Bitcoin

Bitcoin price ‘easily’ due to hit $2M in six years — Larry Lepard

Bitcoin (BTC) is on track to hit a massive $2 million within six years, asset management guru Lawrence “Larry” Lepard believes. In his latest appearance on the Quoth the Raven podcast Oct. 16, Lepard said that BTC/USD could “easily” deliver 100X returns from current prices. Lepard: “I personally believe Bitcoin’s going to go up 100X” With Bitcoin in a downtrend for almost a year, bullish BTC price predictions are few and far between. Lepard, already known for his optimism on both Bitcoin and precious metals, has become one of the lone voices forecasting a seven-figure BTC price tag in the current environment. In his podcast appearance, the Equity Management Associates founder revealed that he is still dollar-cost averaging into BTC — buying a fixed amount every week, regardless of the pric...

5 altcoins that could be ripe for a short-term rally if Bitcoin price holds $19K

The S&P 500 and the Nasdaq Composite fell to a new year-to-date low last week and closed the week with a loss of 1.55% and 3.11%, respectively. The scenario changed drastically on Oct. 17 after the earnings, season ramped up and a sharp policy reversal from U.K. Finance Minister Jeremy Hunt added detail to the government’s plan to fix his predecessor’s (Kwasi Kwarteng’s) fiscal package, which had triggered a record fall in the value of the GBP and a near liquidation of pension plans in the United Kingdom. At the time of writing, the Dow is up 1.78%, while the S&P 500 and Nasdaq present 2.57% and 3.26% respective gains. Meanwhile, Bitcoin (BTC) has managed to stay well above its year-to-date low showing short-term outperformance. Some analysts expect that Bit...

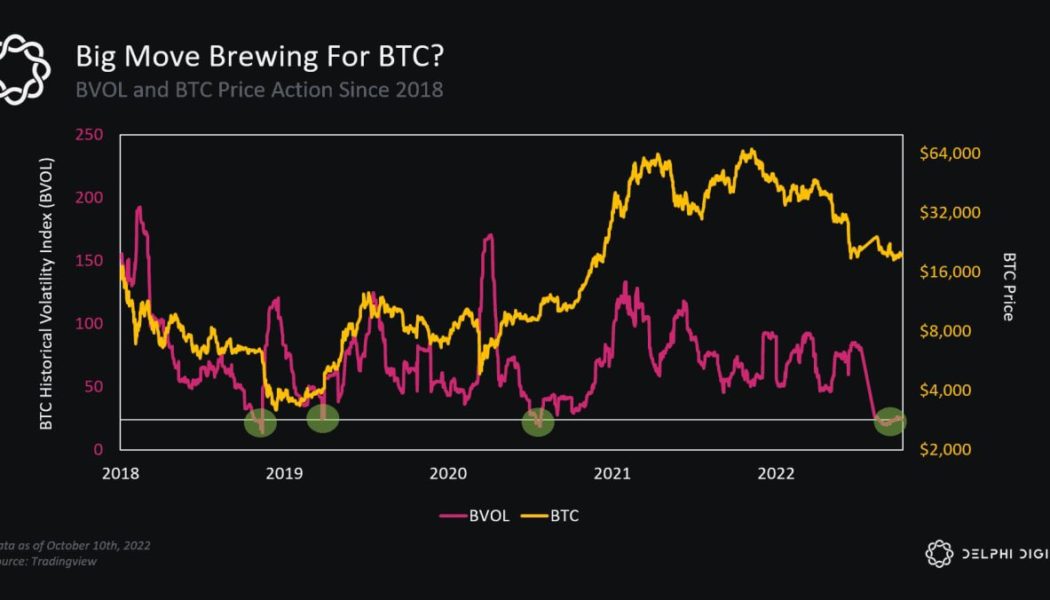

‘Get ready’ for BTC volatility — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week keeping everyone guessing as a tiny trading range stays in play. A non-volatile weekend continues a familiar status quo for BTC/USD, which remains just above $19,000. Despite calls for a rally and a run to lower macro lows next, the pair has yet to make a decision on a trajectory — or even signal that a breakout or breakdown is imminent. After a brief spell of excitement seen on the back of last week’s United States economic data, Bitcoin is thus back at square one — literally, as price action is now exactly where it was at the same time last week. As the market wonders what it might take to crack the range, Cointelegraph takes a look at potential catalysts in store this week. Spot price action has traders dreaming of breakout For Bitcoin traders, it is a ca...

Bitcoin clings to $19K as trader promises capitulation ‘will happen‘

Bitcoin (BTC) stayed rigidly tied to $19,000 into the Oct. 16 weekly close as analysts warned that volatility was long overdue. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: BTC volatility a “matter of time” Data from Cointelegraph Markets Pro and TradingView captured a lackluster weekend for BTC/USD as the pair barely moved in out-of-hours trading. After United States economic data sparked a series of characteristic fakeout events over the week, Bitcoin returned to its original position, and at the time of writing showed no signs of leaving its established range. For Michaël van de Poppe, founder and CEO of trading platform Eight, it was a question of not if, but when unpredictability would return to crypto. “Matter of time until massive volatility is going to...

Bitcoin trader predicts $18K return within days as stocks wilt post-CPI

Bitcoin (BTC) cooled near $19,200 after the Oct. 14 Wall Street open as stocks struggled to preserve their “bear trap.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: “Abandon all hope” for asset price rebound Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it came off one-week highs on the day to circle $19,300. The pair had seen intense volatility on the back of United States economic data the day prior, this sparking hundreds of millions of dollars in liquidations from both long and short positions. Now, after turning the tables and adding almost $2,000 in 24 hours, Bitcoin was again losing momentum as U.S. equities turned red on the day. At the time of writing, the S&P 500 was down 1.9%, while the Nasdaq Composite Index trad...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

‘No emotion’ — Bitcoin metric gives $35K as next BTC price macro low

Bitcoin (BTC) is showing textbook macro bottom signs in a “business as usual” bear market, data suggests. In fresh findings published on Oct. 13, popular Twitter trader Alan revealed that BTC price action is closely mimicking prior cycles. Trader on Stoch data: “Don’t be shaken out” While some are concerned about the current state of Bitcoin and crypto markets, on-chain indicators have long suggested that the 2022 bear market is comfortingly similar to previous ones. Eyeing the one-month stochastic chart for BTC/USD, Alan highlighted Bitcoin repeating a structure common to both the 2014 and 2018 bear markets. Stochastic oscillators are classic tools for identifying price cycles and bullish and bearish interplay. Bitcoin has proved to be no exception, with monthly low Stoc...

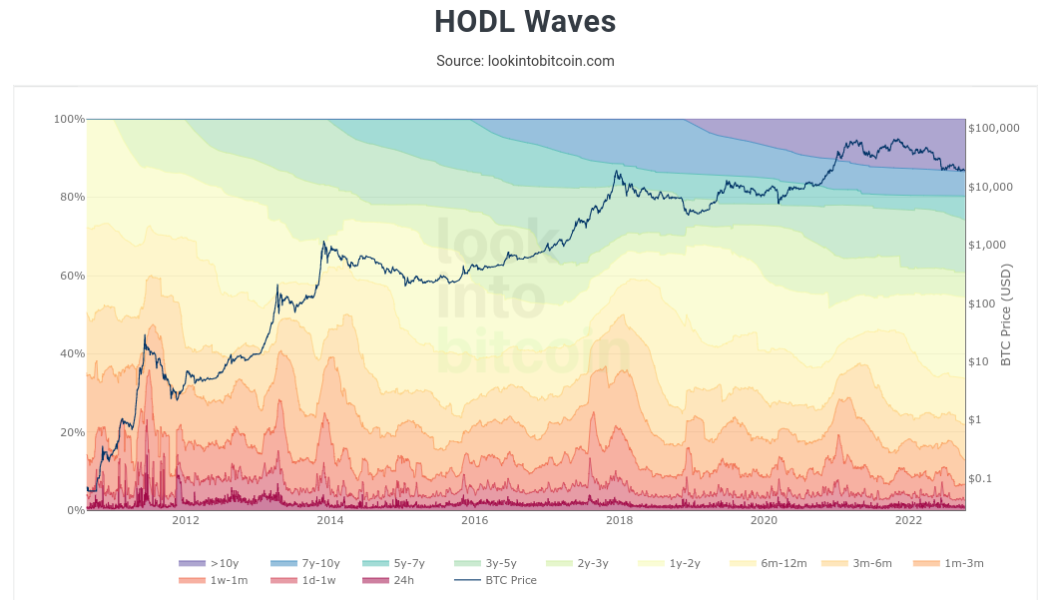

Bitcoin bear market will last ‘2-3 months max’ —Interview with BTC analyst Philip Swift

Bitcoin (BTC) may see more pain in the near future, but the bulk of the bear market is already “likely” behind it. That is one of many conclusions from Philip Swift, the popular on-chain analyst whose data resource, LookIntoBitcoin, tracks many of the best-known Bitcoin market indicators. Swift, who together with analyst Filbfilb is also a co-founder of trading suite Decentrader, believes that despite current price pressure, there is not long to go until Bitcoin exits its latest macro downtrend. In a fresh interview with Cointelegraph, Swift revealed insights into what the data is telling analysts — and what traders should pay attention to as a result. How long will the average hodler need to wait until the tide turns and Bitcoin comes storming back from two-year lows? Cointelegraph (CT): ...

Bitcoin ‘bear trap’ sees BTC price near $20K as daily gains top 9%

Bitcoin (BTC) delivered more surprises into Oct. 14 as the reaction to macro triggers saw a sudden run at $20,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto smoke shorts Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to one-week highs, gaining almost $2,000 in hours. After the United States Consumer Price Index (CPI) print for September came in above expectations, an initial crypto rout put bulls on edge, but the pain was short lived. Bitcoin ultimately ran higher than its pre-CPI levels, following stocks which were described as delivering the “biggest bear trap of 2022.” “That’s gotta be the biggest bear trap I’ve seen so far,” popular Twitter trading account Stockrocker reacted. “Even I was starti...

Best Bitcoin Casinos In The USA Today: Crypto Betting Sites & Bonuses

Best Bitcoin Casinos In The USA Today United States Search The query length is limited to 70 characters Home News best bitcoin casinos usa today crypto betting sites bonuses You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

‘Violent’ Bitcoin breakout due as BTC open interest nears all-time high

Bitcoin (BTC) stayed rangebound at the Oct. 6 Wall Street open with traders already planning for a “violent” breakout. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin whale activity highlights the importance of $19,000 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it moved up and down by only a matter of a few hundred dollars on the day. The amount of $20,000 formed a focus for the pair, which meandered in step with consolidating U.S. equities and dollar strength. With no spot catalyst in sight on short timeframes, on-chain analytics resource Whalemap turned to largescale buy and sell points to sketch out likely support and resistance. To the downside, $19,174 marked the site of whale buy-ins, suggesting its continued strength as a line in the ...

BTC to outperform ‘most major assets’ in H2 2022 — Bloomberg analyst

Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, stated October has historically been the best month for Bitcoin (BTC) since 2014, averaging gains of about 20% for the month, and that commodities appearing to peak could imply that Bitcoin has reached its bottom. In an Oct. 5 Bloomberg Crypto Outlook report, McGlone says while the rise of interest rates globally is putting downwards pressure on most assets, Bitcoin is gaining the upper hand when compared with commodities and tech stocks like Tesla, with the report noting: “When the ebbing economic tide turns, we see the propensity resuming for Bitcoin, Ethereum, and the Bloomberg Galaxy Crypto Index to outperform most major assets.” McGlone notes that Bitcoin has its lowest ever volatility against the Bloomberg Comm...