Bitcoin

Bitcoin hits new September high on US payrolls, G7 Russian energy cap

Bitcoin (BTC) passed $20,400 for the first time this month on Sept. 2 as United States economic data outperformed expectations. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Declining dollar accompanies BTC price rebound Data from Cointelegraph Markets Pro and TradingView showed BTC/USD approaching $20,500 after the Wall Street open, marking new highs for September. The pair had responded well to U.S. non-farm payroll data, which in August showed inflows dropping less than expected. A further boost came from news that the G7 had agreed to implement a price cap on Russian oil, with the European Union also planning to target the country’s gas imports. While the S&P500 and Nasdaq Composite Index both added 1.25% after the first hour’s trading, the U.S. dollar conversely fell...

Bitcoin squeeze to $23K still open as crypto market cap holds key support

Bitcoin (BTC) returned to $20,000 on Sep. 2 amid renewed bets on a “short squeeze” higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader eyes $20,700 short squeeze trigger Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering from another dip below the $20,000 mark on the day, continuing rangebound behavior. The pair gave little insight into which direction the next breakout could be, with opinions differing on the surrounding environment. Amid downside pressure on risk assets and a strong U.S. dollar, overall consensus appeared to favor long-term weakness continuing. For popular trader Il Capo of Crypto, however, there was still reason to believe that a relief bounce could enter first. Thanks to the majority of the market expecting immediate lo...

Former blockchain skeptic David Rubenstein discloses investments in crypto companies

Carlyle Group co-founder David Rubenstein acknowledged on Sept. 2 that he has invested personally in a number of crypto companies, and is optimistic about the industry’s path to regulation in the United States. Speaking with CNBC’S Squawk Box on Thursday, the billionaire said he believes that government regulation will be positive for the industry, and that the U.S. Congress will tak a collaborative approach to boost an innovation environment in the country. “The crypto constituency is very strong in congress [and] they tend to be very Republican [or] very libertarian,” he noted. “The industry is not likely to be soft when dealing with members of Congress.” Previously skeptical about cryptocurrencies, Rubenstein reportedly changed his mind ...

US dollar smashes yet another 20-year high as Bitcoin price sags 2.7%

Bitcoin (BTC) faced familiar pressure on the Sept. 1 Wall Street open as the U.S. dollar hit fresh two-decade highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: DXY could hit 115 before ‘slowdown’ Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell to $19,658 on Bitstamp, down 2.7% from the day’s high. The pair faced stiff resistance trying to flip the important $20,000 mark to solid support, with macro cues further complicating the picture for bulls. That came in the form of a resurgent U.S. dollar index (DXY) on the day, which beat previous peaks to reach 109.97, its highest since September 2002. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView Risk assets thus broadly lost ground, with the S&P 500 and Nas...

Bitcoin erases latest gains with BTC price back below $20K as dollar spikes

Bitcoin (BTC) fell back below $20,000 after the Aug. 30 Wall Street open as data showed hodlers selling at a loss. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView June lows look increasingly attractive Data from Cointelegraph Markets Pro and TradingView captured the latest dive below the 2017 bull market peak for BTC/USD, with United States equities dropping in step. The S&P 500 and Nasdaq Composite Index lost 1.1% and 1.25% in the first hour, respectively, while BTC/USD shed 2.5% during a single hourly candle. The latest moves came as no surprise to traders already wary of a deeper correction for the largest cryptocurrency. Previously, many had called for a retracement toward the macro lows seen in June. For popular trader Crypto Ed, both Bitcoin and Ether (ETH) offered go...

The number of crypto billionaires is growing fast, here’s why

Satoshi Nakamoto has more than 1 million BTC, making him the largest Bitcoin holder. He is followed by the founders of Grayscale and Binance, who together have about the same amount of BTC as Satoshi Nakamoto. When looking at the largest Bitcoin holders, there are a few parties that stand out. Of course, Satoshi Nakamoto, with a total of 1,100,000 BTC, has more significant holdings than number two and three holders of Bitcoin, namely Grayscale and Binance. These companies have over 600,000 BTC and 400,000 BTC, respectively, numbers that most Bitcoin investors can only dream of. Behind these top three Bitcoin holders are the cryptocurrency exchanges Bitfinex and OKX, both of which hold over 200,000 BTC. Then, with MicroStrategy and Block.one, there are two more parties that own more than 10...

Bitcoin threatens 20-month low monthly close with BTC price under $20K

Bitcoin (BTC) looked set to equal its lowest monthly close since 2020 on Aug. 28 as bulls failed to take control. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Odds stack up for a deeper dive below $20,00 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD criss-crossing $20,000 with hours until the weekly candle completed. The pair had been unable to make up for lost ground over the weekend, and just days from the end of the month, even $20,000 appeared vulnerable as support. At the time of writing, Bitcoin traded near $19,900 — below June’s closing price. BTC/USD 1-month candle chart (Bitstamp). Source: TradingView “It didn’t matter what kind of lines or squiggles you had on your charts,” on-chain monitoring resource Material Indicators summarized over ...

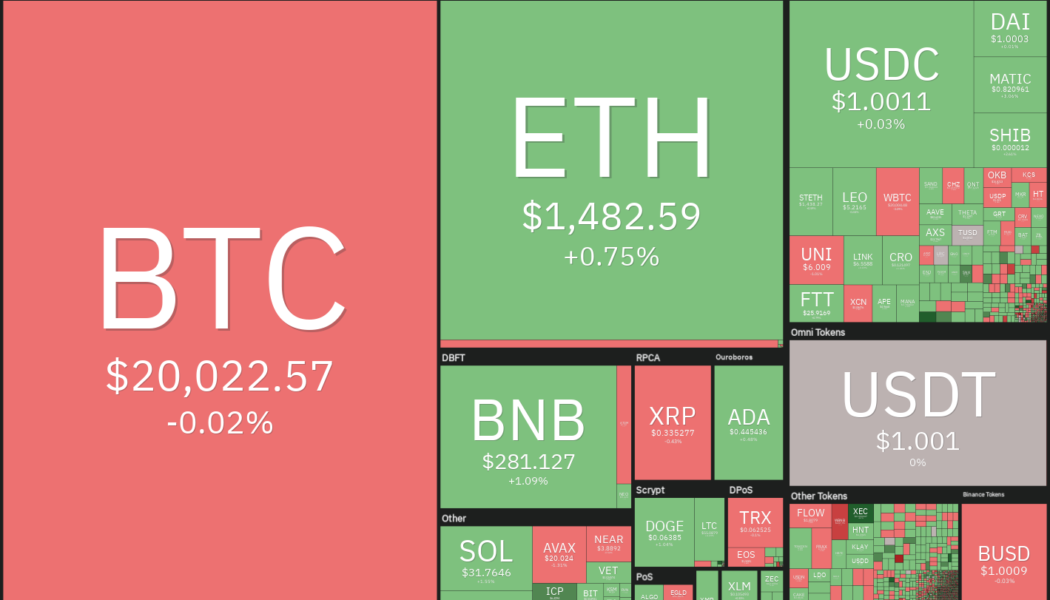

Rocky road lies ahead, but here’s 5 altcoins that still look bullish

The United States equities markets plunged on Aug. 26 following Federal Reserve Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Continuing its correlation with the equities market, Bitcoin (BTC) and the cryptocurrency markets also witnessed a sharp selloff on Aug. 26. Bitcoin has declined about 14% this month, making it the worst performance for August since 2015 when the price had dropped 18.67%. That may be bad news for investors because September has a dubious record of a 6% average loss since 2013, according to data from CoinGlass. Crypto market data daily view. Source: Coin360 Although buying in a downtrending market is not a good strategy, traders can keep a close watch on cryptocurrencies that are outperforming the markets because, in case of any ...

Bitcoin mining difficulty set for 8-month record gains despite BTC price dip

Bitcoin (BTC) may have hit six-week lows of under $20,000 but its network fundamentals are anything but bearish. The latest on-chain data shows that, far from capitulating, hash rate and difficulty are making snap gains. Data supports “doozy” difficulty jump Despite being down around 7% in a week, BTC/USD is not putting off miners, who have recently exited their own multi-month capitulation phase. Now, with hardware and competition returning to the network, fundamental indicators are firmly in “up only” mode as August draws to a close. This is neatly captured by difficulty — an expression of, among other things, the scale of competition among miners for block subsidies — which is due to increase by an estimated 6.8% next week. According to data from on-chain monitor...

Bitcoin risks worst August since 2015 as hodlers brace for ‘Septembear’

BItcoin (BTC) is on track to see its worst August performance since the 2015 bear market — and next month may be even worse. Data from on-chain analytics resource Coinglass shows that BTC/USD has not had an August this bad for seven years. September means average 5.9% BTC price losses After two major BTC price comedowns in recent weeks, Bitcoin hodlers are understandably fearful — but historically, September has delivered even worse performance than August. At $20,000, BTC/USD is down 14% this month, making this August the biggest loser since 2015, when the pair posted an 18.67% red monthly candle. Subsequent years have proven that August can be a mixed bag when it comes to BTC price performance — in 2017, for example, the largest cryptocurrency gained over 65% in a bullish record. One mon...

Why September is shaping up to be a potentially ugly month for Bitcoin price

Bitcoin (BTC) bulls should not get excited about the recovery from the June lows of $17,500 just yet as BTC heads into its riskiest month in the coming days. The psychology behind the “September effect” Historic data shows September being Bitcoin’s worst month between 2013 and 2021, except in 2015 and 2016. At the same time, the average Bitcoin price decline in the month is a modest -6%. Bitcoin monthly returns. Source: CoinGlass Interestingly, Bitcoin’s poor track record across the previous September months coincides with similar downturns in the stock market. For instance, the average decline of the U.S. benchmark S&P 500 in September is 0.7% in the last 25 years. S&P 500 performance in August and September since 1998. Source: Bloomberg Traditional chart a...

Millions of dollars in ETH lie unclaimed in presale wallets — but there’s a way to get them back

Out in the cryptosphere, there’s a vast amount of wealth that’s seemingly out of reach. A long-running statistic suggests four million Bitcoin — almost 20% of the total supply — has been lost forever. Much of it was mined when the network was just beginning, with early adopters tearing their hair out after losing their private keys. One Welshman has endured a nine-year battle as he attempts to receive a hard drive containing 7,500 BTC from landfill. But this isn’t the only treasure trove that’s worth exploring. For example, did you know that over 500 Ethereum presale wallets are yet to be recovered… and collectively, they have a value of several billion dollars? The presale for ETH — which is now the world’s second-largest cryptocurrency — took place bac...