Bitcoin Regulation

Ally or suspect? The war in Ukraine as a stress test for the crypto industry

It has been two weeks since Russia kicked off the first large-scale military action in Europe in the 21st century — a so-called “special operation” in Ukraine. The military conflict immediately triggered devastating sanctions against the Russian economy from the United States, the European Union and their allies and has put the crypto industry in a position that is both highly vulnerable and demanding. As the world watches closely, the crypto space must prove its own standing as a mature and financially and politically responsible community, and it must defy the allegations of being a safe haven for war criminals, authoritarian regimes and sanctioned oligarchs. Up to this point, it has been going relatively well. But despite reassurances from industry opinion leaders, some experts say that...

Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar. Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView. Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%. Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Hold...

Crypto-friendly Yoon Suk-yeol wins Sth Korean presidency, ICX surges 60%

Conservative South Korean presidential candidate Yoon Suk-yeol has officially been elected as South Korea’s next president. The election was one of the closest in South Korean history, according to BBC coverage, which saw Yoon, representing the conservative People Power Party, claim victory over his more politically progressive opponent, Lee Jae-myung, by a margin of less than 1%. Cryptocurrency played a leading role in South Korea’s election debate, with both candidates releasing campaign-related NFTs. Their crypto-sympathetic stances are in opposition to former-President Moon Jae-In’s crackdown on crypto exchanges last year, and helped curry favor with the younger, more crypto enthusiastic demographic. Speaking at a virtual asset forum in January, Yoon promised to deregulate South Korea’...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...

Biden to sign executive order on crypto, authorize all-government effort to consolidate regulation

Later today, U.S. President Joe Biden will sign a long-anticipated executive order on digital assets. Despite fears that the order may resound a regulatory clampdown on the industry, the language of the document is fairly favorable, the key focus being the coordination and consolidation of various agencies’ efforts within a unified national policy. The order designates six key areas of the federal government’s involvement with the digital asset ecosystem — consumer and investor protection, financial stability, financial inclusion, responsible innovation, the United States’ global financial leadership and combating illicit financial activity — and directs specific agencies to lead in designated policy and enforcement domains. The Department of the Treasury will take the lead in developing p...

Crypto industry seeks to educate, influence US lawmakers as it faces increasing regulation

Interaction between the cryptocurrency industry and Capitol Hill is becoming ever more intensive as efforts to regulate crypto grow in tandem with its popularity. The surge in crypto industry lobbying last year was given some concrete parameters in February by crypto analytics startup Crypto Head. It released a report showing that the crypto companies that spent the most money on lobbying in 2021 were Robinhood, Ripple Labs, Coinbase and the Blockchain Association. These organizations were the lobbying leaders during the past five years as well, although with different rankings. Here is what the United States crypto-lobbying landscape looks like today. Metrics of influence Robinhood spent $1.35 million on lobbying in 2021 and was the only crypto-related organization to spend more than $1 m...

Russian crypto volume across major exchanges plunges by 50%

Data from blockchain-analysis firms show that Russian denominated crypto purchasing and trading on major exchanges have faltered, debunking theories that the country will pivot to digital assets to circumvent sanctions. When Bitcoin rallied over 15% last week, some industry experts attributed the surge to Russians buying cryptocurrency in the face of increasing economic sanctions. This theory seems to be proved false, however, as data from Chainalysis showed that ruble-denominated crypto trading volume was just $34.1 million on March 3, around half of a recent peak of $70.7 million a week ago on Feb. 24. Speaking on the matter of sanctions-fueled crypto purchasing to Bloomberg, Citigroup analyst Alexander Saunders said, “Russian volumes have been relatively small so far, suggesting t...

Russia’s Finance Ministry introduces digital currency bill, brushes off Central Bank’s objections

Russia’s Ministry of Finance has upped the stakes in its drawn-out showdown against the country’s Central Bank by formally introducing a bill that proposes to regulate digital assets rather than banning them. On Feb. 21, the Ministry introduced a draft of the federal law “On digital currency” to the government. This stage of the legislative process precedes the bill’s introduction to the parliament for consideration. The agency cited the “formation of a legal marketplace for digital currencies, along with determining rules for their circulation and range of participants” as the rationale for the initiative. Emphasizing that the bill does not seek to endow digital currencies with legal tender status, its authors define cryptocurrencies as an investment vehicle. The bill proposes a licensing...

Mining worldwide: Where should crypto miners go in a changing landscape?

One of the main themes among the crypto community in 2021 was China’s aggressive policy toward mining, which led to a complete ban on such activities in September. While mining as a type of financial activity has not gone away and is unlikely to disappear, Chinese cryptocurrency miners had to look for a new place to set up shop. Many of them moved to the United States — the world’s new mining mecca — while some left to Scandinavia and others to nearby Kazakhstan, with its cheap electricity. Mining activities can’t stay under the radar forever, and governments around the world have begun to raise concerns over electricity capacity and power outages. Erik Thedéen, vice-chair of the European Securities and Markets Authority — who also serves as director general of the Swedish Fina...

Clarity pushed back: Russian government fails to forge a consolidated stance on crypto regulation

On Feb. 18, the Russian Ministry of Finance kicked off public consultations on the rules of cryptocurrency issuance and transactions. While a welcome development, it is less than the country’s crypto space had expected to get. Earlier in the week, the government announced that by Feb. 18, a bill containing the finance ministry and central bank’s consolidated position on crypto regulation would be drafted. Updated estimates suggest that it will take at least another month for draft legislation to see the light. The main reason for the delay appears to be the central bank’s renewed resistance, which just several days ago seemed to have been overcome. Here is a roundup of the latest twists in this rocky ride. Round 1: Central bank’s ban proposal On Jan. 20, the Central Bank of Russia (CBR) is...

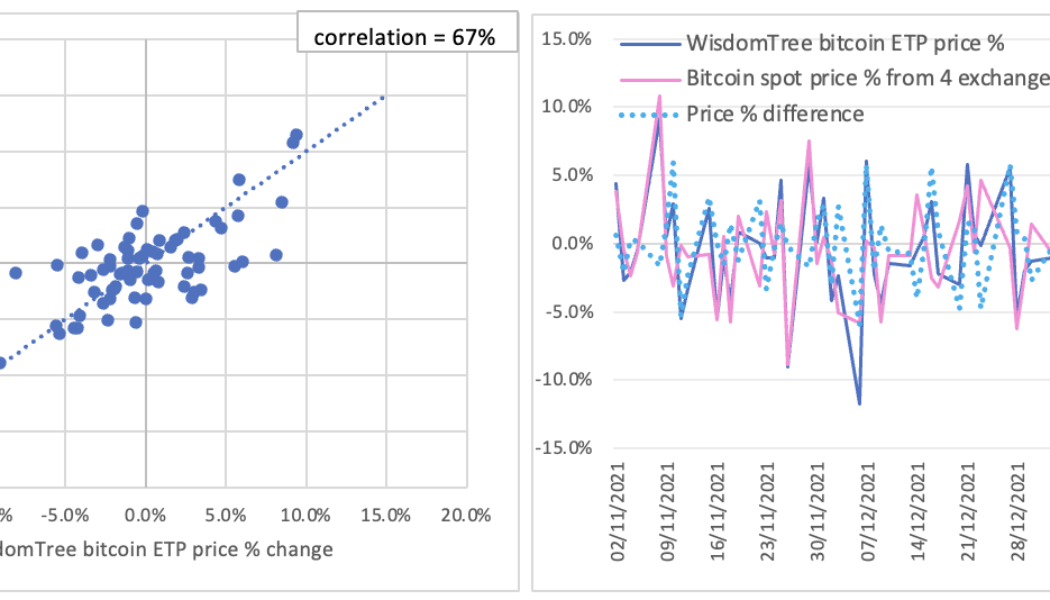

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...