Bitcoin

Bitcoin price cracks $21K as trader says BTC buy now ‘very compelling’

Bitcoin (BTC) circled $21,000 at the Sep. 9 Wall Street open as newly-won gains endured. Meanwhile, the total cryptocurrency market capitalization has crossed back above the $1 billion mark. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price gives “confirmation” of trend change Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as its “short squeeze” punished late bears. After a brief consolidation, the pair set new multi-week highs of $21,254 on Bitstamp, and now faced resistance in the form of an old support level abandoned in late August. For market commentators, however, the latest move had already proved decisive — and should favor bulls beyond short timeframes. “This impulse up is THE confirmation,” popular Twitter trader and ange...

BTC price nears $21.7K as whales boost Bitcoin ‘almost perfectly’

Bitcoin (BTC) sought to overturn August resistance on Sep. 10 as whale buy-levels dictated BTC price action. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Whales provide short-term price ceiling Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting new multi-week highs of $21,671 on Bitstamp. The pair capitalized on a short squeeze which began early on Sep. 9, taking it around 10% higher after plumbing the lowest levels since the end of June. Analyzing the events, on-chain monitoring resource Whalemap noted that clusters of buy-ins by whales had effectively allowed Bitcoin to put in a floor. $19,000 had been a high-volume zone of interest for buyers previously, and this thus remained unviolated during the visit to two-month lows. As Cointelegraph reported,...

Will Bitcoin’s rally sustain? DXY, SPX, GC and WTI could have the answer

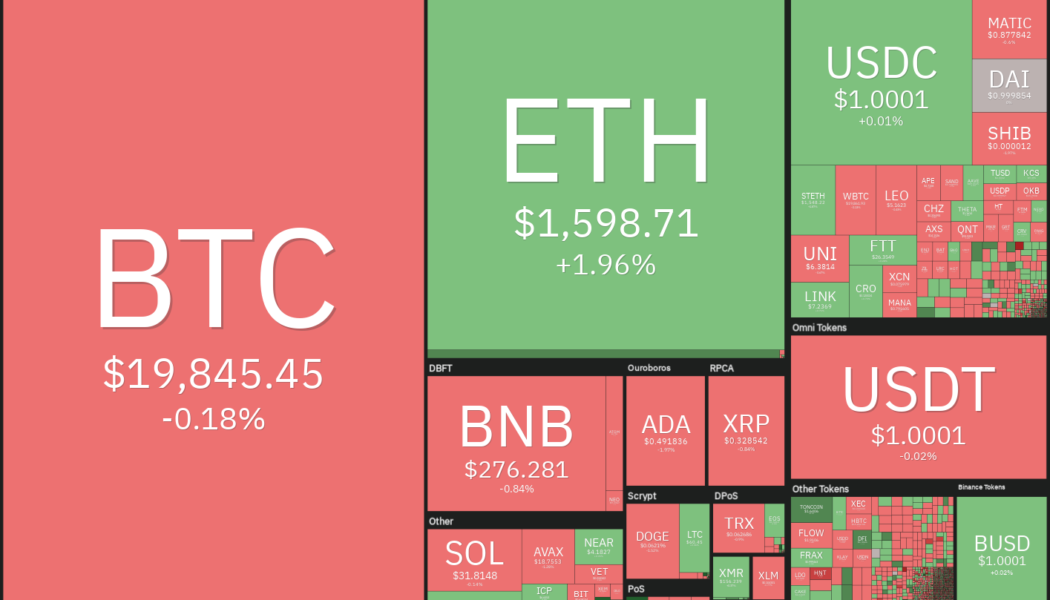

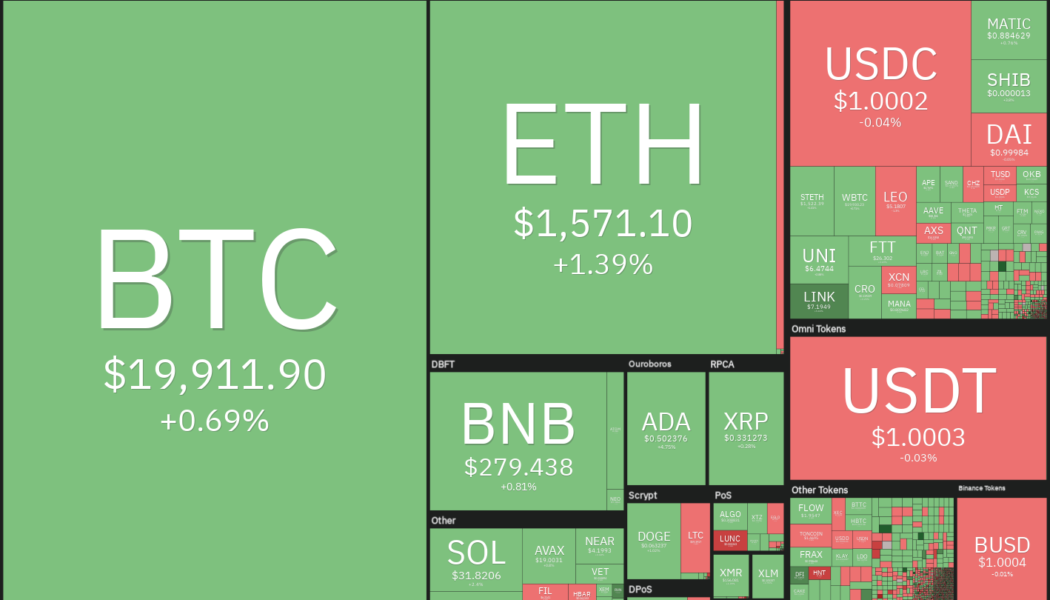

Federal Reserve Chairman Jerome Powell said in a question and answer session hosted by the Cato Institute on Sept. 8 that the central bank will continue to hike rates until inflation is under control. However, these comments did not rattle the markets as much as most would have anticipated, indicating that traders might have already factored in a 75 basis point rate hike in the Fed’s next meeting on Sept. 20–21. Bitcoin has been strongly correlated with the S&P 500 and inversely correlated with the United States dollar index (DXY) for the past several weeks. With the DXY cooling off after hitting a two-decade high, risky assets have been attempting a recovery. Crypto market data daily view. Source: Coin360 U.S. equities markets are attempting to snap a three-week losing streak while Bi...

Bitcoin analyst who called 2018 bottom warns ‘bad winter’ may see $10K BTC

Bitcoin (BTC) could dive another 50% from current levels if the upcoming winter proves a major test for Europe. That was the conclusion of a veteran crypto market analyst this week, with BTC/USD failing to reclaim $20,000 support. In an interview with Cointelegraph, Filbfilb, creator of trading suite Decentrader, forecast a potential BTC price bottom coming in at as low $10,000 in 2022. As the European energy crisis intensifies, risk assets face a major test, he believes, and the extent to which crypto suffers depends considerably on how diplomacy can win out to avert a major emergency into 2023. The figures are not just pie in the sky; at the height of the last halving cycle’s bear market in 2018, Filbfilb perfectly timed the market bottom as BTC/USD put in a floor of $3,100. Cointe...

Bitcoin price hits 10-week low amid ‘painful’ US dollar rally warning

Bitcoin (BTC) provided a long awaited breakout into Sept. 7 as BTC price action dashed bulls’ hopes of a recovery. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $23,000 relief bounce “still likely” says trader Data from Cointelegraph Markets Pro and TradingView captured snap losses for BTC/USD later on Sept. 6, with overnight lows coming in at $18,540 on Bitstamp. The pair put in its lowest levels since June 30, taking liquidity from the July floor and only marginally recovering on the day. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Downside price action followed almost a week of sideways movements and volatility was nowhere to be seen as market participants gritted their teeth hoping for an exit to the upside. In the event, they were left disappoi...

Traders say Bitcoin price bounce is overdue after a ‘massive’ BTC long position appears

Bitcoin (BTC) traded in an increasingly narrow range on Sept. 6 as bets piled in over an imminent breakout. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Binance futures giant sucks in spent BTC Data from Cointelegraph Markets Pro and TradingView showed BTC/USD staying under $20,000 for a fourth straight day with bulls failing to crack resistance. As many wondered when and how the latest consolidation phase would end, two popular social media traders noticed an ongoing accumulation trend by an unknown large-scale Binance futures trading entity. With retail investors selling, that entity had spent several days soaking up the liquidity, and the result was likely obvious. “Bounce incoming,” Il Capo of Crypto predicted in part of an update on the phenomenon, describing the entity...

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week

The decline in the United States equities markets last week extended the market-wide losing streak to three consecutive weeks. The Nasdaq Composite fell for six days in a row for the first time since 2019. The markets negative reaction to a seemingly positive August jobs report suggests that traders are nervous about the Federal Reserve’s future steps and its effects on the economy. Weakness in the U.S. equities markets pulled Bitcoin (BTC) back below $20,000 on Sept. 2 and bears sustained the price below the level during the weekend. This pulled Bitcoin’s market dominance to just under 39% on Sept. 4, its lowest level since June 2018, according to data from CoinMarketCap. Crypto market data daily view. Source: Coin360 Although the sentiment remains negative and it is difficult to call a b...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

Bitcoin market dominance plumbs 4-year lows as BTC price ditches $20K

Bitcoin (BTC) traded below $20,000 on Sep. 3 as commodities declined on news of a G7 Russian energy ban. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView All down after gloomy macro week Data from Cointelegraph Markets Pro and TradingView showed ongoing lackluster performance on BTC/USD, which traded around $19,800. The largest cryptocurrency looked increasingly unable to flip $20,000 to firm support as the weekend began, and the mood among market participants was jaded. Eyeing the 8-day exponential moving average (EMA), popular trader Cheds noted its strength as intraday resistance continuing into September. $BTC if you are trading this and not watching daily EMA 8 you are literally asleep at the wheel. No excuses https://t.co/cTGEHWQNYo pic.twitter.com/WwMmwCLFO5 — Cheds (@Big...

Are Bitcoin transactions anonymous and traceable?

It can be difficult to track Bitcoin transactions when people use various wallets and Bitcoin mixers. These factors disrupt the search process and take up a lot of time. Despite the fact that it is challenging for users of a Bitcoin wallet to conduct transactions completely anonymously, there are several ways to get close to anonymity. For example, it is possible to use a cryptocurrency mixer. In this case, it is a Bitcoin mixer, which ensures that it is more difficult to make Bitcoin traceable. This is done by mixing BTC transactions from different people together in a pool, then sending the transactions to the intended addresses. In addition, wallets can also be very difficult to monitor. If someone does not want their activities on the Bitcoin network to be traceable, it is possible to ...