumption Expenditures Price Index (PCE) readout, which was lower than expected. Analyst...

Bitcoin price taps $21.3K ahead of Fed Chair Powell Jackson Hole speech

Bitcoin (BTC) fell to daily lows on Aug. 26 as market nerves heightened into new macro triggers. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Pre-Fed blues hit BTC markets Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $21,332 on Bitstamp ahead of fresh commentary from Jerome Powell, Chair of the United States Federal Reserve. Part of the Fed’s Jackson Hole annual symposium, Powell was set to deliver a speech on the day that spectators hoped would provide new cues on economic policy going forward. With U.S. Consumer Price Index (CPI) inflation slowing since June, interest remained high over the extent of key interest rate hikes in September. Summarizing the current economic situation in the U.S., macro analyst David Hunter argued that the Fed w...

Prince Philip of Serbia suggests bringing Bitcoin into the classroom

Speaking to Cointelegraph over sandcastles at the Surfin’ Bitcoin 2022 event at Casino de Biarritz in France on Thursday, Prince Philip said he was “bullish on Bitcoin” in part because of the impact it could have on children’s education around the world. The prince, a self-described Bitcoin (BTC) maximalist, hinted that part of his keynote address at the crypto conference — only the second one for which he was a speaker — will focus on informing those in and out of the space of the potential benefits of Bitcoin. “Kids need to understand what Bitcoin is about,” said Prince Philip. “The main thing is the history of money — this is something that we weren’t taught in schools […] Education is getting worse as I can see it.” Citing an example from his own family, Prince Philip said his fo...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...

Warren Buffett pivots to U.S. Treasuries — a bad omen for Bitcoin’s price?

Warren Buffett has put most of Berkshire Hathaway’s cash in short-term U.S. Treasury bills now that they offer as much as 3.27% in yields. But while the news does not concern Bitcoin (BTC) directly, it may still be a clue to the downside potential for BTC price in the near term. Berkshire Hathaway seeks safety in T-bills Treasury bills, or T-Bills, are U.S. government-backed securities that mature in less than a year. Investors prefer them over money-market funds and certificates of deposits (COD) because of their tax benefits. Related: Stablecoin issuers hold more US debt than Berkshire Hathaway: Report Berkshire’s net cash position was $105 billion as of June 30, out of which $75 billion, or 60%, was held in T-bills, up from $58.53 billion at the beginning of 2022 o...

Here’s 5 cryptocurrencies with bullish setups that are on the verge of a breakout

The S&P 500 ended its four-week-long recovery last week after minutes from the Federal Reserve’s July meeting hinted that the central bank’s rate hikes will continue until inflation is under control. Members of the Fed said there was no evidence that inflation pressures appear be easing. Another dampener was the statement by St. Louis Fed president James Bullard who said that he would support a 75 basis point rate hike in September’s Fed policy meeting. This reduced hopes that the era of aggressive rate hikes may be over. Crypto market data daily view. Source: Coin360 Weakening sentiment pulled the S&P 500 lower by 1.29% for the week. Continuing its close correlation with the S&P 500, Bitcoin (BTC) also witnessed a sharp decline on Aug. 19 and is likely to end the week with ste...

3 reasons why the Bitcoin price bottom is not in

Bitcoin (BTC) recovered modestly on Aug. 20 but remained on course to log its worst weekly performance in the last two months. Bitcoin hash ribbons flash bottom signal On the daily chart, BTC’s price climbed 2.58% to $21,372 per token but was still down by nearly 14.5% week-to-date, its worst weekly returns since mid August. Nonetheless, some on-chain indicators suggest that Bitcoin’s correction phase could be coming to an end. That includes Hash Ribbons, a metric that tracks Bitcoin’s hash rate to determine whether miners are in accumulation or capitulation mode. As of Aug. 20, the metric is showing that the miners’ capitulation is over for the first time since August 2021, which could result in the price momentum switching from negative to positive. Bitcoin Hash R...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...