Bitcoin Regulation

P2P payments spurred crypto adoption across Venezuela in 2021

For Venezuela, 2021 has been a year of considerable changes at the microeconomic level, where even more than in 2020, the results of powerful catalysts for change such as COVID-19 were clearly visible. In a more dynamic economy with a higher volume of operations with foreign currencies, cryptocurrencies played a key role during this year for the South American country. In this review, we’ll take a look at the highlights of the Venezuelan crypto ecosystem in 2021 including related areas such as trading, play-to-earn (P2E) games, fintech, mining, regulation and nonfungible tokens (NFTs). More people accepting cryptocurrencies According to blockchain analysis firm Chainalysis, Venezuela ranks seventh in the Global Cryptocurrency Adoption Index 2021 thanks in large part to pe...

Law Decoded: Tangible wins, new menaces and the global crypto taxation drive, Feb. 1–7

Every global event or major political crisis these days can trigger a digital asset-related conversation. As China welcomes the world’s top athletes to the Beijing 2022 Winter Olympics, showing off ultra-high-tech facilities and sports infrastructure, some United States politicians have raised concerns over the Games’ potential to act as a booster to the digital yuan’s adoption. In neighboring Myanmar, the military government that had overthrown the nation’s elected leadership a year ago is now looking into launching its own digital currency, not to project economic influence but to improve the domestic payments system and the struggling economy more broadly. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy developments over the las...

Stealth rulemaking: Is proposed SEC rule with no mention of crypto a threat to DeFi?

On Jan. 26, the United States Securities and Exchange Commission proposed amendments to Rule 3b-16 under the Exchange Act that lacks any mention of digital assets or decentralized finance, which could adversely affect platforms that facilitate crypto transactions. Some cryptocurrency advocates — including SEC Commissioner Hester Peirce — believe that the commission’s extended definition of an exchange could thrust an entire class of crypto entities under the regulator’s jurisdiction, subjecting them to additional registration and reporting burdens. How real is the threat? The proposed change The amendments proposed by the regulator dramatically expand the definition of what an exchange is while eliminating the exemption for systems that merely bring together buyers and sellers of securitie...

Russia houses $200B worth of crypto, Kremlin estimates

Russian citizens reportedly own 16.5 trillion rubles ($214 billion) worth of cryptocurrencies, according to government estimates. A Bloomberg report noted that Russians own about 12% of the total global crypto holdings. The crypto holdings estimates were calculated by analyzing IP addresses of some of the most significant crypto exchange users in the country along with a few other data points, said two people working with Kremlin. The crypto holdings analysis of Russian citizens is being carried out to get an overview of the crypto market and formulate new regulations. The proposals are yet to be finalized. The estimates are believed to be on the lower side, given crypto regulations are not yet clear in the country and many users prefer to use anonymous tools to carry out their transa...

Law Decoded: Russia flounders, America competes, IMF keeps fuming, Jan. 24–31

One of the most fascinating implications of the collision between traditional political institutions and the crypto space is how it can reveal the glaring lack of cohesion within power systems that otherwise look monolithic. Digital assets reside in a parallel policy dimension where neither a centralized consensus nor a clear rulebook exists, leading to a surprising variety of voices and opinions emerging in the absence of a politically coordinated course. Last week, a rare lively policy debate broke out in Russia in the aftermath of its central bank’s attempt to promote a hardline stance on crypto. One does not often see such a public interagency disagreement on substantive issues. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy develo...

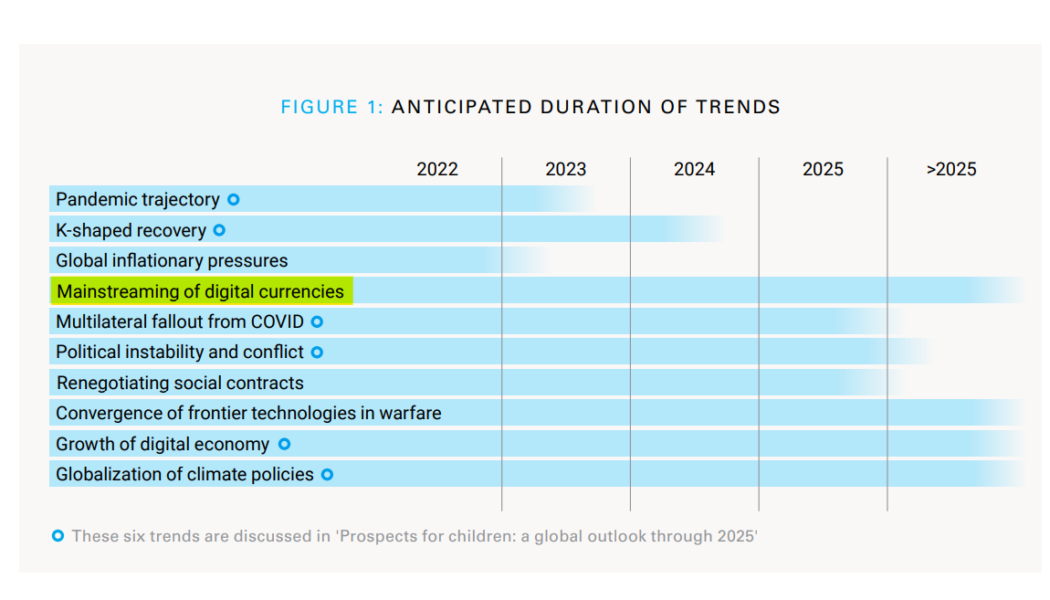

UNICEF calls for child safeguards amid mainstream crypto adoption

The United Nations Children’s Fund has called for incorporating child safeguards into online child protection initiatives, citing financial and exploitative threats posed by unregulated crypto markets. UNICEF’s “Prospects for children in 2022” report, which examines the impact of global trends on children, anticipates further mainstream adoption of cryptocurrencies — “demonstrating both the promise of greater financial inclusion and the need for new child safeguards.” Source: UNICEF The report shows that digital currencies have gained widespread interest in 87 countries by the end of 2021, with the majority of jurisdictions experimenting on their own versions of a central bank digital currency. UNICEF expects a similar growth trajectory in 2022, as the report states: “A potentia...

Fossils vs. Renewables, PoW vs. PoS: Key policy issues around crypto mining in the U.S.

On Jan. 27, a group of eight U.S. lawmakers, led by Senator Elizabeth Warren, sent letters to the world’s six largest Bitcoin mining companies, demanding to reveal the detailed data on their electricity consumption. This isn’t the first time Senator Warren requested this information from a mining operation — last month a similar letter was sent to Greenidge Generation, which uses a natural gas plant to power its facility. These moves highlight the increasing regulatory pressure on crypto mining businesses in the United States. But, as last week’s Congress hearing showed, the growing scrutiny might turn out to be an opportunity to align the mining sector’s development with the broader political push for clean energy. Here are some of the key themes around crypto mining that have captured th...

Clampdown on crypto ads: A one-off or a new phase of global regulation?

Over the last week, regulators in three major jurisdictions across two continents introduced new rules governing cryptocurrency-related promotions and advertisements. Citing consumer risks associated with digital asset investments, authorities in the United Kingdom, Singapore and Spain tightened the requirements around crypto firms’ marketing messaging and customer recruitment practices. While some experts view this emerging trend as a sign of a new global phase of cryptocurrency regulation, questions about the efficiency and universal applicability of this approach persist. New measures In the United Kingdom, Her Majesty’s Treasury issued a report summarizing the results of a public consultation on crypto-asset promotions, published in July 2020, as well as the government’s further steps ...

Central bank overkill: Russia’s proposed crypto ban and why everyone’s against it

On Jan. 20, the Central Bank of Russia (CBR) issued a report summarizing its position on digital assets and proposing a ban on any crypto trading and mining operations in the country. Although the CBR’s strict position on the matter was never a secret, such a bold statement triggered waves of fear, uncertainty, and doubt — otherwise known as FUD — across the board, given Russians’ high rates of involvement in the global digital assets market. Yet, there are reasons to doubt the ultimate effectiveness of the CBR’s hardline bidding, both in terms of its enforceability and its acceptance by other power centers, including legislators and siloviki (securocrats). The picture gets even more complicated for the central bank, as a high-ranking official within another major center of economic ...

U.S. Congressman calls for ‘Broad, bipartisan consensus’ on important issues of digital asset policy

In a letter to the leadership of the United States House Financial Services Committee, ranking member Patrick McHenry took a jab at “inconsistent treatment and jurisdictional uncertainty” inherent in U.S. crypto regulation and called for the Committee to take on its critical issues. McHenry, a Republican representing North Carolina, opened by mentioning that the Committee’s Democrat Chairwoman Maxine Waters is looking to schedule additional hearings addressing matters pertinent to the digital asset industry. He further stressed the need for identifying and prioritizing the key issues and achieving a “broad, bipartisan consensus” on the matters affecting the industry that holds immense promise for the financial system and broader economy. Citing the confusion that the industry faces due to ...

Vibe killers: Here are the countries that moved to outlaw crypto in the past year

Last week, Pakistan’s Sindh High Court held a hearing on the legal status of digital currencies that might lead an outright ban of cryptocurrency trading combined with penalties against crypto exchanges. Several days later, the Central Bank of Russia called for a ban on both crypto trading and mining operations. Both countries could join the growing ranks of nations that moved to outlaw digital assets, which already include China, Turkey, Iran and several other jurisdictions. According to a report by the Library of Congress (LOC), there are currently nine jurisdictions that have applied an absolute ban on crypto and 42 with an implicit ban. The authors of the report highlight a worrisome trend: the number of countries banning crypto has more than doubled since 2018. Here are the ...

Reuters: Binance was withholding information from regulators, repeatedly shunned own compliance department

In a report published on Friday, Reuters laid out the findings of its investigation into the regulatory compliance practices of Binance, the world’s largest cryptocurrency exchange by trading volume. The authors suggest the existence of a recurring pattern whereby the company’s CEO Changpeng Zhao, while proclaiming its openness to government oversight, ran an organization that systematically denied regulators’ requests for financial and corporate structure information and shirked proper client background checks. The reported findings are based on the accounts of Binance’s former senior employees and advisers, as well as the review of documents such as internal correspondence and confidential messages between several national regulators and the company. According to the document, several hi...