Bitcoin

Golden cross vs. death cross explained

Compared to the golden cross, a death cross involves a downside MA crossover. This marks a definitive market downturn and typically occurs when the short-term MA trends down, crossing the long-term MA. Simply put, it’s the exact opposite of the golden cross. A death cross is usually read as a bearish signal. The 50-day MA typically crosses below the 200-day MA, signaling a downtrend. Three phases mark a death cross. The first occurs during an uptrend when the short-term MA is still above the long-term MA. The second phase is characterized by a reversal, during which the short-term MA crosses below the long-term MA. This is followed by the start of a downtrend as the short-term MA continues to move downward, staying below the long-term MA. Like golden crosses, ...

The floppening? Ethereum price weakens post-Merge, risking 55% drop against Bitcoin

Ethereum’s native token Ether (ETH) has been forming an inverse-cup-and-handle pattern since May 2021 on the weekly chart, which hints at a potential decline against Bitcoin (BTC). ETH/BTC weekly price chart featuring inverse cup-and-handle breakdown setup. Source: TradingView An inverse cup-and-handle is a bearish reversal pattern, accompanied by lower trading volume. It typically resolves after the price breaks below its support level, followed by a fall toward the level at a length equal to the maximum height between the cup’s peak and the support line. Applying the theoretical definition on ETH/BTC’s weekly chart presents 0.03 BTC as its next downside target, down around 55% from Sept. 16’s price. Can ETH/BTC pull a Dow Jones? Alternatively, the ...

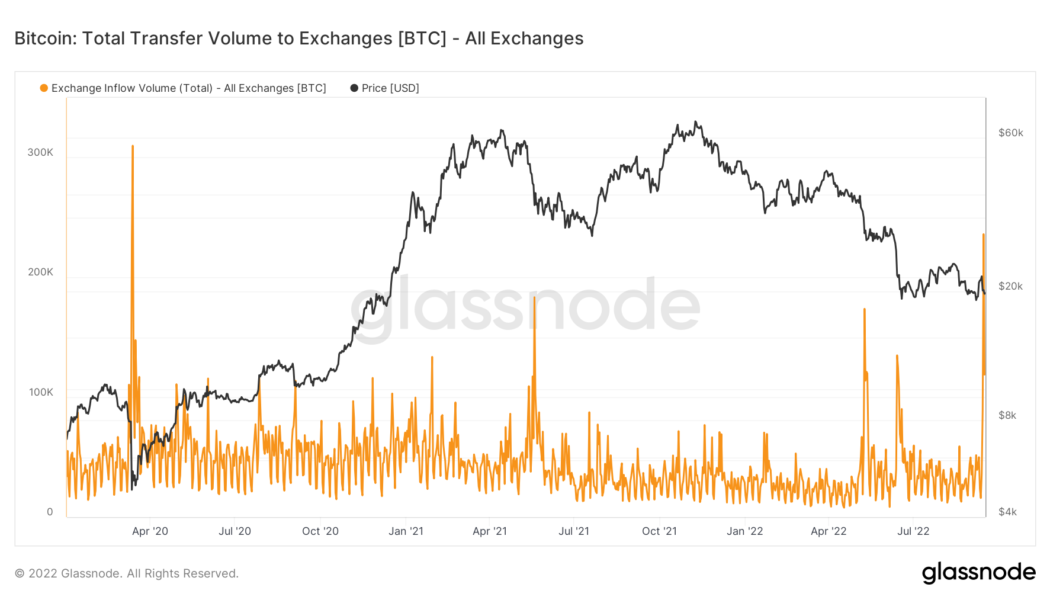

Bitcoin exchange inflows see biggest one-day spike since March 2020

Bitcoin (BTC) exchanges have seen huge volumes this month as price declines lead to renewed interest in trading. Data from sources including on-chain analytics firm Glassnode shows exchange inflows hitting their highest since March 2020. “The scent of volatility is in the air” On Sept. 14, over 236,000 BTC made its way to the 1 major exchanges tracked by Glassnode. This was the largest single-day spike since the chaos that surrounded Bitcoin’s dip to just $3,600 in March 2020. Bitcoin total transfer volume to exchanges chart. Source: Glassnode The sell-offs in May 2021 and May and June this year failed to match the tally, suggesting that more of the Bitcoin investor base is currently aiming to reduce exposure. Separate data from analytics firm Santiment covering both centralize...

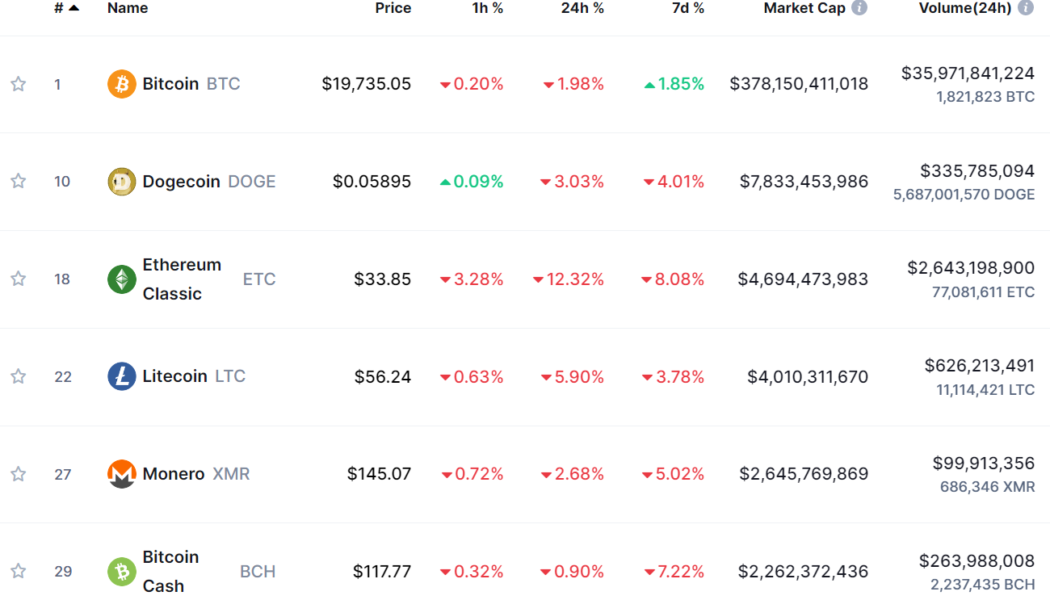

Dogecoin becomes second largest PoW cryptocurrency

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Ethereum Merge: Community reacts with memes, GIFs and tributes

It’s been less than a day since Ethereum’s historic transition to proof-of-stake, with most of the crypto community still abuzz with excitement following the successful Merge. On Sept. 15 at 06:42:42 UTC, the last Ethereum block using the old proof-of-work consensus mechanism was mined. Replacing it is an energy-efficient proof-of-stake consensus mechanism. Many crypto enthusiasts and climate advocates worldwide have been thrilled by the positive impact it will have on the environment and thus, crypto’s reputation. Others have just been in awe of the technological feat of upgrading an entire blockchain network without any stoppages. Ethereum Ethereum30 minutes ago Now pic.twitter.com/cyQb3pAdtt — WolfOfEthereum.eth ️ (@Crypto_Wolf_Of) September 15, 2022 Uniswap Labs founder and CEO ...

Bitcoin price loses $20K, ETH price drops 8% after ‘monumental’ Ethereum Merge

Bitcoin (BTC) spent a second day threatening $20,000 support on Sept. 15 as markets processed the Ethereum (ET Merge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC stuck between price magnets’ Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking below $20,000 again overnight to recover marginally above the boundary for a brief period. The largest cryptocurrency broadly failed to regain lost ground after surprise United States inflation data on Sep. 13 sent risk assets into a tailspin. Down 13.5% versus the week’s top at the time of writing, Bitcoin offered little inspiration to traders who were still eyeing further losses. Yes, we could pump from here. No, the bottom is not in. pic.twitter.com/dXYKngcQtR — Material Indicators (@MI_Algos) S...

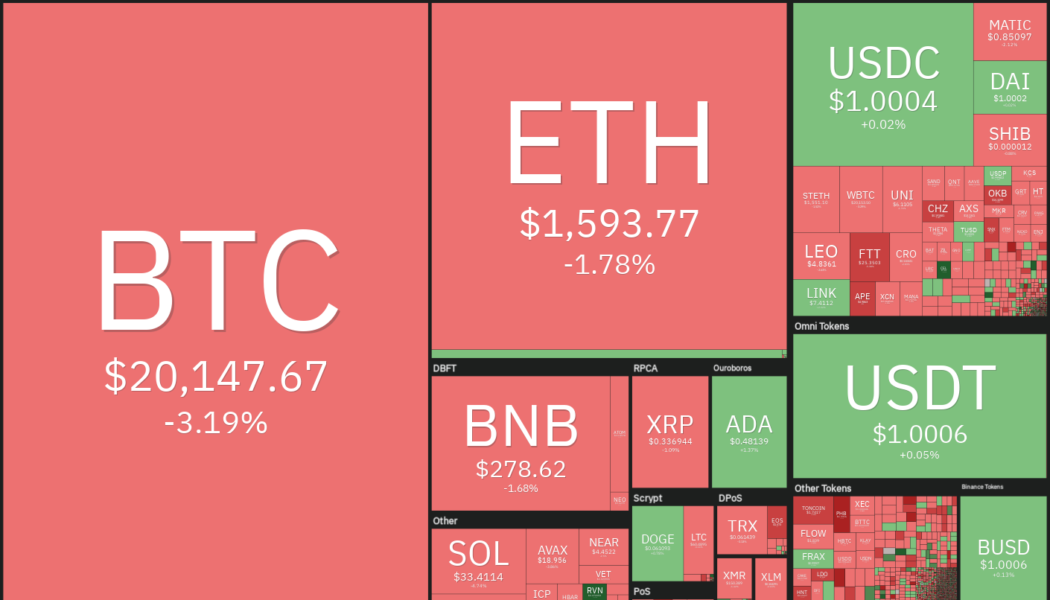

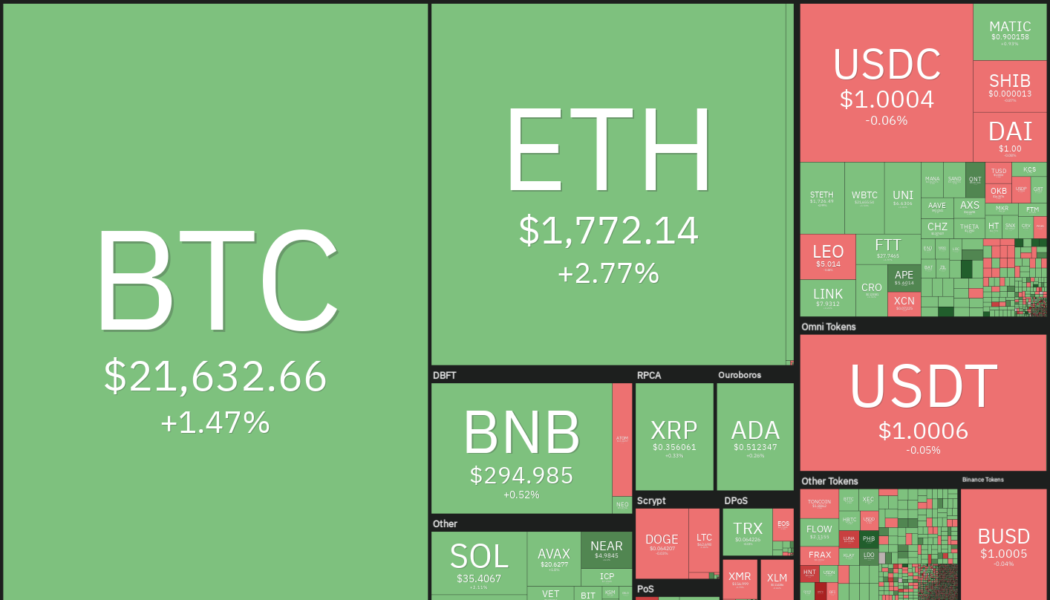

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

Bitcoin price sheds $1K in 3 minutes as US CPI inflation overshoots

Bitcoin (BTC) crashed below $22,000 instantly on Sep. 13 after United States inflation data failed to meet estimates. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI print sparks major crypto rout Data from Cointelegraph Markets Pro and TradingView showed BTC/USD swiftly falling $1,000 after Consumer Price Index (CPI) inflation for August came in at 8.3% year-on-year. Consensus had agreed that 8.1% would be the latest figure, and the overshoot suggested that inflation was not slowing at the expected pace. US CPI for August YoY coming in above expectations at 8.3% (expected 8.1%) but lower than in July with 8.5%. MoM core CPI coming in hot at 0.6% twice as high as the expected 0.3%. Not what the Fed wants to see. So 75bps it is at the next meeting? — Jan Wüstenfel...

Canadia’s new opposition leader is a Bitcoiner

Canadian politician and noted crypto advocate Pierre Poilievre has taken the helm of Canada’s Conservative Party, which looks set to give the current administration a run for its money in the next federal election. The pro-crypto politician reportedly won the leadership of the Conservative Party of Canada in a landslide victory on Sept. 10, securing 68.15% of the electoral points up for grabs, and far outpacing his nearest opponent Jean Charest who received just 16.07% of the vote. Poilievre has been a member of the Conservative Party since 2003, first winning office in the 2004 election. He has since served as a Member of Parliament for seven terms and held various roles including Shadow Minister for Finance and Minister of Employment and Social Development. Poilievre has been known...

Elon Musk, Cathie Wood sound ‘deflation’ alarm — Is Bitcoin at risk of falling below $14K?

Bitcoin (BTC) has rebounded by 20% to almost $22,500 since Sept. 7. But bull trap risks abound in the long run as Elon Musk and Cathie Wood sound an alarm over a potential deflation crisis. Cathie Wood: “Deflation in the pipeline” The Tesla CEO tweeted over the weekend that a major Federal Reserve interest rate hike could increase the possibility of deflation. In other words, Musk suggests that the demand for goods and services will fall in the United States against rising unemployment. A major Fed rate hike risks deflation — Elon Musk (@elonmusk) September 9, 2022 Typically, rate hikes have been bad for Bitcoin this year. In context, the period of the Fed raising its benchmark rates from near zero in March 2022 to 2.25%–2.50% in August 2022 has coincided wi...

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

Bitcoin short squeeze ‘not over’ as BTC price eyes 17% weekly gains

Bitcoin (BTC) stayed higher into the Sep. 10 weekly close as optimistic forecasts favored $23,000 next. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $23,000 targets remain in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $21,730 on Bitstamp overnight — the most since Aug. 26. The pair managed to conserve its prior gains despite low-volume weekend trading conditions being apt to amplify any weakness. Among analysts, excitement was palpable going into the new week, one which should prove pivotal for short-term crypto price action. The Ethereum (ETH) Merge and fresh United States inflation data were the top catalysts expected to influence the market. “Expect volatility to pick up around next week’s economic data,” on-chain monitoring res...