Bitcoin Regulation

Law Decoded: First-mover advantage in a CBDC conversation, Jan. 10–17

Last week saw an unlikely first move in the opening narrative battle around a prospective U.S. central bank digital currency: Congressperson Tom Emmer came forward with an initiative to legally restrict the Federal Reserve’s capacity to issue a retail CBDC and take on the role of a retail bank. This could be massively consequential as we are yet to see a similarly sharp-cut expression of an opposing stance. As a matter of fact, it is not even clear whether other U.S. lawmakers have strong opinions on the matter other than, perhaps, condemning privately issued stablecoins as a digital alternative to the dollar. By framing a potential Fed CBDC as a privacy threat first, Emmer could tilt the conversation in the direction that is friendly to less centralized designs of digital money. Below is ...

Pakistan’s president calls for more training in blockchain technology

Arif Alvi, currently serving as the president of Pakistan, called for additional training in emerging technologies including blockchain, artificial intelligence and cybersecurity while meeting with a delegation of blockchain technology experts. In a Monday announcement, Alvi said Pakistan’s talent pool should be ready to meet the needs of the Fourth Industrial Revolution, which includes utilizing blockchain technology in the public and private sectors. According to the Pakistan president, the technology could be used as a government tool to track transactions, reduce corruption and increase transparency. Among the panel of experts was Bitcoin SV advocate Jimmy Nguyen, founding president of the Bitcoin Association. President Dr. Arif Alvi had a meeting with an international delegation ...

2021: A year of mass adoption for cryptocurrencies in Brazil

Throughout 2021, the Brazilian cryptocurrency market managed to distance itself from the police pages and finally win acceptance with the general public, whether in the financial market or even in the greatest national passion: soccer. Last year, Bitcoin (BTC) acted as a strong alternative to the Brazilian real that ended 2021 by breaking negative records and reaching a devaluation of 6.5% by December, making it the 38th worst currency in the world. In a year of ups and downs for Bitcoin, the biggest cryptocurrency hit a bottom of 167,000 real in January and soared along with global markets to 355,000 real in May. Faced with Bitcoin’s dip, the BRL/BTC pair was stuck below 200,000 reals until August, when it began to rise to a new historic high of 367,000 real on Nov. 8. Faced with the need...

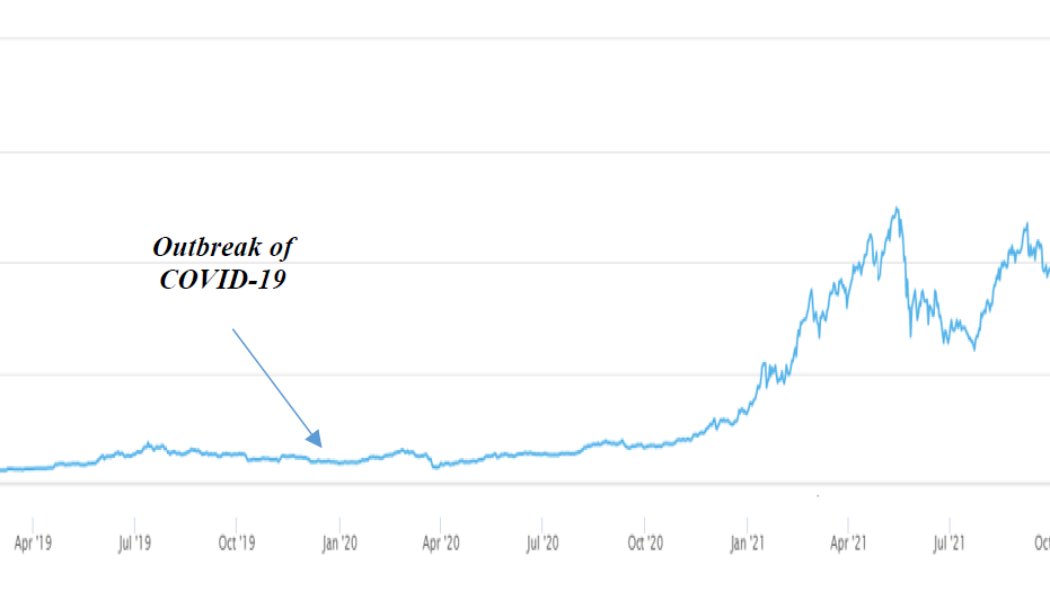

Hong Kong begins discussions to introduce stablecoin regulatory framework

Hong Kong’s central banking institution, the Hong Kong Monetary Authority (HKMA), released a questionnaire to gauge public opinion on regulations for crypto-assets and stablecoins. The state-backed regulator intends to establish a regulatory framework by 2023-24. HKMA’s “Discussion Paper on Crypto-assets and Stablecoins” highlights the explosive growth of the stablecoin market in terms of market capitalization since 2020 and the concurrent regulatory recommendations put forth by international regulators including the United States’ Financial Action Task Force (FATF), the Financial Stability Board (FSB) and The Basel Committee on Banking Supervision (BCBS). Market Capitalization of Crypto-assets. Source: HKMA According to the HKMA, the current size and trading activity of crypto-asset...

Former CFTC chair Giancarlo joins CoinFund as an adviser

Blockchain investment firm CoinFund has appointed former United States commodities regulator J. Christopher Giancarlo as a strategic adviser — a move that should help the Brooklyn-based company navigate the complex, ever-changing regulatory requirements in its home country. Often referred to as “Crypto Dad” by the blockchain community for his support of digital assets, Giancarlo was nominated as commissioner of the Commodity Futures Trading Commission (CFTC) in 2014. In January 2017, he became the agency’s acting chair before assuming the role full-time in August of the same year. He held the position until July 2019. CoinFund president Christopher Perkins described Giancarlo as a “driving force” of innovation at the CFTC, especially for advocating “thoughtful crypto policy in the Un...

Morocco is number one for Bitcoin trading in North Africa

Estimates from Triple A, a Singaporean cryptocurrency provider and aggregator, state that 0.9 million people, or roughly 2.4% of Morocco’s total population, currently own cryptocurrency. That puts the kingdom as the top country in North Africa and in the top 50 holders of cryptocurrency population percentage, just ahead of Portugal. Data from Useful Tulips — a platform that tracks peer-to-peer BTC trading across the globe — confirms the trend. The Kingdom of the West, as it’s known locally, has been the runaway North African leader for BTC trades in the past year, pipped by only Saudi Arabia when weighing up the entire Middle East and North Africa region. Unfortunately for crypto enthusiasts, there has been no change in crypto laws in recent years. According to Morocco’s Foreign Exch...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 2

Michelle is the CEO of the Association for Digital Asset Markets, which works in partnership with financial firms and regulatory experts to devise a code of conduct for digital asset markets. “2021 was the year Washington woke up to the digital assets industry. The year started with the rushed FinCEN “Unhosted Wallets” proposal, which the industry was able to voice its concerns and delay. At the same time, pro-digital asset Senator Cynthia Lummis joined the Senate. As the Biden Administration got up to speed on digital assets, it seemed like all of Washington was studying the industry in some shape or form. Then came the Infrastructure Bill, which contained a rushed provision defining a broker for tax reporting purposes. This flawed language unleashed digital ...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 1

Hatu is the co-founder and chief strategy officer of DAO Maker, which creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors. “2021 has been a stop-start year for crypto and DeFi, as regulatory bodies have not clarified their stance on the industry. This has held back the retail population from getting involved, and this is a huge opportunity cost for the industry. However, with El Salvador adopting Bitcoin as legal tender and more countries embracing crypto, the future looks brighter. In 2021, yes, there have been multiple deliberations at various levels regarding crypto and its regulatory status. Governments and regulatory authorities across the globe have expressed reservations against the mainstreaming of crypto. Howe...

How the Democratic Party didn’t stop worrying and fearing crypto in 2021

As 2022 is kicking off, America nears the first anniversary of Joe Biden’s presidency. Following the tenure’s ambitious start, the last few months witnessed some serious tumult around the overall health of the United States economy, the administration’s handling of the COVID-19 pandemic, and the tense debate around Biden’s opus magnum — the $1.7 trillion Build Back Better infrastructure legislation plan. But even as the Democrats’ ability to maintain undivided power after the 2022 midterm elections can raise doubts, the party’s prevailing view of crypto has become more consolidated than ever. The incumbent president’s party will be setting the tone of the regulatory discussion for at least three more years, so a thorough look at the fundamental premises and potential directions of its emer...

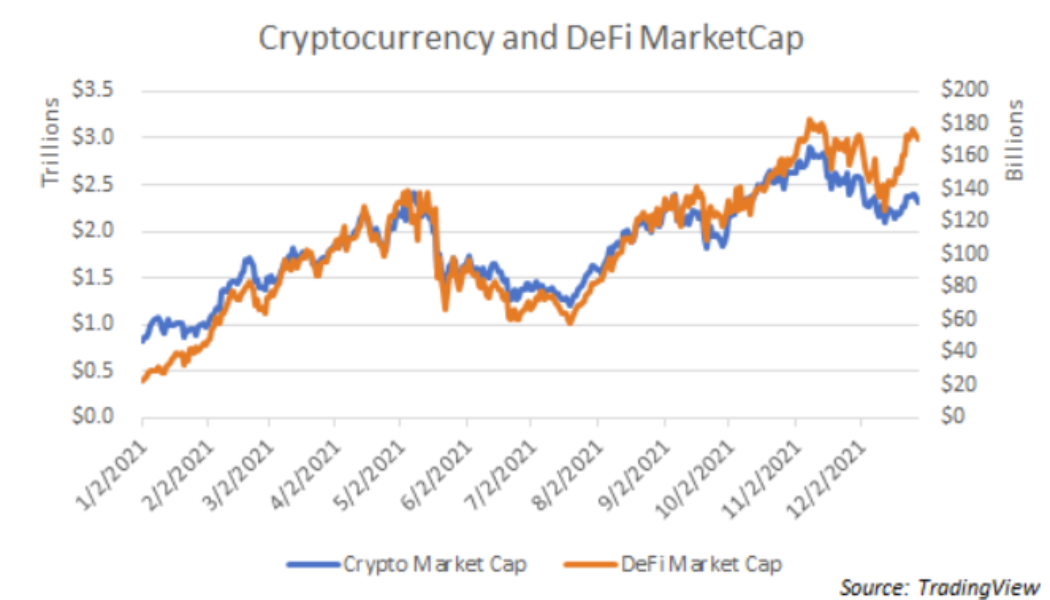

Cointelegraph Consulting: Crypto events of 2021 in retrospect

The year 2021 is coming to a close, and if there’s one way to describe how the cryptocurrency industry fared in the past 12 months, it would be momentous growth. Major cryptocurrencies shattered previous records, adoption grew, new sectors sprouted and novel blockchain use cases made significant breakthroughs. The Market Insight’s latest edition recalls the events covered in past issues as well as deep-dive topics in Cointelegraph Research’s industry reports. DeFi and Altcoins Two of the top gainers of 2021 were Solana (SOL) and Terra (LUNA). SOL gained 9,500%, while LUNA gained 13,000%. Significant investments and ecosystem growth catalyzed the immense gains for the two tokens. One could also argue that the two being billed as potential “Ethereum killers” had a part in contributing ...

Valereum acquires Gibraltar-based Juno to expand on crypto-fiat bridge

Gibraltar-based tech group Valereum Blockchain announced the acquisition of Juno Group, a company that aids in the establishment and administration of trusts, money management and enterprise creation in Gibraltar. Juno is a company that Valereum describes as having three areas of licensed operation: the management of trusts and similar entities, the administration of cash for a range of activities, including both fiat and cryptocurrency transactions, and the incorporation and management of businesses in Gibraltar and other countries around the world. The agreement is a step toward creating a fully regulated link between the fiat and crypto worlds, according to the press release, which complements Valereum’s work with the Gibraltar Stock Exchange (GSX). In October 2021, Vale...

SEC chair has a new senior adviser for crypto

United States Securities and Exchange Commission (SEC) chair Gary Gensler has added a new staff member who will offer advice related to crypto policymaking and interagency work. In a Thursday announcement, the SEC said Corey Frayer would be joining Gensler’s executive staff as a senior adviser on the agency’s oversight of cryptocurrencies. Frayer has worked as a professional staff member of the Senate Banking Committee as well as a senior policy adviser for the House Financial Services Committee with Representatives Maxine Waters and Brad Miller. Frayer’s appointment to the SEC chair’s executive staff came alongside those of Philipp Havenstein, Jennifer Songer and Jorge Tenreiro, who will be working as operations counsel, investment management counsel and enforcement counsel, respect...