Bitcoin

BTC price sees ‘double top’ before FOMC — 5 things to know in Bitcoin this week

Bitcoin (BTC) begins a key week of internal and macroeconomic events still trading above $20,000. After its highest weekly close since mid-September, BTC/USD remains tied to higher levels within a macro trading range. The bulls have been keen to shift the trend entirely, while warnings from more conservative market participants continue to call for macro lows to enter next. So far, a tug-of-war between the two parties is what has characterized BTC price action, and any internal or external triggers have only had a temporary effect. What could change that? The first week of November contains a key event that has the potential to shape price behavior going forward — a decision by the United States Federal Reserve on interest rate hikes. In addition to other macroeconomic data, this will form...

Bitcoin price due sub-$20K dip, traders warn amid claim miners ‘capitulating’

Bitcoin (BTC) climbed back to $20,500 at the Oct. 28 Wall Street open as United States equities sought a stronger finish to the week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets that $20,000 will fail as support increase Data from Cointelegraph Markets Pro and TradingView showed BTC/USD capitalizing on renewed optimism as markets began trading. The atmosphere was volatile after tech stocks suffered a major out-of-hours rout, with Bitcoin managing to avoid sustaining knock-on losses to the same extent. At the time of writing, the S&P 500 and Nasdaq Composite Index were both up around 1.3%. “In this current range bound phase after a prolonged downtrend,” popular trader CryptoYoddha summarized to Twitter followers. “Smart money/Institutional players aim to build up or...

BTC price struggles at $21K as trader says ‘top is in’ for Bitcoin, Ethereum

Bitcoin (BTC) continued consolidating into the Oct. 30 weekly close as concerns over a deeper retracement became vocal. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader avoids new longs below $21,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling levels just below $21,000 on the day. Weekend trading had produced an early return above the $21,000 mark, this being short-lived as Bitcoin bulls failed to offer the volume to sustain higher levels. Now, popular pseudonymous trader and analyst il Capo of Crypto sensed a change of direction was ultimately due for Bitcoin and altcoins alike. Altcoins themselves had also performed strongly through the weekend, notably led by Dogecoin (DOGE), which was up another 25% in the past 24 hours at the time of w...

BNB jumps to new BTC all-time high as Elon Musk’s Twitter fuels DOGE bulls

BNB (formerly known as Binance Coin) has hit new all-time highs against Bitcoin (BTC) as excitement grows over the cryptocurrency’s future role on Twitter. BNB/BTC 1-month candle chart (Binance). Source: TradingView BNB sets new record against BTC Data from Cointelegraph Markets Pro and TradingView confirms that BNB/BTC briefly spiked above 0.15 BTC to a record 0.15267 BTC on Oct. 30. BNB, the in-house token of Binance, the largest crypto exchange by volume, has gained around 10% in the past 72 hours. The strong performance came on the back of reports that Binance was preparing to assist Twitter in eradicating bots as part of its new direction under Elon Musk. Binance had contributed $500 million to Musk’s takeover of the social media platform. “Our intern says we wired the $500 ...

Cowboy hats, boots, guns and crypto talk with Dan Held

Bitcoiner Dan Held gave journalist Nicole Behnam a true Texan welcome to Austin while the pair discussed their individual paths into the world of crypto. Dan Held is a household name in the world of Bitcoin (BTC), while Nicole Behnam is a journalist turned cryptocurrency and NFT enthusiast. Together, the pair explored Held’s hometown of Austin, Texas, getting a taste of local life while delving into their journeys into the cryptocurrency space. [embedded content] Held took Behnam to a local gun range to start things off, with the pair getting the chance to shoot a rare World War II-era German MP40. Behnam then grabbed her first cowboy hat from a local store and matched that with a pair of boots before the pair rounded off their thoughts on the cryptocurrency space. Related: How CZ bui...

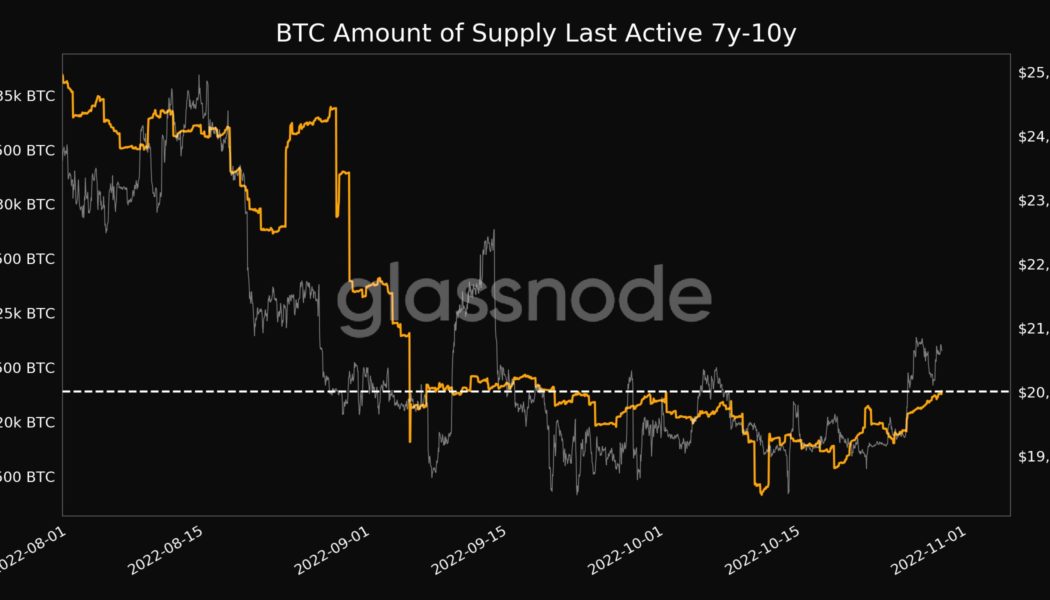

Bitcoin metric warns of $21K profit-taking as decade-old BTC wakes up

Bitcoin (BTC) asleep for up to a decade is waking up this week as BTC price action sees six-week highs. Data from on-chain analytics firm Glassnode shows some of the oldest “dormant” Bitcoin returning to circulation. BTC trends out of hibernation As BTC/USD stages something of a comeback in the second half of October, hodlers are changing their behavior after a year-long bear market. According to Glassnode, the number of Bitcoin previously stationary in their wallet for 7-10 years but not active again reached a one-month high on Oct. 29. This is in fact the latest in a series of such highs, with the previous one seen on Oct. 1. BTC amount of supply last active 7-10 years ago chart. Source: Glassnode/ Twitter Further numbers reveal that the unspent transaction outputs (UTXOs) in profit reac...

Bitcoin hits new 6-week high as Ethereum liquidates $240M more shorts

Bitcoin (BTC) attempted to retake $21,000 on Oct. 29 as weekend trading began on a strong footing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar lurks as BTC price rebounds Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it rebounded overnight to local highs of $21,078 on Bitstamp — enough to clinch new six-week highs. The pair had seen a consolidatory phase ensue after its first trip to the $21,000 mark, the first time it had traded above $21,000 since Sep. 13. The subsequent retracement was modest in character, Bitcoin not even testing $20,000 before reversing higher once more. The end of the Wall Street trading week saw BTC price action follow United States equities, the S&P 500 and Nasdaq Composite Index finishing Oct. 28 up 2.5% and 2.9...

Ethereum sets record ETH short liquidations, wiping out $500 billion in 2 days

Ether (ETH) is setting liquidation records this week as a comparatively modest price uptick reveals how bearish the market has become. Data from on-chain analytics platform CryptoQuant confirmed that United States dollar-denominated short liquidations hit a new all-time high on Oct. 25. Two days, half a billion dollars of ETH shorts It is not just Bitcoin (BTC) causing the bears severe pain this week — data from exchanges also shows that Ethereum shorters have suffered heavy losses. ETH/USD delivered fairly impressive gains on Oct. 25-26, rising from lows of $1,337 to highs of $1,593 on Bitstamp before retracing, according to data from Cointelegraph Markets Pro and TradingView. ETH/USD 1-day candle chart (Bitstamp). Source: TradingView While nothing unusual for crypto and for altcoins, in ...

Bitcoin price reaches $21K as crypto market cap nears $1T

Bitcoin (BTC) returned to $21,000 for the first time since September after the Oct. 26 Wall Street open as buyers solidified gains. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls “eat” ask liquidity Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it hit local highs of $21,012 on Bitstamp. At the time of writing, the pair continued to explore territory out of reach for over six weeks. Liquidations also kept flowing, with the past 24 hours delivering $750 million in liquidated positions on Bitcoin alone, according to data from Coinglass. Cross-crypto liquidations totaled $1.43 billion, adding to what was already the highest tally in 2022 so far. Crypto liquidations chart. Source: Coinglass The impetus did not come from United States equities on ...

Bitcoin liquidates over $1 billion as BTC price hits 6-week highs

Bitcoin (BTC) saw its highest levels since mid-September on Oct. 26 as BTC/USD approached the pivotal $21,000 mark. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bears lose big as Bitcoin climbs Data from Cointelegraph Markets Pro and TradingView showed the pair tackling $20,700 at the time of writing, up over 7% in 24 hours. What began as an assault on $20,000 continued on the day, liquidations mounting further after already sealing the biggest shorts obliteration of 2022. According to data from analytics resource Coinglass, Bitcoin alone accounted for $550 million in liquidations in the past 24 hours. $704 million in cross-crypto shorts were liquidated on Oct. 25, with the Oct. 26 tally so far standing at $275 million. Including long positions, the total was over $1 billion...

HK and Singapore’s mega-rich are eyeing crypto investments: KPMG

Hong Kong and Singapore’s wealthy elite appear to be looking at digital assets with fervor, after a new report from KPMG suggesting over 90% of family offices and high-net-worth individuals (HNWI) are interested in investing in the digital assets space or have already done so. According to an Oct. 24 report from KPMG China and Aspen Digital titled “Investing in Digital Assets,” as much as 58% of family offices and HNWI of respondents in a recent survey are already investing in digital assets, and 34% “plan to do so.” The survey took the pulse from 30 family offices and HNWIs in Hong Kong and Singapore with most respondents managing assets between $10 million to $500 million. KPMG said the large crypto uptake among the ultra-wealthy has increased confidence in the sector, spurred...