Bitcoin

Bitcoin still has $14K target, warns trader as DXY due ‘parabola’ break

Bitcoin (BTC) held $20,000 into Oct. 5 with trader targets still including a fresh high before rejection. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $21,000 upside target to precede new lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $20,470 on Bitstamp overnight before returning lower. The pair succeeded in maintaining the 2017 old all-time high as support, something on-chain analytics resource Material Indicators had hoped would endure as a positive sign. “BTC is still in a congested range,” it summarized in comments the day prior. “The retest of technical resistance at the 50-Day MA was rejected. Now I want to see a retest of support at the 2017 Top. Bulls may be losing momentum, but placed a buy wall at $20k to hold price up.” Material ...

Bitcoin price sees first October spike above $20K as daily gains hit 5%

Bitcoin (BTC) saw its first trip above $20,000 on Oct. 4 as traders expected familiar resistance to cap gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Multi-week dollar lows fuel Bitcoin bulls Data from Cointelegraph Markets Pro and TradingView showed BTC/United States dollar climbing prior to the Wall Street open, up over 5% in 24 hours. The pair had shaken off macroeconomic concerns at the start of the week, with trouble at Credit Suisse and the escalating Russia-Ukraine conflict failing to slow performance. Now, the short-term analysis focused on a run potentially topping out closer to $21,000 — as was the case late last month, as sell-side pressure at that level remained significant. “20500-21000 is a sell zone. If price gets there, which should, don’t be too bullis...

Bitcoin price starts ‘Uptober’ down 0.7% amid hope for final $20K push

Bitcoin (BTC) failed to hold $20,000 into the September monthly close as one trader eyed a final comeback before fresh downside. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader’s $20,500 upside target remains Data from Cointelegraph Markets Pro and TradingView showed BTC/USD staying lower after finishing the month at around $19,400. Capping 3% losses, the monthly chart failed to rally on Oct. 1, with BTC/USD down another 0.7% in “Uptober” so far, according to data from on-chain data resource Coinglass. BTC/USD monthly returns chart (screenshot). Source: Coinglass Dismal financial data from macro markets contributed to the lack of appetite for risk assets, and among crypto traders, the outlook remained gloomy. For popular Twitter account Il Capo of Crypto, a return ...

Bitcoin 2021 bull market buyers ‘capitulate’ as data shows 50% losses

Bitcoin’s (BTC) spot trading below $20,000 is seeing a new “capitulation” event encompassing an entire year’s worth of buyers, research reveals. In one of its Quicktake market updates on Sept. 29, on-chain analytics platform CryptoQuant flagged intense selling by a large number of recent hodlers. 2021 bull market coins “have been sold aggressively” As BTC/USD lingers near levels barely seen since 2020, it is not just miners feeling the pinch. Analyzing Bitcoin’s Exchange Inflow Spent Output Ages Bands (SOAB), CryptoQuant contributor Edris showed that those who bought between April 2021 and April 2022 have been selling coins en masse — for less than they bought them. “Looking at the chart, it is evident that coins aged between 6–18 months ago have been sold aggressively re...

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

So what if Bitcoin price keeps falling! Here is why it’s time to start paying attention

For bulls, Bitcoin’s (BTC) daily price action leaves a lot to be desired, and at the moment, there are few signs of an imminent turnaround. Following the trend of the past six or more months, the current factors continue to place pressure on BTC price: Persistent concerns of potential stringent crypto regulation. United States Federal Reserve policy, interest rate hikes and quantitative tightening. Geopolitical concerns related to Russia, Ukraine and the weaponization of high-demand natural resources imported by the European Union. Strong risk-off sentiment due to the possibility of a U.S. and global recession. When combined, these challenges have made high volatility assets less than interesting to institutional investors, and the euphoria seen during the 2021 bull market has largel...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

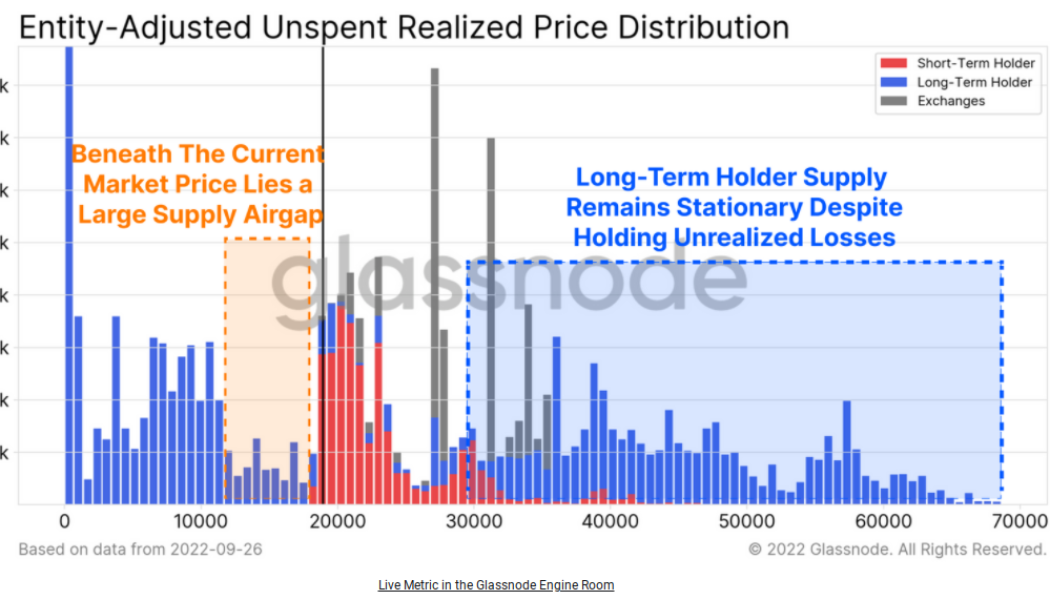

Bitcoin ‘great detox’ could trigger a BTC price drop to $12K — Research

Bitcoin (BTC) is in a “dire condition” when it comes to adoption — but a silver lining is already visible, new research says. In the latest edition of its weekly newsletter, the Week On-Chain, crypto analytics firm Glassnode said that Bitcoin was going through a “great detox.” Bitcoin adoption returns to March 2020 Current BTC price action is pressuring everyone from long-term holders (LTHs) to miners, and relief is hard to come by. Macro turmoil and resistance at $20,000 is keeping BTC/USD at levels visited only once since 2020. With this week’s push above $20,000 accompanied by major profit-taking, warnings remain that more pain is due for the market first before a recovery takes place. For Glassnode, sustained lower levels are causing a seismic shift in the Bitcoin investor profile, wit...

BTC price stays under $19K amid hopes Q4 will end Bitcoin bear market

Bitcoin (BTC) hit new weekly lows into Sept. 28 as risk asset drawdown continued overnight. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: “First new lows” before Q4 recovery Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling to $18,461 on Bitstamp, down almost $2,000 versus the previous day’s high. The change of direction came in lockstep with stocks, which turned red after initially heading marginally higher at the Wall Street open. The S&P 500 and Nasdaq Composite Index ultimately finished the day down 0.25% and up 0.25%, respectively. Crypto, however, failed to recoup its losses, and while hopes were for Q4 to bring about a more solid recovery, traders were betting on the pain continuing first. Popular Twitter account Il Capo of Crypto a...

Bitcoin price loses $20K as trader warns US dollar ‘not quite topped out’

Bitcoin (BTC) crossed under $20,000 after the Sept. 27 Wall Street open as United States equities inched higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. dollar has room to run — trader Data from Cointelegraph Markets Pro and TradingView confirmed the $20,000 mark barely remaining as tentative support on the day. BTC/USD had managed local highs of $20,344 on Bitstamp overnight, while retracing U.S. dollar strength gave modest relief to risk assets across the board. The S&P 500 and Nasdaq Composite Index had been up 0.4% and 0.65%, respectively, after two hours’ trading, but subsequently reversed. At the same time, the U.S. dollar index (DXY) was down 0.15% on the day, back below the 114 mark but still near its highest since mid-2002. “U.S. open coming up. Green ...

Bitcoin gains 5% to reclaim $20K, eyes first ‘green’ September since 2016

Bitcoin (BTC) delivered long-anticipated volatility on Sep. 27 as a squeeze higher resulted in a push beyond $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price 9-day highs greet traders Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it added over 7% after the Sep. 26 close. Local highs of $20,344 appeared on Bitstamp before the pair began consolidating at around $20,200. The move naturally did not go unnoticed by in trading circles, but opinions differed over the outcome, amid warnings that the whole episode may end up trapping overoptimistic traders taking late long positions. “No [rejection] yet, but soon. Expecting higher for now,” popular Twitter account Il Capo of Crypto summarized, sticking by a theory which demanded new lower lows...