Bitcoin Regulation

Coinone will stop withdrawals to unverified external wallets

South Korean crypto exchange Coinone has announced it plans to no longer allow withdrawals of tokens to unverified external wallets starting in January. In a Wednesday announcement, Coinone said users would have from Dec. 30 to Jan. 23 to register their external wallets at the exchange, after which time it would restrict withdrawals. The exchange specified that crypto users could only register their own wallets, and the verification process “may take some time” and could change in the future. According to Coinone, it planned to verify users’ names and resident registration numbers — issued to all residents of South Korea — to ensure crypto transactions were “not used for illegal activities such as money laundering.” Customers at the exchange likely won’t be able to withdraw funds to wallet...

Law Decoded: Three regulatory trends of 2021, Dec. 20–27

It is that time of the year: Singular events must be abandoned in favor of end-of-year, big-picture narratives and yearly lessons learned. As many governments across the globe finally had to face the rapidly mainstreaming realm of digital finance, the year is packed with developments in crypto policy and regulation that are impossible to fit into a neat little summary. However, it is possible to try and distill several major trends that have come to the fore during the past 12 months, and that will keep shaping the relationship among societies, state power and the crypto space as we roll into 2022. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the last week, register for the full newsletter below. U.S. Congress notic...

US lawmaker planning to introduce comprehensive crypto bill in 2022: report

Wyoming Senator Cynthia Lummis, one of the United States lawmakers behind many pro-crypto pieces of legislation, is planning to introduce a comprehensive bill next year to handle digital assets. In a Thursday report, Bloomberg said Lummis’ proposed bill aimed to provide regulatory clarity on stablecoins, guide regulators as to which cryptos belong to different asset classes and offer consumer protections. In addition, the U.S. senator reportedly proposed creating an organization under the joint jurisdiction of the Securities and Exchange Commission and the Commodity Futures Trading Commission to oversee the crypto market. On Twitter, Lummis called for U.S. voters to reach out to their respective senators to support the bill, saying she was looking for bipartisan cosponsors. The Wyomi...

Arsenal football club in dispute with ASA over ‘irresponsible’ crypto ad

The Advertising Standards Authority (ASA), a body that oversees advertising in the United Kingdom, is cracking down on non-compliant crypto advertisements. Earlier this year, Arsenal became one of the many football clubs to collaborate with blockchain firm Chiliz and launch a fan token. On Aug. 12 this year, the club promoted its fan token AFC on its official Facebook page, which the ASA has banned for allegedly violating its advertising rules. The agency stated that the post did not highlight the risks involved in the investment. In a different event, as per a BBC report, the monitor claims that the topic of content on Arsenal’s official website — particularly, a page published on Aug. 6, 2021, with the title “$AFC Fan Token: Everything you need to know” — was violating advertising ...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

Senate hearing on stablecoins: Compliance anxiety and Republican pushback

On Dec. 14, the United States Senate Banking, Housing and Urban Affairs Committee held a hearing titled “Stablecoins: How Do They Work, How Are They Used, and What Are Their Risks?” The testimonies, both spoken and written, focused largely on the last two issues, as anxieties over Know Your Customer compliance and the U.S. dollar inflation threat dominated the discussion. Held less than a week after the House of Representatives Financial Services Committee’s hearing on digital assets, which was generally perceived as “constructive”, the meeting held by the Banking Committee was expected to be tough. Senator Sherrod Brown, a Democrat from Ohio who chairs the Committee and had called the hearing, is infamous for his critical stance on the crypto industry, and the November report from Preside...

Law Decoded: A different Congress hearing, Dec. 6–13

The biggest regulatory story of the week was a United States House Committee on Financial Services hearing squarely focused on crypto. Even the event’s title — “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States” — conveyed a different vibe than countless previous Congressional meetings that had been first and foremost about investor protection or security risks or threats to financial stability. Judging from reactions from many industry participants and experts, the exchange has been received as an overwhelming net positive, with legislators asking informed questions and otherwise acting like their goal was to understand this new thing rather than act on preconceived notions. Of course, there were tired qu...

SEC chair’s regulatory agenda fails to include clarity on crypto, says Hester Peirce

Hester Peirce, a commissioner for the United States Securities and Exchange Commission known by many in the space as Crypto Mom, is pushing back against the regulatory body’s agenda for not including clarification on digital assets. In a Monday joint statement, Peirce and SEC Commissioner Elad Roisman said they were “disappointed” in the failure of chairperson Gary Gensler’s regulatory agenda to include items aimed at helping companies raise capital, furthering investor protection, undoing recent rules passed by the commission and providing clarification on crypto. According to the two regulators, Gensler’s uncertain stance on digital assets may create problems for firms looking to operate in the space. “Rather than taking on the difficult task of formulating rules to allow investors and r...

Point of no return? Crypto investment products could be key to mass adoption

The first Bitcoin (BTC) futures exchange-traded fund (ETF) was launched in the United States back on October 19, 2021. Since then, a number of other cryptocurrency investment products have been launched in various markets. That first ETF, the ProShares Bitcoin Strategy ETF, quicklybecame one of the top ETFs of all time by trading volume on its debut, and soon after, several other Bitcoin futures ETFs were launched in the United States, providing investors with different investment options. To Martha Reyes, head of research at cryptocurrency trading platform Bequant, these options are important. Speaking to Cointelegraph, Reyes pointed out that in traditional finance, ETFs have “proved to be incredibly popular in recent years, with ETF assets expected to reach $14 trillion by 2024.” Reyes s...

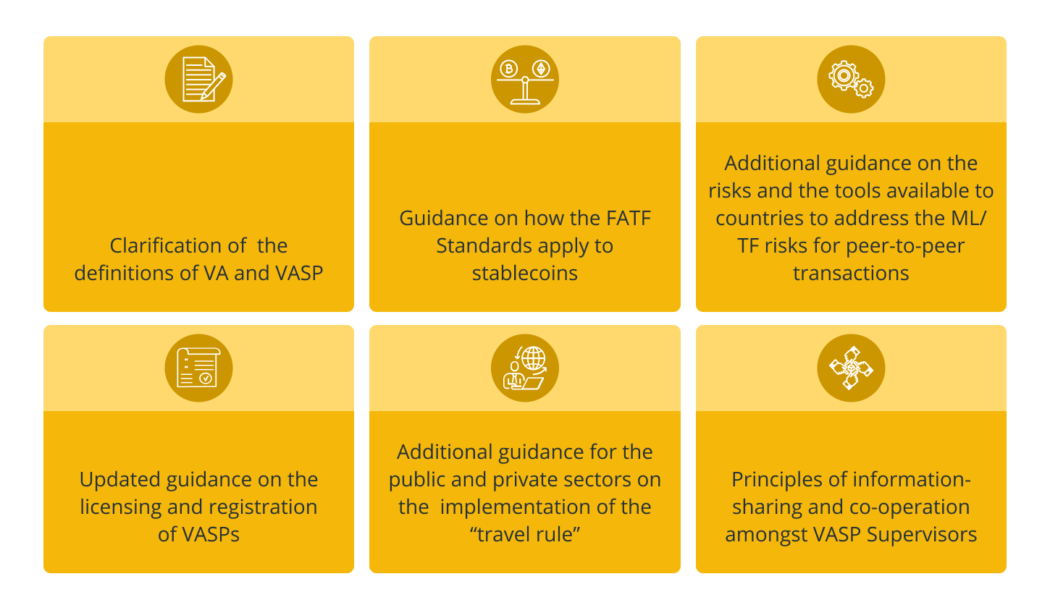

FATF guidance on virtual assets: NFTs win, DeFi loses, rest remains unchanged

The Financial Action Task Force (FATF) released its long-awaited guidance on virtual assets, laying out standards that have the potential to reshape the crypto industry in the United States and around the world. The guidance addresses one of the most important challenges for the crypto industry: To convince regulators, legislators and the public that it does not facilitate money laundering. The guidance is particularly concerned with the parts of the crypto industry that have recently brought about significant regulatory uncertainty including decentralized finance (DeFi), stablecoins and nonfungible tokens (NFTs). The guidance largely follows the emerging approach of U.S. regulators toward DeFi and stablecoins. In a positive note for the industry, the FATF is seemingly less aggressive towa...